by Calculated Risk on 2/27/2018 11:14:00 AM

Tuesday, February 27, 2018

Richmond Fed: District Manufacturing Firms Reported Robust Growth in February

From the Richmond Fed: Fifth District Manufacturing Firms Reported Robust Growth in February

Fifth District manufacturing firms saw robust growth in February, according to the results from the latest survey by the Federal Reserve Bank of Richmond. The composite manufacturing index jumped from 14 in January to 28 in February, the second highest value on record, driven by increases in shipments, orders, and employment. The wages index remained in positive territory at 23, while the available skills metric dropped from −10 in January to −17 in February. Despite greater difficulty finding skilled workers, District manufacturing firms saw strong growth in employment and the average workweek in February. Survey results show that manufacturers expect to see continued growth in the coming months.This was the last of the regional Fed surveys for February.

Manufacturing firms saw growth accelerate for both prices paid and prices received, with each increasing at the highest rate since April 2017. Firms expect prices to continue to grow at a faster rate in the near future.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through February), and five Fed surveys are averaged (blue, through February) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through January (right axis).

Based on these regional surveys, it seems likely the ISM manufacturing index will be strong again in February (to be released Thursday, Mar 1st). The consensus is for the ISM to be at 58.6, down from 59.1 in January.

Powell: Semiannual Monetary Policy Report to the Congress

by Calculated Risk on 2/27/2018 09:51:00 AM

Excerpts from prepared statement from Fed Chair Jerome Powell: Semiannual Monetary Policy Report to the Congress

After easing substantially during 2017, financial conditions in the United States have reversed some of that easing. At this point, we do not see these developments as weighing heavily on the outlook for economic activity, the labor market, and inflation. Indeed, the economic outlook remains strong. The robust job market should continue to support growth in household incomes and consumer spending, solid economic growth among our trading partners should lead to further gains in U.S. exports, and upbeat business sentiment and strong sales growth will likely continue to boost business investment. Moreover, fiscal policy is becoming more stimulative. In this environment, we anticipate that inflation on a 12-month basis will move up this year and stabilize around the FOMC's 2 percent objective over the medium term. Wages should increase at a faster pace as well. The Committee views the near-term risks to the economic outlook as roughly balanced but will continue to monitor inflation developments closely.And on the balance sheet:

emphasis added

The Congress has assigned us the goals of promoting maximum employment and stable prices. Over the second half of 2017, the FOMC continued to gradually reduce monetary policy accommodation. Specifically, we raised the target range for the federal funds rate by 1/4 percentage point at our December meeting, bringing the target to a range of 1-1/4 to 1-1/2 percent. In addition, in October we initiated a balance sheet normalization program to gradually reduce the Federal Reserve's securities holdings. That program has been proceeding smoothly. These interest rate and balance sheet actions reflect the Committee's view that gradually reducing monetary policy accommodation will sustain a strong labor market while fostering a return of inflation to 2 percent.

Case-Shiller: National House Price Index increased 6.3% year-over-year in December

by Calculated Risk on 2/27/2018 09:16:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for December ("December" is a 3 month average of October, November and December prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: S&P CoreLogic Case-Shiller National Home Price Index Shows Home Prices End the Year 6.3% Higher than 2016

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 6.3% annual gain in December, up from 6.1% in the previous month. The 10-City Composite annual increase came in at 6.0%, no change from the previous month. The 20-City Composite posted a 6.3% year-over-year gain, down from 6.4% in the previous month.

Seattle, Las Vegas, and San Francisco reported the highest year-over-year gains among the 20 cities. In December, Seattle led the way with a 12.7% year-over-year price increase, followed by Las Vegas with an 11.1% increase, and San Francisco with a 9.2% increase. Nine cities reported greater price increases in the year ending December 2017 versus the year ending November 2017

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.2% in December. The 10-City and 20-City Composites both reported increases of 0.2%. After seasonal adjustment, the National Index recorded a 0.7% month-over-month increase in December. The 10-City and 20-City Composites both posted 0.6% month-over-month increases. Twelve of the 20 cities reported increases in December before seasonal adjustment, while all 20 cities reported increases after seasonal adjustment.

“The rise in home prices should be causing the same nervous wonder aimed at the stock market after its recent bout of volatility,” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “Across the 20 cities covered by S&P Corelogic Case Shiller Home Price Indices, the average increase from the financial crisis low is 62%; over the same period, inflation was 12.4%. None of the cities covered in this release saw real, inflation-adjusted prices fall in 2017. The National Index, which reached its low point in 2012, is up 38% in six years after adjusting for inflation, a real annual gain of 5.3%. The National Index’s average annual real gain from 1976 to 2017 was 1.3%. Even considering the recovery from the financial crisis, we are experiencing a boom in home prices.

“Within the last few months, there are beginning to be some signs that gains in housing may be leveling off. Sales of existing homes fell in December and January after seasonal adjustment and are now as low as any month in 2017. Pending sales of existing homes are roughly flat over the last several months. New home sales appear to be following the same trend as existing home sales. While the price increases do not suggest any weakening of demand, mortgage rates rose from 4% to 4.4% since the start of the year. It is too early to tell if the housing recovery is slowing. If it is, some moderation in price gains could be seen later this year.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 3.1% from the peak, and up 0.6% in December (SA).

The Composite 20 index is off slightly from the peak, and up 0.6% (SA) in December.

The National index is 7.0% above the bubble peak (SA), and up 0.7% (SA) in December. The National index is up 44.7% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 6.0% compared to December 2016. The Composite 20 SA is up 6.3% year-over-year.

The National index SA is up 6.3% year-over-year.

Note: According to the data, prices increased in all 20 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Monday, February 26, 2018

Tuesday: Case-Shiller, Fed Chair Powell

by Calculated Risk on 2/26/2018 07:23:00 PM

From Matthew Graham at Mortgage News Daily: Another 2018 First For Mortgage Rates

Mortgage rates fell for the third day in a row--the first time that's happened so far in 2018! Much like last week was slightly less spectacular than its "best in 2018" designation, today also comes with caveats. Even though rates technically did fall for the third straight day, most of the day was spent with underlying bond markets moving into weaker territory. This resulted in several lenders raising rates in the middle of the day, leaving them roughly in line with Friday's latest offerings. [30YR FIXED - 4.625%]Tuesday:

emphasis added

• At 8:30 AM ET, Durable Goods Orders for January from the Census Bureau. The consensus is for a 0.2% decrease in durable goods orders.

• At 9:00 AM, S&P/Case-Shiller House Price Index for December. The consensus is for a 6.3% year-over-year increase in the Comp 20 index for December.

• At 9:00 AM, FHFA House Price Index for December 2017. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Fed Chair Jerome Powell Testimony, Semiannual Monetary Policy Report to the Congress, Before the House Financial Services Committee, Washington, D.C.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for February. This is the last of the regional surveys for February.

Housing Inventory Tracking

by Calculated Risk on 2/26/2018 04:05:00 PM

Update: Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

The graph below shows the year-over-year change for non-contingent inventory in Las Vegas through January 2018, Phoenix and Sacramento, and also total existing home inventory as reported by the NAR (through January 2018).

This shows the year-over-year change in inventory for Phoenix, Sacramento, and Las Vegas. The black line if the year-over-year change in inventory as reported by the NAR.

Note that inventory is Sacramento was up 15% year-over-year in January (still very low), and has increased year-over-year for four consecutive months. However inventory is down Nationally, and down in Phoenix and Las Vegas.

I'll try to add a few other markets.

Inventory is a key for the housing market, and I will be watching inventory for the impact of the new tax law and higher mortgage rates on housing.

A few Comments on January New Home Sales

by Calculated Risk on 2/26/2018 01:25:00 PM

New home sales for January were reported at 593,000 on a seasonally adjusted annual rate basis (SAAR). This was below the consensus forecast, however the three previous months were revised up.

I wouldn't read too much into one month of sales, especially in January. January is usually one of the weakest months of the year for new home sales, on a not seasonally adjusted (NSA) basis - and poor weather this year might have impacted sales a little more than usual. I'd like to see data for February and March before blaming higher interest rates, or a negative impact from the new tax law, as the cause of slower sales.

Earlier: New Home Sales decrease to 593,000 Annual Rate in January.

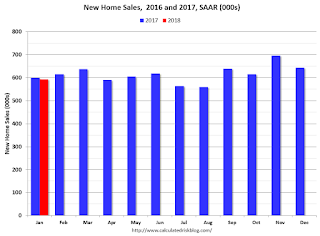

This graph shows new home sales for 2017 and 2018 by month (Seasonally Adjusted Annual Rate).

Sales were down 1% year-over-year in January. No worries - yet!

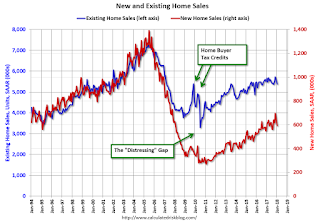

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Black Knight: House Price Index up 0.1% in December, Up 6.6% year-over-year

by Calculated Risk on 2/26/2018 11:46:00 AM

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA and more). Note: Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight: Black Knight HPI: U.S. Home Prices Ended 2017 Up 6.62 Percent from Start of Year, Gaining 0.1 Percent in December

• U.S. home prices edged up slightly in December, closing the year 6.6 percent above end of 2016Once again, this index is Not seasonally adjusted, and seasonally declines in some states is expected (so don't read too much into any regional declines). The year-over-year increase in this index has been about the same for the last year (close to 6% range).

• December marked 68 consecutive months of annual home price appreciation

• New York once again led all states in monthly gains, with home prices up 1.71 percent over last month

...

• Home prices fell in nine of the nation’s 20 largest states, while six others hit new peaks

• Likewise, while 11 of the 40 largest metros hit new home price peaks in December, prices fell in another 20

Note also that house prices are above the bubble peak in nominal terms, but not in real terms (adjusted for inflation). Case-Shiller for December will be released tomorrow.

New Home Sales decrease to 593,000 Annual Rate in January

by Calculated Risk on 2/26/2018 10:12:00 AM

The Census Bureau reports New Home Sales in January were at a seasonally adjusted annual rate (SAAR) of 593 thousand.

The previous three months were revised up.

"Sales of new single-family houses in January 2018 were at a seasonally adjusted annual rate of 593,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 7.8 percent below the revised December rate of 643,000 and is 1.0 percent below the January 2017 estimate of 599,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

The second graph shows New Home Months of Supply.

The months of supply increased in January to 6.1 months from 5.5 months in December.

The months of supply increased in January to 6.1 months from 5.5 months in December. The all time record was 12.1 months of supply in January 2009.

This is at the top end of the normal range (less than 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of January was 301,000. This represents a supply of 6.1 months at the current sales rate. "

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In January 2018 (red column), 43 thousand new homes were sold (NSA). Last year, 45 thousand homes were sold in January.

The all time high for December was 92 thousand in 2005, and the all time low for December was 21 thousand in 2011.

This was below expectations of 600,000 sales SAAR, however the previous months combined were revised up. I'll have more later today.

Chicago Fed "Index Points to Little Change in Economic Growth in January"

by Calculated Risk on 2/26/2018 08:38:00 AM

From the Chicago Fed: Index Points to Little Change in Economic Growth in January

The Chicago Fed National Activity Index (CFNAI) ticked down to +0.12 in January from +0.14 in December.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was above the historical trend in January (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, February 25, 2018

Monday: New Home Sales

by Calculated Risk on 2/25/2018 06:23:00 PM

Weekend:

• Schedule for Week of Feb 25, 2018

Monday:

• 8:30 AM ET, Chicago Fed National Activity Index for January. This is a composite index of other data.

• 10:00 AM, New Home Sales for January from the Census Bureau. The consensus is for 600 thousand SAAR, down from 625 thousand in December.

• 10:30 AM, Dallas Fed Survey of Manufacturing Activity for February.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 5, and DOW futures are up 74 (fair value).

Oil prices were up over the last week with WTI futures at $63.57 per barrel and Brent at $67.27 per barrel. A year ago, WTI was at $54, and Brent was at $55 - so oil prices are up solidly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.51 per gallon. A year ago prices were at $2.29 per gallon - so gasoline prices are up 22 cents per gallon year-over-year.