by Calculated Risk on 1/20/2018 08:09:00 AM

Saturday, January 20, 2018

Schedule for Week of Jan 21, 2018

Note: If the government is shut down, some of these releases will probably be delayed (Q4 GDP, New Home sales, etc.)

The key economic reports this week are the advance estimate of Q4 GDP, and December new home sales and existing home sales.

For manufacturing, the January Richmond Fed and Kansas City Fed manufacturing surveys will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for December. This is a composite index of other data.

10:00 AM ET: Richmond Fed Survey of Manufacturing Activity for January.

10:00 AM: State Employment and Unemployment (Monthly) for December 2017

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:00 AM ET: FHFA House Price Index for November 2017. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: Existing Home Sales for December from the National Association of Realtors (NAR). The consensus is for 5.75 million SAAR, down from 5.81 million in November.

10:00 AM: Existing Home Sales for December from the National Association of Realtors (NAR). The consensus is for 5.75 million SAAR, down from 5.81 million in November.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report sales of 5.66 million SAAR for December.

During the day: The AIA's Architecture Billings Index for December (a leading indicator for commercial real estate).

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, up from 220 thousand the previous week.

10:00 AM ET: New Home Sales for December from the Census Bureau.

10:00 AM ET: New Home Sales for December from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the November sales rate.

The consensus is for 683 thousand SAAR, down from 733 thousand in November.

11:00 AM: the Kansas City Fed manufacturing survey for December.

8:30 AM: Gross Domestic Product, 4th quarter 2017 (Advance estimate). The consensus is that real GDP increased 2.9% annualized in Q4, down from 3.2% in Q3.

8:30 AM: Durable Goods Orders for November from the Census Bureau. The consensus is for a 0.8% increase in durable goods orders.

Friday, January 19, 2018

Lawler: Early Read on Existing Home Sales in December

by Calculated Risk on 1/19/2018 04:15:00 PM

From housing economist Tom Lawler:

Based on publicly-available state and local realtor/MLS reports from across the country released through today, I predict that US existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.66 million in December, down 2.6% from November’s preliminary pace and up 2.7% from last month’s seasonally adjusted pace. Unadjusted sales last month should be down slightly from a year ago, with the “SA/NSA” gap reflecting this year’s lower business day count compared to last year’s.

On the inventory front, realtor/MLS data suggest that inventories in December were down YOY by about a little more than was the case in November, and my “best guess” is that the NAR’s inventory estimate for December will be 1.48 million, down 11.4% from November’s estimate and down 10.3% from last December.

Finally, realtor/MLS data suggest the the NAR’s estimate for the median existing home sales price in November will be up by about 6.5% from last December.

CR Note: Existing home sales for December are scheduled to be released on Wednesday, January 24th. The consensus is for sales of 5.68 million SAAR.

Government Shutdown: Economic Data Likely to be Delayed

by Calculated Risk on 1/19/2018 12:46:00 PM

In previous shutdowns, Government data from the BLS, BEA and Census Bureau were delayed. Data from the Federal Reserve was released on time.

As an example, if the government shuts down, I expect New Home sales, durable goods and Q4 GDP to all be delayed next week. Unemployment claims will probably be released on time (and increase the following week due to the shutdown).

The following week, the key report that will probably be delayed is the employment report for January.

In addition, any shutdown will be expensive and impact Q1 GDP. From Goldman Sachs:

A shutdown would have a modest economic impact, provided it does not last very long. We estimate that each week of shutdown would reduce real GDP growth in Q1 by 0.2pp, qoq annualized. The effects would be reversed the next quarter however.Hopefully the shutdown will be avoided.

Update: For Fun, Stock Market as Barometer of Policy Success

by Calculated Risk on 1/19/2018 11:57:00 AM

Note: This is a repeat of a June post with updated statistics and graph.

There are a number of observers who think the stock market is the key barometer of policy success. My view is there are many measures of success - and that the economy needs to work well for a majority of the people - not just stock investors.

However, for example, Treasury Secretary Steven Mnuchin was on CNBC on Feb 22, 2017, and was asked if the stock market rally was a vote of confidence in the new administration, he replied: "Absolutely, this is a mark-to-market business, and you see what the market thinks."

And Larry Kudlow wrote in 2007: A Stock Market Vote of Confidence for Bush: "I have long believed that stock markets are the best barometer of the health, wealth and security of a nation. And today's stock market message is an unmistakable vote of confidence for the president."

Note: Kudlow's comments were made a few months before the market started selling off in the Great Recession. For more on Kudlow, see: Larry Kudlow is usually wrong

For fun, here is a graph comparing S&P500 returns (ex-dividends) under Presidents Trump and Obama:

Blue is for Mr. Obama, Orange is for Mr. Trump.

At this point, the S&P500 is up 23.2% under Mr. Trump compared to up 41.1% under Mr. Obama for the same number of market days.

Merrill: "Are the stars aligning for wage growth?"

by Calculated Risk on 1/19/2018 09:49:00 AM

A few excerpts from an article by Merrill Lynch economist Joseph Song: Are the stars aligning for wage growth?

One of the puzzles and disappointments of 2017 was the lack of better wage growth. Average hourly earnings started the year growing around 2.5% yoy but ended the year where it started, despite the unemployment rate falling 0.6pp over the course of the year. While we have yet to receive the 4Q reading for ECI, the same story played out through the first three quarters.CR note: Mostly due to the tightening labor market, I'm also expecting to see more wage growth this year.

There is growing optimism that 2018 will tell a different story. With the passage of the Tax Cuts and Jobs Act, major corporations are doling out one-time bonus checks and announcing pay raises for many of its hourly workers. Plus, some minimum wage workers will see a bigger paycheck as several states and local municipalities raised their minimum wage laws on January 1st. We argue that these factors will underpin wage growth at the start of the year. Thereafter, we should expect a continued gradual trend higher in wage growth as the unemployment rate falls further.

...

Wage increases by companies and higher state and local minimum wages should provide a slight bump to wage growth in the next few months. ... Once the initial boost to wage growth fades, we think the trajectory for wage growth should be a function of the degree of tightening in the labor market. The descent in the unemployment rate should be able to boost wages to a high-2% pace by year-end and to 3% by the middle of 2019.

Thursday, January 18, 2018

Mortgage Rates close to 4.25%, "highest in more than 9 months"

by Calculated Risk on 1/18/2018 05:21:00 PM

From Matthew Graham at Mortgage News Daily: Be Careful With News on Mortgage Rates Today

Rates spiked more than normal yesterday and then repeated the feat today. Combine that with weakness in underlying bond markets (which drive mortgage rates) that began on Tuesday afternoon, and the average lender is roughly an eighth of a percentage point higher in rate today. Freddie's headline of 4.04% is the stuff of dreams as far as most borrowers are concerned. While rates near 4.0% are available in some of the best cases, the average top-tier quote is now easily 4.125% and many lenders are up to 4.25%. If you're not putting 20% down or have less than perfect qualifications, it would be even higher. [30YR FIXED - 4.125%-4.25%]Friday:

Like yesterday, these are the highest rates in more than 9 months.

emphasis added

• At 10:00 AM ET, University of Michigan's Consumer sentiment index (Preliminary for January). The consensus is for a reading of 97.0, up from 95.9.

Earlier: Philly Fed Manufacturing Survey showed "Growth Continued" in January

by Calculated Risk on 1/18/2018 02:13:00 PM

Earlier from the Philly Fed: January 2018 Manufacturing Business Outlook Survey

Economic growth continued in January, according to the firms responding to this month’s Manufacturing Business Outlook Survey. The broadest measures of current conditions remained positive this month, although indexes for general activity, new orders, and employment declined from their readings in December. The firms reported higher prices for both inputs and their own manufactured goods this month. The future indexes reflecting expected growth over the next six months remained at high levels, although the indexes fell from their readings in December.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

...

The index for current manufacturing activity in the region decreased from a revised reading of 27.9 in December to 22.2 this month. Although now at its lowest reading in five months, the index has stayed within a relatively narrow range over the past eight months ... The current employment index, while still positive, fell 3 points to 16.8. The percentage of firms reporting an increase in employment (24 percent) exceeded the percentage reporting a decrease (8 percent). The firms reported a slight increase in work hours this month: The average workweek index increased 4 points to 16.7.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through January), and five Fed surveys are averaged (blue, through December) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through December (right axis).

This suggests the ISM manufacturing index night decrease slightly in January, but still show solid expansion again.

Comments on December Housing Starts

by Calculated Risk on 1/18/2018 11:30:00 AM

Earlier: Housing Starts decreased to 1.192 Million Annual Rate in December

The housing starts report released this morning showed starts were down 8.2% in December compared to November, and starts were down 6.0% year-over-year compared to December 2016.

On a yearly basis, starts in 2017 were up 2.4% to 1.202 million compared to 1.174 million in 2016. Single family starts were up 8.5% in 2017 (compared to 2016) and multi-family starts were down 10.1%.

This was the highest level for total housing starts and single family starts since 2007.

Here is a table of housing starts since the bubble peak in 2005.

| Housing Starts (000s) | ||||

|---|---|---|---|---|

| Total Housing Starts | Change | Single Family Starts | Change | |

| 2005 | 2,068 | --- | 1,716 | --- |

| 2006 | 1,801 | -12.9% | 1,465 | -14.6% |

| 2007 | 1,355 | -24.8% | 1,046 | -28.6% |

| 2008 | 906 | -33.2% | 622 | -40.5% |

| 2009 | 554 | -38.8% | 445 | -28.4% |

| 2010 | 587 | 5.9% | 471 | 5.9% |

| 2011 | 609 | 3.7% | 431 | -8.6% |

| 2012 | 781 | 28.2% | 535 | 24.3% |

| 2013 | 925 | 18.5% | 618 | 15.4% |

| 2014 | 1,003 | 8.5% | 648 | 4.9% |

| 2015 | 1,112 | 10.9% | 715 | 10.3% |

| 2016 | 1,174 | 5.6% | 782 | 9.4% |

| 2017 | 1,202 | 2.4% | 848 | 8.5% |

This first graph shows the month to month comparison between 2016 (blue) and 2017 (red).

Click on graph for larger image.

Click on graph for larger image.Starts were down 6.0% in December 2017 compared to December 2016, and starts were only up 2.4% for the year

Note that single family starts were up 8.5% in 2017, and the weakness (as expected) was in multi-family starts.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The blue line is for multifamily starts and the red line is for multifamily completions.

The blue line is for multifamily starts and the red line is for multifamily completions. The rolling 12 month total for starts (blue line) increased steadily over the last few years - but has turned down recently. Completions (red line) have lagged behind - and completions have caught up to starts (more deliveries).

Completions lag starts by about 12 months, so completions will probably turn down in about a year.

As I've been noting for a couple of years, the growth in multi-family starts is behind us - multi-family starts peaked in June 2015 (at 510 thousand SAAR).

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.Note the low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect a few more years of increasing single family starts and completions.

Housing Starts decreased to 1.192 Million Annual Rate in December

by Calculated Risk on 1/18/2018 08:44:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in December were at a seasonally adjusted annual rate of 1,192,000. This is 8.2 percent below the revised November estimate of 1,299,000 and is 6.0 percent below the December 2016 rate of 1,268,000. Single-family housing starts in December were at a rate of 836,000; this is 11.8 percent below the revised November figure of 948,000. The December rate for units in buildings with five units or more was 352,000.

An estimated 1,202,100 housing units were started in 2017. This is 2.4 percent above the 2016 figure of 1,173,800.

Building Permits:

Privately-owned housing units authorized by building permits in December were at a seasonally adjusted annual rate of 1,302,000. This is 0.1 percent below the revised November rate of 1,303,000, but is 2.8 percent above the December 2016 rate of 1,266,000. Single-family authorizations in December were at a rate of 881,000; this is 1.8 percent above the revised November figure of 865,000. Authorizations of units in buildings with five units or more were at a rate of 382,000 in December.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased slightly in December compared to November. However Multi-family starts were down sharply year-over-year.

Multi-family is volatile month-to-month, but has been mostly moving sideways to down recently.

Single-family starts (blue) decreased in December, but are still up year-over-year.

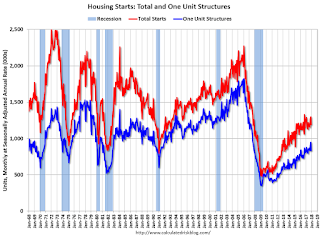

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically fairly low).

Total housing starts in December were below expectations. However starts for October and November were revised up slightly.

I'll have more later ...

Weekly Initial Unemployment Claims decrease to 220,000

by Calculated Risk on 1/18/2018 08:34:00 AM

The DOL reported:

In the week ending January 13, the advance figure for seasonally adjusted initial claims was 220,000, a decrease of 41,000 from the previous week's unrevised level of 261,000. This is the lowest level for initial claims since February 24, 1973 when it was 218,000. The 4-week moving average was 244,500, a decrease of 6,250 from the previous week's unrevised average of 250,750.The previous week was unrevised.

Claims taking procedures continue to be disrupted in the Virgin Islands. The claims taking process in Puerto Rico has still not returned to normal.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 244,500.

This was much lower than the consensus forecast. The low level of claims suggest relatively few layoffs.