by Calculated Risk on 12/12/2017 08:35:00 AM

Tuesday, December 12, 2017

NFIB: Small Business Optimism Index "Near All-Time High" in November

From the National Federation of Independent Business (NFIB): Small Business Optimism Hits Near All-Time High

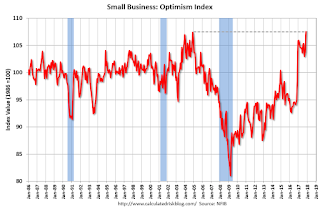

The Index of Small Business Optimism gained 3.7 points to 107.5 in November, the second highest reading in the 44-year history of the NFIB surveys (108.0 in July 1983). Eight of the 10 Index components posted a gain and two declined, as Job Openings fell from its record high level and Capital Spending Plans declined 1 point.

After several solid quarters, job creation slowed in the small business sector as business owners reported a seasonally adjusted average employment change per firm of 0.0 workers.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 107.5 in November.

Monday, December 11, 2017

Tuesday: Small Business Index, PPI

by Calculated Risk on 12/11/2017 06:59:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Unchanged to Slightly Higher

Mortgage rates moved modestly higher for the 3rd straight business day, making for a moderate correction from the last Wednesday's 1-month lows. In the recent context, talking about "1-month lows" and 3-day losing streaks is actually far too dramatic when it comes to the actual movement in rates. Most prospective borrowers would be seeing the same rates as last week with the only differences being a slight adjustment in the upfront costs. Even then, many lenders are perfectly unchanged over the past 2 days. Point being: rate volatility has been calm with few exceptions. [30YR FIXED - 4.0%].Tuesday:

• At 6:00 AM ET, NFIB Small Business Optimism Index for November.

• At 8:30 AM, The Producer Price Index for November from the BLS. The consensus is a 0.3% increase in PPI, and a 0.2% increase in core PPI.

Prime Working-Age Population nears 2007 Peak

by Calculated Risk on 12/11/2017 03:51:00 PM

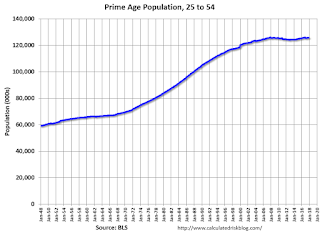

Update through November: The prime working age population peaked in 2007, and bottomed at the end of 2012. As of November 2017, according to the BLS, there were still fewer people in the 25 to 54 age group than in 2007.

At the beginning of this year - based on demographics - it looked like the prime working age (25 to 54) would probably hit a new peak in 2017. However, since the end of last year, the prime working age population has declined slightly (probably due to annual adjustment).

Changes in demographics are an important determinant of economic growth, and although most people focus on the aging of the "baby boomer" generation, the movement of younger cohorts into the prime working age is another key story. Here is a graph of the prime working age population (25 to 54 years old) from 1948 through November 2017.

Note: This is population, not work force.

There was a huge surge in the prime working age population in the '70s, '80s and '90s.

The prime working age labor force grew even quicker than the population in the '70s and '80s due to the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s!

So when we compare economic growth to the '70s, '80, or 90's we have to remember this difference in demographics (the '60s saw solid economic growth as near-prime age groups increased sharply).

The good news is the prime working age group should start growing at 0.5% per year - and this should boost economic activity.

Duy: "Expect the Fed to Stand By Its 2018 Outlook"

by Calculated Risk on 12/11/2017 03:15:00 PM

From Tim Duy at Bloomberg: Expect the Fed to Stand By Its 2018 Outlook. A few excerpts:

The Fed is likely to continue to point toward another 75 basis points of tightening in 2018 when it releases the next Summary of Economic Projections. To be sure, the minutes of the last FOMC meeting painted a dovish outlook as participants fretted about the inflation picture. But these concerns need to be weighed against the outlook for growth, which improved throughout 2017, and the implications of that accelerated growth on unemployment.

...

I anticipate the Fed will largely retain the policy rate forecast for 2018. This may come as a surprise given the dovish Fed minutes, but the recent surge in short-term rates indicates that financial markets are waking up to the reality that solid economic growth will prompt the bank to keep hiking rates despite low inflation. All else equal, the stage will be set for an inversion of the yield curve by the end of next year.

FOMC Preview

by Calculated Risk on 12/11/2017 12:48:00 PM

The consensus is that the Fed will increase the Fed Funds Rate 25bps at the meeting this week.

Assuming the expected happens, the focus will be on the wording of the statement, the projections, and Fed Chair Janet Yellen's final press conference to try to determine how many rate hikes to expect in 2018.

Here are the September FOMC projections.

The projection for GDP in 2017 will likely be revised up. GDP in Q1 was at 1.2% annualized, Q2 at 3.1%, and Q3 at 3.3%. Current projections put Q4 GDP at around 2.5% to 2.9%. This would put GDP (Q4 over Q4) at the high end of the September forecast range.

Note: My guess is, as far as the impact of any fiscal stimulus, the Fed will continue to wait and see and not incorporate any tax cuts in their projections for 2018 and beyond.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Change in Real GDP1 | 2017 | 2018 | 2019 | 2020 |

| Sept 2017 | 2.2 to 2.5 | 2.0 to 2.3 | 1.7 to 2.1 | 1.6 to 2.0 |

| June 2017 | 2.1 to 2.2 | 1.8 to 2.2 | 1.8 to 2.0 | --- |

The unemployment rate was at 4.1% in both October and November. So the unemployment rate for Q4 2017 will be revised down. The unemployment rate for 2018 and 2019 will probably be revised down too.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Unemployment Rate2 | 2017 | 2018 | 2019 | 2020 |

| Sept 2017 | 4.2 to 4.3 | 4.0 to 4.2 | 3.9 to 4.4 | 4.0 to 4.5 |

| June 2017 | 4.2 to 4.3 | 4.0 to 4.3 | 4.1 to 4.4 | --- |

As of October, PCE inflation was up 1.6% from October 2016. Based on recent readings, PCE inflation will probably be revised up slightly for Q4 2017, and possibly for 2018.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| PCE Inflation1 | 2017 | 2018 | 2019 | 2020 |

| Sept 2017 | 1.5 to 1.6 | 1.8 to 2.0 | 2.0 | 2.0 to 2.1 |

| June 2017 | 1.6 to 1.7 | 1.8 to 2.0 | 2.0 to 2.1 | --- |

PCE core inflation was up 1.4% in October year-over-year. Core PCE inflation will probably be unchanged or revised down slightly for Q4 2017.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Core Inflation1 | 2017 | 2018 | 2019 | 2020 |

| Sept 2017 | 1.5 to 1.6 | 1.8 to 2.0 | 2.0 | 2.0 to 2.1 |

| June 2017 | 1.6 to 1.7 | 1.8 to 2.0 | 2.0 to 2.1 | --- |

In general, it appears GDP will be revised up, the unemployment rate revised down, and inflation is mixed. The inflation outlook will be key for Fed rate hikes in 2018.

BLS: Job Openings "Little changed" in October

by Calculated Risk on 12/11/2017 10:06:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings was little changed at 6.0 million on the last business day of October, the U.S. Bureau of Labor Statistics reported today. Over the month, hires increased to 5.6 million and separations were little changed at 5.2 million. Within separations, the quits rate and the layoffs and discharges rate were little changed at 2.2 percent and 1.1 percent, respectively. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The number of quits was unchanged at 3.2 million in October. The quits rate was 2.2 percent. The number of quits was little changed for total private, for government, and in all industries. In the regions, the number of quits increased in the South and decreased in the Midwest.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for October, the most recent employment report was for November.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased in October to 5.996 million from 6.177 in September.

The number of job openings (yellow) are up 7.3% year-over-year.

Quits are up 3.3% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Job openings are mostly moving sideways at a high level, and quits are increasing year-over-year. This is a solid report.

Sunday, December 10, 2017

Sunday Night Futures

by Calculated Risk on 12/10/2017 07:20:00 PM

Weekend:

• Schedule for Week of Dec 10, 2017

Monday:

• 10:00 AM ET: Job Openings and Labor Turnover Survey for October from the BLS.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 3, and DOW futures are up 23 (fair value).

Oil prices were down over the last week with WTI futures at $57.16 per barrel and Brent at $63.14 per barrel. A year ago, WTI was at $52, and Brent was at $52 - so oil prices are up solidly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.45 per gallon. A year ago prices were at $2.21 per gallon - so gasoline prices are up 24 cents per gallon year-over-year.

Hotel Occupancy Rate Increased Year-over-Year, On Pace for Record Year

by Calculated Risk on 12/10/2017 10:59:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 2 December

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 26 November through 2 December 2017, according to data from STR.Note: The hurricanes continue to drive demand in Texas and Florida, especially in Houston.

In comparison with the week of 27 November through 3 December 2016, the industry recorded the following:

• Occupancy: +1.3% to 56.6%

• Average daily rate (ADR): +0.2% to US$117.82

• Revenue per available room (RevPAR): +1.5% to US$66.71

Among the Top 25 Markets, Houston, Texas, reported the largest increase in RevPAR (+33.1% to US$74.18), due primarily to the highest rise in occupancy (+25.5% to 68.6%). Performance in the market continues to be boosted by post-Hurricane Harvey demand.

Tampa/St. Petersburg, Florida, posted the highest lift in ADR (+7.9% to US$113.10).

Orlando, Florida, experienced the second-highest increases in occupancy (+9.6% to 72.2%) and RevPAR (+15.7% to US$83.65).

emphasis added

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).Currently the occupancy rate, to date, is ahead of the record year in 2015. The hurricanes will push the annual occupancy rate to a new record in 2017.

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, December 09, 2017

Goldman: FOMC Preview

by Calculated Risk on 12/09/2017 05:23:00 PM

The FOMC meets on Tuesday and Wednesday, and almost all analysts expect a rate hike this week. Here are a few brief excerpts from a Goldman Sachs research note:

With the FOMC almost certain to deliver the third rate hike of 2017 at its December meeting next week, attention is instead likely to focus on the outlook for 2018 and beyond and in particular on how the Fed will react to a tax reform that now appears likely to become law.CR Note: I think FOMC members will wait until the tax cuts are passed before including the possible impact in their projections.

The economic data have improved slightly on net since the FOMC last met in early November. Growth momentum has remained strong, the unemployment rate has fallen further, and the latest inflation data were encouraging. Meanwhile, financial conditions have eased once again, as they have in the aftermath of each Fed tightening action so far in this hiking cycle.

In light of both the stronger growth momentum and the prospect of tax cuts, we expect the Summary of Economic Projections to upgrade GDP growth in 2018 and 2019 and to mark down the unemployment path by two-tenths to 3.9%, offset only partly by a one-tenth reduction in the longer-run unemployment rate to 3.5%. We expect the 2018 inflation projections to remain at 1.9% ... we continue to expect four rate hikes next year

Schedule for Week of Dec 10, 2017

by Calculated Risk on 12/09/2017 08:09:00 AM

The key economic reports this week are November retail sales and the Consumer Price Index (CPI).

For manufacturing, November industrial production, and the December New York Fed manufacturing survey will be released this week.

The FOMC meets this week and is expected to announce a 25bps increase in the Fed Funds rate.

10:00 AM ET: Job Openings and Labor Turnover Survey for October from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for October from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased slightly in September to 6.093 million from 6.090 in August.

The number of job openings (yellow) were up 7.5% year-over-year, and Quits were up 3.5% year-over-year.

6:00 AM ET: NFIB Small Business Optimism Index for November.

8:30 AM: The Producer Price Index for November from the BLS. The consensus is a 0.3% increase in PPI, and a 0.2% increase in core PPI.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Consumer Price Index for November from the BLS. The consensus is for a 0.4% increase in CPI, and a 0.2% increase in core CPI.

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to increase the Fed Funds rate 25 bps at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Janet Yellen holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 239 thousand initial claims, up from 236 thousand the previous week.

8:30 AM ET: Retail sales for November be released. The consensus is for a 0.3% increase in retail sales.

8:30 AM ET: Retail sales for November be released. The consensus is for a 0.3% increase in retail sales.This graph shows retail sales since 1992 through October 2017.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for October. The consensus is for a 0.1% decrease in inventories.

8:30 AM: The New York Fed Empire State manufacturing survey for December. The consensus is for a reading of 18.0, down from 19.4.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for November.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for November.This graph shows industrial production since 1967.

The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 77.2%.