by Calculated Risk on 12/06/2017 07:00:00 AM

Wednesday, December 06, 2017

MBA: Mortgage Applications Increase in Latest Weekly Survey

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 4.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 1, 2017. The prior week’s results included an adjustment for the Thanksgiving holiday.

... The Refinance Index increased 9 percent from the previous week. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index increased 38 percent compared with the previous week and was 8 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) decreased to 4.19 percent from 4.20 percent, with points increasing to 0.40 from 0.34 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall well below 4%.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, purchase activity is up 8% year-over-year.

Tuesday, December 05, 2017

Wednesday: ADP Employment

by Calculated Risk on 12/05/2017 06:07:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 192,000 payroll jobs added in November, down from 235,000 added in October.

November Employment Revisions

by Calculated Risk on 12/05/2017 03:41:00 PM

Every month, prior to writing my employment preview, I like to look at revisions for that month in prior years.

Here is a table of revisions for November since 2005. Note that most of the revisions have been up. This doesn't mean that the November 2017 revision will be up, but it does seem likely. Although, in recent years, the revisions have been more evenly split between up and down.

The fairly large upward revision in 2005 was related to the hurricanes that year.

| November Employment Report (000s) | |||

|---|---|---|---|

| Year | Initial | Revised | Revision |

| 2005 | 215 | 341 | 126 |

| 2006 | 132 | 209 | 77 |

| 2007 | 94 | 114 | 20 |

| 2008 | -533 | -766 | -233 |

| 2009 | -11 | -2 | 9 |

| 2010 | 39 | 119 | 80 |

| 2011 | 120 | 141 | 21 |

| 2012 | 146 | 132 | -14 |

| 2013 | 203 | 258 | 55 |

| 2014 | 321 | 312 | -9 |

| 2015 | 211 | 272 | 61 |

| 2016 | 178 | 164 | -14 |

Note: In 2008, the BLS significantly under reported job losses. That wasn't surprising since the initial models the BLS used missed turning points (something I wrote about in 2007). The BLS has since improved this model.

ISM Non-Manufacturing Index decreased to 57.4% in November

by Calculated Risk on 12/05/2017 10:05:00 AM

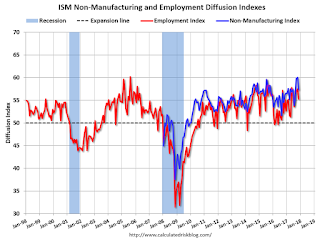

The November ISM Non-manufacturing index was at 57.4%, down from 60.1% in October. The employment index decreased in November to 55.3%, from 57.5%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: November 2017 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in November for the 95th consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee: "The NMI® registered 57.4 percent, which is 2.7 percentage points lower than the October reading of 60.1 percent. This represents continued growth in the non-manufacturing sector at a slower rate. The Non-Manufacturing Business Activity Index decreased to 61.4 percent, 0.8 percentage point lower than the October reading of 62.2 percent, reflecting growth for the 100th consecutive month, at a slightly slower rate in November. The New Orders Index registered 58.7 percent, 4.1 percentage points lower than the reading of 62.8 percent in October. The Employment Index decreased 2.2 percentage points in November to 55.3 percent from the October reading of 57.5 percent. The Prices Index decreased by 2 percentage points from the October reading of 62.7 percent to 60.7 percent, indicating prices increased in November for the sixth consecutive month. According to the NMI®, 16 non-manufacturing industries reported growth. The rate of growth has lessened in the non-manufacturing sector after two very strong months of growth. Comments from the survey respondents indicate that the economy and sector will continue to grow for the remainder of the year."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This suggests slower expansion in November than in October.

CoreLogic: House Prices up 7.0% Year-over-year in October

by Calculated Risk on 12/05/2017 08:51:00 AM

Notes: This CoreLogic House Price Index report is for October. The recent Case-Shiller index release was for September. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic US Home Price Report Marks Second Consecutive Month of 7 Percent Year-Over-Year Increases in October

CoreLogic® ... today released its CoreLogic Home Price Index (HPI™) and HPI Forecast™ for October 2017, which shows home prices are up both year over year and month over month. Home prices nationally increased year over year by 7 percent from October 2016 to October 2017, and on a month-over-month basis home prices increased by 0.9 percent in October 2017 compared with September 2017, according to the CoreLogic HPI.CR Note: The YoY increase has been in the 5% to 7% range for the last couple of years. This is the top end of that range.

Looking ahead, the CoreLogic HPI Forecast indicates that home prices will increase by 4.2 percent on a year-over-year basis from October 2017 to October 2018, and on a month-over-month basis home prices are expected to decrease by 0.2 percent from October 2017 to November 2017. The CoreLogic HPI Forecast is a projection of home prices using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“Single-family residential sales and prices continued to heat up in October,” said Dr. Frank Nothaft, chief economist for CoreLogic. “On a year-over-year basis, home prices grew in excess of 6 percent for four consecutive months ending in October, the longest such streak since June 2014. This escalation in home prices reflects both the acute lack of supply and the strengthening economy.”

emphasis added

The year-over-year comparison has been positive for over five consecutive years since turning positive year-over-year in February 2012.

Trade Deficit at $48.7 Billion in October

by Calculated Risk on 12/05/2017 08:44:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $48.7 billion in October, up $3.8 billion from $44.9 billion in September, revised. October exports were $195.9 billion, down less than $0.1 billion from September exports. October imports were $244.6 billion, $3.8 billion more than September imports.

Click on graph for larger image.

Click on graph for larger image.Exports decreased slightly, and imports increased, in October.

Exports are 18% above the pre-recession peak and up 6% compared to October 2016; imports are 5% above the pre-recession peak, and up 7% compared to October 2016.

In general, trade has been picking up.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $47.26 in October, up from $45.15 in September, and up from $40.03 in October 2016. The petroleum deficit had been declining for years - and is the major reason the overall deficit has mostly moved sideways since early 2012.

The trade deficit with China increased to $35.2 billion in October, from $31.2 billion in October 2016.

Monday, December 04, 2017

Tuesday: Trade Deficit, ISM non-Mfg Index

by Calculated Risk on 12/04/2017 06:52:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Steady to Higher, Depending on Lender

Mortgage rates were distinctly mixed today, with some lenders clearly moving higher while others were effectively unchanged [30YR FIXED - 4.0%]. The deciding factor is both simple and obvious. It has to do with Friday's wild action in the bond market ... That market movement resulted in a handful of lenders reissuing lower rates on Friday afternoon. Those lenders had to move rates back up today because underlying bond markets weren't able to maintain the improvements that resulted in the better rate sheets. Lenders who didn't adjust rates on Friday ended up being in fairly ideal territory for today's bond trading range and thus didn't need to make noticeable adjustments.Tuesday:

• At 8:30 AM ET, Trade Balance report for October from the Census Bureau. The consensus is for the U.S. trade deficit to be at $47.1 billion in October from $43.5 billion in September.

• At 10:00 AM, the ISM non-Manufacturing Index for November. The consensus is for index to decrease to 59.0 from 60.1 in October.

• At 10:00 AM, Corelogic House Price index for October.

Q4 GDP Forecasts

by Calculated Risk on 12/04/2017 03:24:00 PM

From the Altanta Fed: GDPNow

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2017 is 3.5 percent on December 1, up from 2.7 percent on November 30.From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast for 2017:Q4 stands at 3.9%.From Merrill Lynch:

[Recent] data bumped up 4Q GDP tracking by 0.1pp to 2.0% qoq saar.This quite a range of forecasts.

Update: Framing Lumber Prices Up Sharply Year-over-year

by Calculated Risk on 12/04/2017 12:37:00 PM

Here is another update on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs - and prices are once again near the bubble highs.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through November 2017 (via NAHB), and 2) CME framing futures.

Prices in 2017 are up solidly year-over-year and might exceed the housing bubble highs in the Spring of 2018. Note: CME prices hit an all time high briefly in November.

Right now Random Lengths prices are up 25% from a year ago, and CME futures are up about 36% year-over-year.

There is a seasonal pattern for lumber prices. Prices frequently peak around May, and bottom around October or November - although there is quite a bit of seasonal variability.

It looks like we will see record prices in 2018.

Black Knight Mortgage Monitor: Tax Changes may Reduce Supply of Homes for Sale

by Calculated Risk on 12/04/2017 10:00:00 AM

Black Knight released their Mortgage Monitor report for October today. According to Black Knight, 4.44% of mortgages were delinquent in October, up from 4.35% in October 2016. Black Knight also reported that 0.68% of mortgages were in the foreclosure process, down from 0.99% a year ago.

This gives a total of 5.12% delinquent or in foreclosure.

Press Release: Black Knight’s Mortgage Monitor: Tax Reform Could Further Constrict Already Tight Housing Inventory, While Increasing Net Housing Expenses for Many Buyers

Today, the Data & Analytics division of Black Knight, Inc. released its latest Mortgage Monitor Report, based on data as of the end of October 2017. Given the significant impact proposed changes to the tax code could have on the housing and mortgage markets, this month Black Knight explored the impact from the Senate and House versions of tax reform as currently written. As Black Knight Data & Analytics Executive Vice President Ben Graboske explained, proposed changes to the standard deduction, mortgage interest deduction (MID) and capital gains exemptions in particular could put even more pressure on already limited available housing inventory, with ramifications for both current homeowners and prospective buyers.

“Both tax reform proposals double the standard tax deduction, which may, in many cases, provide a greater benefit to renters than to homeowners,” said Graboske. “It may also reduce the tax incentive to purchase a home and generally make the MID less valuable to borrowers. We’ve observed in the past that positive tax incentives can certainly impact home buying decisions – the Black Knight Home Price Index showed clear evidence of this as a result of 2008’s first-time homebuyer tax credit. However, limited data is available to examine the effects of removing an existing tax incentive on borrowers’ purchase behavior. One thing that seems clear is that a reduction of the MID could further constrain available housing inventory, which itself has helped to push home prices even higher in many places. Almost 3 million active first-lien mortgages -- current mortgage holders -- have original balances exceeding $500K -- the cap proposed in the House version of the tax bill. These borrowers would be exempt from the limit. We’ve already seen signs of ‘interest rate lock’ on the market, as homeowners with low interest rate mortgages have a disincentive to sell in a rising rate environment. The question now becomes whether the proposed tax reform adds another layer of ‘tax deduction lock’ on the market. Do these homeowners now also have a disincentive to sell their home in order to keep their current interest rate deduction of up to $1 million? If so, this would potentially add new supply constraints.

“Lower-priced markets may see little effects from these changes, but the most recent Black Knight Home Price Index shows 22 markets nationwide where the median home price is over $500K. Mortgage originations at or above that point have increased by 350 percent since the bottom of the housing market. At the current rate of growth, we could see approximately 480,000 purchase originations in 2018 with original balances over $500K, with an estimated 2.9 million over the first five years of the tax plan. If home prices continue to rise and the cap is left in place, more families in the upper-middle income range could be impacted. Even if interest rates stayed steady around four percent, a $500K MID cap could cost the average homeowner with a larger mortgage an additional $2,600 - $4,200 per year depending on their tax bracket, representing a 6 to 10 percent increase in housing-related expenses as compared to the average annual principal and interest payment today.”

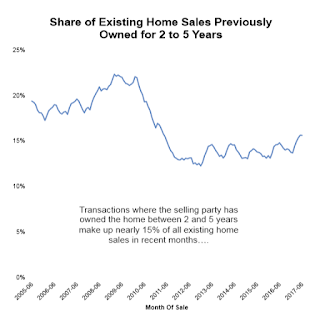

Black Knight also found that proposed changes to the capital gains exemption on profits from the sale of a home (requiring five years of continuous residence as compared to the current two) could impact approximately 750,000 home sellers per year, also potentially increasing pressure on available inventory. Leveraging the company’s SiteX property records database, Black Knight found that on average, over the past 24 months, more than 14 percent of property sales were by homeowners falling into that two-to-five-year window and who would no longer be exempt from capital gains taxation. On average, $60 billion in capital gains each year could be impacted, with a worst-case scenario (taxing the full amount under the highest tax bracket) putting the cost to home sellers at approximately $23 billion. If such homeowners choose to forego or delay selling to avoid a tax liability, this may also further reduce the supply of homes for sale.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graphic from Black Knight looks at the percentage of existing home sales owned from 2 to 5 years.

From Black Knight:

• Currently taxpayers filing jointly can 'exclude' up to $500K of capital gains from the sale of their primary residence (up to $250K for single filers) tax-free, provided they have lived in the property for two years of the preceding fiveThere is much more in the mortgage monitor.

• Both the House and Senate proposals lengthen the ownership requirement to five of the preceding eight years, and homeowners could only use the tax-free provision once every five years

• Black Knight found that over the past 24 months, more than 14 percent of property sales were by homeowners falling into that two-to-five-year window and who would no longer be exempt from capital gains taxation

• On average, $60 billion in capital gains each year could be affected, with a worst-case scenario (taxing the full amount under the highest tax bracket) putting the cost to home sellers at approximately $23 billion

• If such homeowners choose to forego or delay selling their home due to tax liability this may also further reduce the supply of homes for sale