by Calculated Risk on 11/29/2017 08:34:00 AM

Wednesday, November 29, 2017

Q3 GDP Revised up to 3.3% Annual Rate

From the BEA: Gross Domestic Product: Third Quarter 2017 (Second Estimate)

Real gross domestic product (GDP) increased at an annual rate of 3.3 percent in the third quarter of 2017, according to the "second" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 3.1 percent.Here is a Comparison of Second and Advance Estimates. PCE growth was revised down from 2.4% to 2.3%. Residential investment was revised up slightly from -6.0% to -5.1%. This was at the consensus forecast.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 3.0 percent. With this second estimate for the third quarter, the general picture of economic growth remains the same; nonresidential fixed investment, state and local government spending, and private inventory investment were revised up from the prior estimate ...

emphasis added

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 11/29/2017 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 24, 2017. This week’s results include an adjustment for the Thanksgiving holiday.

... The Refinance Index decreased 8 percent from the previous week to its lowest level since January 2017. The seasonally adjusted Purchase Index increased 2 percent from one week earlier to its highest level since September 2017. The unadjusted Purchase Index decreased 32 percent compared with the previous week and was 6 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) remained unchanged from the week prior at 4.20 percent, with points decreasing to 0.34 from 0.42 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

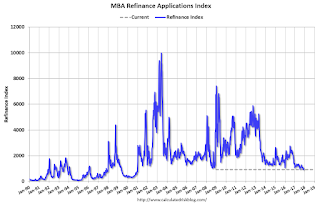

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall well below 4%.

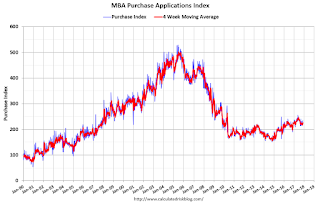

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, purchase activity is up 6% year-over-year.

Tuesday, November 28, 2017

Wednesday: GDP, Pending Home Sales, Fed Chair Yellen

by Calculated Risk on 11/28/2017 08:01:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Gross Domestic Product, 3rd quarter 2017 (Second estimate). The consensus is that real GDP increased 3.3% annualized in Q3, up from 3.0% in the advance report.

• At 10:00 AM, Testimony, Fed Chair Janet Yellen, Economic Outlook, Joint Economic Committee, U.S. Congress

• Also at 10:00 AM, Pending Home Sales Index for October. The consensus is for a 1.0% increase in the index.

Zillow Case-Shiller Forecast: More Solid House Price Gains in October

by Calculated Risk on 11/28/2017 04:16:00 PM

The Case-Shiller house price indexes for September were released this morning. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Svenja Gudell at Zillow: Case-Shiller September Results and October Forecast: Underbuilding Continues to Take a Toll

The primary Case-Shiller indices paint a picture of a national housing market that’s largely stable and maybe even a bit boring from 50,000 feet, with home prices growing at roughly the same pace for the past year or more.The year-over-year change for the Case-Shiller National index will be about the same in October as in September. Zillow is forecasting larger year-over-year increases for both the 10-city and 20-city indexes in October.

The U.S. National Index for September showed an annual increase in home prices of 6.2 percent. The month-over-month increase from August was 0.7 percent.

The 10-city composite gained 5.7 percent annually and 0.6 percent from August to September, while the 20-city composite grew 6.2 percent annually and 0.5 percent month-over-month. Seattle, Las Vegas, and San Diego continued to post the largest annual gains among the 20-city composite, climbing 12.9 percent, 9 percent and 8.2 percent, respectively.

But the real action is on the sidelines. Demand is coming first and foremost from buyers in the entry-level and mid-market segments, but available inventory is largely concentrated at the high end – causing the nation’s most affordable homes to grow in value at more than twice the pace of homes at the top of the market. The past two months have shown promising signs of life from builders who have had difficulty meeting intense demand in the face of rising land, lumber and labor prices – but it’s going to take a lot more than two good months to erase a housing deficit accumulated from years of underbuilding.

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 11/28/2017 02:35:00 PM

CR Note: This is a repeat of earlier posts with updated graphs.

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see former Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through September 2017). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

Real House Prices and Price-to-Rent Ratio in September

by Calculated Risk on 11/28/2017 11:48:00 AM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 6.2% year-over-year in September

It has been more than ten years since the bubble peak. In the Case-Shiller release this morning, the seasonally adjusted National Index (SA), was reported as being 5.1% above the previous bubble peak. However, in real terms, the National index (SA) is still about 12.2% below the bubble peak (and historically there has been an upward slope to real house prices).

The year-over-year increase in prices is mostly moving sideways now around 6%. In September, the index was up 6.2% YoY.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $280,300 today adjusted for inflation (40%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is at a new peak, and the Case-Shiller Composite 20 Index (SA) is back to November 2005 levels.

Real House Prices

In real terms, the National index is back to August 2004 levels, and the Composite 20 index is back to March 2004.

In real terms, house prices are back to mid 2004 levels.

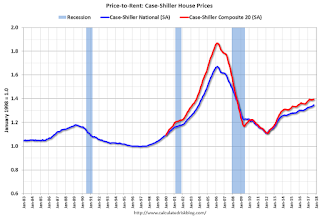

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to December 2003 levels, and the Composite 20 index is back to September 2003 levels.

In real terms, prices are back to mid 2004 levels, and the price-to-rent ratio is back to 2003 - and the price-to-rent ratio has been increasing slowly.

Richmond Fed: "Fifth District Manufacturing Activity Saw Robust Growth in November"

by Calculated Risk on 11/28/2017 10:03:00 AM

From the Richmond Fed: Fifth District Manufacturing Activity Saw Robust Growth in November

Manufacturing firms reported robust growth in November, according to the latest survey by the Federal Reserve Bank of Richmond. The composite index jumped from 12 to 30, the highest it has been since 1993. This rise was bolstered by strengthening conditions across all three components of the index. While indicators of current wages and finished goods fell in November, both maintained positive values, dropping from 24 to 21 and 14 to 9, respectively.This was the last of the regional Fed surveys for November.

District manufacturing firms remained optimistic that growth will continue in the coming six months. But a smaller share of firms raised their expectations than had in October in all areas, except for wages and capital expenditures.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through November), and five Fed surveys are averaged (blue, through November) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through October (right axis).

Based on these regional surveys, it seems likely the ISM manufacturing index will be strong again in November (to be released Friday, Dec 1st).

Case-Shiller: National House Price Index increased 6.2% year-over-year in September

by Calculated Risk on 11/28/2017 09:13:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for September ("September" is a 3 month average of July, August and September prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: September S&P CoreLogic Case-Shiller National Home Price NSA Index Up 6.2% In Last 12 Months

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 6.2% annual gain in September, up from 5.9% in the previous month. The 10-City Composite annual increase came in at 5.7%, up from 5.2% the previous month. The 20-City Composite posted a 6.2% year-over-year gain, up from 5.8% the previous month.

Seattle, Las Vegas, and San Diego reported the highest year-over-year gains among the 20 cities. In September, Seattle led the way with a 12.9% year-over-year price increase, followed by Las Vegas with a 9.0% increase, and San Diego with an 8.2% increase. 13 cities reported greater price increases in the year ending September 2017 versus the year ending August 2017.

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.4% in September. The 10-City and 20-City Composites reported increases of 0.5% and 0.4%, respectively. After seasonal adjustment, the National Index recorded a 0.7% month-over-month increase in September. The 10-City and 20-City Composites posted 0.6% and 0.5% month-over-month increases, respectively. 15 of 20 cities reported increases in September before seasonal adjustment, while all 20 cities reported increases after seasonal adjustment.

“Home prices continued to rise across the country with the S&P CoreLogic Case-Shiller National Index rising at the fastest annual rate since June 2014,” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “Home prices were higher in all 20 cities tracked by these indices compared to a year earlier; 16 cities saw annual price increases accelerate from last month. Strength continues to be concentrated in the west with Seattle, Las Vegas, San Diego and Portland seeing the largest gains. The smallest increases were in Atlanta, New York, Miami, Chicago and Washington. Eight cities have surpassed their pre-financial crisis peaks.”

“Most economic indicators suggest that home prices can see further gains. Rental rates and home prices are climbing, the rent-to-buy ratio remains stable, the average rate on a 30-year mortgage is still under 4%, and at a 3.8-month supply, the inventory of homes for sale is still low. The overall economy is growing with the unemployment rate at 4.1%, inflation at 2% and wages rising at 3% or more. One dark cloud for housing is affordability – rising prices mean that some people will be squeezed out of the market.”

emphasis added

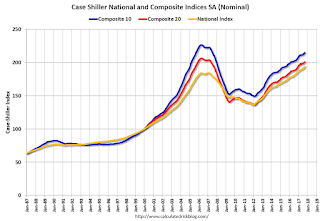

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 5.3% from the peak, and up 0.6% in September (SA).

The Composite 20 index is off 2.6% from the peak, and up 0.5% (SA) in September.

The National index is 5.1% above the bubble peak (SA), and up 0.7% (SA) in September. The National index is up 42.1% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 5.7% compared to September 2016. The Composite 20 SA is up 6.2% year-over-year.

The National index SA is up 6.2% year-over-year.

Note: According to the data, prices increased in all 20 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Monday, November 27, 2017

Tuesday: Case-Shiller House Prices, Richmond Fed Mfg, Jerome Powell Fed Nomination Hearing

by Calculated Risk on 11/27/2017 07:45:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Flat as Markets Get Back to Business

Mortgage rates were almost perfectly unchanged today as markets returned to full force following the extended Thanksgiving break [30YR FIXED - 4.0%]. Bond markets (which dictate mortgage rate momentum) had been consolidating in a narrower and narrower range in the weeks leading up to Thanksgiving. While it's safe to assume that we'll see a bigger move in the coming weeks, today didn't deliver.Tuesday:

The volatility is widely expected to result from the tax reform process. The Senate will begin debate this week, but don't expect anything conclusive until mid-to-late December. Markets are ready to react to success (which would be bad for rates) or failure (which would be good), and will move in the direction of those results to whatever extent one seems more likely than the other.

• At 9:00 AM ET, FHFA House Price Index for September 2017. This was originally a GSE only repeat sales, however there is also an expanded index.

• Also at 9:00 AM, S&P/Case-Shiller House Price Index for September. The consensus is for a 6.2% year-over-year increase in the Comp 20 index for September.

• At 9:45 AM, Testimony, Fed Governor Jerome Powell, Nomination Hearing, Committee on Banking, Housing, and Urban Affairs, U.S. Senate

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for November. This is the last of the regional surveys for November.

Dallas Fed: "Manufacturing Expansion Slows but Remains Solid" in November

by Calculated Risk on 11/27/2017 02:09:00 PM

Earlier from the Dallas Fed: Manufacturing Expansion Slows but Remains Solid

Texas factory activity continued to expand in November, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, fell 10 points from its October reading but remained elevated at 15.1.

Other measures of manufacturing activity also pointed to November growth that was slightly slower than in October but still well above average. The new orders index moved down five points to 20.0, and the capacity utilization and shipments indexes similarly fell to 17.3 and 16.7, respectively. Meanwhile, the growth rate of orders index signaled a stronger pickup in demand, climbing six points to 18.1. This represents the index’s highest reading since 2010.

Perceptions of broader business conditions remained highly positive in November. The general business activity index came in at 19.4, down eight points from October. The company outlook index posted its 15th consecutive positive reading but dipped to 18.5.

Labor market measures suggested slower employment growth and longer workweeks this month. The employment index fell 10 points from October to 6.3, reflecting a more normal index level after several months of elevated readings. Nineteen percent of firms noted net hiring, compared with 13 percent noting net layoffs. The hours worked index edged down but remained positive at 11.5, indicating a continued lengthening of workweeks.

emphasis added