by Calculated Risk on 10/31/2017 08:08:00 PM

Tuesday, October 31, 2017

Wednesday: FOMC Annoucement, ADP Employment, Vehicle Sales, ISM Mfg, Construction Spending

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for October. This report is for private payrolls only (no government). The consensus is for 210,000 payroll jobs added in October, up from 135,000 added in September.

• At 10:00 AM, ISM Manufacturing Index for October. The consensus is for the ISM to be at 59.5, down from 60.8 in September. The PMI was at 60.8% in September, the employment index was at 60.3%, and the new orders index was at 64.6%.

• Also at 10:00 AM, Construction Spending for September. The consensus is for a 0.1% increase in construction spending.

• All Day, Light vehicle sales for October. The consensus is for light vehicle sales to be 17.5 million SAAR in October, down from 18.6 million in September (Seasonally Adjusted Annual Rate).

• At 2:00 PM, FOMC Meeting Announcement. The FOMC is expected to announce no change to policy at this meeting.

Zillow Case-Shiller Forecast: More Solid House Price Gains in September

by Calculated Risk on 10/31/2017 05:52:00 PM

The Case-Shiller house price indexes for August were released this morning. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Svenja Gudell at Zillow: Case-Shiller August Results and September Forecast: Gains to the Horizon

The U.S. housing market has settled into a predictable rhythm that shows very few signs of changing. There is incredibly strong demand, driven by a largely healthy overall economy and aging millennials entering their home buying prime, and there is too-low inventory, driven by limited home building activity. Together, those two factors continue to push housing prices up.The year-over-year change for the Case-Shiller National index will be about the same in September as in August.

...

Our home-price forecast for September, which Case-Shiller will not release until Nov. 28, is for more of the same: We expect the national index to maintain its 0.5 percent month-over-month trend, with both city composites climbing 0.4 percent month-over-month, which is slightly slower than they have been.

Real House Prices and Price-to-Rent Ratio in August

by Calculated Risk on 10/31/2017 01:23:00 PM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 6.1% year-over-year in August

It has been more than ten years since the bubble peak. In the Case-Shiller release this morning, the seasonally adjusted National Index (SA), was reported as being 4.3% above the previous bubble peak. However, in real terms, the National index (SA) is still about 13.3% below the bubble peak (and historically there has been an upward slope to real house prices).

The year-over-year increase in prices is mostly moving sideways now around 5% to 6%. In August, the index was up 6.1% YoY.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $278,000 today adjusted for inflation (39%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is at a new peak, and the Case-Shiller Composite 20 Index (SA) is back to November 2005 levels.

Real House Prices

In real terms, the National index is back to August 2004 levels, and the Composite 20 index is back to March 2004.

In real terms, house prices are back to mid 2004 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to November 2003 levels, and the Composite 20 index is back to September 2003 levels.

In real terms, prices are back to mid 2004 levels, and the price-to-rent ratio is back to 2003 - and the price-to-rent ratio has been increasing slowly.

HVS: Q3 2017 Homeownership and Vacancy Rates

by Calculated Risk on 10/31/2017 10:11:00 AM

The Census Bureau released the Residential Vacancies and Homeownership report for Q3 2017.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate increased to 63.9% in Q3, from 63.7% in Q2.

I'd put more weight on the decennial Census numbers - and given changing demographics, the homeownership rate has probably bottomed.

Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey.

Overall this suggests that vacancies have declined significantly, and my guess is the homeownership rate has bottomed - and that the rental vacancy rate has bottomed for this cycle.

Case-Shiller: National House Price Index increased 6.1% year-over-year in August

by Calculated Risk on 10/31/2017 09:14:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for August ("August" is a 3 month average of June, July and August prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: The S&P Corelogic Case-Shiller National Home Price NSA Index Reaches New High as Momentum Continues

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 6.1% annual gain in August, up from 5.9% in the previous month. The 10-City Composite annual increase came in at 5.3%, up from 5.2% the previous month. The 20-City Composite posted a 5.9% year-over-year gain, up from 5.8% the previous month.

Seattle, Las Vegas, and San Diego reported the highest year-over-year gains among the 20 cities. In August, Seattle led the way with a 13.2% year-over-year price increase, followed by Las Vegas with an 8.6% increase, and San Diego with a 7.8% increase. Nine cities reported greater price increases in the year ending August 2017 versus the year ending July 2017.

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.5% in August. The 10-City and 20-City Composites reported increases of 0.5% and 0.4% respectively. After seasonal adjustment, the National Index recorded a 0.5% month-over-month increase in August. The 10-City Composite and 20-City Composite both posted 0.5% month-over-month increases. Nineteen of 20 cities reported increases in August both before and after seasonal adjustment.

“Home price increases appear to be unstoppable,” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “August saw the National Index annual rate tick up to 6.1%; all 20 cities followed in the report were up year-over-year while one, Atlanta, saw the seasonally adjusted monthly number slip 0.2%. Most prices across the rest of the economy are barely moving compared to housing. Over the last year the consumer price index rose 2.2%, driven largely by energy costs. Aside from oil, the only other major item with price gains close to housing was hospital services, which were up 4.6%. Wages climbed 3.6% in the year to August.

“The ongoing rise in home prices poses questions of why prices are climbing and whether they will continue to outpace most of the economy. Currently, low mortgage rates combined with an improving economy are supporting home prices. Low interest rates raise the value of both real and financial longlived assets. The price gains are not simply a rebound from the financial crisis; nationally and in nine of the 20 cities in the report, home prices have reached new all-time highs. However, home prices will not rise forever. Measures of affordability are beginning to slide, indicating that the pool of buyers is shrinking. The Federal Reserve is pushing short term interest rates upward and mortgage rates are likely to follow over time, removing a key factor supporting rising home prices.”

emphasis added

Click on graph for larger image.

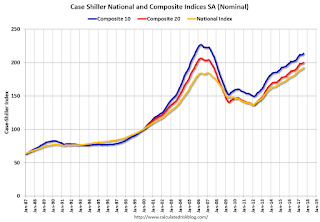

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 5.8% from the peak, and up 0.5% in August (SA).

The Composite 20 index is off 3.1% from the peak, and up 0.4% (SA) in August.

The National index is 4.3% above the bubble peak (SA), and up 0.5% (SA) in August. The National index is up 41.0% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 5.4% compared to August 2016. The Composite 20 SA is up 6.0% year-over-year.

The National index SA is up 6.1% year-over-year.

Note: According to the data, prices increased in 19 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Monday, October 30, 2017

Tuesday: Case-Shiller House Prices

by Calculated Risk on 10/30/2017 07:12:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Lowest in a Week

Mortgage rates recovered even more of their recent losses today ... Whether this proves to be a turning point in the bigger picture remains to be seen. Rates are in a well-established uptrend. [30YR FIXED - 4.0-4.125%]Tuesday:

• At 9:15 AM ET, S&P/Case-Shiller House Price Index for August. The consensus is for a 6.0% year-over-year increase in the Comp 20 index for August.

• At 9:45 AM, Chicago Purchasing Managers Index for October. The consensus is for a reading of 62.0, down from 65.2 in September.

• At 10:00 AM, the Q3 Housing Vacancies and Homeownership from the Census Bureau.

Are house prices a new bubble?

by Calculated Risk on 10/30/2017 02:28:00 PM

Update: Here are five questions that people ask me all the time.

1. Are house prices in a bubble?

2. Is a recession imminent (within the next 12 months)?

3. Is the stock market a bubble?

4. Can investors use macro analysis?

5. Will Mr. Trump have a negative impact on the economy?

On Friday, I posted five economic questions I'm frequently asked. I'll post some thoughts on each of these topics over the next couple of weeks.

A common question is: Are house prices in a new bubble? My short answer was: No. Here is an explanation.

First, we need to define a bubble. Way back in April 2005, when I was very bearish on housing, I wrote: Housing: Speculation is the Key. From that post:

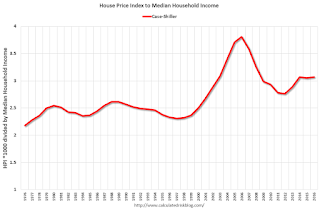

I have taken to calling the housing market a "bubble". But how do I define a bubble?First, on valuation: two key measures are house prices to income, and real house prices. The Census Bureau released the Income, Poverty and Health Insurance Coverage in the United States: 2016 in September. The report showed a significant increase in the real median household income:

A bubble requires both overvaluation based on fundamentals and speculation. It is natural to focus on an asset’s fundamental value, but the real key for detecting a bubble is speculation - the topic of this post. Speculation tends to chase appreciating assets, and then speculation begets more speculation, until finally, for some reason that will become obvious to all in hindsight, the "bubble" bursts.

The U.S. Census Bureau announced today that real median household income increased by 3.2 percent between 2015 and 2016 ... Median household income in the United States in 2016 was $59,039, an increase in real terms of 3.2 percent from the 2015 median income of $57,230. This is the second consecutive annual increase in median household income.The firs two graphs use annual averages of the Case-Shiller house price index - and the nominal median household income (and the mean for the fourth fifth income) through 2016.

Click on graph for larger image.

Click on graph for larger image.This graph shows the ratio of house price indexes divided by the Median Household Income through 2016 (the HPI is first multiplied by 1000).

This uses the annual average National Case-Shiller index since 1976.

As of 2016, house prices were above the median historical ratio - but far below the bubble peak.

The second graph is similar but uses the mean of the fourth fifth household income (if we separate households into fifths, this is the second highest income group).

These are key households since they are more likely to be homeowners (and home buyers).

These are key households since they are more likely to be homeowners (and home buyers).Using this group, prices are well below the bubble peak.

By these measures, we could argue house prices are 15% to 20% too high, but this is a relatively small overvaluation compared to the 50%+ overpricing at the peak of the housing bubble.

The third graph shows the monthly Case-Shiller National index SA, and the monthly Case-Shiller Composite 20 index SA (through July) in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The third graph shows the monthly Case-Shiller National index SA, and the monthly Case-Shiller Composite 20 index SA (through July) in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.At first glance, this seems to suggest prices are 30% too high (and were maybe 50% to 60% too high during the bubble). However there is an upward slope to real prices, see The upward slope of Real House Prices and Lawler: On the upward trend in Real House Prices.

After adjusting for the historical upward slope in real prices, I'd estimate prices are about 15% too high.

On Speculation: Back in 2005, it was easy to identify excess speculation. There is currently some flipping activity, but this is more the normal type of flipping (buy, improve and then sell). Back in 2005, people were just buying homes are letting them sit vacant - and then selling without significant improvements. Classic speculation.

And even more dangerous during the bubble was the excessive use of leverage (all those poor quality loans). Currently lending standards are decent, and loan quality is excellent.

So prices may be a little overvalued, but there is little speculation - and I wouldn't call house prices a bubble - and I don't expect house prices to decline nationally like during the bust.

Black Knight: House Price Index up 0.2% in August, Up 6.2% year-over-year

by Calculated Risk on 10/30/2017 01:01:00 PM

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA and more). Note: Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight: Black Knight Home Price Index: U.S. Home Prices Hit Another New Peak, Gaining 0.24 Percent in August 2017 With Year-Over-Year Growth Steady at 6.24 Percent

• The national-level HPI rose in August ($282K), marking another new high for U.S. home pricesThe year-over-year increase in this index has been about the same for the last year (close to 6% range).

• Home prices rose just 0.24 percent from July, while the annual rate of appreciation remained steady at 6.24 percent

• Year-to-date, U.S. home prices have gained more than six percent

• August’s rate of monthly appreciation fell to less than half that of July’s, marking five consecutive months of slowing growth

• Of the nation’s 40 largest metros, 14 hit new peaks – Boston, MA; Charlotte, NC; Cincinnati, OH; Dallas, TX; Houston, TX; Kansas City, MO; Los Angeles, CA; Nashville, TN; New York, NY; Portland, OR; San Antonio, TX; San Diego, CA; San Francisco, CA and San Jose, CA

Note that house prices are above the bubble peak in nominal terms, but not in real terms (adjusted for inflation). Case-Shiller for August will be released tomorrow.

Dallas Fed: "Growth in Texas Manufacturing Activity Gains Momentum" in October

by Calculated Risk on 10/30/2017 10:40:00 AM

From the Dallas Fed: Growth in Texas Manufacturing Activity Gains Momentum

Texas factory activity expanded at a faster pace in October, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose six points to 25.6 and reached its highest reading since April 2014.This was the last of the regional Fed surveys for October.

Other measures of current manufacturing activity also indicated a pickup in growth. The new orders index climbed six points to a 10-year high of 24.8, and the growth rate of orders index moved up to 12.3. The capacity utilization index also pushed to its highest level in a decade at 22.5. Meanwhile, the shipments index moved down several points but remained positive and at a well-above-average level of 20.9.

Perceptions of broader business conditions improved in October. The general business activity index increased to 27.6, its highest reading since 2006. The company outlook index posted its 14th consecutive positive reading, holding steady at an elevated 25.8.

Labor market measures suggested solid employment growth and longer workweeks this month. The employment index came in at 16.7, unchanged from September and still well above average. Less than 5 percent of firms noted net layoffs—something that has only been seen five other times since the start of the survey more than 13 years ago. The hours worked index moved down but remained positive at 13.7, indicating a continuing lengthening of workweeks.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through October), and five Fed surveys are averaged (blue, through October) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through September (right axis).

Based on these regional surveys, it seems likely the ISM manufacturing index will be strong again in October (to be released Wednesday, Nov 1st).

Personal Income increased 0.4% in September, Spending increased 1.0%

by Calculated Risk on 10/30/2017 08:36:00 AM

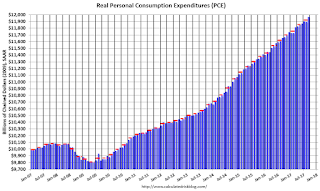

The BEA released the Personal Income and Outlays report for September:

Personal income increased $66.9 billion (0.4 percent) in September according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $53.0 billion (0.4 percent) and personal consumption expenditures (PCE) increased $136.0 billion (1.0 percent).The September PCE price index increased 1.6 percent year-over-year and the September PCE price index, excluding food and energy, increased 1.3 percent year-over-year.

...

Real PCE increased 0.6 percent. The PCE price index increased 0.4 percent. Excluding food and energy, the PCE price index increased 0.1 percent.

The following graph shows real Personal Consumption Expenditures (PCE) through September 2017 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was at expectations, and the increase in PCE was slightly above expectations.