by Calculated Risk on 9/20/2017 02:02:00 PM

Wednesday, September 20, 2017

FOMC Statement: "In October, the Committee will initiate the balance sheet normalization program"

Information received since the Federal Open Market Committee met in July indicates that the labor market has continued to strengthen and that economic activity has been rising moderately so far this year. Job gains have remained solid in recent months, and the unemployment rate has stayed low. Household spending has been expanding at a moderate rate, and growth in business fixed investment has picked up in recent quarters. On a 12-month basis, overall inflation and the measure excluding food and energy prices have declined this year and are running below 2 percent. Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations are little changed, on balance.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. Hurricanes Harvey, Irma, and Maria have devastated many communities, inflicting severe hardship. Storm-related disruptions and rebuilding will affect economic activity in the near term, but past experience suggests that the storms are unlikely to materially alter the course of the national economy over the medium term. Consequently, the Committee continues to expect that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace, and labor market conditions will strengthen somewhat further. Higher prices for gasoline and some other items in the aftermath of the hurricanes will likely boost inflation temporarily; apart from that effect, inflation on a 12-month basis is expected to remain somewhat below 2 percent in the near term but to stabilize around the Committee's 2 percent objective over the medium term. Near-term risks to the economic outlook appear roughly balanced, but the Committee is monitoring inflation developments closely.

In view of realized and expected labor market conditions and inflation, the Committee decided to maintain the target range for the federal funds rate at 1 to 1-1/4 percent. The stance of monetary policy remains accommodative, thereby supporting some further strengthening in labor market conditions and a sustained return to 2 percent inflation.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. The Committee will carefully monitor actual and expected inflation developments relative to its symmetric inflation goal. The Committee expects that economic conditions will evolve in a manner that will warrant gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.

In October, the Committee will initiate the balance sheet normalization program described in the June 2017 Addendum to the Committee's Policy Normalization Principles and Plans. Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; Charles L. Evans; Stanley Fischer; Patrick Harker; Robert S. Kaplan; Neel Kashkari; and Jerome H. Powell.

emphasis added

A Few Comments on August Existing Home Sales

by Calculated Risk on 9/20/2017 11:26:00 AM

Earlier: NAR: "Existing-Home Sales Subside 1.7 Percent in August"

First, as usual, housing economist Tom Lawler's estimate was much closer to the NAR report than the consensus. So the decline in sales in August was no surprise for CR readers.

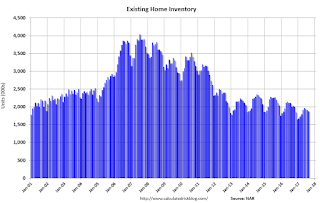

Inventory is still very low and falling year-over-year (down 6.5% year-over-year in August). Inventory has declined year-over-year for 27 consecutive months. I started the year expecting inventory would be increasing year-over-year by the end of 2017. That now seems unlikely (but not impossible).

Inventory is a key metric to watch. More inventory would probably mean smaller price increases, and less inventory somewhat larger price increases.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA in August (535,000, red column) were below sales in August 2016 (539,000, NSA).

Sales NSA are now in the seasonally strong period (March through September).

Note: Existing home sales will be weak in the hurricane damaged areas in September.

NAR: "Existing-Home Sales Subside 1.7 Percent in August "

by Calculated Risk on 9/20/2017 10:14:00 AM

From the NAR: Existing-Home Sales Subside 1.7 Percent in August

Existing-home sales stumbled in August for the fourth time in five months as strained supply levels continue to subdue overall activity, according to the National Association of Realtors®. Sales gains in the Northeast and Midwest were outpaced by declines in the South and West.

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, retreated 1.7 percent to a seasonally adjusted annual rate of 5.35 million in August from 5.44 million in July. Last month's sales pace is 0.2 percent above last August, and is the lowest since then.

...

Total housing inventory at the end of August declined 2.1 percent to 1.88 million existing homes available for sale, and is now 6.5 percent lower than a year ago (2.01 million) and has fallen year-over-year for 27 consecutive months. Unsold inventory is at a 4.2-month supply at the current sales pace, which is down from 4.5 months a year ago.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in August (5.35 million SAAR) were 1.7% lower than last month, and were 0.2% above the August 2016 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 1.88 million in August from 1.92 million in July. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory decreased to 1.88 million in August from 1.92 million in July. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 6.5% year-over-year in August compared to August 2016.

Inventory decreased 6.5% year-over-year in August compared to August 2016. Months of supply was at 4.2 months in August.

As expected, sales were below the consensus view. For existing home sales, a key number is inventory - and inventory is still low. I'll have more later ...

AIA: Architecture Billings Index "growth streak" continues in August

by Calculated Risk on 9/20/2017 09:16:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index continues growth streak

With all geographic regions and building project sectors showing positive conditions, there continues to be a heightened level of demand for design services signaled in the latest Architecture Billings Index (ABI). As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the August ABI score was 53.7, up from a score of 51.9 in the previous month. This score reflects an increase in design services provided by U.S. architecture firms (any score above 50 indicates an increase in billings). The new projects inquiry index was 62.5, up from a reading of 59.5 the previous month, while the new design contracts index eased somewhat from 56.4 to 54.2.

“The August results continue a string of very positive readings from the design professions, pointing to future healthy growth across the major construction sectors, as well as across the major regions of the country,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “Given the focus and discussions around the infrastructure needs of the nation, we expect strong growth in design activity for the coming months and years.”

...

• Regional averages: South (55.7), Northeast (54.3), Midwest (52.5), West (51.3)

• Sector index breakdown: commercial / industrial (57.6), multi-family residential (53.8), mixed practice (52.5), institutional (50.1)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 53.7 in August, up from 51.9 in July. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 10 of the last 12 months, suggesting a further increase in CRE investment in 2017 and into 2018.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 9/20/2017 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 9.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 15, 2017. Last week’s results included an adjustment for the Labor Day holiday.

... The Refinance Index decreased 9 percent from the previous week. The seasonally adjusted Purchase Index decreased 11 percent from one week earlier. The unadjusted Purchase Index increased 10 percent compared with the previous week and was 2 percent higher than the same week one year ago ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) increased to 4.04 percent from 4.03 percent, with points remaining unchanged at 0.40 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall well below 4%.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, purchase activity is up 2% year-over-year.

Tuesday, September 19, 2017

Wednesday: FOMC Announcement, Existing Home Sales

by Calculated Risk on 9/19/2017 07:56:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• During the day, The AIA's Architecture Billings Index for August (a leading indicator for commercial real estate).

• At 10:00 AM, Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for 5.48 million SAAR, up from 5.44 million in July. Housing economist Tom Lawler expects the NAR to report sales of 5.39 million SAAR for August.

• At 2:00 PM, FOMC Meeting Announcement. The FOMC is expected to announce the beginning of the process to reduce the Fed's balance sheet at this meeting.

• At 2:00 PM, FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chair Janet Yellen holds a press briefing following the FOMC announcement.

Chemical Activity Barometer "Holds Steady" in September

by Calculated Risk on 9/19/2017 01:38:00 PM

Note: This appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Holds Steady; Storms Likely to Cause Future Revisions

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), remained virtually unchanged in September despite the effects of unprecedented Hurricanes Harvey and Irma. Though future revisions are likely, the barometer slipped just 0.04 percent in September, following a 0.03 percent decline in August. Compared to a year earlier, the CAB is up 2.8 percent year-over-year, a marked pullback from recent year-over-year gains. All data is measured on a three-month moving average (3MMA) basis.

On a year-over-year basis, the unadjusted CAB is up 2.3 percent, also an easing from the previous six months.

...

Applying the CAB back to 1912, it has been shown to provide a lead of two to fourteen months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

CAB increased solidly in early 2017 suggesting an increase in Industrial Production, however, the year-over-year increase in the CAB has slowed recently.

Comments on August Housing Starts

by Calculated Risk on 9/19/2017 10:53:00 AM

Earlier: Housing Starts decreased to 1.180 Million Annual Rate in August

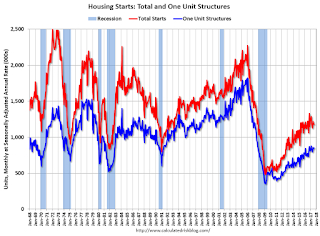

The housing starts report released this morning showed starts were down 0.8% in August compared to July (July was revised up), and starts were up 1.4% year-over-year compared to August 2016. This was a decent report and was above the consensus forecast. Also permits were solid for August.

This first graph shows the month to month comparison between 2016 (blue) and 2017 (red).

Starts were up 1.4% in August 2017 compared to August 2016, and starts are up only 2.7% year-to-date.

Note that single family starts are up 8.9% year-to-date, and the weakness (as expected) has been in multi-family starts.

My guess is starts will increase around 3% to 7% in 2017.

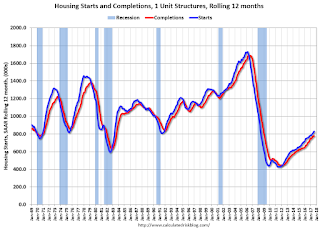

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years - but has turned down recently. Completions (red line) have lagged behind - but completions have almost caught up to starts (more deliveries).

Completions lag starts by about 12 months.

As I've been noting for a couple of years, the growth in multi-family starts is behind us - multi-family starts peaked in June 2015 (at 510 thousand SAAR).

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect a few years of increasing single family starts and completions.

Housing Starts decreased to 1.180 Million Annual Rate in August

by Calculated Risk on 9/19/2017 08:38:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in August were at a seasonally adjusted annual rate of 1,180,000. This is 0.8 percent below the revised July estimate of 1,190,000, but is 1.4 percent above the August 2016 rate of 1,164,000. Single-family housing starts in August were at a rate of 851,000; this is 1.6 percent above the revised July figure of 838,000. The August rate for units in buildings with five units or more was 323,000.

Building Permits:

Privately-owned housing units authorized by building permits in August were at a seasonally adjusted annual rate of 1,300,000. This is 5.7 percent above the revised July rate of 1,230,000 and is 8.3 percent above the August 2016 rate of 1,200,000. Single-family authorizations in August were at a rate of 800,000; this is 1.5 percent below the revised July figure of 812,000. Authorizations of units in buildings with five units or more were at a rate of 464,000 in August.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in August compared to July. Multi-family starts are down 23% year-over-year.

Multi-family is volatile month-to-month, but has been mostly moving sideways over the last few years.

Single-family starts (blue) increased in August, and are up 17.1% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),

Total housing starts in August were above expectations, And starts for June and July were revised up. Also permits were strong in August. I'll have more later ...

Monday, September 18, 2017

Tuesday: Housing Starts

by Calculated Risk on 9/18/2017 06:30:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Continue Pushing Recent Highs

Mortgage rates resumed their recent uptrend today, after taking a quick break to end the week last Friday. The result is another push up to the highest levels in just over 3 weeks. The average scenario is being quoted rates that are about an eighth of a point higher compared to the lows seen in early September. The most prevalent top-tier conventional 30yr fixed rates still range from 3.875% to 4.0%, but the latter is increasingly in the spotlight.Tuesday:

• At 8:30 AM ET, Housing Starts for August. The consensus is for 1.173 million SAAR, up from the July rate of 1.155 million.