by Calculated Risk on 7/25/2017 05:06:00 PM

Tuesday, July 25, 2017

Real House Prices and Price-to-Rent Ratio in May

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 5.6% year-over-year in May

It has been more than ten years since the bubble peak. In the Case-Shiller release this morning, the seasonally adjusted National Index (SA), was reported as being 2.7% above the previous bubble peak. However, in real terms, the National index (SA) is still about 13.3% below the bubble peak.

The year-over-year increase in prices is mostly moving sideways now just over 5%. In May, the index was up 5.6% YoY.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $278,000 today adjusted for inflation (39%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is at a new peak, and the Case-Shiller Composite 20 Index (SA) is back to October 2005 levels.

Real House Prices

In real terms, the National index is back to June 2004 levels, and the Composite 20 index is back to March 2004.

In real terms, house prices are back to early 2004 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to November 2003 levels, and the Composite 20 index is back to August 2003 levels.

In real terms, prices are back to early 2004 levels, and the price-to-rent ratio is back to 2003 - and the price-to-rent ratio maybe moving a little more sideways now.

Chemical Activity Barometer increased slightly in July

by Calculated Risk on 7/25/2017 02:57:00 PM

Note: This appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Notches Gain

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), ticked up 0.1 percent in July following a flat reading in June and a 0.2 percent gain in May. Gains during the second quarter averaged 0.2 percent following average gains of 0.5 percent during the first quarter. Compared to a year earlier, the CAB is up 3.6 percent year-over-year, an easing from recent year-over-year gains. All data is measured on a three-month moving average (3MMA).

...

Applying the CAB back to 1912, it has been shown to provide a lead of two to fourteen months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

CAB increased solidly in early 2017 suggesting an increase in Industrial Production, however, the year-over-year increase in the CAB has slowed recently.

Case-Shiller: National House Price Index increased 5.6% year-over-year in May

by Calculated Risk on 7/25/2017 09:13:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for May ("May" is a 3 month average of March, April and May prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P: The S&P Corelogic Case-Shiller National Home Price NSA Index Sets Record for Sixth Consecutive Months

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 5.6% annual gain in May, the same as the prior month. The 10-City Composite annual increase came in at 4.9%, down from 5.0% the previous month. The 20-City Composite posted a 5.7% year-over-year gain, down from 5.8% in April.I'll have more later.

Seattle, Portland, and Denver reported the highest year-over-year gains among the 20 cities. In May, Seattle led the way with a 13.3% year-over-year price increase, followed by Portland with 8.9%, and Denver overtaking Dallas with a 7.9% increase. Nine cities reported greater price increases in the year ending May 2017 versus the year ending April 2017.

...

Before seasonal adjustment, the National Index posted a month -over-month gain of 1.0% in May. The 10-City Composite posted a 0.7% increase and 20-City Composite reported a 0.8% increase in May. After seasonal adjustment, the National Index recorded a 0. 2% month-over-month increase. The 10- City Composite remained stagnant with no month-over-month increase. The 20-City Composite posted a 0.1% month-over-month increase. All 20 cities reported increases in May before seasonal adjustment; after seasonal adjustment, 14 cities saw prices rise.

“Home prices continue to climb and outpace both inflation and wages,” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “Housing is not repeating the bubble period of 2000-2006: price increases vary across the country unlike the earlier period when rising prices were almost universal; the number of homes sold annually is 20% less today than in the earlier period and the months’ supply is declining, not surging. The small supply of homes for sale, at only about four months’ worth, is one cause of rising prices. New home construction, higher than during the recession but still low, is another factor in rising prices.

“For the last 19 months, either Seattle or Portland OR was the city with fastest rising home prices based on 12-month gains. Since the national index bottomed in February 2012, San Francisco has the largest gain. Using Census Bureau data for 2011 to 2015, it is possible to compare these three cities to national averages. The proportion of owner-occupied homes is lower than the national average in all three cities with San Francisco being the lowest at 36%, Seattle at 46%, and Portland at 52%. Nationally, the figure is 64%. The key factor for the rise in home prices is population growth from 2010 to 2016: the national increase is 4.7%, but for these cities, it is 8.2% in San Francisco, 9.6% in Portland and 15.7% in Seattle. A larger population combined with more people working leads to higher home prices.”

emphasis added

Monday, July 24, 2017

Tuesday: Case-Shiller House Prices

by Calculated Risk on 7/24/2017 07:49:00 PM

From Matthew Graham at Mortgage News Daily: Rates Begin Week Unchanged at July's Lows

Mortgage rates held steady today, which leaves them in line with the lowest levels in July. [30YR FIXED - 4.00%] ... The most obvious calendar item is the Fed Announcement on Wednesday.Tuesday:

• At 9:00 AM ET, FHFA House Price Index for May 2017. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 9:00 AM, S&P/Case-Shiller House Price Index for May. The consensus is for a 5.8% year-over-year increase in the Comp 20 index for May.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for July.

Funny Real Estate Quote from 10 Years Ago

by Calculated Risk on 7/24/2017 03:51:00 PM

Time flies!

Ten years ago, the NAR reported existing home sales of 5.75 million SAAR for June 2007. Since then sales for June 2007 have been revised down to 5.120 million SAAR.

Note: Earlier today, the NAR reported June 2017 sales at 5.52 million SAAR - after several years of increasing sales.

Ten years ago, NAR's senior economist said:

"It is too early to say if home sales have already passed bottom," said Lawrence Yun, the senior economist for the group in the report. "Still, major declines in home sales are likely to have occurred already and further declines, if any, are likely to be modest given the accumulating pent-up demand."Yes. It was too early to call the bottom - by several years. And sales fell much further to a low of 3.3 million SAAR in July 2010 (Sales for a number of months were below 4 million SAAR).

A Few Comments on June Existing Home Sales

by Calculated Risk on 7/24/2017 01:06:00 PM

Earlier: NAR: "Existing-Home Sales Retreat 1.8 Percent in June"

Inventory is still very low and falling year-over-year (down 7.1% year-over-year in June). Inventory has declined year-over-year for 25 consecutive months, although the pace of decline has slowed over the two months.

I started the year expecting inventory would be increasing year-over-year by the end of 2017. That now seems unlikely, but still possible. In April, inventory was down 9.4% year-over-year, and in May, inventory was down 7.9% - and in June, down 7.1%. If that trend continues, inventory might be close to unchanged (or just down slightly) year-over-year by December.

Inventory is a key metric to watch. More inventory would probably mean smaller price increases, and less inventory somewhat larger price increases.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA in June (red column) were above June2016. (NSA) - and the highest for June since 2006.

Note that sales NSA are now in the seasonally strong period (March through September).

NAR: "Existing-Home Sales Retreat 1.8 Percent in June"

by Calculated Risk on 7/24/2017 10:11:00 AM

From the NAR: Existing-Home Sales Retreat 1.8 Percent in June

Existing-home sales slipped in June as low supply kept homes selling at a near record pace but ultimately ended up muting overall activity, according to the National Association of Realtors®. Only the Midwest saw an increase in sales last month.

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, decreased 1.8 percent to a seasonally adjusted annual rate of 5.52 million in June from 5.62 million in May. Despite last month's decline, June's sales pace is 0.7 percent above a year ago, but is the second lowest of 2017 (February, 5.47 million).

...

Total housing inventory at the end of June declined 0.5 percent to 1.96 million existing homes available for sale, and is now 7.1 percent lower than a year ago (2.11 million) and has fallen year-over-year for 25 consecutive months. Unsold inventory is at a 4.3-month supply at the current sales pace, which is down from 4.6 months a year ago.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in June (5.63 million SAAR) were 1.8% lower than last month, and were 0.7% above the June 2016 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 1.96 million in June from 1.97 million in May. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory decreased to 1.96 million in June from 1.97 million in May. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 7.1% year-over-year in June compared to June 2016.

Inventory decreased 7.1% year-over-year in June compared to June 2016. Months of supply was at 4.3 months in June.

This was slightly below the consensus expectations. For existing home sales, a key number is inventory - and inventory is still low. I'll have more later ...

Sunday, July 23, 2017

Sunday Night Futures

by Calculated Risk on 7/23/2017 09:27:00 PM

Weekend:

• Schedule for Week of July 23, 2017

Monday:

• At 10:00 AM ET, Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for 5.58 million SAAR, down from 5.62 million in May. Housing economist Tom Lawler expects the NAR to report sales of 5.59 million SAAR for June.

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures are down 3, and DOW futures are down 25 (fair value).

Oil prices were down over the last week with WTI futures at $45.72 per barrel and Brent at $48.00 per barrel. A year ago, WTI was at $43, and Brent was at $44 - so oil prices are up 5% to 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.28 per gallon - a year ago prices were at $2.16 per gallon - so gasoline prices are up 12 cents per gallon year-over-year.

Hotels: Occupancy Rate Down Slightly Year-over-Year

by Calculated Risk on 7/23/2017 12:23:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 15 July

The U.S. hotel industry reported mostly positive year-over-year results in the three key performance metrics during the week of 9-15 July 2017, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 10-16 July 2016, the industry recorded the following:

• Occupancy: -0.1% to 77.4%

• Average daily rate (ADR): +1.7% to US$130.76

• Revenue per available room (RevPAR): +1.6% to US$101.15

emphasis added

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).Currently the occupancy rate is tracking close to last year, and slightly behind the record year in 2015.

For hotels, occupancy will be strong over the summer.

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, July 22, 2017

Schedule for Week of July 23, 2017

by Calculated Risk on 7/22/2017 08:09:00 AM

The key economic reports this week are the advance estimate of Q1 GDP, New and Existing Home sales for June, and Case-Shiller house prices.

The FOMC meets on Tuesday and Wednesday, and no change to policy is expected.

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for 5.58 million SAAR, down from 5.62 million in May.

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for 5.58 million SAAR, down from 5.62 million in May.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report sales of 5.59 million SAAR for June.

9:00 AM: FHFA House Price Index for May 2017. This was originally a GSE only repeat sales, however there is also an expanded index.

9:00 AM ET: S&P/Case-Shiller House Price Index for May.

9:00 AM ET: S&P/Case-Shiller House Price Index for May.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the April 2017 report (the Composite 20 was started in January 2000).

The consensus is for a 5.8% year-over-year increase in the Comp 20 index for May.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for July.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

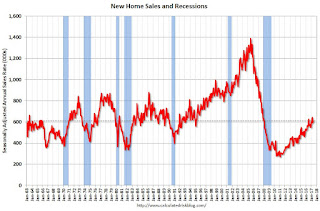

10:00 AM ET: New Home Sales for June from the Census Bureau.

10:00 AM ET: New Home Sales for June from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the May sales rate.

The consensus is for 612 thousand SAAR, up from 610 thousand in May.

2:00 PM: FOMC Meeting Announcement. No change to policy is expected at this meeting.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, up from 233 thousand the previous week.

8:30 AM: Durable Goods Orders for June from the Census Bureau. The consensus is for a 3.2% increase in durable goods orders.

8:30 AM: Chicago Fed National Activity Index for June. This is a composite index of other data.

10:00 AM: the Q2 Housing Vacancies and Homeownership from the Census Bureau.

11:00 AM: the Kansas City Fed manufacturing survey for July.

8:30 AM: Gross Domestic Product, 2nd quarter 2017 (Advance estimate). The consensus is that real GDP increased 2.6% annualized in Q2, up from 1.4% in Q1.

10:00 AM: University of Michigan's Consumer sentiment index (final for July). The consensus is for a reading of 93.1, unchanged from the preliminary reading 93.1.