by Calculated Risk on 5/02/2017 09:29:00 AM

Tuesday, May 02, 2017

CoreLogic: House Prices up 7.1% Year-over-year in March

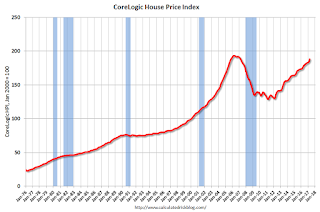

Notes: This CoreLogic House Price Index report is for March. The recent Case-Shiller index release was for February. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic US Home Price Report Shows Prices Up 7.1 Percent in March 2017

Home prices nationwide, including distressed sales, increased year over year by 7.1 percent in March 2017 compared with March 2016 and increased month over month by 1.6 percent in March 2017 compared with February 2017, according to the CoreLogic HPI.

...

“Home prices posted strong gains in March 2017, and the CoreLogic Home Price Index is only 2.8 percent from its 2006 peak,” said Dr. Frank Nothaft, chief economist for CoreLogic. “With a forecasted increase of almost 5 percent over the next 12 months, the index is expected to reach the previous peak during the second half of this year. Prices in more than half the country have already surpassed their previous peaks, and almost 20 percent of metropolitan areas are now at their price peaks. Nationally, price growth has gradually accelerated over the past half-year, while rent growth for single-family rental homes has slowly decelerated over the same period, according to the CoreLogic Single-family Rental Index, recording a 3 percent rise over the year through March.”

“A potent mix of strong job gains, household formation, population growth and still-attractive mortgage rates in the face of tight inventories are fueling a continuing surge in home prices across the U.S.,” said Frank Martell, president and CEO of CoreLogic. “Price gains were broad-based with 90 percent of metropolitan areas posting year-over-year gains. Major metropolitan areas were especially hot with CoreLogic data indicating that four of the largest 10 markets are now overvalued. Geographically, gains were strongest in the West with Washington showing the highest appreciation at almost 13 percent, and Seattle, Tacoma and Bellingham posting gains of 13 to 14 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 1.6% in March (NSA), and is up 7.1% over the last year.

This index is not seasonally adjusted, and this was another strong month-to-month increase.

The index is still 2.8% below the bubble peak in nominal terms (not inflation adjusted).

The second graph shows the YoY change in nominal terms (not adjusted for inflation).

The second graph shows the YoY change in nominal terms (not adjusted for inflation).The YoY increase had been moving sideways over the last two years, but might have picked up recently (the recent pickup could be revised away).

The year-over-year comparison has been positive for five consecutive years since turning positive year-over-year in February 2012.

Monday, May 01, 2017

Tuesday: Auto Sales

by Calculated Risk on 5/01/2017 06:44:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Unchanged to Slightly Higher

Mortgage rates were unchanged to slightly higher today, keeping them in line with the previous 4 business days. This 5-day block stands out from the previous trend that had taken rates generally lower since the middle of March, ultimately hitting the best levels of the year on April 18th. At the time, a majority of lenders were quoting conventional 30yr fixed rates of 4.00% on top tier scenarios.Tuesday:

While there are still several lenders at 4.0%, most have moved up to 4.125%. Most borrowers will be quoted the same NOTE rate today and Friday, but with higher upfront costs (thus making for a higher EFFECTIVE rate).

emphasis added

• All day: Light vehicle sales for April. The consensus is for light vehicle sales to increase to 17.2 million SAAR in April, from 16.6 million in March (Seasonally Adjusted Annual Rate).

Black Knight on Mortgages "19 Percent of Active HELOCs Are Scheduled to Reset in 2017"

by Calculated Risk on 5/01/2017 02:27:00 PM

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for March today. According to BKFS, 3.62% of mortgages were delinquent in March, down from 4.08% in March 2016. BKFS also reported that 0.88% of mortgages were in the foreclosure process, down from 1.25% a year ago.

This gives a total of 4.50% delinquent or in foreclosure.

Press Release: Black Knight’s March Mortgage Monitor: 19 Percent of Active HELOCs Are Scheduled to Reset in 2017

Today, the Data and Analytics division of Black Knight Financial Services, Inc. released its latest Mortgage Monitor Report, based on data as of the end of March 2017. This month, Black Knight took a closer look at home equity lines of credit (HELOCs), particularly on the share of HELOCs with draw periods – typically a 10-year term of interest-only payments before payments become fully amortizing – ending in 2017. Accounting for just under $100 billion in outstanding unpaid principal balances (UPB), these HELOCs represent the last of the pre-crisis lines of credit – those originated from between 2004 and 2007. As Black Knight Data & Analytics Executive Vice President Ben Graboske explained, as draw periods end and HELOCs reset with new payments, borrowers can face very different monthly obligations.

“In 2017, 19 percent of active HELOCs are facing reset,” said Graboske. “This is the largest share of active HELOCs facing reset of any single year on record, although the approximate 1.5 million borrowers slated to see their HELOC payments increase this year is about 100,000 fewer borrowers than in 2016. With the lines beginning to reset this year and early into 2018, we’re seeing the last of the pre-crisis-era HELOCs that the industry has been focusing on since early 2014. After deceleration in early 2018, we will have a lull of several years in reset activity. On average, borrowers facing resets this year are looking at a ‘payment shock’ of about $250 per month over their current HELOC payments – more than doubling their current payments, in fact. Historically, those increases have impacted HELOC performance significantly; delinquency rates of 2006 vintage HELOCs – which reset last year – jumped by 74 percent. That was marginally lower than the 2004 and 2005 vintages, which saw delinquency rates rise by 90 and 88 percent, respectively. Payment shocks remain high for lines resetting in 2018 but then drop along with the overall volume of resets in 2019.

“One thing that’s working in the 2007 vintage HELOCs’ favor has been the equity and interest rate environment of the last year. Rising home prices and low interest rates throughout 2016 have allowed borrowers to be much more proactive than in years past in terms of paying off or refinancing their lines to avoid increased monthly payments. For those still facing resets, however, equity continues to be a struggle. One-third of borrowers whose HELOCs will reset in 2017 have less than 20 percent equity in their home, making refinancing problematic. One in five have less than 10 percent, and one in 10 are actually underwater. Even that reflects improvement in home prices, though; last year 45 percent of borrowers facing reset had less than 20 percent equity and nearly 20 percent were underwater.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from Black Knight shows the 90 day delinquency rate compared to the average of 2000 through 2005.

From Black Knight:

• Although the inventory of loans 90 or more days delinquent (but not yet in foreclosure) fell by 14 percent over Q1 2017 and is down 20 percent year-over-year, it remains roughly 25 percent above long term norms

• There are still over 250K more seriously delinquent (90+ days) and active foreclosure loans today than would be expected in a “healthy” market

• Approximately 40 percent of all delinquent mortgages are 30 days past due in today’s market; historically, that share has been closer to 55 percent, further reflecting the supply of lingering aged delinquencies

This graph from Black Knight shows the foreclosure rate compared to the 2000-2005 average,

This graph from Black Knight shows the foreclosure rate compared to the 2000-2005 average,From Black Knight:

• Similarly, loans in the active foreclosure population have decreased by seven percent year-to-date and 29 percent year-over-year, but remain 45 percent above normal levelsThere is much more in the mortgage monitor.

• As 90+ day delinquent and active foreclosure inventories improve, overall delinquencies will continue to move toward a more normal distribution, albeit perhaps a lower than normal total volume of troubled loans

Construction Spending decreased in March

by Calculated Risk on 5/01/2017 11:59:00 AM

Earlier today, the Census Bureau reported that overall construction spending decreased in March:

Construction spending during March 2017 was estimated at a seasonally adjusted annual rate of $1,218.3 billion, 0.2 percent below the revised February estimate of $1,220.7 billion. The March figure is 3.6 percent above the March 2016 estimate of $1,176.4 billion.Private spending was unchanged, and public spending decreased in March:

Spending on private construction was at a seasonally adjusted annual rate of $940.2 billion, nearly the same as the revised February estimate of $940.1 billion. ...

In March, the estimated seasonally adjusted annual rate of public construction spending was $278.1 billion, 0.9 percent below the revised February estimate of $280.7 billion

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has been generally increasing, and is still 26% below the bubble peak.

Non-residential spending is now 5% above the previous peak in January 2008 (nominal dollars).

Public construction spending is now 15% below the peak in March 2009, and only 6% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 7%. Non-residential spending is up 6% year-over-year. Public spending is down 6% year-over-year.

Looking forward, all categories of construction spending should increase in 2017 (maybe not public spending).

This was below the consensus forecast of a 0.5% increase for March, however January and February were revised up sharply - a decent report.

ISM Manufacturing index decreased to 54.8 in April

by Calculated Risk on 5/01/2017 10:04:00 AM

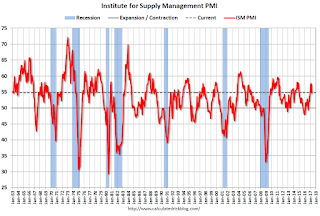

The ISM manufacturing index indicated expansion in April. The PMI was at 54.8% in April, down from 57.2% in March. The employment index was at 52.0%, down from 58.9% last month, and the new orders index was at 54.8%, down from 64.5%.

From the Institute for Supply Management: April 2017 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in April, and the overall economy grew for the 95th consecutive month, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: "The April PMI® registered 54.8 percent, a decrease of 2.4 percentage points from the March reading of 57.2 percent. The New Orders Index registered 57.5 percent, a decrease of 7 percentage points from the March reading of 64.5 percent. The Production Index registered 58.6 percent, 1 percentage point higher than the March reading of 57.6 percent. The Employment Index registered 52 percent, a decrease of 6.9 percentage points from the March reading of 58.9 percent. Inventories of raw materials registered 51 percent, an increase of 2 percentage points from the March reading of 49 percent. The Prices Index registered 68.5 percent in April, a decrease of 2 percentage points from the March reading of 70.5 percent, indicating higher raw materials prices for the 14th consecutive month, but at a slower rate of increase in April compared with March. Comments from the panel generally reflect stable to growing business conditions; with new orders, production, employment and inventories of raw materials all growing in April over March."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 56.5%, and suggests manufacturing expanded at a slower pace in April than in March.

Still a decent report.

Personal Income increased 0.2% in March, Spending increased less than 0.1%

by Calculated Risk on 5/01/2017 08:36:00 AM

The BEA released the Personal Income and Outlays report for March:

Personal income increased $40.0 billion (0.2 percent) in March according to estimates released today by the Bureau of Economic Analysis. ... personal consumption expenditures (PCE) increased $5.7 billion (less than 0.1 percent).The March PCE price index increased 1.8 percent year-over-year and the February PCE price index, excluding food and energy, increased 1.6 percent year-over-year.

...

Real PCE increased 0.3 percent. The PCE price index decreased 0.2 percent. Excluding food and energy, the PCE price index decreased 0.1 percent.

The following graph shows real Personal Consumption Expenditures (PCE) through March 2017 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was below expectations, and the increase in PCE was close to expectations.

Sunday, April 30, 2017

Monday: Personal Income and Outlays, ISM Mfg Survey, Construction Spending

by Calculated Risk on 4/30/2017 08:50:00 PM

Weekend:

• Schedule for Week of Apr 30, 2017

Monday:

• At 8:30 AM ET, Personal Income and Outlays for March. The consensus is for a 0.3% increase in personal income, and for a 0.1% increase in personal spending. And for the Core PCE price index to be unchanged.

• At 10:00 AM, ISM Manufacturing Index for April. The consensus is for the ISM to be at 56.5, down from 57.2 in March. The ISM manufacturing index indicated expansion at 57.2% in March. The employment index was at 58.9%, and the new orders index was at 64.5%.

• Also at 10:00 AM, Construction Spending for March. The consensus is for a 0.5% increase in construction spending.

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures and DOW futures are down slightly (fair value).

Oil prices were down over the last week with WTI futures at $49.22 per barrel and Brent at $51.91 per barrel. A year ago, WTI was at $46, and Brent was at $46 - so oil prices are up about 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.38 per gallon - a year ago prices were at $2.23 per gallon - so gasoline prices are up about 15 cents a gallon year-over-year.

April 2017: Unofficial Problem Bank list declines to 151 Institutions

by Calculated Risk on 4/30/2017 10:26:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Changes and comments from surferdude808:

Update on the Unofficial Problem Bank List for April 2017. During the month, the list dropped from 151 to 148 institutions after four removals and one addition. Aggregate assets fell by $5.2 billion to $36.1 billion. A year ago, the list held 223 institutions with assets of $64.6 billion.

Actions were terminated against The Heritage Bank, Hinesville, GA ($542 million); The Bank of Commerce, Sarasota, FL ($183 million); and Peoples National Bank, Niceville, FL ($103 million).

This Friday, the FDIC closed a bank for the fourth time this year shuttering First NBC Bank, New Orleans, LA ($4.7 billion). This is the largest failure since the $5.9 billion Doral Bank, San Juan, PR on February 27, 2015. Since the on-set of the Great Recession in 2007, 525 insured institutions with assets of $749 billion have failed with resolution costs of $96.3 billion.

The addition this month was Admirals Bank, Boston, MA ($323 million). Also, the FDIC issued a deposit insurance termination action against Builders Bank, Chicago, IL ($41 million).

Saturday, April 29, 2017

Schedule for Week of Apr 30, 2017

by Calculated Risk on 4/29/2017 08:12:00 AM

The key report this week is the April employment report on Friday.

Other key indicators include the April ISM manufacturing and non-manufacturing indexes, April auto sales, and the March Trade Deficit.

8:30 AM: Personal Income and Outlays for March. The consensus is for a 0.3% increase in personal income, and for a 0.1% increase in personal spending. And for the Core PCE price index to be unchanged.

10:00 AM: ISM Manufacturing Index for April. The consensus is for the ISM to be at 56.5, down from 57.2 in March.

10:00 AM: ISM Manufacturing Index for April. The consensus is for the ISM to be at 56.5, down from 57.2 in March.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 57.2% in March. The employment index was at 58.9%, and the new orders index was at 64.5%.

10:00 AM: Construction Spending for March. The consensus is for a 0.5% increase in construction spending.

All day: Light vehicle sales for April. The consensus is for light vehicle sales to increase to 17.2 million SAAR in April, from 16.6 million in March (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for April. The consensus is for light vehicle sales to increase to 17.2 million SAAR in April, from 16.6 million in March (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the March sales rate.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for April. This report is for private payrolls only (no government). The consensus is for 170,000 payroll jobs added in April, down from 263,000 added in March.

10:00 AM: the ISM non-Manufacturing Index for April. The consensus is for index to increase to 55.8 from 55.2 in March.

2:00 PM: FOMC Meeting Announcement. No change to policy is expected at this meeting.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 246 thousand initial claims, down from 257 thousand the previous week.

8:30 AM: Trade Balance report for March from the Census Bureau.

8:30 AM: Trade Balance report for March from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through January. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $44.5 billion in March from $43.6 billion in February.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for March. The consensus is a 0.4% increase in orders.

8:30 AM: Employment Report for April. The consensus is for an increase of 185,000 non-farm payroll jobs added in April, up from the 98,000 non-farm payroll jobs added in March.

The consensus is for the unemployment rate to increase to 4.6%.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In March, the year-over-year change was 2.13 million jobs.

A key will be the change in wages.

3:00 PM: Consumer credit from the Federal Reserve. The consensus is for a $15.6 billion increase in credit.

Friday, April 28, 2017

Goldman: U.S. Economy "now at full employment"

by Calculated Risk on 4/28/2017 10:03:00 PM

A few excerpts from a note by Goldman Sachs economists Jan Hatzius and Daan Struyven:

On a broad range of measures, the US economy is now at full employment. Headline unemployment has fallen below most estimates of the structural rate, the discouraged worker share is back to pre-recession lows, and the still somewhat elevated share of involuntary part-timers is arguably structural.

And while the employment/population ratio remains well below its pre-recession level, the gap is fully explained by a combination of population aging and declining participation of prime-age men. This trend among prime-age men has continued for over six decades, has not stood in the way of a strong recent wage acceleration in that demographic, and therefore looks structural.

...

Job growth remains well above the pace needed to stabilize unemployment. The speed of the likely overshoot is comparable to the average postwar cycle, and we have lowered our end-2018 unemployment rate forecast to 4.1% from 4.3% prior.

emphasis added