by Calculated Risk on 4/04/2017 10:01:00 AM

Tuesday, April 04, 2017

CoreLogic: House Prices up 7.0% Year-over-year in February

Notes: This CoreLogic House Price Index report is for February. The recent Case-Shiller index release was for January. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic US Home Price Report Shows Prices Up 7 Percent in February 2017

Home prices nationwide, including distressed sales, increased year over year by 7 percent in February 2017 compared with February 2016 and increased month over month by 1 percent in February 2017 compared with January 2017, according to the CoreLogic HPI.

...

“Home prices and rents have risen the most in local markets with high demand and limited supply, such as Seattle, Portland and Denver,” said Dr. Frank Nothaft, chief economist for CoreLogic. “The rise in housing costs has been largest for lower-tier-priced homes. For example, from December to February in Seattle, the CoreLogic Home Price Index rose 12 percent and our single-family rent index rose 6 percent for all price tiers compared with the same period a year earlier. However, when looking at only lower-cost homes in Seattle, the price increase was 13 percent and the rent increase was 7 percent.”

“Home prices continue to grow at a torrid pace so far in 2017 and these gains are likely to continue well into the future,” said Frank Martell, president and CEO of CoreLogic. “Home prices are at peak levels in many major markets and the appreciation is being driven by a number of dynamics—high demand, stronger employment, lean supplies and affordability—that will continue to play out in the coming years. The CoreLogic Home Price Index is projecting an additional 5 percent rise in home prices nationally over the next 12 months.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 1.0% in February (NSA), and is up 7.0% over the last year.

This index is not seasonally adjusted, and this was another strong month-to-month increase.

The index is still 3.7% below the bubble peak in nominal terms (not inflation adjusted).

The second graph shows the YoY change in nominal terms (not adjusted for inflation).

The second graph shows the YoY change in nominal terms (not adjusted for inflation).The YoY increase had been moving sideways over the last two years, but might have picked up recently (the recent pickup could be revised away).

The year-over-year comparison has been positive for five consecutive years since turning positive year-over-year in February 2012.

Trade Deficit declines to $43.6 Billion in February

by Calculated Risk on 4/04/2017 08:42:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $43.6 billion in February, down $4.6 billion from $48.2 billion in January, revised. February exports were $192.9 billion, $0.4 billion more than January exports. February imports were $236.4 billion, $4.3 billion less than January imports.The first graph shows the monthly U.S. exports and imports in dollars through February 2017.

Click on graph for larger image.

Click on graph for larger image.Imports decreased and exports increased in February.

Exports are 16% above the pre-recession peak and up 7% compared to February 2016; imports are 2% above the pre-recession peak, and up 4% compared to February 2016.

In general, trade has been picking up.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $45.25 in February, up from $43.94 in January, and up from $27.48 in February 2016. The petroleum deficit has generally been declining and is the major reason the overall deficit has mostly moved sideways since early 2012.

The trade deficit with China decreased to $23.0 billion in February, from $28.1 billion in February 2016. Some of the decrease this year was probably due to the timing of the Chinese New Year. In general the deficit with China has been declining.

Monday, April 03, 2017

Lawler: Updated Population Projections = Slower Growth, Less Robust Housing Recovery

by Calculated Risk on 4/03/2017 05:11:00 PM

From housing economist Tom Lawler (note: this is work in process, but here are some initial findings)

In assessing the intermediate and/or long-term outlook for the US economy, housing, entitlement spending, tax revenues, and a host of other variables, a Major input to analysts’ forecasts are projections of the US population – not, of course, just the totals, but the composition of the population, especially by age. Analysts often use “official” Census projections, which include detailed projections by age, gender, and race/ethnicity, to project other key variables such as labor force growth, household formations, tax revenues, etc. Unfortunately, the last official Census population projection available to the public was released in late 2014 (and its “starting point” was the “vintage 2013” population estimate), and since then (1) “actual” population growth has been significantly lower than these projections, and (2) the outlook for population growth has changed drastically. As such, the latest available “official” Census population projections are not very useful to analysts or policymakers, and any economic/housing/other forecasts based on these outdated population projections is of little use as well.

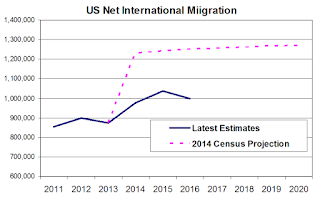

One of the major reasons the 2014 Census population projections are of limited value relates to (1) the “unusually” high projections for net international migration (which were way above the latest estimates for the last few years) ; and (2) the implications of Donald Trump’s election for net international migration over the next several years.

On the first point, in its 2014 population projection Census assumed that net international migration from 2014 to 2016 would average 1.241 million a year, a sizable increase from the annual average of about 876,000 in the previous three years. According to the latest estimates (“vintage 2016,” released late last year), net international migration averaged 1.004 million from 2014 to 2016. (The vintage 2016 estimates incorporated an improved methodology for estimating foreign-born emigration, which reduced previous estimates of net international immigration. (See LEHC, 2/7/2017)). As such, the cumulative net international migration assumption in Census’ 2014 projection for the 2014 to 2016 period was about 710,000 higher than the latest estimate for that period.

On the second point, in the 2014 Census population projections the average annual net international migration assumption from 2017 to 2020 was 1.264 million. With the election of Donald Trump, however, virtually no competent analysts believe that such a projection is plausible. While it is extremely difficult to translate various Trump officials’ statements into actual projections of net international migration, it seems to safe to safe that a “best guess” projection from now through 2020 would be massively lower than the Census 2014 projections.

Another reason (not nearly as important) why one might think that the Census 2014 projections need to be updated related to its assumptions on the number of deaths in the US. In the 2014 projections, the projected number of deaths per year was 2.619 million in 2015 and 2.650 million in 2016. The most recent estimates are than deaths in the US totaled 2.687 million in 2015 and 2.746 million. The 2016 jump surprised and worried many analysts, and folks are still “digging into” the numbers, However, there is good reason to believe that the 2014 Census projection for the number of deaths from 2017 to 2020 (death projections increase each year, mainly reflecting the aging population) are too low.

Finally, the Census 2014 projections for the number of births was 3.999 million in 2015 and 4.027 million in 2016, what the latest estimates for these years are 3.983 million and 3.978 million, respectively. (These differences have virtually no impact on projections of, say, the labor force or the number of households through 2020.)

Below is a table showing Census 2014 projections for 2016 (July 1), compared to the “vintage 2016” estimates.

| July 1, 2016 US Resident Population, Current Estimate vs. Census 2014 Projection | |||

|---|---|---|---|

| Current Estimate | Census 2014 Projection | Difference | |

| Total | 323,127,513 | 323,995,528 | -868,015 |

| 18 Years or older | 249,485,228 | 250,293,421 | -808,193 |

Census has not yet released “vintage 2016” estimates on the detailed characteristics of the population (including more detailed age data, as well as revisions for previous years.) Attempting to estimate the vintage 2016 age distribution of the population is actually quite challenging, because there were downward revisions to previous years, mainly reflecting downward revisions in net international migration. Using Census based assumptions on the age distributions of immigrants, as well as using Census based on assumptions of death rates by age (adjusted to equal newly revised estimates, I have attempted to estimate the “vintage” 2016 population estimates by age. My estimates, compared to Census 2014 projections for 2016, are shown below.

| July 1 2016 US Resident Population by Selected Age Groups (000's) | |||

|---|---|---|---|

| Based on Vintage 2016* | Census 2014 Projections | Difference | |

| Total | 323,128 | 323,996 | -868 |

| 0-14 | 60,963 | 61,037 | -74 |

| 15-24 | 43,468 | 43,613 | -145 |

| 25-34 | 44,630 | 44,865 | -235 |

| 35-44 | 40,512 | 40,578 | -66 |

| 45-54 | 42,840 | 42,864 | -24 |

| 55-64 | 41,519 | 41,619 | -100 |

| 65-74 | 28,635 | 28,747 | -112 |

| 75+ | 20,560 | 20,673 | -113 |

| *LEHC Estimate. Totals may not add up due to rounding | |||

Looking ahead to 2020, the net international migration assumptions imbedded in the Census 2014 US population projections through 2020 are unreasonably high. Trying to gauge what more “realistic” assumptions under a Trump administration is, unfortunately, a rather difficult exercise. E.g., some statements on potential actions, if taken at face value and implemented, would effectively imply net international out-migration over the next few years!

Rather than attempting to make specific forecasts about net international migration through 2020, I am instead show what population projections by age would look like under two different scenarios, shown below, and compare them to projections from the Census 2014 projections. (Note: each year’s forecast is from July 1st of the previous year to June 30th of the following year, so 2017 only has three months left).

| Net Immigration: Three Scenarios | |||

|---|---|---|---|

| Census 2014 Projection | Sorta Trumpy | Really Trumpy | |

| 2017 | 1,256,000 | 850,000 | 750,000 |

| 2018 | 1,262,000 | 600,000 | 0 |

| 2019 | 1,267,000 | 600,000 | 0 |

| 2020 | 1,271,000 | 600,000 | 0 |

Below are estimates of the US resident population by selected age groups for each scenario. (Note: The starting point for the “Trumpy”scenarios are based on Vintage 2016 estimates, while the “Census 2014 Projection” starting point reflects that release’s projection for 2016. Also, the “Trumpy” scenarios use updated estimates for annual deaths and births).

| US Resident Population by Age Group Under Various Scenarios, 2016-2020 (million's) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Total | 0-14 | 15-24 | 25-34 | 35-44 | 45-54 | 55-64 | 65-74 | 75+ | ||

| Census 2014 | 7/2016 | 324.0 | 61.0 | 43.6 | 44.9 | 40.6 | 42.9 | 41.6 | 28.7 | 20.7 |

| 7/2020 | 334.5 | 61.6 | 43.1 | 46.9 | 42.6 | 40.8 | 43.0 | 33.1 | 23.4 | |

| Dif | 10.5 | 0.5 | -0.5 | 2.0 | 2.1 | -2.0 | 1.4 | 4.3 | 2.7 | |

| Sorta Trumpy | 7/2016 | 323.1 | 61.0 | 43.5 | 44.6 | 40.5 | 42.8 | 41.5 | 28.6 | 20.6 |

| 7/2020 | 330.3 | 60.7 | 42.5 | 45.9 | 42.2 | 40.6 | 42.7 | 32.8 | 23.1 | |

| Dif | 7.2 | -0.2 | -1.0 | 1.3 | 1.6 | -2.3 | 1.2 | 4.1 | 2.5 | |

| Really Trumpy | 7/2016 | 323.1 | 61.0 | 43.5 | 44.6 | 40.5 | 42.8 | 41.5 | 28.6 | 20.6 |

| 7/2020 | 328.5 | 60.5 | 41.9 | 45.4 | 41.9 | 40.4 | 42.6 | 32.7 | 23.1 | |

| Dif | 5.3 | -0.5 | -1.5 | 0.7 | 1.4 | -2.4 | 1.1 | 4.0 | 2.5 | |

Assuming no material change either in labor force participation rates of headship rates by age, here is what annual growth rates in select measures would look like under these scenarios.

| Population Growth | Labor Force Growth | Household Growth | |

|---|---|---|---|

| Census 2014 | 0.80% | 0.51% | 1.19% |

| Sorta Trumpy | 0.55% | 0.26% | 1.00% |

| Really Trumpy | 0.41% | 0.09% | 0.86% |

Obviously, a projection for overall economic activity under the “really Trumpy” scenario would probably be significantly slower than projections based using Census 2014 projections, unless either (1) labor force participation rates increased significantly, or (2) productivity growth increased materially. For those who prefer numerical rather than % change numbers for households, a “unchanged” headship rate projection using Census 2014 population projections translates into about 1.48 million net household formations per year from 2016 to 2010, while the “Really Trumpy” scenarios translates into about 1.06 net household formations per year over than same period.

Of course, these “Trumpy” projections are based on “seat of the pants” projections of net international migration, combined with incorporation of updated “actuals” for 2016 as well as updated projections for births and death, and different net international migration projections would produce different population/labor forece/household projections. For entities who produce such forecasts and cite them for various purposes and whose latest forecast was based on the Census 2014 population projection report, however, they should either (1) send out a note that their latest forecasts are no longer valid, or (2) develop new projections based on more realistic assumptions.

U.S. Light Vehicle Sales at 16.5 million annual rate in March

by Calculated Risk on 4/03/2017 03:23:00 PM

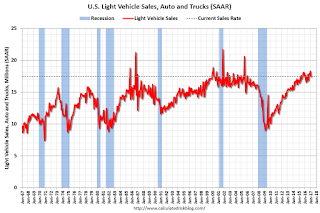

Based on a preliminary estimate from WardsAuto, light vehicle sales were at a 16.53 million SAAR in March.

That is down slightly from March 2016, and down 5% from last month.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for February (red, light vehicle sales of 17.47 million SAAR from WardsAuto).

This was well below the consensus forecast of 17.4 million for March.

After two consecutive years of record sales, it looks like sales will be down or move sideways in 2017.

Note: dashed line is current estimated sales rate.

Construction Spending increased in February

by Calculated Risk on 4/03/2017 12:05:00 PM

Earlier today, the Census Bureau reported that overall construction spending increased in February:

Construction spending during February 2017 was estimated at a seasonally adjusted annual rate of $1,192.8 billion, 0.8 percent above the revised January estimate of $1,183.8 billion. The February figure is 3.0 percent above the February 2016 estimate of $1,157.7 billion.Both private and public spending increased in February:

Spending on private construction was at a seasonally adjusted annual rate of $917.3 billion, 0.8 percent above the revised January estimate of $910.0 billion. ...

In February, the estimated seasonally adjusted annual rate of public construction spending was $275.5 billion, 0.6 percent above the revised January estimate of $273.9 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has been generally increasing, and is still 29% below the bubble peak.

Non-residential spending is now 4% above the previous peak in January 2008 (nominal dollars).

Public construction spending is now 15% below the peak in March 2009, and only 5% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 6%. Non-residential spending is up 8% year-over-year. Public spending is down 8% year-over-year.

Looking forward, all categories of construction spending should increase in 2017.

This was close to the consensus forecast of a 1.0% increase for February.

ISM Manufacturing index decreased to 57.2 in March

by Calculated Risk on 4/03/2017 10:04:00 AM

The ISM manufacturing index indicated expansion in March. The PMI was at 57.2% in March, down from 57.7% in February. The employment index was at 58.9%, up from 54.2% last month, and the new orders index was at 64.5%, down from 65.1%.

From the Institute for Supply Management: March 2017 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in March, and the overall economy grew for the 94th consecutive month, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: "The March PMI® registered 57.2 percent, a decrease of 0.5 percentage point from the February reading of 57.7 percent. The New Orders Index registered 64.5 percent, a decrease of 0.6 percentage point from the February reading of 65.1 percent. The Production Index registered 57.6 percent, 5.3 percentage points lower than the February reading of 62.9 percent. The Employment Index registered 58.9 percent, an increase of 4.7 percentage points from the February reading of 54.2 percent. Inventories of raw materials registered 49 percent, a decrease of 2.5 percentage points from the February reading of 51.5 percent. The Prices Index registered 70.5 percent in March, an increase of 2.5 percentage points from the February reading of 68 percent, indicating higher raw materials prices for the 13th consecutive month. Consistent with generally positive comments from the panel, all 18 industries reported growth in new orders for the month of March."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was close to expectations of 57.1%, and suggests manufacturing expanded at as slightly slower pace in March than in February.

Another solid report.

Black Knight on Mortgages "44 Percent of Q4 Refis Were Cash-Outs, Most Equity Drawn in Eight Years"

by Calculated Risk on 4/03/2017 08:01:00 AM

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for February today. According to BKFS, 4.21% of mortgages were delinquent in February, down from 4.45% in February 2016. BKFS also reported that 0.93% of mortgages were in the foreclosure process, down from 1.30% a year ago.

This gives a total of 5.14% delinquent or in foreclosure.

Press Release: Black Knight’s Mortgage Monitor: Tappable Equity Hit $4.7 Trillion in 2016, Highest Since 2006; 44 Percent of Q4 Refis Were Cash-Outs, Most Equity Drawn in Eight Years

Today, the Data & Analytics division of Black Knight Financial Services, Inc. (NYSE: BKFS) released its latest Mortgage Monitor Report, based on data as of the end of February 2017. This month, Black Knight revisited the equity landscape, finding that continued annual home price appreciation at the national level has helped to both further drive down the number of underwater borrowers and increase the level of tappable, or lendable, equity available to homeowners with a mortgage. As Black Knight Data & Analytics Executive Vice President Ben Graboske explained, today’s equity landscape – in conjunction with a higher interest rate environment – will likely impact mortgage lending trends over the coming year.

“December 2016 marked 56 consecutive months of annual home price appreciation,” said Graboske. “That served to not only lift an additional one million formerly underwater homeowners back into positive equity throughout the year, but also increased the amount of tappable equity available to U.S. mortgage holders by an additional $568 billion. There are now 39.5 million homeowners with tappable equity, meaning they have current combined loan-to-value (CLTV) ratios of less than 80 percent. Cash-out refinance data suggests that they have been increasingly tapping that equity, though perhaps more conservatively than homeowners had in the past. In Q4 2016, $31 billion in equity was extracted from the market via first lien refinances. While that was the most equity drawn in over eight years, borrowers are still tapping equity at less than a third of the rate they were back in 2005, and they’re doing so more prudently. In fact, the resulting post-cash-out loan-to-value-ratio was 65.6 percent, the lowest on record.

“However, it’s important to remember that we’ve also seen prepayment speeds – which are historically a good indicator of refinance activity – decline by nearly 40 percent since the start of 2017 in the face of today’s higher interest rate environment. Given the fact that nearly 70 percent of tappable equity belongs to borrowers with current interest rates below today’s prevailing 30-year interest rate, the incentive for many of these borrowers is shifting away from tapping equity via a first lien refinance and instead to home equity lines of credit. The last time interest rates rose as much as they have over the past few months, we saw cash-out refinances decline by 50 percent, but rate-term refinances decline by 75 percent. Based on past behavior, we may see a decline in first lien cash-out refinance volume, but it’s still likely that cash-out refinances – and purchase loans – will drive the lion’s share of prepayment activity over the coming year in any case. That’s why it’s so critical that those in the industry ensure that their prepayment models account for refinancing not just in terms of rate/term incentive, but also equity incentive as well. Additionally, prepayment models will need a stronger focus on housing turnover as purchase transactions become a larger fraction of total prepayments.”

emphasis added

Click on graph for larger image.

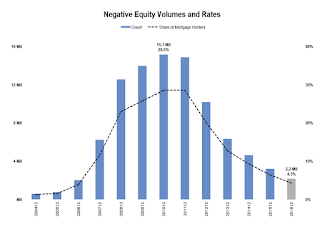

Click on graph for larger image.This graph from Black Knight shows the number and percent of properties with negative equity.

From Black Knight:

• December 2016 marked 56 consecutive months of annual home price appreciation, with home prices rising 5.5 percent over the course of the year

• An additional one million formerly underwater homeowners moved back into positive equity by year’s end, reducing the total negative equity population by 33 percent

• There are now 2.2 million homeowners remaining who owe more on their mortgages than their homes are worth, representing 4.3 percent of borrowers with a mortgage

This graph from Black Knight shows their estimate of "tappable equity".

This graph from Black Knight shows their estimate of "tappable equity".From Black Knight:

• Tappable (i.e., lendable) equity increased by nearly $570 billion in 2016, bringing total tappable equity to $4.7 trillion, the highest level seen since 2006There is much more in the mortgage monitor.

• There are now 39.5 million borrowers with tappable equity – meaning they have current combined loanto-value (CLTV) ratios of less than 80 percent – an increase of 2.6 million from one year ago

• 27 million of these borrowers have credit scores of 720 or higher, and between them they carry 78 percent of the nation’s tappable equity

• To put that in perspective: there are only 2.8 million borrowers that make for traditional refinance candidates (75BPS of rate incentive, 20 percent equity, 720 credit score or higher)

Sunday, April 02, 2017

Sunday Night Futures

by Calculated Risk on 4/02/2017 08:36:00 PM

Weekend:

• Schedule for Week of Apr 2, 2017

Monday:

• At 10:00 AM ET, ISM Manufacturing Index for March. The consensus is for the ISM to be at 57.1, down from 57.7 in February. The ISM manufacturing index indicated expansion at 57.7% in February. The employment index was at 54.2%, and the new orders index was at 65.1%.

• Also at 10:00 AM, Construction Spending for February. The consensus is for a 1.0% increase in construction spending.

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures and DOW futures are unchanged (fair value).

Oil prices were up over the last week with WTI futures at $50.58 per barrel and Brent at $53.45 per barrel. A year ago, WTI was at $36, and Brent was at $36 - so oil prices are up about 40% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.32 per gallon - a year ago prices were at $2.06 per gallon - so gasoline prices are up about 26 cents a gallon year-over-year.

March 2016: Unofficial Problem Bank list declines to 151 Institutions, Q1 2017 Transition Matrix

by Calculated Risk on 4/02/2017 09:54:00 AM

Note: Surferdude808 compiles an unofficial list of Problem Banks compiled only from public sources. Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for March 2017. During the month, the list declined slightly from 155 institutions to 151 after five removals and one addition. Assets dropped by a minuscule $498 million to an aggregate $41.3 billion. A year ago, the list held 223 institutions with assets of $64.6 billion.

This month, actions have been terminated against NewDominion Bank, Charlotte, NC ($316 million); Abacus Federal Savings Bank, New York, NY ($253 million); The Somerville National Bank, Somerville, OH ($164 million); and The Trust Bank, Lenox, GA ($39 million). Proficio Bank, Cottonwood Heights, UT ($68 million) left the list through failure.

The addition this month was Texas Champion Bank, Corpus Christi, TX ($342 million). Also, the FDIC issued a Prompt Corrective Action order against First NBC Bank, New Orleans, LA ($4.7 billion) on February 24, 2017.

With it being the end of the first quarter, we bring an updated transition matrix to detail how banks are moving off the Unofficial Problem Bank List. Since the Unofficial Problem Bank List was first published on August 7, 2009 with 389 institutions, a total of 1,717 institutions have appeared on a weekly or monthly list at some point. Only 8.8 percent of the banks that have appeared on the list remain today. In all, there have been 1,566 institutions that have transitioned through the list. Departure methods include 898 action terminations, 402 failures, 250 mergers, and 16 voluntary liquidations. Of the 389 institutions on the first published list, 15 or 3.9 percent still remain more than seven years later. The 402 failures represent 23.4 percent of the 1,717 institutions that have made an appearance on the list. This failure rate is well above the 10-12 percent rate frequently cited in media reports on the failure rate of banks on the FDIC's official list.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 173 | (64,253,325) | |

| Unassisted Merger | 40 | (9,818,439) | |

| Voluntary Liquidation | 4 | (10,584,114) | |

| Failures | 157 | (184,803,449) | |

| Asset Change | (1,103,405) | ||

| Still on List at 3/31/2017 | 15 | 5,750,697 | |

| Additions after 8/7/2009 | 136 | 35,588,852 | |

| End (3/31//2017) | 151 | 41,339,549 | |

| Intraperiod Removals1 | |||

| Action Terminated | 725 | 302,397,736 | |

| Unassisted Merger | 210 | 81,003,647 | |

| Voluntary Liquidation | 12 | 2,474,477 | |

| Failures | 245 | 120,346,094 | |

| Total | 1,192 | 506,221,954 | |

| 1Institution not on 8/7/2009 or 3/31/2017 list but appeared on a weekly list. | |||

Saturday, April 01, 2017

Schedule for Week of Apr 2, 2017

by Calculated Risk on 4/01/2017 08:11:00 AM

The key report this week is the March employment report on Friday.

Other key indicators include the March ISM manufacturing and non-manufacturing indexes, March auto sales, and the February Trade Deficit.

Also the Q1 quarterly Reis surveys for office and malls will be released this week.

10:00 AM: ISM Manufacturing Index for March. The consensus is for the ISM to be at 57.1, down from 57.7 in February.

10:00 AM: ISM Manufacturing Index for March. The consensus is for the ISM to be at 57.1, down from 57.7 in February.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 57.7% in February. The employment index was at 54.2%, and the new orders index was at 65.1%.

10:00 AM: Construction Spending for February. The consensus is for a 1.0% increase in construction spending.

All day: Light vehicle sales for March. The consensus is for light vehicle sales to decrease to 17.4 million SAAR in March, from 17.5 million in February (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for March. The consensus is for light vehicle sales to decrease to 17.4 million SAAR in March, from 17.5 million in February (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the February sales rate.

8:30 AM: Trade Balance report for February from the Census Bureau.

8:30 AM: Trade Balance report for February from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through January. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $44.5 billion in February from $48.5 billion in January.

Early: Reis Q1 2017 Mall Survey of rents and vacancy rates.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for February. The consensus is a 1.0% increase in orders.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for March. This report is for private payrolls only (no government). The consensus is for 170,000 payroll jobs added in March, down from 298,000 added in February.

Early: Reis Q1 2017 Office Survey of rents and vacancy rates.

10:00 AM: the ISM non-Manufacturing Index for March. The consensus is for index to decrease to 57.0 from 57.6 in February.

2:00 PM: FOMC Minutes for the Meeting of March 14 - 15, 2017

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 250 thousand initial claims, down from 258 thousand the previous week.

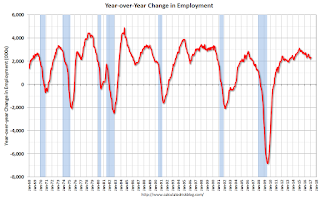

8:30 AM: Employment Report for March. The consensus is for an increase of 178,000 non-farm payroll jobs added in March, down from the 235,000 non-farm payroll jobs added in February.

The consensus is for the unemployment rate to be unchanged at 4.7%.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In February, the year-over-year change was 2.35 million jobs.

A key will be the change in wages.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for February.

3:00 PM: Consumer credit from the Federal Reserve. The consensus is for a $15.0 billion increase in credit.