by Calculated Risk on 4/06/2017 10:25:00 AM

Thursday, April 06, 2017

Las Vegas Real Estate in March: Sales up 11.9% YoY, Inventory down Sharply

This is a key distressed market to follow since Las Vegas saw the largest price decline, following the housing bubble, of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported Raiders Aren’t Only Ones Moving to Las Vegas, Where Home Prices and Sales Are Rising, GLVAR Housing Statistics for March 2017

The recent trend of rising home prices and sales in Southern Nevada continued through March, according to a report released Friday by the Greater Las Vegas Association of REALTORS® (GLVAR).1) Overall sales were up 11.9% year-over-year.

...

... The total number of existing local homes, condos and townhomes sold in March was 3,903, up from 3,488 in March 2016. Compared to one year ago, sales were up 14.8 percent for homes and up 0.4 percent for condos and townhomes.

According to GLVAR, 2017 is ahead of the sales pace in 2016, when 41,720 total properties were sold in Southern Nevada. That was more than the 38,577 properties sold during 2015. It was also more than in 2014, but fewer than each year from 2009 through 2013.

...

By the end of March, GLVAR reported 5,488 single-family homes listed for sale without any sort of offer. That’s down 23.9 percent from one year ago. For condos and townhomes, the 715 properties listed without offers in March represented a 69.0 percent drop from one year ago.

For several years, GLVAR has been reporting fewer distressed sales and more traditional home sales, where lenders are not controlling the transaction. That trend continued in March, when 4.4 percent of all local sales were short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. That’s down from 5.9 percent of all sales in March 2016. Another 5.4 percent of all March sales were bank-owned, down from 7.1 percent one year ago.

emphasis added

2) Active inventory (single-family and condos) is down sharply from a year ago (A very sharp decline in condo inventory).

3) Fewer distressed sales.

Weekly Initial Unemployment Claims decrease to 234,000

by Calculated Risk on 4/06/2017 08:48:00 AM

The DOL reported:

In the week ending April 1, the advance figure for seasonally adjusted initial claims was 234,000, a decrease of 25,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 258,000 to 259,000. The 4-week moving average was 250,000, a decrease of 4,500 from the previous week's revised average. The previous week's average was revised up by 250 from 254,250 to 254,500.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 250,000.

This was below the consensus forecast.

The low level of claims suggests relatively few layoffs.

Wednesday, April 05, 2017

FOMC Minutes: "A change to the Committee's reinvestment policy would likely be appropriate later this year"

by Calculated Risk on 4/05/2017 02:10:00 PM

From the Fed: Minutes of the Federal Open Market Committee, March 14 - 15, 2017. Excerpts:

Provided that the economy continued to perform about as expected, most participants anticipated that gradual increases in the federal funds rate would continue and judged that a change to the Committee's reinvestment policy would likely be appropriate later this year. Many participants emphasized that reducing the size of the balance sheet should be conducted in a passive and predictable manner. ...

...

When the time comes to implement a change to reinvestment policy, participants generally preferred to phase out or cease reinvestments of both Treasury securities and agency MBS. Policymakers also discussed the potential benefits and costs of approaches that would either phase out or cease all at once reinvestments of principal from these securities. An approach that phased out reinvestments was seen as reducing the risks of triggering financial market volatility or of potentially sending misleading signals about the Committee's policy intentions while only modestly slowing reductions in the Committee's securities holdings. An approach that ended reinvestments all at once, however, was generally viewed as easier to communicate while allowing for somewhat swifter normalization of the size of the balance sheet. To promote rapid normalization of the size and composition of the balance sheet, one participant preferred to set a minimum pace for reductions in MBS holdings and, if and when necessary, to sell MBS to maintain such a pace.

Nearly all participants agreed that the Committee's intentions regarding reinvestment policy should be communicated to the public well in advance of an actual change. It was noted that the Committee would continue its deliberations on reinvestment policy during upcoming meetings and would release additional information as it becomes available. In that context, several participants indicated that, when the Committee announces its plans for a change to its reinvestment policy, it would be desirable to also provide more information to the public about the Committee's expectations for the size and composition of the Federal Reserve's assets and liabilities in the longer run.

emphasis added

Reis: Office Vacancy Rate "steady" in Q1 at 15.8%

by Calculated Risk on 4/05/2017 12:13:00 PM

Reis released their Q1 2017 Office Vacancy survey this morning. Reis reported that the office vacancy rate was unchanged at 15.8% in Q1, from 15.8% in Q4. This is down from 16.0% in Q1 2016, and down from the cycle peak of 17.6%.

From Reis Economist Barbara Denham: Office Vacancy Holds Steady at 15.8%; Rents Increase 0.5% in the Quarter. Vacancy Increases in 42 U.S. Metros, but only 10 See Effective Rent Decline.

The office market held steady in the first quarter as vacancy was flat at 15.8%, the same as the previous quarter and down from 16.0% a year ago. The vacancy rate has fallen less than 200 basis points from a high of 17.6% in 2010.

The national average asking rent increased 0.5% in the first quarter while effective rents, which net out landlord concessions, increased 0.4%. At $32.13 per square foot, the average rent increased only 1.8% from the first quarter of 2016: this is the slowest annual rate of office rent growth since 2011.

Net absorption was 4.9 million square feet in the first quarter, down from an average net absorption of 9.4 million square feet per quarter in 2016. Construction was also low at 7.9 million square feet, down from an average of 8.8 million square feet in 2016. ...

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was at 15.8% in Q1. The office vacancy rate is at the lowest level since early 2009, but remains elevated.

Office vacancy data courtesy of Reis.

ISM Non-Manufacturing Index decreased to 55.2% in March

by Calculated Risk on 4/05/2017 10:04:00 AM

The March ISM Non-manufacturing index was at 55.2%, down from 57.6% in February. The employment index decreased in March to 51.6%, from 55.2%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management:March 2017 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in March for the 87th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee: "The NMI® registered 55.2 percent, which is 2.4 percentage points lower than the February reading of 57.6 percent. This represents continued growth in the non-manufacturing sector at a slower rate. The Non-Manufacturing Business Activity Index decreased to 58.9 percent, 4.7 percentage points lower than the February reading of 63.6 percent, reflecting growth for the 92nd consecutive month, at a slower rate in March. The New Orders Index registered 58.9 percent, 2.3 percentage points lower than the reading of 61.2 percent in February. The Employment Index decreased 3.6 percentage points in March to 51.6 percent from the February reading of 55.2 percent. The Prices Index decreased 4.2 percentage points from the February reading of 57.7 percent to 53.5 percent, indicating prices increased for the 12th consecutive month, at a slower rate in March. According to the NMI®, 15 non-manufacturing industries reported growth in March. The sector continues to reflect growth; however, the rate of growth has declined since last month. The majority of respondents’ comments indicate a positive outlook on business conditions and the overall economy. There were several comments about the uncertainty of future government policies on health care, trade and immigration, and the potential impact on business."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This suggests slower expansion in March than in February.

ADP: Private Employment increased 263,000 in March

by Calculated Risk on 4/05/2017 08:15:00 AM

Private sector employment increased by 263,000 jobs from February to March according to the March ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was well above the consensus forecast for 170,000 private sector jobs added in the ADP report.

...

“The U.S. labor market finished the first quarter on a strong note,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “Consumer dependent industries including healthcare, leisure and hospitality, and trade had strong growth during the month.”

Mark Zandi, chief economist of Moody’s Analytics said, “Job growth is off to a strong start in 2017. The gains are broad based but most notable in the goods producing side of the economy including construction, manufacturing and mining.”

The BLS report for March will be released Friday, and the consensus is for 178,000 non-farm payroll jobs added in March.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 4/05/2017 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 31, 2017.

... The Refinance Index decreased 4 percent from the previous week. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index increased 1 percent compared with the previous week and was 8 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) increased to 4.34 percent from 4.33 percent, with points decreasing to 0.31 from 0.43 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity remains low - and would not increase significantly unless rates fall sharply.

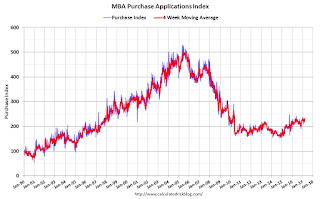

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. Even with the increase in mortgage rates over the last few months, purchase activity is still up.

However refinance activity has declined significantly since rates increased.

Tuesday, April 04, 2017

Wednesday: ADP Employment, ISM non-Mfg Survey, FOMC Minutes

by Calculated Risk on 4/04/2017 08:52:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for March. This report is for private payrolls only (no government). The consensus is for 170,000 payroll jobs added in March, down from 298,000 added in February.

• At 10:00 AM, the ISM non-Manufacturing Index for March. The consensus is for index to decrease to 57.0 from 57.6 in February.

• Early: Reis Q1 2017 Office Survey of rents and vacancy rates.

• At 2:00 PM, FOMC Minutes for the Meeting of March 14 - 15, 2017

Annual Vehicle Sales: On Pace for First Decline Since 2009

by Calculated Risk on 4/04/2017 04:08:00 PM

Through March, light vehicle sales are on pace to decline about 2% in 2017 from the record year in 2016.

This would be the first annual decline in auto sales since 2009, but it would still be the fourth best year on record after 2016, 2015, and 2000.

This isn't a huge concern - most likely vehicle sales will move sideways at near record levels. But the economic boost from increasing auto sales is probably over.

Click on graph for larger image.

This graph shows annual light vehicle sales since 1976. Source: BEA.

Sales for 2017 are estimate at the pace of the first three months.

Reis: Mall Vacancy Rate mostly unchanged in Q1 2017

by Calculated Risk on 4/04/2017 12:41:00 PM

Reis reported that the vacancy rate for regional malls was 7.9% in Q1 2017, up from 7.8% in Q4, and up from 7.8% in Q1 2016. This is down from a cycle peak of 9.4% in Q3 2011.

For Neighborhood and Community malls (strip malls), the vacancy rate was 9.9% in Q1, unchanged from Q4, and unchanged from 9.9% in Q1 2016. For strip malls, the vacancy rate peaked at 11.1% in Q3 2011.

Comments from Reis Economist Barbara Byrne Denham: Retail Vacancy Holds Steady at 9.9%; Rents Increase 0.3% in the Quarter. Effective rents decline in 19 metros across the U.S. while 25 see vacancy rate increase.

Despite dire reports of store closures in major brands across the country, the overall retail real estate statistics recorded very little change in the quarter as the neighborhood and community shopping center vacancy rate held steady at 9.9%, unchanged from year-end 2016 as well as from the first quarter of 2016. The average national asking rent increased 0.3% in the first quarter while effective rents, which net out landlord concessions, increased 0.4%.

Vacancy stayed flat in the quarter due to very low new retail construction. At 796,000 square feet, construction was the lowest since 2011. Net absorption, or the growth in occupancy, was also low at 1.25 million square feet.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

Currently, both the strip mall and regional mall vacancy rates are mostly moving sideways at an elevated level.

Mall vacancy data courtesy of Reis.