by Calculated Risk on 3/19/2017 02:05:00 PM

Sunday, March 19, 2017

Existing Home Sales: Take the Under

The NAR will report February Existing Home Sales on Wednesday, March 22nd at 10:00 AM ET.

The consensus, according to Bloomberg, is that the NAR will report sales of 5.55 million. Housing economist Tom Lawler estimates the NAR will report sales of 5.41 million on a seasonally adjusted annual rate (SAAR) basis, down from 5.69 million SAAR in January.

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for almost 7 years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initial reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

NOTE: There have been times when Lawler "missed", but then he pointed out an apparent error in the NAR data - and the subsequent revision corrected that error. As an example, see: The “Curious Case” of Existing Home Sales in the South in April

Over the last seven years, the consensus average miss was 150 thousand, and Lawler's average miss was 70 thousand.

Many analysts now change their "forecast" after Lawler's estimate is posted, so the consensus has improved a little recently!

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | 5.49 |

| Jul-15 | 5.41 | 5.64 | 5.59 |

| Aug-15 | 5.50 | 5.54 | 5.31 |

| Sep-15 | 5.35 | 5.56 | 5.55 |

| Oct-15 | 5.41 | 5.33 | 5.36 |

| Nov-15 | 5.32 | 4.97 | 4.76 |

| Dec-15 | 5.19 | 5.36 | 5.46 |

| Jan-16 | 5.32 | 5.36 | 5.47 |

| Feb-16 | 5.30 | 5.20 | 5.08 |

| Mar-16 | 5.27 | 5.27 | 5.33 |

| Apr-16 | 5.40 | 5.44 | 5.45 |

| May-16 | 5.64 | 5.55 | 5.53 |

| Jun-16 | 5.48 | 5.62 | 5.57 |

| Jul-16 | 5.52 | 5.41 | 5.39 |

| Aug-16 | 5.44 | 5.49 | 5.33 |

| Sep-16 | 5.35 | 5.55 | 5.47 |

| Oct-16 | 5.44 | 5.47 | 5.60 |

| Nov-16 | 5.54 | 5.60 | 5.61 |

| Dec-16 | 5.54 | 5.55 | 5.49 |

| Jan-17 | 5.55 | 5.60 | 5.69 |

| Feb-17 | 5.55 | 5.41 | --- |

| 1NAR initially reported before revisions. | |||

Saturday, March 18, 2017

Goldman on Fed Balance Sheet Runoff

by Calculated Risk on 3/18/2017 07:04:00 PM

A few brief excerpts from a note today by Goldman Sachs economist Daan Struyven: Balance Sheet Runoff: Sooner, Slower, Safer

The debate within the FOMC about balance sheet normalization is now underway. Fed officials have two basic choices. They can rely exclusively on the funds rate for now and leave balance sheet decisions to the new leadership team in 2018, or they can combine ongoing funds rate hikes with a turn to balance sheet runoff later this year.CR Note: This might depend on who is the next Fed Chair. Fed Chair Janet Yellen's term expires in Feb 2018 and the smart choice would be to reappoint her to another term (Like Reagan reappointing Democrat Volcker in 1983, Clinton reappointing Republican Greenspan, and Obama reappointing Republican Bernanke).

...

A ... practical case for early balance sheet normalization is based on the upcoming Fed leadership transition. If the new appointments—especially the new Chair—are thought to favor aggressive balance sheet normalization, perhaps even including asset sales ... financial markets might experience heightened uncertainty during the transition. ...

The current FOMC could reduce that uncertainty by establishing an early “baseline” path for very gradual balance sheet rundown. Committee decisions are subject to change, of course, but markets would probably take comfort from the fact that most FOMC members will remain in their positions and that it is harder for the new leadership to radically change a policy that is already in place than to devise a new one. We therefore expect the committee to announce gradual tapering of reinvestments in December 2017, while holding the funds rate unchanged at that meeting.

Schedule for Week of Mar 19, 2017

by Calculated Risk on 3/18/2017 08:11:00 AM

The key economic report this week are February New and Existing Home sales.

8:30 AM: Chicago Fed National Activity Index for February. This is a composite index of other data.

No economic releases scheduled.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:00 AM: FHFA House Price Index for January 2017. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for 5.55 million SAAR, down from 5.69 million in January.

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for 5.55 million SAAR, down from 5.69 million in January.Housing economist Tom Lawler expects the NAR to report sales of 5.41 million SAAR in February.

During the day: The AIA's Architecture Billings Index for February (a leading indicator for commercial real estate).

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, down from 241 thousand the previous week.

8:45 AM, Speech by Fed Chair Janet L. Yellen, Opening Remarks, At the 2017 Federal Reserve System Community Development Research Conference, Washington, D.C.

10:00 AM ET: New Home Sales for February from the Census Bureau.

10:00 AM ET: New Home Sales for February from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the January sales rate.

The consensus is for a increase in sales to 565 thousand Seasonally Adjusted Annual Rate (SAAR) in February from 555 thousand in January.

11:00 AM: the Kansas City Fed manufacturing survey for March.

8:30 AM: Durable Goods Orders for January from the Census Bureau. The consensus is for a 1.5% increase in durable goods orders.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for February 2017

Friday, March 17, 2017

Oil: "Another Big Rig Add"

by Calculated Risk on 3/17/2017 02:47:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Mar 17, 2017:

• The US oil rig count was up by 14 this week to 631

• US horizontal oil rigs were up by 14 to 530

...

• This was another very aggressive rig add, but curiously came from outside the major plays. This suggests that either the business is spreading beyond its historical boundaries, or that some technical and non-recurring issues may be at play.

• Decidedly bearish on the face of it.

Click on graph for larger image.

Click on graph for larger image.Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Q1 GDP Forecasts

by Calculated Risk on 3/17/2017 11:20:00 AM

The advance GDP report for Q1 GDP will be released in April. Here are a few early forecasts ...

From the Altanta Fed: GDPNow

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2017 is 0.9 percent on March 16, unchanged from March 15.From the NY Fed Nowcasting Report

emphasis added

The FRBNY Staff Nowcast stands at 2.8% for 2017:Q1 and 2.5% for 2017:Q2.From Merrill Lynch:

We revised down our 1Q GDP forecast to 1.5%, reflecting a mark-to-market with tracking. However, we expect a payback over the next two quarters and upgraded growth to 2.3% from 2.0%. This leaves 2017 growth unchanged at 2.1%.

Industrial Production unchanged in February

by Calculated Risk on 3/17/2017 09:24:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production was unchanged in February following a 0.1 percent decrease in January. In February, manufacturing output moved up 0.5 percent for its sixth consecutive monthly increase. Mining output jumped 2.7 percent, but the index for utilities fell 5.7 percent, as continued unseasonably warm weather further reduced demand for heating. At 104.7 percent of its 2012 average, total industrial production in February was 0.3 percent above its level of a year earlier. Capacity utilization for the industrial sector declined 0.1 percentage point in February to 75.4 percent, a rate that is 4.5 percentage points below its long-run (1972–2016) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 8.7 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 75.4% is 4.5% below the average from 1972 to 2015 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

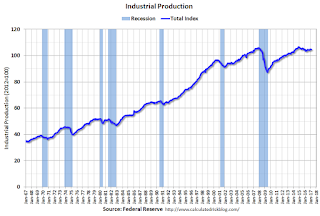

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production was unchanged in February at 104.7. This is 19.8% above the recession low, and is close to the pre-recession peak.

This was below expectations of a 0.2% increase, but January was revised up.

Thursday, March 16, 2017

LA area Port Traffic declined in February

by Calculated Risk on 3/16/2017 04:09:00 PM

LA area port traffic was down in February due to the timing of the Chinese New Year.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was down 1.5% compared to the rolling 12 months ending in January. Outbound traffic was up 0.2% compared to 12 months ending in January.

The downturn in exports in 2015 was probably due to the slowdown in China and the stronger dollar. Now exports are picking up again,

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

The Chinese New Year was early this year, so imports declined in February.

In general exports have started increasing, and imports have been gradually increasing.

Lawler: Early Read on Existing Home Sales in February

by Calculated Risk on 3/16/2017 03:42:00 PM

From housing economist Tom Lawler

Based on state and local realtor/MLS reports from across the country released through today, I project that US existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.41 million in February, down 4.9% from January’s preliminary pace but up 4.0% from last February’s seasonally unadjusted pace. The YOY % gain in unadjusted sales for last month should be much lower than that for seasonally adjusted sales, reflecting this February’s lower business day count compared to last February (last year, of course, was a leap year).

On the inventory front, local realtor/MLS data suggest that the number of existing homes for sale last month increased from January to February by a bit more than was the case a year ago. By the same token, however, local realtor/MLS data – as well as data compiled by Realtor.com – suggest that the YOY decline in the inventory of homes for sale is greater than that implied by the NAR data, making a projection a little challenging. My “best guess” is that the NAR’s estimate for the number of existing homes for sale at the end of February will be 1.72 million, up 1.8% from January’s preliminary estimate (which should be revised downward), and down 8.0% from a year ago.

Finally, local realtor/MLS data suggest that the NAR’s estimate of the median existing SF home sales price for February should be about 7.2% from last February.

CR Note: The NAR is scheduled to release February existing home sales on Wednesday, March 22nd.

Comments on February Housing Starts

by Calculated Risk on 3/16/2017 01:49:00 PM

Earlier: Housing Starts increased to 1.288 Million Annual Rate in February

The housing starts report released this morning showed starts were up in February compared to January, and up 6.2% year-over-year.

Note that multi-family is frequently volatile month-to-month, and has seen especially wild swings over the last six months. Single family starts were solid in February and at the highest level since 2007.

This first graph shows the month to month comparison between 2016 (blue) and 2017 (red).

Starts were up 6.2% in February 2017 compared to February 2016.

My guess is starts will increase around 3% to 7% in 2017.

This is a solid start to 2017, however starts were probably boosted by the weather since this was a warmer than normal February.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years - but has started to decline. Completions (red line) have lagged behind - but completions have been generally catching up (more deliveries, although this has dipped lately). Completions lag starts by about 12 months.

I think most of the growth in multi-family starts is probably behind us - in fact multi-family starts probably peaked in June 2015 (at 510 thousand SAAR) - although I expect solid multi-family starts for a few more years (based on demographics).

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect a few years of increasing single family starts and completions.

Philly Fed: Manufacturing "Expansion Continues" in March

by Calculated Risk on 3/16/2017 11:32:00 AM

Earlier from the Philly Fed: Current Indicators Suggest Expansion Continues

Results from the March Manufacturing Business Outlook Survey suggest that regional manufacturing activity continued to expand. The diffusion index for general activity fell from its high reading in February, but the survey’s other broad indicators for new orders, shipments, and employment all improved or were steady this month. Price pressures also picked up, according to reporting firms. The survey’s future indicators continued to improve and reflect a broadening base of optimism about future growth in manufacturing.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

...

The index for current manufacturing activity in the region decreased from a reading of 43.3 in February to 32.8 this month. The index has been positive for eight consecutive months and remains at a relatively high reading ...

...

Firms reported an increase in manufacturing employment and work hours this month. The percentage of firms reporting an increase in employment (25 percent) exceeded the percentage reporting a decrease (8 percent). The current employment index improved 6 points, its fourth consecutive positive reading. Firms also reported an increase in work hours this month: The average workweek index, which increased 5 points, has been positive for five consecutive months.

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through March), and five Fed surveys are averaged (blue, through February) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through February (right axis).

It seems likely the ISM manufacturing index will show strong expansion again in March.