by Calculated Risk on 3/16/2017 03:42:00 PM

Thursday, March 16, 2017

Lawler: Early Read on Existing Home Sales in February

From housing economist Tom Lawler

Based on state and local realtor/MLS reports from across the country released through today, I project that US existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.41 million in February, down 4.9% from January’s preliminary pace but up 4.0% from last February’s seasonally unadjusted pace. The YOY % gain in unadjusted sales for last month should be much lower than that for seasonally adjusted sales, reflecting this February’s lower business day count compared to last February (last year, of course, was a leap year).

On the inventory front, local realtor/MLS data suggest that the number of existing homes for sale last month increased from January to February by a bit more than was the case a year ago. By the same token, however, local realtor/MLS data – as well as data compiled by Realtor.com – suggest that the YOY decline in the inventory of homes for sale is greater than that implied by the NAR data, making a projection a little challenging. My “best guess” is that the NAR’s estimate for the number of existing homes for sale at the end of February will be 1.72 million, up 1.8% from January’s preliminary estimate (which should be revised downward), and down 8.0% from a year ago.

Finally, local realtor/MLS data suggest that the NAR’s estimate of the median existing SF home sales price for February should be about 7.2% from last February.

CR Note: The NAR is scheduled to release February existing home sales on Wednesday, March 22nd.

Comments on February Housing Starts

by Calculated Risk on 3/16/2017 01:49:00 PM

Earlier: Housing Starts increased to 1.288 Million Annual Rate in February

The housing starts report released this morning showed starts were up in February compared to January, and up 6.2% year-over-year.

Note that multi-family is frequently volatile month-to-month, and has seen especially wild swings over the last six months. Single family starts were solid in February and at the highest level since 2007.

This first graph shows the month to month comparison between 2016 (blue) and 2017 (red).

Starts were up 6.2% in February 2017 compared to February 2016.

My guess is starts will increase around 3% to 7% in 2017.

This is a solid start to 2017, however starts were probably boosted by the weather since this was a warmer than normal February.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years - but has started to decline. Completions (red line) have lagged behind - but completions have been generally catching up (more deliveries, although this has dipped lately). Completions lag starts by about 12 months.

I think most of the growth in multi-family starts is probably behind us - in fact multi-family starts probably peaked in June 2015 (at 510 thousand SAAR) - although I expect solid multi-family starts for a few more years (based on demographics).

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect a few years of increasing single family starts and completions.

Philly Fed: Manufacturing "Expansion Continues" in March

by Calculated Risk on 3/16/2017 11:32:00 AM

Earlier from the Philly Fed: Current Indicators Suggest Expansion Continues

Results from the March Manufacturing Business Outlook Survey suggest that regional manufacturing activity continued to expand. The diffusion index for general activity fell from its high reading in February, but the survey’s other broad indicators for new orders, shipments, and employment all improved or were steady this month. Price pressures also picked up, according to reporting firms. The survey’s future indicators continued to improve and reflect a broadening base of optimism about future growth in manufacturing.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

...

The index for current manufacturing activity in the region decreased from a reading of 43.3 in February to 32.8 this month. The index has been positive for eight consecutive months and remains at a relatively high reading ...

...

Firms reported an increase in manufacturing employment and work hours this month. The percentage of firms reporting an increase in employment (25 percent) exceeded the percentage reporting a decrease (8 percent). The current employment index improved 6 points, its fourth consecutive positive reading. Firms also reported an increase in work hours this month: The average workweek index, which increased 5 points, has been positive for five consecutive months.

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through March), and five Fed surveys are averaged (blue, through February) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through February (right axis).

It seems likely the ISM manufacturing index will show strong expansion again in March.

BLS: Job Openings "little changed" in January

by Calculated Risk on 3/16/2017 10:10:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings was little changed at 5.6 million on the last business day of January, the U.S. Bureau of Labor Statistics reported today. Over the month, hires and separations were also little changed at 5.4 million and 5.3 million, respectively. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

The number of quits edged up to 3.2 million in January. The quits rate was 2.2 percent. Over the month, the number of quits edged up for total private (+129,000) and was little changed for government.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for January, the most recent employment report was for February.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings were mostly unchanged in January at 5.626 million compared to 5.539 million in December. Job openings are mostly moving sideways at a high level.

The number of job openings (yellow) are down slightly year-over-year.

Quits are up 11% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

This is another solid report.

Housing Starts increased to 1.288 Million Annual Rate in February

by Calculated Risk on 3/16/2017 08:45:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in February were at a seasonally adjusted annual rate of 1,288,000. This is 3.0 percent above the revised January estimate of 1,251,000 and is 6.2 percent above the February 2016 rate of 1,213,000. Single-family housing starts in February were at a rate of 872,000; this is 6.5 percent above the revised January figure of 819,000. The February rate for units in buildings with five units or more was 396,000.

Building Permits:

Privately-owned housing units authorized by building permits in February were at a seasonally adjusted annual rate of 1,213,000. This is 6.2 percent below the revised January rate of 1,293,000, but is 4.4 percent above the February 2016 rate of 1,162,000. Single-family authorizations in February were at a rate of 832,000; this is 3.1 percent above the revised January figure of 807,000. Authorizations of units in buildings with five units or more were at a rate of 334,000 in February.

emphasis added

Click on graph for larger image.

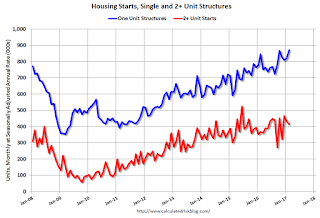

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in February compared to January. Multi-family starts are up year-over-year.

Multi-family is volatile, and the swings have been huge over the last six months.

Single-family starts (blue) increased in February, and are up 3.2% year-over-year.

This is the highest level for single family starts since 2007.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),

Total housing starts in February were above expectations. December and January were revised slightly. Another solid report. I'll have more later ...

Weekly Initial Unemployment Claims decrease to 241,000

by Calculated Risk on 3/16/2017 08:33:00 AM

The DOL reported:

In the week ending March 11, the advance figure for seasonally adjusted initial claims was 241,000, a decrease of 2,000 from the previous week's unrevised level of 243,000. The 4-week moving average was 237,250, an increase of 750 from the previous week's unrevised average of 236,500.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 237,250.

This was at the consensus forecast.

The low level of claims suggests relatively few layoffs.

Wednesday, March 15, 2017

Thursday: Housing Starts, Unemployment Claims, Philly Fed Mfg, Job Openings

by Calculated Risk on 3/15/2017 08:44:00 PM

The FOMC's statement and projections were perceived at "dovish" (probably one less hike this year than expected). So mortgage rates declined ...

From Matthew Graham at Mortgage News Daily: Biggest Intraday Drop of the Year For Mortgage Rates

Mortgage rates fell at their fastest pace of the year following today's rate hike announcement from the Fed. If you're wondering why mortgage rates fell while the Fed's rate moved up, you're not alone. Fortunately, the explanation is simple.Thursday:

Financial markets had already fully accounted for the chance that the Fed would hike rates today. They'd even gone a step further an begun to account for a faster pace of future rate hikes. And it was that future outlook that allowed for our pleasant surprise.

As it turns out, the median forecast among Fed members didn't see the Fed Funds rate ending the year any higher than the previous batch of forecasts (both for 2017 AND 2018). ... The average lender offered mid-day improvements that brought rates 0.125% lower, on average. In terms of conventional 30yr fixed rates, most lenders are back down to 4.25% now on top tier scenarios.

emphasis added

• At 8:30 AM ET, Housing Starts for February. The consensus is for 1.266 million, up from the January rate of 1.246 million.

• Also at 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 242 thousand initial claims, down from 243 thousand the previous week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for March. The consensus is for a reading of 32.5, down from 43.3.

• At 10:00 AM, Job Openings and Labor Turnover Survey for January from the BLS. Jobs openings were mostly unchanged in December at 5.501 million compared to 5.505 million in November.

FOMC Projections and Press Conference Link

by Calculated Risk on 3/15/2017 02:10:00 PM

Statement here. 25 bps rate hike.

Yellen press conference video here.

On the projections, projections for GDP in 2017 were narrowed slightly.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2017 | 2018 | 2019 |

| Mar 2017 | 2.0 to 2.2 | 1.8 to 2.3 | 1.8 to 2.0 |

| Dec 2016 | 1.9 to 2.3 | 1.8 to 2.2 | 1.8 to 2.0 |

The unemployment rate was at 4.7% in February, and the unemployment rate projections were mostly unchanged.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2017 | 2018 | 2019 |

| Mar 2017 | 4.5 to 4.6 | 4.3 to 4.6 | 4.3 to 4.7 |

| Dec 2016 | 4.5 to 4.6 | 4.3 to 4.7 | 4.3 to 4.8 |

As of January, PCE inflation was up 1.9% from January 2016. Inflation was revised up slightly for 2017.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2017 | 2018 | 2019 |

| Mar 2017 | 1.8 to 2.0 | 1.9 to 2.0 | 2.0 to 2.1 |

| Dec 2016 | 1.7 to 2.0 | 1.9 to 2.0 | 2.0 to 2.1 |

PCE core inflation was up 1.7% in January year-over-year. Core PCE inflation was unrevised for 2017.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2017 | 2018 | 2019 |

| Mar 2017 | 1.8 to 1.9 | 1.9 to 2.0 | 2.0 to 2.1 |

| Dec 2016 | 1.8 to 1.9 | 1.9 to 2.0 | 2.0 |

FOMC Statement: 25bps Rate Hike

by Calculated Risk on 3/15/2017 02:02:00 PM

Information received since the Federal Open Market Committee met in February indicates that the labor market has continued to strengthen and that economic activity has continued to expand at a moderate pace. Job gains remained solid and the unemployment rate was little changed in recent months. Household spending has continued to rise moderately while business fixed investment appears to have firmed somewhat. Inflation has increased in recent quarters, moving close to the Committee's 2 percent longer-run objective; excluding energy and food prices, inflation was little changed and continued to run somewhat below 2 percent. Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations are little changed, on balance.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace, labor market conditions will strengthen somewhat further, and inflation will stabilize around 2 percent over the medium term. Near-term risks to the economic outlook appear roughly balanced. The Committee continues to closely monitor inflation indicators and global economic and financial developments.

In view of realized and expected labor market conditions and inflation, the Committee decided to raise the target range for the federal funds rate to 3/4 to 1 percent. The stance of monetary policy remains accommodative, thereby supporting some further strengthening in labor market conditions and a sustained return to 2 percent inflation.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. The Committee will carefully monitor actual and expected inflation developments relative to its symmetric inflation goal. The Committee expects that economic conditions will evolve in a manner that will warrant gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction, and it anticipates doing so until normalization of the level of the federal funds rate is well under way. This policy, by keeping the Committee's holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; Charles L. Evans; Stanley Fischer; Patrick Harker; Robert S. Kaplan; Jerome H. Powell; and Daniel K. Tarullo. Voting against the action was Neel Kashkari, who preferred at this meeting to maintain the existing target range for the federal funds rate.

emphasis added

Key Measures Show Inflation close to 2% in February

by Calculated Risk on 3/15/2017 11:41:00 AM

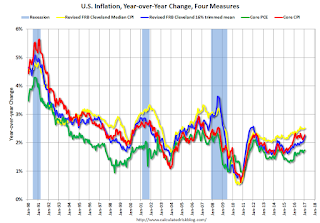

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.5% annualized rate) in February. The 16% trimmed-mean Consumer Price Index also rose 0.2% (2.2% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for February here. Motor fuel was down 30% annualized in February.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.1% (1.5% annualized rate) in February. The CPI less food and energy rose 0.2% (2.5% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.5%, the trimmed-mean CPI rose 2.2%, and the CPI less food and energy rose 2.2%. Core PCE is for January and increased 1.7% year-over-year.

On a monthly basis, median CPI was at 2.5% annualized, trimmed-mean CPI was at 2.2% annualized, and core CPI was at 2.5% annualized.

Using these measures, inflation has generally been moving up, and most of these measures are above the Fed's 2% target (Core PCE is still below).