by Calculated Risk on 2/14/2017 02:19:00 PM

Tuesday, February 14, 2017

LA area Port Traffic "Surges" in January

From the Port of Long Beach: Port Traffic Surges In January

Renewed activity at the Port of Long Beach’s largest terminal and extra ships calling ahead of the Lunar New Year pushed cargo 8.7 percent higher in January compared to the same month a year ago.From the Port of Los Angeles: Port of Los Angeles Records Busiest January in Port's 110-Year History

...

The month’s total container traffic growth was notable since TEU traffic in January 2016 jumped 25 percent from the same month in 2015.

“It was a tough benchmark, so we’re very happy with the way the new year is starting in Long Beach,” said Board of Harbor Commissioners President Lori Ann Guzmán.

The Port of Los Angeles handled 826,640 Twenty-Foot Equivalent Units (TEUs) in January 2017, an increase of 17.4 percent compared to January 2016. It was the busiest January in the port’s 110-year history, outpacing last January, which was the previous record for the first month of the year. It was also the second-best month overall for the Port, eclipsed only by last November’s 877,564 TEUs.Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

"Coming off our best year ever in 2016, it’s very encouraging to keep the momentum going into 2017,” said Port of Los Angeles Executive Director Gene Seroka. ...

The January surge is due in part to retail stores replenishing inventories after the holidays, a trend of increased U.S. exports and cargo ships calling ahead of the Lunar New Year, when goods from Asia slow down considerably.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.On a rolling 12 month basis, inbound traffic was up 0.9% compared to the rolling 12 months ending in December. Outbound traffic was up 1.4% compared to 12 months ending in December.

The downturn in exports in 2015 was probably due to the slowdown in China and the stronger dollar. Now exports are picking up again,

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year). In general exports have started increasing, and imports have been gradually increasing.

Yellen: Semiannual Monetary Policy Report to the Congress

by Calculated Risk on 2/14/2017 10:10:00 AM

Federal Reserve Chair Janet Yellen testimony "Semiannual Monetary Policy Report to the Congress" Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate, Washington, D.C.. A few excepts:

Since my appearance before this Committee last June, the economy has continued to make progress toward our dual-mandate objectives of maximum employment and price stability. In the labor market, job gains averaged 190,000 per month over the second half of 2016, and the number of jobs rose an additional 227,000 in January. Those gains bring the total increase in employment since its trough in early 2010 to nearly 16 million. In addition, the unemployment rate, which stood at 4.8 percent in January, is more than 5 percentage points lower than where it stood at its peak in 2010 and is now in line with the median of the Federal Open Market Committee (FOMC) participants' estimates of its longer-run normal level. A broader measure of labor underutilization, which includes those marginally attached to the labor force and people who are working part time but would like a full-time job, has also continued to improve over the past year. In addition, the pace of wage growth has picked up relative to its pace of a few years ago, a further indication that the job market is tightening. Importantly, improvements in the labor market in recent years have been widespread, with large declines in the unemployment rates for all major demographic groups, including African Americans and Hispanics. Even so, it is discouraging that jobless rates for those minorities remain significantly higher than the rate for the nation overall.Here is the C-Span Link

Ongoing gains in the labor market have been accompanied by a further moderate expansion in economic activity. U.S. real gross domestic product is estimated to have risen 1.9 percent last year, the same as in 2015. Consumer spending has continued to rise at a healthy pace, supported by steady income gains, increases in the value of households' financial assets and homes, favorable levels of consumer sentiment, and low interest rates. Last year's sales of automobiles and light trucks were the highest annual total on record. In contrast, business investment was relatively soft for much of last year, though it posted some larger gains toward the end of the year in part reflecting an apparent end to the sharp declines in spending on drilling and mining structures; moreover, business sentiment has noticeably improved in the past few months. In addition, weak foreign growth and the appreciation of the dollar over the past two years have restrained manufacturing output. Meanwhile, housing construction has continued to trend up at only a modest pace in recent quarters. And, while the lean stock of homes for sale and ongoing labor market gains should provide some support to housing construction going forward, the recent increases in mortgage rates may impart some restraint.

Inflation moved up over the past year, mainly because of the diminishing effects of the earlier declines in energy prices and import prices. Total consumer prices as measured by the personal consumption expenditures (PCE) index rose 1.6 percent in the 12 months ending in December, still below the FOMC's 2 percent objective but up 1 percentage point from its pace in 2015. Core PCE inflation, which excludes the volatile energy and food prices, moved up to about 1-3/4 percent.

My colleagues on the FOMC and I expect the economy to continue to expand at a moderate pace, with the job market strengthening somewhat further and inflation gradually rising to 2 percent.

emphasis added

NFIB: Small Business Optimism Index increased slightly in January

by Calculated Risk on 2/14/2017 10:05:00 AM

Earlier from the National Federation of Independent Business (NFIB): National Federation of Independent Business Monthly Survey Shows Another Gain in Small Business Optimism

Small business optimism rose again in January to its highest level since December 2004, suggesting that the post-election surge has staying power, according to the monthly National Federation of Independent Business (NFIB) Index of Small Business Optimism, released today.

...

The Index reached 105.9 in January, an increase of 0.1 points. The uptick follows the largest month-over-month increase in the survey’s history. Five of the Index components increased and five decreased, but many held near their record high.

...

[T]he seasonally adjusted average employment change per firm posting a gain of 0.15 workers per firm, the best reading since September 2015 and historically, a strong showing. ... Fifty-three percent reported hiring or trying to hire (up 2 points), but 47 percent reported few or no qualified applicants for the positions they were trying to fill. Fifteen percent of owners cited the difficulty of finding qualified workers as their Single Most Important Business Problem (up 3 points).

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 105.9 in January.

This is the highest level since 2004.

Monday, February 13, 2017

Tuesday: Yellen, PPI

by Calculated Risk on 2/13/2017 07:00:00 PM

Tuesday:

• At 6:00 AM ET, NFIB Small Business Optimism Index for January.

• At 8:30 AM, The Producer Price Index for January from the BLS. The consensus is for 0.3% increase in PPI, and a 0.2% increase in core PPI.

• At 10:00 AM, Testimony by Fed Chair Janet Yellen, Semiannual Monetary Policy Report to the Congress, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate, Washington, D.C.

Lawler: Some Data on Institutional Holdings of Single-Family Properties

by Calculated Risk on 2/13/2017 03:10:00 PM

From housing economist Tom Lawler: Some Data on Institutional Holdings of Single-Family Properties

Invitation Homes, Blackstone Group’s single-family rental operator, recently went public, and its prospectus included some information on its portfolio of single-family rental properties. Other publicly-traded entities in the single-family rental business also provide such information, and I figured I’d compile some data.

Here is a table showing the number of single-family homes owned by selected publicly-traded companies (or subsidiaries of such companies). These totals include homes held for sale.

| Single-Family Homes Owned by Selected Institutions, 9/30/2016 | ||

|---|---|---|

| Number | Avg. Sq. Ft. | |

| Invitation Homes | 48,431 | 1,844 |

| American Homes 4 Rent | 48,158 | 1,959 |

| Colony Starwood Homes | 31,557 | 1,849 |

| Silver Bay Realty Trust Corp.* | 8,974 | 1,645 |

| Tricon American Homes | 8,006 | 1,521 |

| Total | 145,126 | 1,853 |

| *Silver Bay reported 8,837 SF homes, but the total excluded homes for sale, which I have estimated | ||

American Homes 4 Rent merged with American Residential Properties, Inc. in 2006, and that merger involved the “acquisition” of about 8,938 homes, bringing AH4R’s total property holdings to about the same as Invitation Homes.

Below is a table showing the geographic distribution of single-family homes held by these institutions. Note that reporting by “geographic market” in some cases varies by institution. E.g., one institution combines Charlotte and Raleigh, NC into one market, while another breaks those markets out separately. Also, two institutions have an “other” category – American Homes 4 Rent (a significant number of homes owned are in this category) and Colony Starwood Homes.

| Single Family Property Holdings of Certain Institions by Market, 9/30/2016 | ||||||

|---|---|---|---|---|---|---|

| Invitation Homes | American Homes 4 Rent | Colony Starwood Homes | Silver Bay Realty Trust | Tricom American Homes | Total | |

| West | ||||||

| Southern CA | 4,633 | 2,794 | 280 | 7,707 | ||

| Northern CA | 2,892 | 972 | 382 | 631 | 4,877 | |

| Seattle WA | 3,177 | 3,177 | ||||

| Phoenix AZ | 5,636 | 2,776 | 1,375 | 1,424 | 409 | 11,620 |

| Tucson AZ | 0 | 209 | 209 | |||

| Las Vegas NV | 940 | 1,023 | 1,713 | 290 | 295 | 4,261 |

| Reno NV | 0 | 251 | 251 | |||

| Salt Lake City UT | 0 | 1,048 | 1,048 | |||

| Denver CO | 0 | 1,981 | 1,981 | |||

| Midwest | ||||||

| Gr. Chicago ILIN | 2,973 | 2,047 | 5,020 | |||

| Minneapolis MN | 1,183 | 1,183 | ||||

| Indianapolis IN | 0 | 2,901 | 353 | 3,254 | ||

| Cincinnati OH | 0 | 1,952 | 1,952 | |||

| Columbus OH | 0 | 1,500 | 284 | 1,784 | ||

| South | ||||||

| Southeast FL | 5,588 | 3,693 | 308 | 604 | 10,193 | |

| Tampa FL | 4,997 | 1,729 | 3,717 | 1,111 | 500 | 12,054 |

| Orlando FL | 3,734 | 1,557 | 1,941 | 491 | 7,723 | |

| Jacksonville FL | 2,018 | 1,659 | 451 | 4,128 | ||

| Atlanta GA | 7,537 | 3,950 | 5,557 | 2,694 | 1,207 | 20,945 |

| Charlotte NC | 3,123 | 2,800 | 892 | 689 | 1,412 | 8,916 |

| Raleigh NC | 0 | 1,828 | 1,828 | |||

| Winston-Salem NC | 0 | 761 | 761 | |||

| Charleston SC | 0 | 725 | 725 | |||

| Columbia SC | 0 | 426 | 426 | |||

| Dallas TX | 0 | 4,340 | 2,043 | 504 | 614 | 7,501 |

| Houston TX | 0 | 3,153 | 2,726 | 820 | 6,699 | |

| San Antonio TX | 0 | 1,003 | 204 | 1,207 | ||

| Austin TX | 0 | 695 | 695 | |||

| Nashville TN | 0 | 2,381 | 240 | 2,621 | ||

| Not Specified | 0 | 7,087 | 967 | 8,054 | ||

| TOTAL | 48,431 | 46,915 | 30,611 | 8,837 | 8,006 | 142,800 |

| Note: AH4R, Colony, and Starwood totals exclude homes available for sale | ||||||

There are a few striking things to note. First, none of the properties held by these companies are in either the Northeast of the Mid-Atlantic regions of the country. Second, the different entities have decidedly different geographic concentrations, though none would be classified as “geographically diverse” relative to the US as a whole. And finally, the entities’ single-family rental property holdings are especially large relative to the size of the overall housing market in Atlanta, Charlotte, Orlando, Tampa, and (to a lesser extent) Phoenix.

Lawler: Selected Operating Statistics, Large Publicly-Traded Home Builders

by Calculated Risk on 2/13/2017 02:03:00 PM

From housing economist Tom Lawler.

Below is a table from Tom Lawler showing selected operating results of large publicly-traded builders for the quarter ended December 31, 2016.

| Net Orders | Settlements | Average Closing Price (000s) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 12/16 | 12/15 | % Chg | 12/16 | 12/15 | % Chg | 12/16 | 12/15 | % Chg |

| D.R. Horton | 9,241 | 8,064 | 14.6% | 9,404 | 8,061 | 16.7% | 298 | 290 | 2.4% |

| Pulte Group | 4,202 | 3,659 | 14.8% | 6,197 | 5,662 | 9.4% | 396 | 353 | 12.3% |

| NVR | 3,645 | 3,100 | 17.6% | 4,419 | 4,010 | 10.2% | 389 | 382 | 1.9% |

| Cal Atlantic | 2,848 | 2,699 | 5.5% | 4,338 | 3,795 | 14.3% | 450 | 437 | 3.0% |

| Beazer Homes | 1,005 | 923 | 8.9% | 995 | 1,049 | -5.1% | 338 | 321 | 5.3% |

| Meritage Homes | 1,493 | 1,568 | -4.8% | 2,117 | 1,919 | 10.3% | 414 | 397 | 4.3% |

| MDC Holdings | 1,018 | 1,020 | -0.2% | 1,582 | 1,275 | 24.1% | 453 | 435 | 4.1% |

| M/I Homes | 999 | 897 | 11.4% | 1,416 | 1,253 | 13.0% | 356 | 360 | -1.1% |

| Total | 24,451 | 21,930 | 11.5% | 30,468 | 27,024 | 12.7% | 373 | 356 | 4.6% |

Gary Cohn and the Participation Rate

by Calculated Risk on 2/13/2017 12:05:00 PM

A Bloomberg article from December had some comments from Gary Cohn, the White House National Economic Council Director: Cohn in His Own Words

The published U.S. unemployment rate “is a very, very fictitious rate. It’s only that low because the participation rate has gone downward...”This is not a "fun fact", it is complete nonsense.

“The participation rate really measures people out in the U.S. population that are looking for jobs. There are so many people who are frustrated looking for jobs that they’ve just stopped. If the participation rate normalized -- this is a fun fact -- if it normalized to Day 1 of the Obama administration, we’d still be at an 11 percent plus unemployment rate.” -- July 2015

First, Cohn obviously ignored his own economic research at Goldman Sachs. In March 2016, Goldman Sachs economist David Mericle wrote: "At this point, we see the cyclical “participation gap” as nearly closed." If most of the cyclical gap is closed, then the remaining decline was due to demographics and long term trends.

Second, as I've been discussing for years, the reason the recent decline in the overall participation rate (for those 16+ years old) is mostly due to demographics and long term trends. The two main drivers of the lower participation rate have been aging baby boomers, and younger people staying in school. There are also other long term trends that have pushed down the participation rate.

Lets look at the participation rate trend for two young male cohorts, those 16 to 19 years old, and those 20 to 24 years old.

Click on graph for larger image.

Click on graph for larger image.Note: For simplification, I used men only for this graph. It is more complicated for women because there was a significant increase in women participating in the labor force in the '60s, '70s, and '80s due to changing societal norms.

There has been a down trend that for both the "16 to 19" and "20 to 24" year old male cohorts that preexisted the recent recession. This is because more people are staying in school (a long term positive for the economy). This pushed down the overall participation rate - especially since there were large cohorts recently in these age groups.

Another key trend has been the aging of the baby boomers. This is a little more complicated because we have to look at two factors - the participation rate for older workers, and the number of people in each cohort.

The following table tracks two cohorts over the last decade. Those people in the 50 to 54 year old cohort in January 2007, are now in the 60 to 64 year old cohort.

And those people in the 55 to 59 year old cohort in 2007, are now in the 65 to 69 year old cohort.

If we track these people over time, we see the large cohort in the 50 to 54 in January 2007 has seen their participation rate decline from 80.5% to 55.6%.

And the cohort in the 55 to 59 age group in 2007 has seen their participation rate decline from 71.9% to 31.8%. These people are retiring (being able to retire is a positive for an individual).

| Demographics and Participation, Selected Cohorts | ||||

|---|---|---|---|---|

| Population | 50 to 54 | 55 to 59 | 60 to 64 | 65 to 69 |

| Jan-07 | 20,667 | 18,194 | ||

| Jan-17 | 19,786 | 16,607 | ||

| Participation Rate | 50 to 54 | 55 to 59 | 60 to 64 | 65 to 69 |

| Jan-07 | 80.5% | 71.9% | ||

| Jan-17 | 55.6% | 31.8% | ||

These are large population cohorts, and the decline in their participation has pushed down the overall participation rate.

A careful analysis suggests that almost all of the decline in the overall participation rate over the last decade is related to demographics and long term trends.

Perhaps Mr. Cohn doesn't know how to normalize using demographics, but his assertions are nonsense.

Hotels: Solid Start to 2017

by Calculated Risk on 2/13/2017 10:11:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 4 February

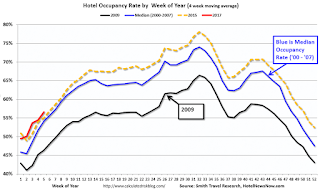

he U.S. hotel industry reported mostly negative results in the three key performance metrics during the week of 29 January through 4 February 2017, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In a year-over-year comparison with the week of 31 January through 6 February 2016:

• Occupancy: -1.5% to 55.6%

• Average daily rate (ADR): +0.2% to US$119.58

• Revenue per available room (RevPAR): -1.3% to US$66.51

emphasis added

The red line is for 2017, dashed is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.

The red line is for 2017, dashed is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.2015 was the best year on record for hotels.

So far occupancy in 2017 is slightly ahead of 2015, and well ahead of the median rate.

For hotels, this is the slow season of the year, and occupancy will pick up into the Spring.

Data Source: STR, Courtesy of HotelNewsNow.com

Sunday, February 12, 2017

Sunday Night Futures

by Calculated Risk on 2/12/2017 07:42:00 PM

Weekend:

• Schedule for Week of Feb 12, 2017

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures are up 2, and DOW futures are up 23 (fair value).

Oil prices were down over the last week with WTI futures at $53.74 per barrel and Brent at $56.56 per barrel. A year ago, WTI was at $29, and Brent was at $32 - so oil prices are up sharply year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.28 per gallon - a year ago prices were at $1.70 per gallon - so gasoline prices are up almost 60 cents a gallon year-over-year.

Update: "Scariest jobs chart ever"

by Calculated Risk on 2/12/2017 12:51:00 PM

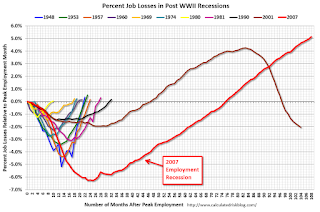

During and following the 2007 recession, every month I posted a graph showing the percent jobs lost during the recession compared to previous post-WWII recessions.

Some people started calling this the "scariest jobs chart ever". In 2009 it was pretty scary!

I retired the graph in May 2014 when employment finally exceeded the pre-recession peak.

I keep getting asked if I could post an update to the graph, and here it is through the January 2017 report.

This graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. Since exceeding the pre-recession peak in May 2014, employment is now 5.2% above the previous peak.

Note: I ended the lines for most previous recessions when employment reached a new peak, although I continued the 2001 recession too on this graph. The downturn at the end of the 2001 recession is the beginning of the 2007 recession. I don't expect a downturn for employment any time soon (unlike in 2007 when I was forecasting a recession).