by Calculated Risk on 1/10/2017 02:47:00 PM

Tuesday, January 10, 2017

Question #4 for 2017: What will the unemployment rate be in December 2017?

Late last year I posted some questions for 2017: Ten Economic Questions for 2017. I'll try to add some thoughts, and maybe some predictions for each question.

4) Unemployment Rate: The unemployment rate was at 4.6% in November, down 0.4 percentage points year-over-year. Currently the FOMC is forecasting the unemployment rate will be in the 4.5% to 4.6% range in Q4 2017. What will the unemployment rate be in December 2017?

Note: The unemployment rate was 4.7% in December 2016.

Forecasting the unemployment rate includes forecasts for economic and payroll growth, and also for changes in the participation rate. Note: The participation rate is the percent of the working age population (16 and over) that is in the labor force.

On participation: We can be pretty certain that the participation rate will decline over the next couple of decades based on demographic trends. However, over the last several years, the participation rate has been fairly steady as the stronger labor market offset the long term trend.

Here is a table of the participation rate and unemployment rate since 2008.

| Unemployment and Participation Rate for December each Year | |||

|---|---|---|---|

| December of | Participation Rate | Change in Participation Rate (percentage points) | Unemployment Rate |

| 2008 | 65.8% | 7.3% | |

| 2009 | 64.6% | -1.2 | 9.9% |

| 2010 | 64.3% | -0.3 | 9.3% |

| 2011 | 64.0% | -0.3 | 8.5% |

| 2012 | 63.7% | -0.3 | 7.9% |

| 2013 | 62.9% | -0.8 | 6.7% |

| 2014 | 62.7% | -0.2 | 5.6% |

| 2015 | 62.7% | 0.0 | 5.0% |

| 2016 | 62.7% | 0.0 | 4.7% |

Depending on the estimate for the participation rate and job growth (next question), it appears the unemployment rate will declining slightly by December 2017 from the current 4.7%. My guess is based on the participation rate declining slightly in 2017 - as the long term trends continue - and for decent job growth in 2017, but less than in 2016.

Here are the Ten Economic Questions for 2017 and a few predictions:

• Question #1 for 2017: What about fiscal and regulatory policy in 2017?

• Question #2 for 2017: How much will the economy grow in 2017?

• Question #3 for 2017: Will job creation slow further in 2017?

• Question #4 for 2017: What will the unemployment rate be in December 2017?

• Question #5 for 2017: Will the core inflation rate rise in 2017? Will too much inflation be a concern in 2017?

• Question #6 for 2017: Will the Fed raise rates in 2017, and if so, by how much?

• Question #7 for 2017: How much will wages increase in 2017?

• Question #8 for 2017: How much will Residential Investment increase?

• Question #9 for 2017: What will happen with house prices in 2017?

• Question #10 for 2017: Will housing inventory increase or decrease in 2017?

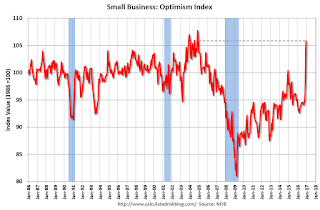

NFIB: Small Business Optimism Index increases in December

by Calculated Risk on 1/10/2017 12:10:00 PM

Earlier from the National Federation of Independent Business (NFIB): Small Business Optimism Skyrocketed in December

Small business optimism rocketed to its highest level since 2004, with a stratospheric 38-point jump in the number of owners who expect better business conditions, according to the monthly National Federation of Independent Business (NFIB) Index of Small Business Optimism, released today.

...

The Index reached 105.8, an increase of 7.4 points. Leading the charge was “Expect Better Business Conditions,” which shot up from a net 12 percent in November to a net 50 percent last month.

...

Despite sharply higher optimism, hiring activity remained flat in December. Job creation increased by 0.01 workers per firm and job openings dropped two points. According to the NFIB Jobs report, released last week, finding qualified workers remains a persistent problem for small business owners.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 105.8 in December.

This is the highest level since 2004.

BLS: Job Openings "little changed" in November

by Calculated Risk on 1/10/2017 10:07:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings was little changed at 5.5 million on the last business day of November, the U.S. Bureau of Labor Statistics reported today. Over the month, hires and separations were also little changed at 5.2 million and 5.0 million, respectively.....The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

The number of quits was little changed in November at 3.1 million. The quits rate was 2.1 percent. Over the month, the number of quits was little changed for total private and for government.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for November, the most recent employment report was for December.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in November to 5.522 million from 5.451 million in October. Job openings are mostly moving sideways at a high level.

The number of job openings (yellow) are up 6% year-over-year.

Quits are up 7% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

This is another solid report.

Monday, January 09, 2017

Tuesday: Job Openings, Small Business Survey

by Calculated Risk on 1/09/2017 07:44:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Recover Most of Friday's Losses

Mortgage rates recovered much of Friday's losses today, moving back near the lowest levels in more than a month. To be fair, that's a claim they could have made on Friday, which was still the 2nd best day in a month despite the deterioration vs Thursday. 2017 has consequently been "so far, so good" for rates. When combined with the 2nd half of December, rates are a quarter of a point lower on average, and as much as a half point lower at certain lenders.Tuesday:

The most prevalent conventional 30yr fixed rate remains 4.125% on top tier scenarios.

emphasis added

• At 6:00 AM, NFIB Small Business Optimism Index for December.

• At 10:00 AM, Job Openings and Labor Turnover Survey for November from the BLS. Jobs openings decreased in October to 5.534 million from 5.631 million in September.

It DOES Rains in California!

by Calculated Risk on 1/09/2017 01:44:00 PM

California has been enduring a five year drought, but it is raining in SoCal and snowing in the mountains this year.

Here are a few resources to track the rain and snow.

These tables show the snowpack in the North, Central and South Sierra. Currently the snowpack is about 101% of normal for this date in the North, 118% of normal in the Central Sierra, and 167% of normal in the Southern Sierra. A great start to the season.

And here are some plots comparing the current and previous years to the average, a very dry year ('14-'15) and a wet year ('82-'83). This winter is above normal so far.

And for Los Angeles, here is a historical table of annual rainfall. After five years of significantly below average rainfall, this year is above normal (and the rain is still falling).

It is too early to declare the five-year drought over, but this is good news for the state and the state economy. It will be interesting to see how much the reservoirs fill up in the Spring.

There were four very dry years in a row, and then last winter was a little better - but still below normal.

There is already as much snow this year as last year.

Question #5 for 2017: Will the core inflation rate rise in 2017? Will too much inflation be a concern in 2017?

by Calculated Risk on 1/09/2017 10:45:00 AM

Late last year I posted some questions for 2017: Ten Economic Questions for 2017. I'll try to add some thoughts, and maybe some predictions for each question.

5) Inflation: The inflation rate has increased a little recently, and some key measures are now close to the the Fed's 2% target. Will core inflation rate rise in 2017? Will too much inflation be a concern in 2017?

Although there are different measure for inflation (including some private measures) they all show that inflation is now close to the Fed's 2% inflation target - except Core PCE.

Note: I follow several measures of inflation, median CPI and trimmed-mean CPI from the Cleveland Fed. Core PCE prices (monthly from the BEA) and core CPI (from the BLS).

On a year-over-year basis in November, the median CPI rose 2.5%, the trimmed-mean CPI rose 2.1%, and the CPI less food and energy rose 2.1%. Core PCE is for October and increased 1.7% year-over-year.

On a monthly basis, median CPI was at 2.2% annualized, trimmed-mean CPI was at 1.9% annualized, and core CPI was at 1.8% annualized.

These measures have been trending up slowly.

The Fed is projecting core PCE inflation will increase to 1.8% to 1.9% by Q4 2017. However there are risks for higher inflation. The labor market is approaching full employment, and the new administration is proposing some fiscal stimulus (tax cuts, possible infrastructure spending), so it is possible - as a result - that inflation will increase more than expected in 2017 and 2018.

Currently I think PCE core inflation (year-over-year) will increase further and be close to 2% in 2017, but too much inflation will still not be a serious concern in 2017.

Here are the Ten Economic Questions for 2017 and a few predictions:

• Question #1 for 2017: What about fiscal and regulatory policy in 2017?

• Question #2 for 2017: How much will the economy grow in 2017?

• Question #3 for 2017: Will job creation slow further in 2017?

• Question #4 for 2017: What will the unemployment rate be in December 2017?

• Question #5 for 2017: Will the core inflation rate rise in 2017? Will too much inflation be a concern in 2017?

• Question #6 for 2017: Will the Fed raise rates in 2017, and if so, by how much?

• Question #7 for 2017: How much will wages increase in 2017?

• Question #8 for 2017: How much will Residential Investment increase?

• Question #9 for 2017: What will happen with house prices in 2017?

• Question #10 for 2017: Will housing inventory increase or decrease in 2017?

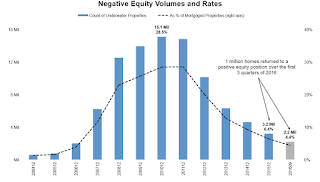

Black Knight November Mortgage Monitor

by Calculated Risk on 1/09/2017 08:11:00 AM

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for November today. According to BKFS, 4.46% of mortgages were delinquent in November, down from 4.92% in November 2015. BKFS also reported that 0.98% of mortgages were in the foreclosure process, down from 1.38% a year ago.

This gives a total of 5.44% delinquent or in foreclosure.

Press Release: Black Knight’s Mortgage Monitor: 2.2 Million Homeowners in Negative Equity, Fewest Since Early 2007; $4.6 Trillion in Tappable Equity is Within Six Percent of Peak

Today, the Data & Analytics division of Black Knight Financial Services, Inc. (NYSE: BKFS) released its latest Mortgage Monitor Report, based on data as of the end of November 2016. In the first three quarters of 2016, as home prices continued to appreciate, one million previously underwater homeowners returned to positive equity positions, while tappable equity totals continued to rise. This month, Black Knight looked at the extent and impact of these changes on the market. As Black Knight Data & Analytics Executive Vice President Ben Graboske explained, there is a distinct geographical component at work, with regard to both the negative and tappable equity sides of the equation.

“The negative equity situation has improved substantially since the height of the great recession,” said Graboske. “There are now just 2.2 million homeowners left in negative equity positions, a full one million fewer than at the start of 2016. Whereas negative home equity was once a widespread national problem – with roughly 30 percent of all homeowners being underwater on their mortgages at the end of 2010 – it has now become much more of a localized issue. By and large, the majority of states have negative equity rates below the national average of 4.4 percent. There are, though, some pockets where homeowners continue to struggle. Three states in particular stand out: Nevada, Missouri and New Jersey, all of which have negative equity rates more than twice the national average."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from Black Knight shows their estimate of the number and percent of loans with negative equity.

From Black Knight:

• Only 2.2 million (4.4 percent) mortgage holders remain underwater on their homes, a decline of one million since the beginning of 2016

• Whereas negative equity was once a widespread national problem – with nearly 30 percent of all homeowners being underwater on their mortgages at the end of 2010 – it has now become much more of a localized issue

• Lower priced homes – those in the bottom 20 percent of prices in their communities – are nine times more likely to be underwater than those in the top 20 percent

• The negative equity rate for borrowers living in the bottom 20 percent of their metro area by price is 11.5 percent, compared to just 1.3 percent for those in the top 20 percent of the market

This graph from Black Knight shows their estimate of tappable equity:

This graph from Black Knight shows their estimate of tappable equity:From Black Knight:

• There are now 39 million borrowers with tappable equity in their homes, meaning they have current combined loan-to-value (CLTV) ratios of less than 80 percentThere is much more in the mortgage monitor.

• These borrowers have a total of $4.6 trillion in available, lendable equity—an average of about $180,000 per borrower—making for the highest market total and highest average per borrower since 2006

• Total tappable equity grew by $500 billion in just the first three quarters of 2016

• We are now within about six percent of the peak in lendable/tappable equity seen back in late 2005/early 2006

Sunday, January 08, 2017

Sunday Night Futures

by Calculated Risk on 1/08/2017 08:04:00 PM

Weekend:

• Schedule for Week of Jan 8, 2017

• Question #6 for 2017: Will the Fed raise rates in 2017, and if so, by how much?

Monday:

• At 10:00 AM ET, The Fed will release the monthly Labor Market Conditions Index (LMCI).

• At 3:00 PM, Consumer credit from the Federal Reserve. The consensus is for a $18.5 billion increase in credit.

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures are up 2, and DOW futures are up 24 (fair value).

Oil prices were up over the last week with WTI futures at $53.81 per barrel and Brent at $56.97 per barrel. A year ago, WTI was at $33, and Brent was at $32 - so oil prices are up sharply year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.37 per gallon - a year ago prices were at $2.00 per gallon - so gasoline prices are up almost 40 cents a gallon year-over-year.

Question #6 for 2017: Will the Fed raise rates in 2017, and if so, by how much?

by Calculated Risk on 1/08/2017 12:20:00 PM

Last week I posted some questions for 2017: Ten Economic Questions for 2017. I'll try to add some thoughts, and maybe some predictions for each question.

6) Monetary Policy: The Fed raised rates this month, and now the question is how much will the Fed raise rates in 2017? The market is pricing in three 25 bps rate hikes in 2017, and most analysts expect two to three hikes in 2017. Will the Fed raise rates in 2017, and if so, by how much?

For years I made fun of those predicting an imminent Fed Funds rate increase. Based on high unemployment and low inflation, I argued it would be a "long time" before the first rate hike. A long time passed ... and in 2015 I finally argued a rate hike was likely (although I thought we'd see more than one in 2015). The Fed raised rates in December 2015, and then once again in December 2016.

Currently the the target range for the federal funds rate is 1/2 to 3/4 percent.

As of December, the FOMC members see the following number of rate hikes in 2017:

| 25bp Rate Hikes in 2017 | FOMC Members |

|---|---|

| One | 2 |

| Two | 4 |

| Three | 6 |

| Four | 3 |

| More than Four | 2 |

Analysts are being cautious on forecasting rate hikes, probably because they forecasted too many hikes over the last few years. However, as the economy approaches full employment, and with the possibility of fiscal stimulus in 2017, it is possible that inflation will pick up a little - and, if so, the Fed could hike more than expected.

Analysts at Merrill Lynch recently wrote:

We expect the Fed to hike once in 2017, but the risks are to the upside. Once fiscal stimulus kicks in, we expect the Fed to hike faster – we forecast 3 hikes in 2018.Tim Duy noted Friday: Solid Employment Report Keeps Fed On Track

The labor market finished out the year on a solid note. Solid, not spectacular, and largely consistent with the Fed's expectations. Consequently, the final employment report for 2016 should not impact the Fed's median forecast for 75bp of rate hikes in 2017.The number of hikes depends on the economic outlook and inflation. There are significant uncertainities concerning fiscal policy, and some of the proposals could boost economic growth (as an example, if there is a real infrastructure spending program), and some could impede growth (like a significant trade dispute).

...

The economy is now at a point where a sudden boost in activity would prompt the Fed to accelerate the pace of rate increases. This employment report, however, suggests this isn't happening just yet.

...

Bottom Line: A solid report largely consistent with expectations among monetary policymakers. Hence it should have little impact on interest rate forecasts for the coming year. But watch out for upside risks to the outlook; the economy gained some traction in the final months of 2016. It is reasonable to believe that traction will hold in 2017.

My current guess is the Fed will hike twice in 2017.

Here are the Ten Economic Questions for 2017 and a few predictions:

• Question #1 for 2017: What about fiscal and regulatory policy in 2017?

• Question #2 for 2017: How much will the economy grow in 2017?

• Question #3 for 2017: Will job creation slow further in 2017?

• Question #4 for 2017: What will the unemployment rate be in December 2017?

• Question #5 for 2017: Will the core inflation rate rise in 2017? Will too much inflation be a concern in 2017?

• Question #6 for 2017: Will the Fed raise rates in 2017, and if so, by how much?

• Question #7 for 2017: How much will wages increase in 2017?

• Question #8 for 2017: How much will Residential Investment increase?

• Question #9 for 2017: What will happen with house prices in 2017?

• Question #10 for 2017: Will housing inventory increase or decrease in 2017?

Saturday, January 07, 2017

Schedule for Week of Jan 8th

by Calculated Risk on 1/07/2017 08:11:00 AM

This will be a light week for economic data.

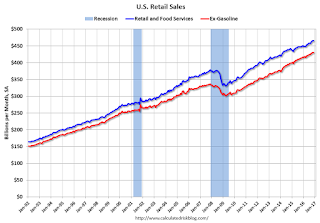

The key economic report this week is December Retail Sales.

10:00 AM ET: The Fed will release the monthly Labor Market Conditions Index (LMCI).

3:00 PM: Consumer credit from the Federal Reserve. The consensus is for a $18.5 billion increase in credit.

6:00 AM ET: NFIB Small Business Optimism Index for December.

10:00 AM: Job Openings and Labor Turnover Survey for November from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for November from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in October to 5.534 million from 5.631 million in September.

The number of job openings (yellow) were up 2% year-over-year, and Quits were up 7% year-over-year.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 255 thousand initial claims, up from 235 thousand the previous week.

7:00 PM, Conversation with the Chair: A Teacher Town Hall Meeting, Chair Janet Yellen will address educators in Washington, D.C., and nationwide via webcast.

8:30 AM ET: Retail sales for December will be released. The consensus is for 0.7% increase in retail sales in December.

8:30 AM ET: Retail sales for December will be released. The consensus is for 0.7% increase in retail sales in December.This graph shows retail sales since 1992 through November 2016.

8:30 AM: The Producer Price Index for December from the BLS. The consensus is for a 0.3% increase in prices, and a 0.1% increase in core PPI.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for November. The consensus is for a 0.6% increase in inventories.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for January). The consensus is for a reading of 98.6, up from 98.2 in November.