by Calculated Risk on 1/07/2017 08:11:00 AM

Saturday, January 07, 2017

Schedule for Week of Jan 8th

This will be a light week for economic data.

The key economic report this week is December Retail Sales.

10:00 AM ET: The Fed will release the monthly Labor Market Conditions Index (LMCI).

3:00 PM: Consumer credit from the Federal Reserve. The consensus is for a $18.5 billion increase in credit.

6:00 AM ET: NFIB Small Business Optimism Index for December.

10:00 AM: Job Openings and Labor Turnover Survey for November from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for November from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in October to 5.534 million from 5.631 million in September.

The number of job openings (yellow) were up 2% year-over-year, and Quits were up 7% year-over-year.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 255 thousand initial claims, up from 235 thousand the previous week.

7:00 PM, Conversation with the Chair: A Teacher Town Hall Meeting, Chair Janet Yellen will address educators in Washington, D.C., and nationwide via webcast.

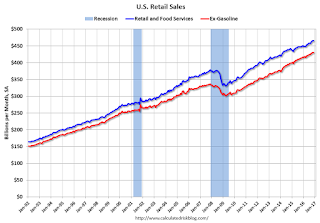

8:30 AM ET: Retail sales for December will be released. The consensus is for 0.7% increase in retail sales in December.

8:30 AM ET: Retail sales for December will be released. The consensus is for 0.7% increase in retail sales in December.This graph shows retail sales since 1992 through November 2016.

8:30 AM: The Producer Price Index for December from the BLS. The consensus is for a 0.3% increase in prices, and a 0.1% increase in core PPI.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for November. The consensus is for a 0.6% increase in inventories.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for January). The consensus is for a reading of 98.6, up from 98.2 in November.