by Calculated Risk on 9/29/2016 08:21:00 PM

Thursday, September 29, 2016

Friday: Personal Income, Chicago PMI, Consumer Sentiment

From Merrill Lynch: Elections: what keeps us up at night?

The US elections are quickly approaching and, in our view, have become one of the most significant near-term risks for the economy and markets. The facts are changing quickly, both in terms of the policies that each candidate supports but also in terms of expectations over the outcome of the election. According to the Iowa Electronic Markets (IEM) and PredictWise, Clinton currently has about a 70-75% chance of winning the election. FiveThirtyEight, a political aggregator, is expecting a closer race with Clinton’s chances at only about 60%. According to IEM and PredictWise, the probability of Republicans retaining control of the House is running at 70%-90%, and the probability of Democrats taking control of the Senate is about 40%-60%.CR Note: All key analysts are assuming Ms. Clinton will be the next President (my forecasts also assume a Clinton presidency). The alternative is too grim to contemplate.

Although the race has narrowed, the markets and political aggregators are suggesting the most likely outcome is split government, with Hillary Clinton in the White House and the Republicans in control of the House. This would imply that the gridlock in Washington continues and that policy changes would not be significant – which is assumed in our baseline economic forecasts. However, we cannot rule out the possibility of a Republican sweep. As our strategists have noted, the initial reaction to a potential Trump victory would likely be a risk-off event in the markets, which we think could end up delaying the Fed from hiking in December.

emphasis added

Friday:

• At 8:30 AM ET, Personal Income and Outlays for August. The consensus is for a 0.2% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 9:45 AM, Chicago Purchasing Managers Index for September. The consensus is for a reading of 52.0, up from 51.5 in August.

• At 10:00 AM, University of Michigan's Consumer sentiment index (final for September). The consensus is for a reading of 90.1, up from the preliminary reading 89.8.

Fannie Mae: Mortgage Serious Delinquency rate declined in August, Lowest since April 2008

by Calculated Risk on 9/29/2016 05:09:00 PM

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined in August to 1.24%, down from 1.30% in July. The serious delinquency rate is down from 1.62% in August 2015.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

This is the lowest rate since April 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Although the rate is generally declining, the "normal" serious delinquency rate is under 1%.

The Fannie Mae serious delinquency rate has fallen 0.38 percentage points over the last year, and at that rate of improvement, the serious delinquency rate will not be below 1% for about 8 more months.

Note: Freddie Mac reported yesterday.

Zillow Forecast: Expect Similar YoY Growth in August for the Case-Shiller Indexes

by Calculated Risk on 9/29/2016 01:37:00 PM

The Case-Shiller house price indexes for July were released Tuesday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: August Case-Shiller Forecast: New Home Price Peaks Within Sight

According to Zillow’s August Case-Shiller forecast, the national index and both smaller 10 and 20-city indices look set to keep growing at a very similar rate as they have been for the past few months. After two full years of steady growth around 5 percent annually, the U.S. National Case-Shiller home price index is within striking distance of reaching its July 2006 peak levels, just 0.6 percent off those levels, according to today’s data.The year-over-year change for the 20-city index will probably be slightly lower in the August report than in the July report. The change for the National index will probably be slightly higher.

The August Case-Shiller National Index is expected to grow 5.2 percent year-over-year and 0.5 percent month-to-month (seasonally adjusted). We expect the 10-City Index to grow 4.1 percent year-over-year and to stay flat (SA) from July. The 20-City Index is expected to grow 4.9 percent between August 2015 and August 2016, and rise 0.1 percent (SA) from July.

Zillow’s August Case-Shiller forecast is shown in the table below. These forecasts are based on today’s July Case-Shiller data release and the August 2016 Zillow Home Value Index (ZHVI). The August S&P CoreLogic Case-Shiller Indices will not be officially released until Tuesday, October 25.

NAR: Pending Home Sales Index decreased 2.4% in August, down 0.2% year-over-year

by Calculated Risk on 9/29/2016 10:03:00 AM

From the NAR: Pending Home Sales Retreat in August

After bouncing back in July, pending home sales cooled in August for the third time in four months and to their lowest level since January, according to the National Association of Realtors®.This was well below expectations of a 0.5% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in September and October.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, declined 2.4 percent to 108.5 in August from a downwardly revised 111.2 in July and is now slightly lower (0.2 percent) than August 2015 (108.7). With last month's decline, the index is now at its second lowest reading this year after January (105.4).

...

The PHSI in the Northeast rose 1.3 percent to 98.1 in August, and is now 5.9 percent above a year ago. In the Midwest the index decreased 0.9 percent to 104.7 in August, and is now 1.7 percent lower than August 2015.

Pending home sales in the South declined 3.2 percent to an index of 119.8 in August and are now 1.5 percent lower than last August. The index in the West fell 5.3 percent in August to 102.8, and is now 0.6 percent lower than a year ago.

emphasis added

Weekly Initial Unemployment Claims at 254,000

by Calculated Risk on 9/29/2016 08:38:00 AM

The DOL reported:

In the week ending September 24, the advance figure for seasonally adjusted initial claims was 254,000, an increase of 3,000 from the previous week's revised level. The previous week's level was revised down by 1,000 from 252,000 to 251,000. The 4-week moving average was 256,000, a decrease of 2,250 from the previous week's revised average. The previous week's average was revised down by 250 from 258,500 to 258,250.The previous week was revised down.

There were no special factors impacting this week's initial claims. This marks 82 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 256,000.

This was lower than the consensus forecast of 260,000. The low level of claims suggests relatively few layoffs.

Q2 GDP Revised Up to 1.4% Annual Rate

by Calculated Risk on 9/29/2016 08:34:00 AM

From the BEA: Gross Domestic Product: Second Quarter 2016 (Third Estimate)

Real gross domestic product increased at an annual rate of 1.4 percent in the second quarter of 2016 (table 1), according to the "third" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 0.8 percent.Here is a Comparison of Second and Advance Estimates. PCE growth was revised down from 4.4% to 4.3%. (Solid PCE). Non-Residential investment was revised up from -0.9% to +1.0%. This was close to the consensus forecast.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 1.1 percent. With the third estimate for the second quarter, the general picture of economic growth remains the same. The most notable change from the second to third estimate is that nonresidential fixed investment increased in the second quarter; in the previous estimate, nonresidential fixed investment decreased ...

emphasis added

Wednesday, September 28, 2016

Thursday: GDP, Unemployment Claims, Pending Home Sales

by Calculated Risk on 9/28/2016 08:06:00 PM

The GDP release will be for Q2. Here are two looks at Q3 ...

Atlanta Fed GDP Now:

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2016 is 2.8 percent on September 28, down from 2.9 percent on September 20.New York Fed Nowcasting:

The FRBNY Staff Nowcast stands at 2.3% and 1.2% for 2016:Q3 and 2016:Q4, respectively.Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 260 thousand initial claims, up from 252 thousand the previous week.

• Also at 8:30 AM, Gross Domestic Product, 2nd quarter 2016 (Third estimate). The consensus is that real GDP increased 1.3% annualized in Q2, up from 1.1% in the second estimate.

• At 10:00 AM, Pending Home Sales Index for August. The consensus is for a 0.5% increase in the index.

• At 5:10 PM, Speech by Fed Chair Janet Yellen, Conversation with conference participants, At the Banking and the Economy: A Forum for Minority Bankers, Federal Reserve Bank of Kansas City, Kansas City, Missouri

Freddie Mac: Mortgage Serious Delinquency rate declined in August, Lowest since July 2008

by Calculated Risk on 9/28/2016 04:40:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate declined in August to 1.03%, down from 1.08% in July. Freddie's rate is down from 1.45% in August 2015.

This is the lowest rate since July 2008.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Although the rate is generally declining, the "normal" serious delinquency rate is under 1%.

The Freddie Mac serious delinquency rate has fallen 0.42 percentage points over the last year, and at that rate of improvement, the serious delinquency rate could be below 1% in next month (September).

Note: Fannie Mae will report in the next few days.

OPEC Agrees to Cut Oil Output

by Calculated Risk on 9/28/2016 03:34:00 PM

From Bloomberg: OPEC Agrees to First Oil Output Cut in Eight Years

In two days of round-the-clock talks in Algiers, the group agreed to drop production to 32.5 million barrels a day, the delegate said, asking not to be named because the decision isn’t yet public. That’s nearly 750,000 barrels a day less than it pumped in August.

...

As OPEC agreed to limit its output, Russia smashed a post-Soviet oil-supply record, pumping 11.1 million barrels a day in September, up 400,000 from August, according to preliminary estimates. Russia participated in the Algiers talks, but it’s not party to the OPEC deal.

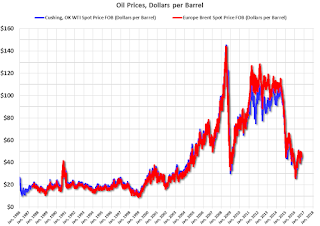

Click on graph for larger image

Click on graph for larger imageThis graph shows the year-over-year change in WTI based on data from the EIA.

Five times since 1987, oil prices have increased 100% or more YoY. And several times prices have almost fallen in half YoY.

Brent and WTI oil prices are now up about 5% year-over-year.

The second graph shows WTI and Brent spot oil prices from the EIA. (Prices today added).

The second graph shows WTI and Brent spot oil prices from the EIA. (Prices today added). According to Bloomberg, WTI is at $46.83 per barrel today, and Brent is at $48.41.

Prices really collapsed at the end of 2014 - and then rebounded a little - and then collapsed again at the end of 2015 and in early 2016.

Who knows if this agreement will hold, but it seems likely that oil prices - and eventually gasoline prices - will be up year-over-year at the end of 2016 and no longer a drag on CPI.

Update on "Peak Renter"

by Calculated Risk on 9/28/2016 12:52:00 PM

From economist Josh Lehner at Oregon Office of Economic Analysis Peak Renter In Real Life

A year ago our office asked “Is 2015 Peak Renter?” We laid out a straightforward case examining the three main underlying drivers for the shift into rentership over the past decade: household finances, demographics, and preferences and tastes. We know the pendulum has swung all the way toward rentership. The question is not whether or not it will swing back toward ownership, it will. The question is when will this happen. Our office’s position was that it would happen probably sooner than the conventional wisdom suggested. The reason was household finances and demographics are now working in favor of ownership.CR Note: there is much more in the post. When Lehner sent me his post last year, I added some comments here - including the following graph.

...

Well, the 2015 ACS data was just released and we got an update on the question of ownership vs rentership. As Jed Kolko notes in his great summary of the ACS data, rentership ticked up 0.1 percentage points nationwide last year. So not yet peak renter across the entire U.S. and the HVC data differ from the ACS data as well. That said, the U.S. changes were minimal, suggesting the shift into rentership has slowed considerably; possibly an indication that peak renter is near.

Locally, however, peak renter is already here. Statewide the homeownership rate ticked up from 60.7% in 2014 to 61.1% in 2015. In the Portland metro region the increase was even bigger at 1.6 percentage points.

Click on graph for larger image.

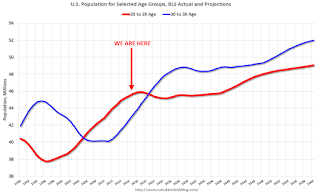

Click on graph for larger image.This graph shows the long term trend for two key age groups: 20 to 29, and 30 to 39.

This graph is from 1990 to 2060 (all data from BLS: current to 2060 is projected).

We can see the surge in the 20 to 29 age group (red). Once this group exceeded the peak in earlier periods, there was an increase in apartment construction. This age group will peak in 2018 (until the 2030s).

Note: I used a similar graph six years ago to argue there would be a surge in rentals from both demographics, and also from people losing their homes to foreclosure.

For buying, the 30 to 39 age group (blue) is important (note: see Demographics and Behavior for some reasons for changing behavior). The population in this age group is increasing, and will increase significantly over the next 10+ years.

This demographics is positive for home buying, and this is a key reason I expect single family housing starts to continue to increase in coming years.