by Calculated Risk on 9/20/2016 08:38:00 AM

Tuesday, September 20, 2016

Housing Starts decreased to 1.142 Million Annual Rate in August

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in August were at a seasonally adjusted annual rate of 1,142,000. This is 5.8 percent below the revised July estimate of 1,212,000, but is 0.9 percent above the August 2015 rate of 1,132,000.

Single-family housing starts in August were at a rate of 722,000; this is 6.0 percent below the revised July figure of 768,000. The August rate for units in buildings with five units or more was 403,000.

Building Permits:

Privately-owned housing units authorized by building permits in August were at a seasonally adjusted annual rate of 1,139,000. This is 0.4 percent below the revised July rate of 1,144,000 and is 2.3 percent below the August 2015 estimate of 1,166,000.

Single-family authorizations in August were at a rate of 737,000; this is 3.7 percent above the revised July figure of 711,000. Authorizations of units in buildings with five units or more were at a rate of 370,000 in August.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in August compared to July. Multi-family starts are up 4.7% year-over-year.

Single-family starts (blue) decreased in August, and are down 1.2% year-over-year.

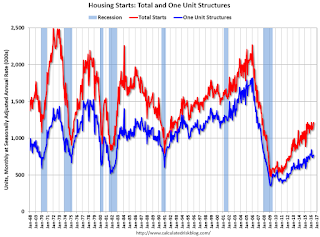

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),

Total housing starts in August were below expectations, however combined starts for June and July were revised up slightly. I'll have more later ...

Monday, September 19, 2016

Tuesday: Housing Starts

by Calculated Risk on 9/19/2016 06:39:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Steady to Slightly Higher

Mortgage Rates were unchanged for a third straight day, although several lenders did raise rates at the end of the day. ... Lenders continue quoting conventional 30yr fixed rates of 3.5% on top tier scenarios, with the runners-up being 3.625% and 3.375% in that order.Tuesday:

Keep in mind that Wednesday afternoon brings the FOMC Announcement (where the Fed releases its updated policy statement). This can be a significant source of volatility for rates markets. That said, volatility could already be picking up as the Bank of Japan releases its own policy update earlier in the morning. Although markets (and rates) can go either way in response to these events, big, negative reactions tend to happen faster and more abruptly than big, positive reactions.

emphasis added

• At 8:30 AM ET, Housing Starts for August. Total housing starts increased to 1.211 million (SAAR) in July. Single family starts increased to 770 thousand SAAR in July. The consensus for 1.190 million, down from the July rate.

• At 10:00 AM, Regional and State Employment and Unemployment (Monthly) for August 2016

Kolko: "Unpacking the Jump In Median Household Income"

by Calculated Risk on 9/19/2016 01:05:00 PM

From Jed Kolko, chief economist at Indeed, formerly chief economist at Trulia.

Last week the Census reported large gains in median household income in two different surveys: 5.2% from the Current Population Survey’s March 2016 Annual Social and Economic Supplement (ASEC), and 3.8% from the 2015 American Community Survey (ACS). But these are slippery measures, and several thoughtful responses (here, here, and here) catalogued numerous cautions, including the limitations of these self-reported Census survey data relative to administrative data.

A particularly important concern when interpreting these income gains is whether households are changing. The share of young adults living in their parents’ homes has climbed sharply since 2005 and continues to rise, according to last week’s data release. Their earnings count toward their parents’ household income – so larger households mean higher household incomes, even if individuals’ earnings don’t change. Fortunately, the surveys released last week aren’t just about income; they’re also the definitive sources on households and living arrangements, so we can unpack the change in median household income and assess whether changing household structure had an effect.

Both the ASEC and ACS show a that the number of adults per household was essentially unchanged between 2014 and 2015. (The two surveys actually cover different time periods, but for simplicity I’m calling them 2014-to-2015 changes. See note at end.) The number of adults (18+) per household rose a slight 0.2% in the ACS and was flat in the ASEC. The increase in young adults living at home, noted above, is only part of the broader changes in living arrangements; at the same time as more young adults are living with parents, a rising share of households are single-person. Changes in household size, therefore, explain essentially none of the increase in median household income.

A different factor, however, explains some of the jump in household income. More adults were working in 2015 than in 2014. The number of workers per household increased 1.1% in the ASEC and 0.5% in the ACS: this includes all workers, regardless of how many hours per week or weeks per year they worked. The number of full-time, year-round workers per household increased more: 1.2% in the ASEC and 1.7% in the ACS.

| Change, 2014-2015, in: | ASEC | ACS |

|---|---|---|

| adults (18+) per household | 0.0% | 0.2% |

| workers (all types, any age) per household | 1.1% | 0.5% |

| full-time, year-round workers (any age) per household | 1.2% | 1.7% |

| median earnings: full-time, year-round workers | 2.9% | 2.8% |

| median income: households (as published) | 5.2% | 3.8% |

Still, the percentage increases in workers per household and full-time, year-round workers per household were smaller than the percentage increases in median household income. That suggests that even after accounting for changing in household size and changes in employment rates, earnings per worker rose. And, in fact, both surveys report that explicitly: median earnings for full-time, year-round workers rose 2.9% in the ASEC and 2.8% in the ACS.

In theory the change in median household income should be pretty close to the sum of the change in earnings per full-time, year-round workers and the change in full-time, year-round workers per household. But they’re not, in either survey. That’s because medians don’t behave as neatly as means do when you try to combine or disaggregate them; it’s also because income encompasses more than work-related earnings (e.g. investment income); and there are margins of error around all of these survey-data estimates.

Despite these caveats, consistent results emerge from the two surveys. Even with the rising share of young adults living with parents, household size was essentially unchanged and therefore does not explain the rise in median household incomes. Both employment rates (especially full-time, year-round employment) and per-worker earnings rose, and the percentage rise in earnings was larger than the percentage rise in employment. Most of the jump in median household income, therefore, appears to be rising earnings, with rising employment playing an important supporting role. The labor market improved for workers on both of these fronts: the rise in median household income is indeed good news.

Methodology notes and data sources:

ASEC: estimates for households, adult population, workers, and full-time year-round workers are based on my calculations from the microdata file and exclude group quarters. The estimate of per-worker earnings is based on the Census PINC05 files. Note that the increase in median earnings for full-time, year-round workers is higher than those for men and women separately as shown in the published report, even when averaged properly; such as the quirky properties of medians. The ASEC was conducted in March 2016, and income refers to the 2015 calendar year.

ACS: estimates for households, adult population, workers, full-time year-round workers, and per-working earnings are from Factfinder tables S2002, S2601A, B23027, and B25002. Adult population excludes group quarters; workers include adults in group quarters (not possible to separate them using the published tables). The ACS was conducted on a rolling basis through 2015, and income refers to the previous twelve months.

Here’s a longer explanation of the differences between the ASEC and the ACS, especially the time periods covered.

NAHB: Builder Confidence increases to 65 in September

by Calculated Risk on 9/19/2016 10:05:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 65 in September, up from 59 in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Surges in September

Builder confidence in the market for newly built, single-family homes in September jumped six points to 65 from a downwardly revised August reading of 59 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) released today. This marks the highest HMI level since October 2015.

...

“With the inventory of new and existing homes remaining tight, builders are confident that if they can build more homes they can sell them,” said NAHB Chief Economist Robert Dietz. “Though solid job creation and low interest rates are also fueling demand, builders continue to be hampered by supply-side constraints that include shortages of labor and lots.”

...

All three HMI components moved higher in September. The component measuring current sales expectations rose six points to 71 and the gauge charting sales expectations in the next six months increased five points to also stand at 71. The index measuring traffic of prospective buyers posted a four-point gain to 48.

The three-month moving averages for HMI scores posted gains in three out of the four regions. The Northeast and South each registered a one-point gain to 42 and 64, respectively, while the West rose four points to 73. The Midwest was unchanged at 55.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was above the consensus forecast of 60, and is another solid reading.

Hotels: "Demand Growth Slows, Supply Growth Increases"

by Calculated Risk on 9/19/2016 08:50:00 AM

First here is the weekly data from HotelNewsNow.com: STR: US hotel results for week ending 10 September

he U.S. hotel industry recorded mixed results in the three key performance metrics during the week of 4-10 September 2016, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In year-over-year comparisons, the industry’s occupancy fell 1.4% to 62.8%. However, average daily rate increased 1.8% to US$118.58, and revenue per available room was nearly flat (+0.3% to US$74.45).

emphasis added

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.2015 was the best year on record for hotels.

So far 2016 is tracking just behind 2015, and well ahead of the median rate.

Also 2016 is tracking ahead of 2000 (the previous 2nd best year).

The Summer travel period has ended, and the occupancy rate has declined seasonally. The occupancy rate will now increase as business travel picks up in the Fall.

The second graph is from a Smith Travel Research data presentation. This shows that demand is slowing and supply is increasing. This suggests the occupancy rate will decline in 2017.

The second graph is from a Smith Travel Research data presentation. This shows that demand is slowing and supply is increasing. This suggests the occupancy rate will decline in 2017. This graph is from a data presentation by STR. These presentations are available here with a free registration (including local data depending on presentation).

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Sunday, September 18, 2016

Sunday Night Futures

by Calculated Risk on 9/18/2016 08:06:00 PM

From James Hamilton at Econbrowser: Why didn’t the recent oil price decline help the U.S. economy more? A few excerpts:

Baumeister and Kilian update those calculations and conclude that there was a significant boost to consumer spending, noting that real consumption spending grew on average by 3.1% over the two years since oil prices began falling in 2014:Q3 compared with only 2.0% during the preceding two years. ... But gains to consumer spending were mostly offset by a drop in oil-related investment spending.Weekend:

...

Their paper examined a number of details of the economic response. The bottom line is that there seemed to be little net stimulus to the U.S. economy from the collapse in oil prices.

• Schedule for Week of Sept 18, 2016

Monday:

• At 10:00 AM ET, The September NAHB homebuilder survey. The consensus is for a reading of 60, unchanged from 60 in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures are up 6 and DOW futures are up 55 (fair value).

Oil prices were down over the last week with WTI futures at $43.67 per barrel and Brent at $46.29 per barrel. A year ago, WTI was at $45, and Brent was at $47 - so prices are down slightly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.21 per gallon (down about $0.10 per gallon from a year ago).

Preview: Existing Home Sales

by Calculated Risk on 9/18/2016 12:29:00 PM

Last month I suggested taking the "under" on the consensus for existing home sales based on housing economist Tom Lawler's analysis. This month the consensus is probably a little low.

The NAR will report August Existing Home Sales on Thursday, September at 10:00 AM.

The consensus, according to Bloomberg, is that the NAR will report sales of 5.44 million. Housing economist Tom Lawler estimates the NAR will report sales of 5.49 million on a seasonally adjusted annual rate (SAAR) basis, up from 5.39 million SAAR in July.

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for over 6 years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initial reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

NOTE: There have been times when Lawler "missed", but then he pointed out an apparent error in the NAR data - and the subsequent revision corrected that error. As an example, see: The “Curious Case” of Existing Home Sales in the South in April

Over the last six years, the consensus average miss was 150 thousand, and Lawler's average miss was 70 thousand.

Many analysts now change their "forecast" after Lawler's estimate is posted, so the consensus has improved a little recently!

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | 5.49 |

| Jul-15 | 5.41 | 5.64 | 5.59 |

| Aug-15 | 5.50 | 5.54 | 5.31 |

| Sep-15 | 5.35 | 5.56 | 5.55 |

| Oct-15 | 5.41 | 5.33 | 5.36 |

| Nov-15 | 5.32 | 4.97 | 4.76 |

| Dec-15 | 5.19 | 5.36 | 5.46 |

| Jan-16 | 5.32 | 5.36 | 5.47 |

| Feb-16 | 5.30 | 5.20 | 5.08 |

| Mar-16 | 5.27 | 5.27 | 5.33 |

| Apr-16 | 5.40 | 5.44 | 5.45 |

| May-16 | 5.64 | 5.55 | 5.53 |

| Jun-16 | 5.48 | 5.62 | 5.57 |

| Jul-16 | 5.52 | 5.41 | 5.39 |

| Aug-16 | 5.44 | 5.49 | --- |

| 1NAR initially reported before revisions. | |||

Saturday, September 17, 2016

Schedule for Week of Sept 18, 2016

by Calculated Risk on 9/17/2016 08:11:00 AM

The key economic reports this week are August housing starts and Existing Home Sales.

The FOMC meets on Tuesday and Wednesday, and no change to policy is expected.

10:00 AM: The September NAHB homebuilder survey. The consensus is for a reading of 60, unchanged from 60 in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM: Housing Starts for August.

8:30 AM: Housing Starts for August. Total housing starts increased to 1.211 million (SAAR) in July. Single family starts increased to 770 thousand SAAR in July.

The consensus for 1.190 million, down from the July rate.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for August 2016

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for August (a leading indicator for commercial real estate).

2:00 PM: FOMC Meeting Announcement. No change to the Fed Funds rate is expected at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Janet Yellen holds a press briefing following the FOMC announcement.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 261 thousand initial claims, up from 260 thousand the previous week.

8:30 AM ET: Chicago Fed National Activity Index for August. This is a composite index of other data.

9:00 AM: FHFA House Price Index for July 2016. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% month-to-month increase for this index.

10:00 AM: Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for 5.44 million SAAR, up from 5.39 million in July.

10:00 AM: Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for 5.44 million SAAR, up from 5.39 million in July.Housing economist Tom Lawler expects the NAR to report sales of 5.49 million SAAR in August, up 1.9% from July’s preliminary pace.

No major releases scheduled.

Friday, September 16, 2016

Lawler: Early Read on Existing Home Sales in August

by Calculated Risk on 9/16/2016 04:43:00 PM

From housing economist Tom Lawler:

Based on publicly-available state and local realtor/MLS reports from across the country released through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.49 million in August, up 1.9% from July’s preliminary pace and up 3.8% from last August’s seasonally adjusted pace. Unadjusted sales last month should register a significantly larger YOY increase than seasonally adjusted sales, as there were two more business days this August compared to last August.

Local realtor/MLS data also suggest that existing home listings in aggregate declined slightly last month, and I project that the inventory of existing homes for sale as estimated by the NAR for the end of August will be 2.11 million, down 0.9% from July’s preliminary estimate and down 7.0% from last August.. Finally, local realtor/MLS data suggest that the NAR’s estimate of the median existing single-family home sales price for August will be up about 6.3% from last August.

CR Note: The NAR is scheduled to release August existing home sales on Thursday, September 22nd. The consensus is for 5.39 million SAAR in August. Take the over!

Mortgage Equity Withdrawal Slightly Positive in Q2

by Calculated Risk on 9/16/2016 02:00:00 PM

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data (released today) and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW", but there is still little (but increasing) MEW right now - and normal principal payments and debt cancellation (modifications, short sales, and foreclosures).

For Q2 2016, the Net Equity Extraction was a positive $7 billion, or a positive 0.2% of Disposable Personal Income (DPI) . With revisions, this is the first positive MEW since Q1 2008 - and MEW will probably be positive in Q3 this year too (there is a seasonal pattern for MEW).

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

Note: This data is impacted by debt cancellation and foreclosures, but much less than a few years ago.

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding increased by $56 billion in Q2.

The Flow of Funds report also showed that Mortgage debt has declined by almost $1.3 trillion since the peak. This decline is mostly because of debt cancellation per foreclosures and short sales, and some from modifications. There has also been some reduction in mortgage debt as homeowners paid down their mortgages so they could refinance.

With a slower rate of debt cancellation, MEW will likely stay positive.

For reference:

Dr. James Kennedy also has a simple method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.