by Calculated Risk on 9/06/2016 01:03:00 PM

Tuesday, September 06, 2016

My interview with Barry Ritholtz

When I was in New York last week, I had the opportunity to sit down with Barry Ritholtz for almost two hours. It was a great discussion (Barry was too kind).

From Ritholtz at Bloomberg: Bill McBride and the Case for Facts

This week on Masters in Business podcast I chat with Bill McBride of Calculated Risk, widely regarded as one of the best economics blogs.

McBride was famously right -- in public, in print and in real time -- about the impending housing collapse in 2006, the financial meltdown in 2008, the economic rebound in 2009 and the housing recovery in 2010. In our discussion, we talked about how the Calculated Risk blog developed, why it is data- and fact-driven, and why he so rarely offers his own opinions on anything economic. ...

You can hear the full interview, including the podcast extras, by streaming [at Bloomberg]; you can also download the podcast at iTunes, Soundcloud or Bloomberg.

ISM Non-Manufacturing Index decreased to 51.4% in August

by Calculated Risk on 9/06/2016 10:03:00 AM

The August ISM Non-manufacturing index was at 51.4%, down from 55.5% in July. The employment index decreased in August to 50.7%, down from 51.4% in July. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management:August 2016 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in August for the 79th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 51.4 percent in August, 4.1 percentage points lower than the July reading of 55.5 percent. This represents continued growth in the non-manufacturing sector at a slower rate. The Non-Manufacturing Business Activity Index decreased substantially to 51.8 percent, 7.5 percentage points lower than the July reading of 59.3 percent, reflecting growth for the 85th consecutive month, at a notably slower rate in August. The New Orders Index registered 51.4 percent, 8.9 percentage points lower than the reading of 60.3 percent in July. The Employment Index decreased 0.7 percentage point in August to 50.7 percent from the July reading of 51.4 percent. The Prices Index decreased 0.1 percentage point from the July reading of 51.9 percent to 51.8 percent, indicating prices increased in August for the fifth consecutive month. According to the NMI®, 11 non-manufacturing industries reported growth in August. The majority of the respondents’ comments indicate that there has been a slowing in the level of business for their respective companies."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 55.5, and suggests slower expansion in August than in July.

CoreLogic: House Prices up 6.0% Year-over-year in July

by Calculated Risk on 9/06/2016 09:12:00 AM

Notes: This CoreLogic House Price Index report is for July. The recent Case-Shiller index release was for June. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic US Home Price Report Shows Prices Up 6 Percent Year Over Year in July 2016

Home prices nationwide, including distressed sales, increased year over year by 6 percent in July 2016 compared with July 2015 and increased month over month by 1.1 percent in July 2016 compared with June 2016, according to the CoreLogic HPI.

...

“If mortgage rates continue to remain relatively low and job growth continues, as most forecasters expect, then home purchases are likely to rise in the coming year,” said Dr. Frank Nothaft, chief economist for CoreLogic. “The increased sales will support further price appreciation, and according to the CoreLogic Home Price Index, home prices are projected to rise about 5 percent over the next year.”

“The strongest home price gains continue to be in the western region,” said Anand Nallathambi, president and CEO of CoreLogic. “As evidence, the Denver, Portland and Seattle metropolitan areas all recorded double-digit appreciation over the past year.”

emphasis added

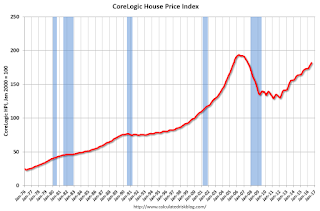

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 1.1% in July (NSA), and is up 6.0% over the last year.

This index is not seasonally adjusted, and this was another solid month-to-month increase.

The index is still 6.1% below the bubble peak in nominal terms (not inflation adjusted).

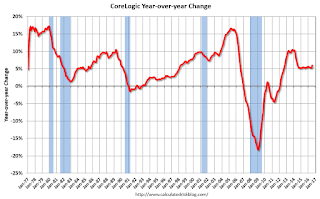

The second graph shows the YoY change in nominal terms (not adjusted for inflation).

The second graph shows the YoY change in nominal terms (not adjusted for inflation).The YoY increase had been moving sideways over the last two years.

The year-over-year comparison has been positive for fifty four consecutive months.

Black Knight July Mortgage Monitor: "Purchase Lending Highest Since 2007"

by Calculated Risk on 9/06/2016 08:01:00 AM

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for July today. According to BKFS, 4.51% of mortgages were delinquent in July, down from 4.67% in July 2015. BKFS also reported that 1.09% of mortgages were in the foreclosure process, down from 1.52% a year ago.

This gives a total of 5.60% delinquent or in foreclosure.

Press Release: Black Knight’s Mortgage Monitor: Q2 Originations Hit Three-Year High; Purchase Lending Highest Since 2007, Refinance Volume Still Lags 2015

Today, the Data & Analytics division of Black Knight Financial Services, Inc. (NYSE: BKFS) released its latest Mortgage Monitor Report, based on data as of the end of July 2016. This month, Black Knight looked at first-lien mortgage originations through Q2 2016. As Black Knight Data & Analytics Executive Vice President Ben Graboske explained, the data showed significant growth in origination volume; however, refinance volume was not as strong as the current low interest rate environment might suggest.

“Mortgage originations posted their strongest quarter in three years in Q2 2016,” said Graboske. “In total, we saw $518 billion in first-lien mortgage originations in Q2, driven by a combination of continued purchase origination growth and refinance activity spurred by low interest rates. Interestingly however, with interest rates 15 basis points lower than in Q1, and even lower than in early 2015, refinance activity wasn’t nearly as strong as one might have expected. While purchase originations jumped more than 50 percent from Q1, refinances saw only an eight percent increase over that period, and were actually down from the same time last year, despite the number of potential refinance candidates outpacing 2015 by over one million in every month since March. That said, refinance lending has risen for three consecutive quarters and accounted for $221 billion in originations in Q2.

“It was a particularly strong month for purchase originations, which made up 57 percent of all first-lien lending in the quarter,” Graboske continued. “At $297 billion, Q2 purchase originations marked the highest level – in terms of both volume and dollar amount – seen since 2007. Although the purchase lending credit box remains tight, there is increasing participation among ‘moderate’ credit borrowers as well. Two-thirds of Q2 purchase loans went to borrowers with credit scores of 740 or higher – on par with what we saw during the same period last year – but there was a 13 percent year-over-year increase in lending to borrowers with credit scores between 700 and 739. This segment has seen the highest rate of growth over the last three quarters, and now makes up 19 percent of all purchase originations. On the other end of the spectrum, sub-700 score borrowers now account for only 15 percent of originations, with less than five percent going to borrowers with scores of 660 or below. Both of these mark the lowest share of low credit purchase lending seen dating back to at least 2000.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from Black Knight shows first lien mortgage originations.

From Black Knight:

• At $518 billion, first lien mortgage originations marked the highest volume seen in a single quarter since Q2 2013, driven by a combination of continued purchase origination growth and refinance activity spurred by low interest rates

• It was a particularly strong month for purchase originations, which made up 57 percent of all first lien lending in the quarter

• At $297 billion, purchase loan originations saw a 52 percent ($102 billion) seasonal increase from Q1 and hit their highest level in terms of both volume and dollar amount since 2007

• We are seeing a deceleration in purchase market growth on an annual basis at approximately six percent growth over Q2 last year, but down from over 20 percent growth for most of 2015

• Refinance originations rose by 8 percent from Q1, but fell slightly below last year’s levels

The second graph shows the number and percent of distressed sales. From Black Knight:

The second graph shows the number and percent of distressed sales. From Black Knight:

• Distressed sales accounted for seven percent of all residential real estate transactions in Q2 2016, the lowest such share since Q2 2007, but still more than twice what would be seen in a ‘normal’ marketDistressed sales are getting closer to normal. There is much more in the mortgage monitor.

• At the peak (Q2 2011), there were over 350,000 distressed sales in a single quarter, and distressed sales had accounted for nearly 40 percent of all transactions in Q1 2011; there are now less than 100,000 distressed sales per quarter

• The makeup of the distressed market has been roughly 2/3 REO to 1/3 short sales for roughly two years; at the bottom of the market in 2012, short sales accounted for more than half of all distressed transactions

• Nearly one out of every five distressed sales nationwide still occurs in Florida, but that share is waning as the state’s severely delinquent and active foreclosure inventories continue to improve

• The backlog and slower reduction of troubled inventories in New York and New Jersey has led to more sustained levels of distressed activity in those states

Monday, September 05, 2016

Tuesday: ISM non-Mfg Index

by Calculated Risk on 9/05/2016 07:59:00 PM

Tuesday:

• At 10:00 AM ET, the ISM non-Manufacturing Index for August. The consensus is for the index to decrease to 55.0 from 55.5 in July.

• Also at 10:00 AM, The Fed will release the monthly Labor Market Conditions Index (LMCI).

Weekend:

• Schedule for Week of Sept 4, 2016

• Update: Prime Working-Age Population Growing Again

From CNBC: Pre-Market Data and Bloomberg futures: S&P and DOW futures are down slightly (fair value).

Oil prices were down over the last week with WTI futures at $45.05 per barrel and Brent at $47.63 per barrel. A year ago, WTI was at $46, and Brent was at $49 - so prices are down slightly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.20 per gallon (down over $0.20 per gallon from a year ago).

August Employment Revisions

by Calculated Risk on 9/05/2016 11:24:00 AM

Two years ago, in 2014, the BLS initially reported job gains in August at 142,000. Douglas Holtz-Eakin wrote "Disaster!". I couldn't help myself and made fun of Holtz-Eakin.

Not only wasn't the initial August 2014 report a "disaster", but it has since been revised up to 218,000. And 2014 was the best year for employment gains since the '90s. Some "disaster"!

Here is a table of revisions for August since 2005. Note that most of the revisions have been up. This doesn't mean that the August 2016 revision will be up, but it does seem likely. I'm not sure why the BLS has underestimated job growth in August (possibly because of the timing of seasonal teacher hiring and the end of the summer jobs).

Overall I think the August 2016 employment report was decent and indicates further improvement in the labor market.

| August Employment Report (000s) | |||

|---|---|---|---|

| Year | Initial | Revised | Revision |

| 2005 | 169 | 194 | +25 |

| 2006 | 128 | 181 | 53 |

| 2007 | -4 | -24 | -20 |

| 2008 | -84 | -266 | -182 |

| 2009 | -216 | -212 | 4 |

| 2010 | -54 | -34 | 20 |

| 2011 | 0 | 107 | 107 |

| 2012 | 96 | 190 | 94 |

| 2013 | 169 | 269 | 100 |

| 2014 | 142 | 218 | 76 |

| 2015 | 173 | 150 | -23 |

| 2016 | 151 | --- | --- |

Note: In 2008, the BLS significantly under reported job losses. That wasn't surprising since the initial models the BLS used missed turning points (something I wrote about in 2007). The BLS has since improved this model.

Sunday, September 04, 2016

Sunday Night: Happy Labor Day!

by Calculated Risk on 9/04/2016 07:48:00 PM

Some good news for those sitting in a traffic jam on Labor Day, from the EIA: Gasoline prices prior to Labor Day lowest in 12 years

The U.S. average retail price for regular gasoline was $2.24/gallon (gal) on August 29, the lowest price on the Monday before Labor Day since 2004, and 27¢/gal lower than the same time last year. Lower crude oil prices are the main factor behind falling U.S. gasoline prices. Lower crude oil prices reflect continued high global crude oil and petroleum product inventories and increased drilling activity in the United States.Weekend:

...

As fall approaches and U.S. driving decreases, lower gasoline demand, shifts to less costly winter fuel specifications, and reduced crude oil purchases by refineries undergoing seasonal maintenance have the potential to put downward pressure on crude oil and gasoline prices. In the August Short-Term Energy Outlook, EIA forecasts U.S. regular gasoline prices will decline to an average of $1.95/gal during the fourth quarter of 2016 and will average $2.06/gal for 2016.

• Schedule for Week of Sept 4, 2016

• Update: Prime Working-Age Population Growing Again

Oil prices were down over the last week with WTI futures at $44.13 per barrel and Brent at $46.63 per barrel. A year ago, WTI was at $46, and Brent was at $49 - so prices are down slightly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.20 per gallon (down over $0.20 per gallon from a year ago).

Update: Prime Working-Age Population Growing Again

by Calculated Risk on 9/04/2016 11:25:00 AM

The prime working age population peaked in 2007, and bottomed at the end of 2012. As of August 2016, there are still fewer people in the 25 to 54 age group than in 2007!

However the prime working age (25 to 54) will probably hit a new peak in a couple of months.

An update: in 2014, I posted some demographic data for the U.S., see: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group, Decline in the Labor Force Participation Rate: Mostly Demographics and Long Term Trends, and The Future's so Bright ...

I pointed out that "even without the financial crisis we would have expected some slowdown in growth this decade (just based on demographics). The good news is that will change soon."

Changes in demographics are an important determinant of economic growth, and although most people focus on the aging of the "baby boomer" generation, the movement of younger cohorts into the prime working age is another key story. Here is a graph of the prime working age population (this is population, not the labor force) from 1948 through August 2016.

There was a huge surge in the prime working age population in the '70s, '80s and '90s - and the prime age population has been mostly flat recently (even declined a little).

The prime working age labor force grew even quicker than the population in the '70s and '80s due to the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s!

So when we compare economic growth to the '70s, '80, or 90's we have to remember this difference in demographics (the '60s saw solid economic growth as near-prime age groups increased sharply).

See: Demographics and GDP: 2% is the new 4%

The good news is the prime working age group has started to grow again, and is now growing at 0.5% per year - and this should boost economic activity. And it appears the prime working age group will exceed the previous peak later this year.

Note: If we expand the prime working age to 25 to 64, the story is a little different. The 55 to 64 age group is still expanding, but that will change in a few years - and that will slow growth in the 25 to 64 total age group.

Demographics are now improving in the U.S.!

Saturday, September 03, 2016

Schedule for Week of Sept 4, 2016

by Calculated Risk on 9/03/2016 08:12:00 AM

This will be light week for economic data.

The preliminary annual benchmark revision for the employment report will be released on Wednesday.

All US markets will be closed in observance of the Labor Day holiday.

10:00 AM: the ISM non-Manufacturing Index for August. The consensus is for the index to decrease to 55.0 from 55.5 in July.

10:00 AM ET: The Fed will release the monthly Labor Market Conditions Index (LMCI).

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

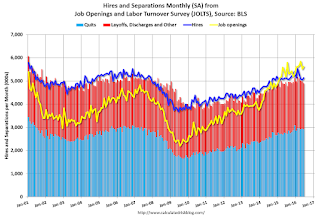

10:00 AM: Job Openings and Labor Turnover Survey for July from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for July from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in June to 5.624 million from 5.514 million in May.

The number of job openings (yellow) were up 9% year-over-year, and Quits were up 6% year-over-year.

10:00 AM: 2016 Current Employment Statistics (CES) Preliminary Benchmark Revision. From the BLS:

"Each year, the Current Employment Statistics (CES) survey estimates are benchmarked to comprehensive counts of employment from the Quarterly Census of Employment and Wages (QCEW) for the month of March. These counts are derived from state unemployment insurance (UI) tax records that nearly all employers are required to file. On September 7, 2016 at 10:00 a.m. (EST) the Bureau of Labor Statistics (BLS) will release the preliminary estimate of the annual benchmark revision to the establishment survey employment series. ... The final benchmark revision will be issued with the publication of the January 2017 Employment Situation news release in February."2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 264 thousand initial claims, up from 263 thousand the previous week.

10:00 AM: The Q2 Quarterly Services Report from the Census Bureau.

3:00 PM: Consumer Credit for July from the Federal Reserve. The consensus is for credit to increase $15.6 billion.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for July. The consensus is for no change in inventories.

Friday, September 02, 2016

Hotels: Occupancy Rate on Track to be 2nd Best Year

by Calculated Risk on 9/02/2016 08:19:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 27 August

The U.S. hotel industry recorded positive results in the three key performance metrics during the week of 21-27 August 2016, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In year-over-year comparisons, the industry’s occupancy grew 4.3% to 67.5%. Average daily rate increased 4.2% to US$121.22. Revenue per available room rose 8.7% to US$81.85.

emphasis added

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.2015 was the best year on record for hotels.

So far 2016 is tracking just behind 2015, and well ahead of the median rate.

Also 2016 is tracking just ahead of 2000 (the previous 2nd best year).

The Summer travel period is ending, and the occupancy rate will decline seasonally over the next month.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com