by Calculated Risk on 8/04/2016 03:25:00 PM

Thursday, August 04, 2016

NAHB: Builder Confidence "Remains in Positive Territory" for 55+ Housing Market in Q2

This is a quarterly index that was released yesterday by the the National Association of Home Builders (NAHB). This index is similar to the overall housing market index (HMI). The NAHB started this index in Q4 2008 (during the housing bust), so the readings were initially very low

From the NAHB: Second Quarter Results Show 55+ Housing Market Remains in Positive Territory

Builder confidence in the single-family 55+ housing market remains in positive territory in the second quarter with a reading of 57, up one point from the previous quarter, according to the National Association of Home Builders' (NAHB) 55+ Housing Market Index (HMI) released today. This is the ninth consecutive quarter with a reading above 50.

“Builders and developers for the 55+ housing sector continue to report steady demand,” said Jim Chapman, chairman of NAHB's 55+ Housing Industry Council and president of Jim Chapman Homes LLC in Atlanta. “However, there are many places around the country facing labor and lot shortages, which are hindering production.”

...

“Much like the overall housing market, this quarter’s 55+ HMI results show that this segment continues its gradual, steady recovery,” said NAHB Chief Economist Robert Dietz. “A solid labor market, combined with historically low mortgage rates, are enabling 55+ consumers to be able to sell their homes at a favorable price and buy or rent a home in a 55+ community.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB 55+ Single Family HMI through Q2 2016. Any reading above 50 indicates that more builders view conditions as good than as poor. The index increased to 57 in Q2 up from 56 in Q1.

There are two key drivers in addition to the improved economy: 1) there is a large cohort that has moved into the 55 to 70 age group, and 2) the homeownership rate typically increases for people in the 55 to 70 year old age group. So demographics should be favorable right now for the 55+ market.

Fannie and Freddie: REO inventory declined in Q2, Down 33% Year-over-year

by Calculated Risk on 8/04/2016 12:57:00 PM

Fannie and Freddie reported results this week. Here is some information on Real Estate Owned (REOs).

Freddie Mac reported the number of REO declined to 13,284 at the end of Q2 2106 compared to 19,484 at the end of Q2 2015.

For Freddie, this is down 82% from the 74,897 peak number of REOs in Q3 2010. For Freddie, this is the lowest since 2007.

Fannie Mae reported the number of REO declined to 45,981 at the end of Q2 2016 compared to 68,717 at the end of Q2 2015.

For Fannie, this is down 72% from the 166,787 peak number of REOs in Q3 2010. For Fannie, this is the lowest since Q1 2008.

Here is a graph of Fannie and Freddie Real Estate Owned (REO).

REO inventory decreased in Q2 for both Fannie and Freddie, and combined inventory is down 33% year-over-year.

Delinquencies are falling, but there are still a number of properties in the foreclosure process with long time lines in judicial foreclosure states - but this is getting close to normal levels of REOs.

Goldman's July NFP Preview

by Calculated Risk on 8/04/2016 10:34:00 AM

A few excerpts from Goldman Sachs' July Payroll Preview by economist David Mericle:

We expect a 190k increase in nonfarm payroll employment in July, slightly above consensus expectations for a 180k gain. ...

The unemployment rate is likely to remain at 4.9%, though we see the risks as tilted to the downside. Average hourly earnings likely rose 0.3% in July and 2.6% over the past year.

...

Our wage tracker—which aggregates four measures of wage growth—has accelerated to 2.8% year-on-year in our preliminary Q2 estimate, a sign that diminishing slack is boosting wage growth.

Weekly Initial Unemployment Claims increased to 269,000

by Calculated Risk on 8/04/2016 08:33:00 AM

The DOL reported:

In the week ending July 30, the advance figure for seasonally adjusted initial claims was 269,000, an increase of 3,000 from the previous week's unrevised level of 266,000. The 4-week moving average was 260,250, an increase of 3,750 from the previous week's unrevised average of 256,500.The previous week was unrevised.

There were no special factors impacting this week's initial claims. This marks 74 consecutive weeks of initial claims below 300,000, the longest streak since 1973.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 260,250.

This was above the consensus forecast of 265,000. The low level of claims suggests relatively few layoffs.

Wednesday, August 03, 2016

Preview of July Employment Report

by Calculated Risk on 8/03/2016 06:35:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for July. The consensus, according to Bloomberg, is for an increase of 185,000 non-farm payroll jobs in July (with a range of estimates between 150,000 to 215,000, and for the unemployment rate to decrease to 4.8%.

The BLS reported 287,000 jobs added in June.

Here is a summary of recent data:

• The ADP employment report showed an increase of 179,000 private sector payroll jobs in July. This was above expectations of 165,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth somewhat above expectations.

• The ISM manufacturing employment index decreased in June to 49.4%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs decreased about 22,000 in July. The ADP report indicated 4,000 manufacturing jobs added in July.

The ISM non-manufacturing employment index decreased in July to 52.7%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll jobs increased about 110,000 in June.

Combined, the ISM indexes suggests employment gains of about 88,000. This suggests employment growth well below expectations.

• Initial weekly unemployment claims averaged 256,000 in July, down from 267,000 in June. For the BLS reference week (includes the 12th of the month), initial claims were at 252,000, down from 258,000 during the reference week in June.

The decrease during the reference suggests fewer layoffs in July as compared to June. This suggests a positive employment report.

• The final July University of Michigan consumer sentiment index decreased to 90.0 from the June reading of 93.5. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and possibly politics.

• Conclusion: Unfortunately none of the indicators alone is very good at predicting the initial BLS employment report. The ADP report and unemployment claims suggest stronger job growth. The ISM reports suggests weaker job growth in July.

My guess is the July report will be close to the consensus forecast.

Off-Topic: Update on Litmus Test Moments

by Calculated Risk on 8/03/2016 03:53:00 PM

Back in May I outlined a few "litmus test" moments in life - moments that define us - and I concluded that we are seeing a political litmus test moment right now (see: Off-Topic: A Comment on Litmus Test Moments)

Since then Mr. Trump has made many more disqualifying statements (too numerous to list).

For example, I wrote that post before Mr. Trump criticized U.S. District Judge Gonzalo Curiel calling him a "Mexican" (although he is an American citizen born in Indiana), and suggesting Curiel was biased because Trump was going to build a wall between the U.S. and Mexico. Trump went on to repeat the same accusations several times, even as many Americans criticized his comments. As Rep Paul Ryan noted, claiming that a person's heritage makes them biased, is "the textbook definition of a racist comment."

I've spoken to several lawyers in San Diego, and Judge Curiel is considered one the best. He was first appointed as a Judge by Republican Governor Arnold Schwarzenegger who wrote after Trump's attack: "Judge Curiel is an American hero who stood up to the Mexican cartels. I was proud to appoint him when I was Gov."

Mr Trump never apologized or backed down.

And the most recent attack on the Khan family is even worse. The VFW statement says what all Americans feel:

Presidential candidate Donald J. Trump has a history of lashing out after being attacked, but to ridicule a Gold Star Mother is out-of-bounds, said the new national commander of the near 1.7 million-member Veterans of Foreign Wars of the United States and its Auxiliary.Once again Trump is unwilling to apologize.

“Election year or not, the VFW will not tolerate anyone berating a Gold Star family member for exercising his or her right of speech or expression,” said Brian Duffy, of Louisville, Ky., who was elected July 27 to lead the nation’s oldest and largest major war veterans organization.

“There are certain sacrosanct subjects that no amount of wordsmithing can repair once crossed,” he said. “Giving one’s life to nation is the greatest sacrifice, followed closely by all Gold Star families, who have a right to make their voices heard.”

My advice for politicians and American citizens who supported Trump: If you haven't abandoned Trump yet, do it now. If your family, friends and co-workers know you supported Trump - tell them you've had enough. They will respect you for changing your mind (if not now, in the near future). If you have a Trump sign in your yard, take it down. If you have a Trump bumper sticker on your car, take it off.

I'm voting for Hillary Clinton, but if you can't stomach voting for her - still vote! - but vote for a 3rd party candidate or write-in another candidate. If you can't stand Hillary (I think she will be fine), maybe you can console yourself that she won without 50% of the vote.

But it is important for our future that Trump loses and loses badly. This vote will be a message to the future that people like Trump are not acceptable. And I guarantee you that you will feel better about yourself in a few years when you can honestly say you didn't vote for Trump.

Q2 2016 GDP Details on Residential and Commercial Real Estate

by Calculated Risk on 8/03/2016 12:45:00 PM

The BEA has released the underlying details for the Q2 advance GDP report this morning.

The BEA reported that investment in non-residential structures decreased at a 7.9% annual pace in Q1. However most of the decline was due to less investment in petroleum exploration. Investment in petroleum and natural gas exploration declined from a $62.4 billion annual rate in Q1 to a $50.2 billion annual rate in Q2 - and is down from $106 billion in Q2 2015 (declined more than 50%).

Excluding petroleum, non-residential investment in structures increased at a 5.5% annual rate in Q2.

The first graph shows investment in offices, malls and lodging as a percent of GDP. Office, mall and lodging investment has increased a little recently, but from a very low level.

Investment in offices increased in Q2, and is up 22% year-over-year -increasing from a very low level - and is now above the lows for previous recessions (as percent of GDP).

Investment in multimerchandise shopping structures (malls) peaked in 2007 and was down slightly year-over-year. The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment increased further in Q2, and with the hotel occupancy rate near record levels, it is likely that hotel investment will increase further in the near future. Lodging investment is up 19% year-over-year.

Home improvement was the top category for five consecutive years following the housing bust ... but now investment in single family structures has been back on top for three years and will probably stay there for a long time.

However - even though investment in single family structures has increased from the bottom - single family investment is still very low, and still below the bottom for previous recessions as a percent of GDP. I expect further increases over the next few years.

Investment in single family structures was $242 billion (SAAR) (about 1.3% of GDP), and was down in Q2 compared to Q1, but is up 7.3% year-over-year.

Investment in home improvement was at a $220 billion Seasonally Adjusted Annual Rate (SAAR) in Q2 (about 1.1% of GDP), and is up 9.0% year-over-year.

ISM Non-Manufacturing Index decreased to 55.5% in July

by Calculated Risk on 8/03/2016 10:05:00 AM

The July ISM Non-manufacturing index was at 55.5%, down from 56.5% in June. The employment index decreased in June to 51.4%, down from 52.7% in June. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management:July 2016 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in July for the 78th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 55.5 percent in July, 1 percentage point lower than the June reading of 56.5 percent. This represents continued growth in the non-manufacturing sector at a slower rate. The Non-Manufacturing Business Activity Index decreased to 59.3 percent, 0.2 percentage point lower than the June reading of 59.5 percent, reflecting growth for the 84th consecutive month, at a slightly slower rate in July. The New Orders Index registered 60.3 percent, 0.4 percentage point higher than the reading of 59.9 percent in June. The Employment Index decreased 1.3 percentage points in July to 51.4 percent from the June reading of 52.7 percent. The Prices Index decreased 3.6 percentage points from the June reading of 55.5 percent to 51.9 percent, indicating prices increased in July for the fourth consecutive month. According to the NMI®, 15 non-manufacturing industries reported growth in July. The majority of the respondents’ comments reflect stability and continued growth for their respective companies and a positive outlook on the economy."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was slightly below the consensus forecast of 56.0, and suggests slower expansion in July than in June.

ADP: Private Employment increased 179,000 in July

by Calculated Risk on 8/03/2016 08:20:00 AM

Private sector employment increased by 179,000 jobs from June to July according to the July ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was above the consensus forecast for 165,000 private sector jobs added in the ADP report.

...

Goods-producing employment was down by 6,000 jobs in July, following June losses of 28,000. The construction industry lost 6,000 jobs, following June losses of 4,000 jobs. Meanwhile, manufacturing gained 4,000 jobs after losing 15,000 the previous month.

Service-providing employment rose by 185,000 jobs in July, fewer than June’s 203,000 jobs. The ADP National Employment Report indicates that professional/business services contributed 59,000 jobs, down from June’s 78,000. Trade/transportation/utilities increased by 27,000 jobs in July, down from 41,000 jobs added the previous month. Financial activities added 11,000 jobs, following last month’s gain of 9,000 jobs.

...

Mark Zandi, chief economist of Moody’s Analytics, said, “Job growth remains strong, but is moderating as the economy approaches full employment. Businesses are having a more difficult time filling open job positions, which are near record highs. The nation’s biggest economic problem will soon be the lack of available workers.”

The BLS report for July will be released Friday, and the consensus is for 185,000 non-farm payroll jobs added in July.

MBA: "Mortgage Applications Decrease in Latest Weekly Survey"

by Calculated Risk on 8/03/2016 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 29, 2016.

... The Refinance Index decreased 4 percent from the previous week. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier to the lowest level since February 2016 while the seasonally adjusted Government Purchase Index fell to the lowest level since November 2015. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 6 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 3.67 percent from 3.69 percent, with points decreasing to 0.30 from 0.36 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

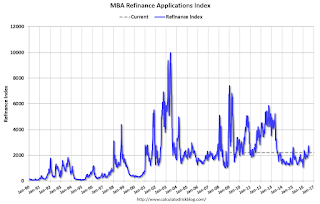

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity has increased this year since rates have declined.

However it would take another significant move down in mortgage rates to see a large increase in refinance activity.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The purchase index is "6 percent higher than the same week one year ago".