by Calculated Risk on 6/01/2016 04:03:00 PM

Wednesday, June 01, 2016

U.S. Light Vehicle Sales increase to 17.4 million annual rate in May

Based on a preliminary estimate from WardsAuto, light vehicle sales were at a 17.37 million SAAR in May (Preliminary estimate excluding Jaguar Land Rover and Volvo).

That is down about 1.5% from May 2015, and up slightly from the 17.32 million annual sales rate last month.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for May (red, light vehicle sales of 17.37 million SAAR from WardsAuto).

This was above the consensus forecast of 17.2 million SAAR (seasonally adjusted annual rate).

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Sales for 2016 - through the first five months - are up about 2% from the comparable period last year.

Fed's Beige Book: "Modest economic growth" in most Districts

by Calculated Risk on 6/01/2016 02:03:00 PM

Fed's Beige Book "Prepared at the Federal Reserve Bank of Minneapolis and based on information collected before May 23, 2016. "

Information received from the 12 Federal Reserve Districts mostly described modest economic growth since the last Beige Book report. Economic activity in April through mid-May increased at a moderate pace in the San Francisco District, while modest growth was reported by Philadelphia, Cleveland, Atlanta, Chicago, St. Louis, and Minneapolis. Chicago noted that the pace of growth slowed, as did Kansas City. Dallas reported that economic activity grew marginally, while New York characterized activity as generally flat since the last report. Several Districts noted that contacts had generally optimistic outlooks, with firms expecting growth either to continue at its current pace or to increase.And on real estate:

Construction and real estate activity generally expanded since the last report, and the overall outlook among contacts remained positive. Commercial construction activity increased in Philadelphia, Richmond, and Minneapolis. Strong project pipelines were reported in Cleveland, and some contractors in Atlanta noted one- to two-year backlogs. An uptick in industrial construction was cited in St. Louis, while activity was varied across markets in Boston. Residential construction increased in most Districts but was mixed in Richmond and Dallas, where some markets saw a decline in single-family construction. In Chicago, a slight increase in residential construction was concentrated in single-family and suburban markets. St. Louis contacts reported an uptick in residential construction, and many contacts expected a similar increase next quarter. Multifamily construction continued to grow in many Districts, including New York, St. Louis, and Dallas, but a slowing was noted in Atlanta. In San Francisco, construction of multifamily units continued to outpace single-family units. In Boston, apartment construction remained very active, but related lending slowed among smaller banks.Decent Real Estate growth in most districts ...

Commercial real estate activity increased in most Districts that reported. Absorption of space increased in Atlanta and Kansas City, while Dallas reported healthy demand for office space. A decline in vacancy rates and a rise in rents were noted in Chicago and Minneapolis. Contacts in San Francisco said demand for commercial real estate expanded further, particularly in urban areas with robust technology and health care industries. Residential real estate activity increased moderately across most Districts. Home sales were strong in Boston, Cleveland, Kansas City, and San Francisco. Residential sales were positive but somewhat lower in other Districts. Sales for entry-level and other lower-priced homes were particularly strong, according to Chicago and Dallas contacts. Lower inventories of homes were reported by contacts in New York, Cleveland, Atlanta, St. Louis, and Minneapolis and have led to bidding wars in the Richmond District and constrained home sales in Philadelphia. Home prices were reported higher overall; Cleveland contacts said that home prices rose 3 percent year over year. In Philadelphia, home prices were mixed across markets and price categories.

emphasis added

Construction Spending decreased 1.8% in April

by Calculated Risk on 6/01/2016 12:18:00 PM

Earlier today, the Census Bureau reported that overall construction spending decreased 1.8% in April compared to March:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during April 2016 was estimated at a seasonally adjusted annual rate of $1,133.9 billion, 1.8 percent below the revised March estimate of $1,155.1 billion. The April figure is 4.5 percent above the April 2015 estimate of $1,085.0 billion.Private and public spending decreased in April:

Spending on private construction was at a seasonally adjusted annual rate of $843.1 billion, 1.5 percent below the revised March estimate of $855.9 billion ...

In April, the estimated seasonally adjusted annual rate of public construction spending was $290.8 billion, 2.8 percent below the revised March estimate of $299.2 billion

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has been increasing, but is 35% below the bubble peak.

Non-residential spending is only 3% below the peak in January 2008 (nominal dollars).

Public construction spending is now 11% below the peak in March 2009.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 8%. Non-residential spending is up 3% year-over-year. Public spending is up 1% year-over-year.

Looking forward, all categories of construction spending should increase in 2016. Residential spending is still very low, non-residential is increasing (except oil and gas), and public spending is also increasing after several years of austerity.

This was well below the consensus forecast of a 0.6% increase for April, however construction spending for February and March were revised up.

ISM Manufacturing index increased to 51.3 in May

by Calculated Risk on 6/01/2016 10:04:00 AM

The ISM manufacturing index indicated expansion for the third consecutive month in May, following five months of contraction. The PMI was at 51.3% in May, up from 50.8% in April. The employment index was at 49.2%, unchanged from 49.2% in April, and the new orders index was at 55.7%, down from 55.8% in April.

From the Institute for Supply Management: May 2016 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in May for the third consecutive month, while the overall economy grew for the 84th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The May PMI® registered 51.3 percent, an increase of 0.5 percentage point from the April reading of 50.8 percent. The New Orders Index registered 55.7 percent, a decrease of 0.1 percentage point from the April reading of 55.8 percent. The Production Index registered 52.6 percent, 1.6 percentage points lower than the April reading of 54.2 percent. The Employment Index registered 49.2 percent, the same reading as in April. Inventories of raw materials registered 45 percent, a decrease of 0.5 percentage point from the April reading of 45.5 percent. The Prices Index registered 63.5 percent, an increase of 4.5 percentage points from the April reading of 59 percent, indicating higher raw materials prices for the third consecutive month. Manufacturing registered growth in May for the third consecutive month, as 14 of our 18 industries reported an increase in new orders in May (down from 15 in April), and 12 of our 18 industries reported an increase in production in May (down from 15 in April)."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 50.6%, and suggests manufacturing expanded at a slightly faster pace in May than in April.

MBA: "Mortgage Applications Decrease in Latest MBA Weekly Survey"

by Calculated Risk on 6/01/2016 08:05:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 4.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 27, 2016.

...

The Refinance Index decreased 4 percent from the previous week. The seasonally adjusted Purchase Index decreased 5 percent from one week earlier. ... The unadjusted Purchase Index decreased 6 percent compared with the previous week and was 28 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) remained unchanged at 3.85 percent, with points decreasing to 0.36 from 0.37 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity was higher in 2015 than in 2014, but it was still the third lowest year since 2000.

Refinance activity increased a little this year when rates declined.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 28% higher than a year ago.

Tuesday, May 31, 2016

Wednesday: ISM Mfg Survey, Construction Spending, Auto Sales, Beige Book

by Calculated Risk on 5/31/2016 07:24:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, ISM Manufacturing Index for May. The consensus is for the ISM to be at 50.6, down from 50.8 in April. The ISM manufacturing index indicated expansion at 50.8% in April. The employment index was at 49.2%, and the new orders index was at 55.8%.

• Also at 10:00 AM, Construction Spending for April. The consensus is for a 0.6% increase in construction spending.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

• All day, Light vehicle sales for May. The consensus is for light vehicle sales to decrease to 17.3 million SAAR in May from 17.4 million in April (Seasonally Adjusted Annual Rate).

Real Prices and Price-to-Rent Ratio in March

by Calculated Risk on 5/31/2016 01:56:00 PM

Here is the earlier post on Case-Shiller: Case-Shiller Graphs: National House Price Index increased 5.2% year-over-year in March

The year-over-year increase in prices is mostly moving sideways now around 5%. In March, the index was up 5.2% YoY.

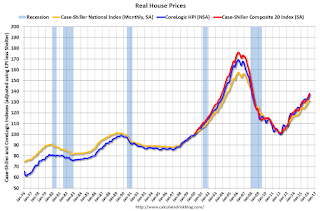

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $274,000 today adjusted for inflation (37%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

It has been almost ten years since the bubble peak. In the Case-Shiller release this morning, the National Index was reported as being 3.0% below the bubble peak. However, in real terms, the National index is still about 17% below the bubble peak.

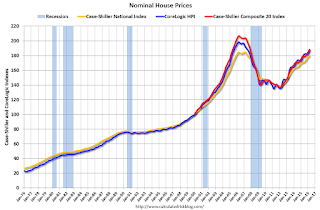

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is back to November 2005 levels, and the Case-Shiller Composite 20 Index (SA) is back to June 2005 levels, and the CoreLogic index (NSA) is back to August 2005.

Real House Prices

In real terms, the National index is back to February 2004 levels, the Composite 20 index is back to November 2003, and the CoreLogic index back to February 2004.

In real terms, house prices are back to early 2004 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to August 2003 levels, the Composite 20 index is back to June 2003 levels, and the CoreLogic index is back to October 2003.

In real terms, and as a price-to-rent ratio, prices are back to late 2003 and early 2004 levels - and the price-to-rent ratio maybe moving a little more sideways now.

Dallas Fed: Regional Manufacturing Activity declined in May

by Calculated Risk on 5/31/2016 12:03:00 PM

From the Dallas Fed: Texas Manufacturing Activity Declines

Texas factory activity declined in May after two months of increases, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, fell from 5.8 to -13.1, hitting its lowest reading in a year.The impact of lower oil prices is still being felt in the Dallas region.

Other measures of current manufacturing activity also reflected contraction this month. The new orders index fell more than 20 points to -14.9 after pushing into positive territory last month. The growth rate of orders index has been negative since late 2014 and fell to -14.7 in May after climbing to near zero in April. The capacity utilization and shipments indexes returned to negative territory after two months of positive readings, coming in at yearlong lows of -11.0 and -11.5, respectively.

Perceptions of broader business conditions were more pessimistic this month. The general business activity index declined from -13.9 to -20.8, and the company outlook index fell 10 points to -16.1.

Latest readings on employment and workweek length indicated a fifth consecutive month of contraction in May. The employment index moved down three points to -6.7. ...

emphasis added

This was the last of the regional Fed surveys for May.

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through May), and five Fed surveys are averaged (blue, through May) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through April (right axis).

It seems likely the ISM manufacturing index will show contraction in May, although the consensus is for a reading of 50.6 (slow expansion).

Case-Shiller Graphs: National House Price Index increased 5.2% year-over-year in March

by Calculated Risk on 5/31/2016 10:34:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for March ("March" is a 3 month average of January, February and March prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Prices Continue Steady Gains in March According to the S&P/Case-Shiller Home Price Indices

The S&P/Case-Shiller U.S. National Home Price Index, covering all nine U.S. census divisions, reported a 5.2% annual gain in March, down from 5.3% the previous month. The 10-City Composite and the 20-City Composites’ year-over-year gains remained unchanged at 4.7% and 5.4%, respectively, from the prior month.

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.7% in March. The 10-City Composite recorded a 0.8% month-over-month increase while the 20-City Composite posted a 0.9% increase in March. After seasonal adjustment, the National Index recorded a 0.1% month-over-month increase, the 10-City Composite posted a 0.8% increase, and the 20-City Composite reported a 0.9% month-over-month increase. After seasonal adjustment, six cities saw prices rise, one city was unchanged, and 13 cities experienced negative monthly price changes.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 10.6% from the peak, and up 0.8% in March (SA).

The Composite 20 index is off 8.9% from the peak, and up 0.9% (SA) in March.

The National index is off 3.0% from the peak, and up 0.1% (SA) in March. The National index is up 31.1% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.7% compared to March 2015.

The Composite 20 SA is up 5.4% year-over-year..

The National index SA is up 5.2% year-over-year.

Note: According to the data, prices increased in 19 of 20 cities month-over-month seasonally adjusted. (the press release says 6).

I'll have more later.

Case-Shiller: National House Price Index increased 5.2% year-over-year in March

by Calculated Risk on 5/31/2016 10:10:00 AM

Note: S&P is having difficulty this morning.

From the WSJ: U.S. Home Price Growth Remained Robust in March, Case-Shiller Says

The S&P/Case-Shiller Home Price Index, covering the entire nation rose 5.2% in the 12 months ended in March, slightly less than a 5.3% increase in February.I'll have more on house prices later.

The 10-city index gained 4.7% from a year earlier and the 20-city index gained 5.4% year-over-year.

...

Month-over-month prices the U.S. Index rose 0.7% in March before seasonal adjustment; the 20-city index rose 0.9% and the 10-city index rose 0.8% from February to March.

After seasonal adjustment, the national index rose 0.1% month-over-month, the 10-City index posted a 0.8% increase, and the 20-City index reported a 0.9% month-over-month increase.