by Calculated Risk on 5/31/2016 07:24:00 PM

Tuesday, May 31, 2016

Wednesday: ISM Mfg Survey, Construction Spending, Auto Sales, Beige Book

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, ISM Manufacturing Index for May. The consensus is for the ISM to be at 50.6, down from 50.8 in April. The ISM manufacturing index indicated expansion at 50.8% in April. The employment index was at 49.2%, and the new orders index was at 55.8%.

• Also at 10:00 AM, Construction Spending for April. The consensus is for a 0.6% increase in construction spending.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

• All day, Light vehicle sales for May. The consensus is for light vehicle sales to decrease to 17.3 million SAAR in May from 17.4 million in April (Seasonally Adjusted Annual Rate).

Real Prices and Price-to-Rent Ratio in March

by Calculated Risk on 5/31/2016 01:56:00 PM

Here is the earlier post on Case-Shiller: Case-Shiller Graphs: National House Price Index increased 5.2% year-over-year in March

The year-over-year increase in prices is mostly moving sideways now around 5%. In March, the index was up 5.2% YoY.

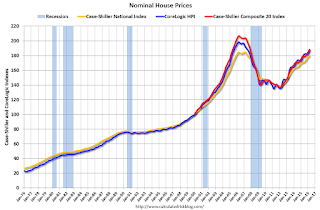

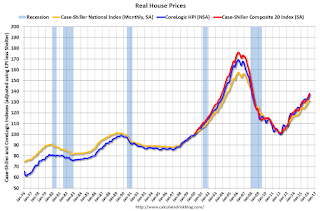

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $274,000 today adjusted for inflation (37%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

It has been almost ten years since the bubble peak. In the Case-Shiller release this morning, the National Index was reported as being 3.0% below the bubble peak. However, in real terms, the National index is still about 17% below the bubble peak.

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is back to November 2005 levels, and the Case-Shiller Composite 20 Index (SA) is back to June 2005 levels, and the CoreLogic index (NSA) is back to August 2005.

Real House Prices

In real terms, the National index is back to February 2004 levels, the Composite 20 index is back to November 2003, and the CoreLogic index back to February 2004.

In real terms, house prices are back to early 2004 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to August 2003 levels, the Composite 20 index is back to June 2003 levels, and the CoreLogic index is back to October 2003.

In real terms, and as a price-to-rent ratio, prices are back to late 2003 and early 2004 levels - and the price-to-rent ratio maybe moving a little more sideways now.

Dallas Fed: Regional Manufacturing Activity declined in May

by Calculated Risk on 5/31/2016 12:03:00 PM

From the Dallas Fed: Texas Manufacturing Activity Declines

Texas factory activity declined in May after two months of increases, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, fell from 5.8 to -13.1, hitting its lowest reading in a year.The impact of lower oil prices is still being felt in the Dallas region.

Other measures of current manufacturing activity also reflected contraction this month. The new orders index fell more than 20 points to -14.9 after pushing into positive territory last month. The growth rate of orders index has been negative since late 2014 and fell to -14.7 in May after climbing to near zero in April. The capacity utilization and shipments indexes returned to negative territory after two months of positive readings, coming in at yearlong lows of -11.0 and -11.5, respectively.

Perceptions of broader business conditions were more pessimistic this month. The general business activity index declined from -13.9 to -20.8, and the company outlook index fell 10 points to -16.1.

Latest readings on employment and workweek length indicated a fifth consecutive month of contraction in May. The employment index moved down three points to -6.7. ...

emphasis added

This was the last of the regional Fed surveys for May.

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through May), and five Fed surveys are averaged (blue, through May) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through April (right axis).

It seems likely the ISM manufacturing index will show contraction in May, although the consensus is for a reading of 50.6 (slow expansion).

Case-Shiller Graphs: National House Price Index increased 5.2% year-over-year in March

by Calculated Risk on 5/31/2016 10:34:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for March ("March" is a 3 month average of January, February and March prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Prices Continue Steady Gains in March According to the S&P/Case-Shiller Home Price Indices

The S&P/Case-Shiller U.S. National Home Price Index, covering all nine U.S. census divisions, reported a 5.2% annual gain in March, down from 5.3% the previous month. The 10-City Composite and the 20-City Composites’ year-over-year gains remained unchanged at 4.7% and 5.4%, respectively, from the prior month.

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.7% in March. The 10-City Composite recorded a 0.8% month-over-month increase while the 20-City Composite posted a 0.9% increase in March. After seasonal adjustment, the National Index recorded a 0.1% month-over-month increase, the 10-City Composite posted a 0.8% increase, and the 20-City Composite reported a 0.9% month-over-month increase. After seasonal adjustment, six cities saw prices rise, one city was unchanged, and 13 cities experienced negative monthly price changes.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 10.6% from the peak, and up 0.8% in March (SA).

The Composite 20 index is off 8.9% from the peak, and up 0.9% (SA) in March.

The National index is off 3.0% from the peak, and up 0.1% (SA) in March. The National index is up 31.1% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.7% compared to March 2015.

The Composite 20 SA is up 5.4% year-over-year..

The National index SA is up 5.2% year-over-year.

Note: According to the data, prices increased in 19 of 20 cities month-over-month seasonally adjusted. (the press release says 6).

I'll have more later.

Case-Shiller: National House Price Index increased 5.2% year-over-year in March

by Calculated Risk on 5/31/2016 10:10:00 AM

Note: S&P is having difficulty this morning.

From the WSJ: U.S. Home Price Growth Remained Robust in March, Case-Shiller Says

The S&P/Case-Shiller Home Price Index, covering the entire nation rose 5.2% in the 12 months ended in March, slightly less than a 5.3% increase in February.I'll have more on house prices later.

The 10-city index gained 4.7% from a year earlier and the 20-city index gained 5.4% year-over-year.

...

Month-over-month prices the U.S. Index rose 0.7% in March before seasonal adjustment; the 20-city index rose 0.9% and the 10-city index rose 0.8% from February to March.

After seasonal adjustment, the national index rose 0.1% month-over-month, the 10-City index posted a 0.8% increase, and the 20-City index reported a 0.9% month-over-month increase.

Personal Income increased 0.4% in April, Spending increased 1.0%

by Calculated Risk on 5/31/2016 08:36:00 AM

The BEA released the Personal Income and Outlays report for April:

Personal income increased $69.8 billion, or 0.4 percent ...in April, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $119.2 billion, or 1.0 percent.The following graph shows real Personal Consumption Expenditures (PCE) through April 2016 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.6 percent in April, in contrast to a decrease of less than 0.1 percent in March. ... The price index for PCE increased 0.3 percent in April, compared with an increase of 0.1 percent in March. The PCE price index, excluding food and energy, increased 0.2 percent, compared with an increase of 0.1 percent.

The April PCE price index increased 1.1 percent from April a year ago. The April PCE price index, excluding food and energy, increased 1.6 percent from April a year ago.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was at consensus expectations. And the increase in PCE was above the consensus. A solid start for Q2.

On inflation: The PCE price index increased 1.1 percent year-over-year due to the sharp decline in oil prices. The core PCE price index (excluding food and energy) increased 1.6 percent year-over-year in April.

Monday, May 30, 2016

Tuesday: Personal Income and Outlays, Case-Shiller House Prices, Chicago PMI

by Calculated Risk on 5/30/2016 07:54:00 PM

Tuesday:

• At 8:30 AM ET, Personal Income and Outlays for April. The consensus is for a 0.4% increase in personal income, and for a 0.7% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 9:00 AM, S&P/Case-Shiller House Price Index for March. Although this is the February report, it is really a 3 month average of January, February and March prices. The consensus is for a 5.1% year-over-year increase in the Comp 20 index for March. The Zillow forecast is for the National Index to increase 5.3% year-over-year in March.

• At 9:45 AM, Chicago Purchasing Managers Index for May. The consensus is for a reading of 50.7, up from 50.4 in April.

• At 10:00 AM, the Dallas Fed Survey of Manufacturing Activity for May.

Weekend:

• Schedule for Week of May 29, 2016

• The War on Data

From CNBC: Pre-Market Data and Bloomberg futures: S&P are up 5 and DOW futures are up 50 (fair value).

Oil prices were up over the last week with WTI futures at $49.49 per barrel and Brent at $49.76 per barrel. A year ago, WTI was at $60, and Brent was at $63 - so prices are down about 20%+ year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.32 per gallon (down about $0.40 per gallon from a year ago).

Hamilton: 'Trends in oil supply and demand'

by Calculated Risk on 5/30/2016 10:48:00 AM

From Professor Hamilton at Econbrowser: Trends in oil supply and demand. A few excerpts:

The new supplies from the U.S., Iraq, and Iran brought prices down dramatically. And in response, demand has been climbing back up. U.S. consumption over the last 12 months was 800,000 b/d higher than in 2013, a 4% increase. Vehicle miles traveled in the U.S. are up 6% over the last two years.

...

Low prices are increasing demand and will also dramatically reduce supply. The EIA is estimating that U.S. production from shale formations is down almost a million barrels a day from last year.

These factors all contributed to a rebound in the price of oil, which traded below $30/barrel at the start of this year but is now back close to $50.

Nevertheless, I doubt that $50 is high enough to reverse the decline in U.S. shale production. Nor is the slashing that we’ve seen in longer-term oil-producing projects about to be undone. And while there is enough geopolitical stability at the moment in places like Iraq and Iran to sustain significantly higher levels of production than we saw in 2013, there is no shortage of news elsewhere in the world that could develop into important new disruptions. For example, conflict in Nigeria may cut that country’s oil production by a million barrels a day.

Adding a million barrels/day to U.S. oil demand and subtracting 2 million b/d from U.S. and Nigerian supply would seem to go a long way toward erasing that glut in oil supply that we’ve been hearing about.

Sunday, May 29, 2016

Gasoline Prices: Down 40 cents per gallon from last year on Memorial Day

by Calculated Risk on 5/29/2016 07:55:00 PM

According to Gasbuddy.com, gasoline prices are down to a national average of $2.33 per gallon. One year ago for the week of Memorial Day, prices were at $2.75 per gallon, and for the same week two years ago prices were $3.75 per gallon.

This is the lowest Memorial Day gasoline prices since 2005 (even lower than in 2009).

Ten years ago, price were at $2.94 per gallon, and fifteen years ago at $1.74.

| Memorial Day | Weekly Average Gasoline Price |

|---|---|

| 29-May-00 | $1.57 |

| 28-May-01 | $1.74 |

| 27-May-02 | $1.43 |

| 26-May-03 | $1.53 |

| 31-May-04 | $2.10 |

| 30-May-05 | $2.17 |

| 29-May-06 | $2.94 |

| 28-May-07 | $3.25 |

| 26-May-08 | $3.99 |

| 25-May-09 | $2.49 |

| 31-May-10 | $2.84 |

| 30-May-11 | $3.90 |

| 28-May-12 | $3.73 |

| 27-May-13 | $3.70 |

| 26-May-14 | $3.75 |

| 25-May-15 | $2.75 |

| 29-May-16 | $2.33 |

According to Bloomberg, WTI oil is at $49.61 per barrel, and Brent is at $49.60 per barrel. Last year on Memorial Day, Brent was at $65.37 per barrel, and two years ago Brent was at $110.01.

The War on Data

by Calculated Risk on 5/29/2016 10:38:00 AM

People have different priorities and different values. But we share the same data. Over the last few days, we've heard a presidential contender make comments completing ignoring the data. This should concern everyone - ignoring data leads to irresponsible comments and poor policy decisions.

First, I live in California, and I was shocked to hear Donald Trump say there is no drought in the state. That is the opposite of what the data says!

Here is an excerpt from Daniel Swain at the California Weather Blog (written 10 days ago discussing the data):

While the reservoirs in California’s wetter, more northern reaches have reached (or are nearing) capacity after a slightly wetter-than-average winter in that part of the state, multi-year water deficits remain enormous. The 2015-2016 winter did bring some drought relief to California, but nearly all long-term drought indicators continue to suggest that California remains in a significant drought. Residents of Southern California–who witnessed a much drier than average winter this year despite the occurrence of one of the strongest El Niño events on record–can certainly attest to this. In fact, nearly all of California is still “missing” at least 1 year’s worth of precipitation over the past 4 years, and in Southern California the numbers suggest closer to 2-3 years’ worth of “missing” rain and snow. These numbers, of course, don’t even begin to account for the effect of consecutive years of record-high temperatures, which have dramatically increased evaporation in our already drought-stressed region.For the current year, these tables show the snowpack in the North, Central and South Sierra. Currently the statewide snowpack is about 29% of normal for this date.

emphasis added

This graph shows the snow water content for Upper Tyndall Creek for the last 20+ years.

This graph shows the snow water content for Upper Tyndall Creek for the last 20+ years.For Pacific Crest Trail and John Muir Trail hikers, I recommend using the Upper Tyndall Creek sensor to track the snow conditions. This is the fifth dry year in a row along the JMT - although more snow than the previous four years.

As Swain noted, "California remains in a significant drought". Mr. Trump's comments were incorrect and irresponsible.

Second, Mr. Trump was also quoted as saying that anyone who believes the unemployment rate is 5% is a "dummy".

Trump says he thinks the US unemployment rate is close to 20 percent and not the 5 percent reported by the Labor Department.I don't believe the headline U-3 unemployment rate tells the entire story, and that is why I also track U-6 (a measure of underemployment) and other measures. But U-3 is measured in a transparent way - and remains a key measure of unemployment - and is measured consistently.

Anyone who believes the 5 percent is a “dummy,” he said.

When we use U-6 (includes "unemployed, plus all marginally attached workers plus total employed part time for economic reasons") we need to compare to previous readings of U-6, not previous readings of U-3. Currently U-6 is at 9.7%. U-6 bottomed in 2006 at 7.9% and in 2000 at 6.8%. So U-6 is still elevated and there is still slack in the labor market.

Also, some people think the participation rate will increase significantly as the labor market improves. I've written about the participation rate extensively, and I've pointed out that most of the recent decline in the participation rate can be explained by demographics and various long term trends. There is no huge hidden pool of workers that will suddenly show up in the labor force.

Looking at the data, Mr. Trump's suggestion that unemployment is closer to 20% than 5% is absurd.

I guess Trump thinks I'm a "dummy"! I think he is reckless and irresponsible.