by Calculated Risk on 4/22/2016 02:35:00 PM

Friday, April 22, 2016

Goldman: Expect FOMC statement next week to say risks are "nearly balanced"

The FOMC meets next week and no change in policy is expected. The focus will be on the wording and for any hint of a June rate increase.

Here are a few brief excerpts from a research note by Goldman Sachs economists Zach Pandl and Jan Hatzius:

Financial markets once again expect the FOMC to stand pat at its upcoming meeting. Indeed, minutes from the March FOMC meeting essentially ruled out any action next week ... Nonetheless, the statement accompanying Wednesday’s decision could offer important signals for the near-term policy outlook.

The key question will be what the committee does with its balance of risks assessment, which has been excluded from the statements following the last two meetings. We expect the statement to say that risks to the outlook are “nearly balanced”, or to otherwise indicate that downside risks have receded somewhat since early this year.

ATA Trucking Index decreased in March

by Calculated Risk on 4/22/2016 12:23:00 PM

From the ATA: ATA Truck Tonnage Index Fell 4.5% in March

American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index decreased 4.5% in March, following a 7.2% surge during February. In March, the index equaled 137.6 (2000=100), down from 144 in February. February’s level is an all-time high.

Compared with March 2015, the SA index was up 2.2%, which was down from February’s 8.6% year-over-year gain. Year-to-date, compared with the same period in 2015, tonnage was up 3.9%.

...

As expected, tonnage came back to earth in March from the jump in February,” said ATA Chief Economist Bob Costello. “These things tend to correct, and March took back more than half of the surprisingly large gain in February.

“The freight economy continues to be mixed, with housing and consumer spending generally giving support to tonnage, while new fracking activity and factory output being drags,” he said. “In addition, freight volumes are softer than the overall economy because of the current inventory overhang throughout the supply chain.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index is now up 2.2% year-over-year.

Black Knight's First Look at March Mortgage Data: Delinquency rate lowest in 9 Years

by Calculated Risk on 4/22/2016 09:10:00 AM

From Black Knight: Black Knight Financial Services’ First Look at March 2016 Mortgage Data: Delinquencies at Lowest Level in Nine Years; 30-Day Delinquency Rate Lowest Since Pre-2000

• National delinquency rate fell 8 percent in March; at 4.08 percent, it is at its lowest point since March 2007According to Black Knight's First Look report for March, the percent of loans delinquent decreased 8.4% in March compared to February, and declined 12.4% year-over-year.

• At just under 2 percent, the rate of 30-day delinquencies is at lowest level in over 15 years

• Spurred by declining interest rates, prepayment speeds (historically a good indicator of refinance activity) were up 46 percent from one month ago

• Foreclosure starts were down 14 percent from February; still driven primarily by repeat foreclosure activity

The percent of loans in the foreclosure process declined 3.7% in March and were down 25.6% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.08% in March, down from 4.48% in February. This is the lowest delinquency rate since March 2007.

The percent of loans in the foreclosure process declined in March to 1.25%.

The number of delinquent properties, but not in foreclosure, is down 287,000 properties year-over-year, and the number of properties in the foreclosure process is down 215,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for March in early May.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Mar 2016 | Feb 2016 | Mar 2015 | Mar 2014 | |

| Delinquent | 4.08% | 4.45% | 4.66% | 5.49% |

| In Foreclosure | 1.25% | 1.30% | 1.68% | 2.21% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,062,000 | 2,252,000 | 2,349,000 | 2,766,000 |

| Number of properties in foreclosure pre-sale inventory: | 631,000 | 655,000 | 846,000 | 1,112,000 |

| Total Properties | 2,693,000 | 2,907,000 | 3,195,000 | 3,878,000 |

Thursday, April 21, 2016

NMHC: Apartment Market Tightness Index declined in April Survey

by Calculated Risk on 4/21/2016 03:50:00 PM

From the National Multifamily Housing Council (NMHC): Apartment Markets Mixed in the April NMHC Quarterly Survey

Apartment markets appeared mixed in the April 2016 National Multifamily Housing Council (NMHC) Quarterly Survey of Apartment Market Conditions, with two of four indexes landing below the breakeven level of 50. The Market Tightness (43) and Equity Financing (45) indexes showed declining conditions for the second quarter in a row, while Sales Volume (53) and Debt Financing (50) indicated improving and steady conditions, respectively.

“We continue to see some softening in the market relative to one of the strongest runs in recent memory for the apartment industry,” said Mark Obrinsky, NMHC’s Senior Vice President of Research and Chief Economist. “As new apartment construction catches up with demand, we expect to see moderation from record rent growth as well as more selectivity from equity and debt financing sources.”

Consumer demand for apartments declined in the Market Tightness Index, dropping four points to 43. After seven quarters reporting tighter conditions, this marks the second quarter indicating a looser market.

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading below 50 indicates looser conditions from the previous quarter. This indicates market conditions were looser over the last quarter.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010.

This is the second consecutive month of looser conditions - it appears supply has caught up with demand - and I expect rent growth to slow (the vacancy rate is also starting to increase).

Earlier: Chicago Fed: "Index shows economic growth below average in March"

by Calculated Risk on 4/21/2016 02:32:00 PM

The Chicago Fed released the national activity index (a composite index of other indicators): Index shows economic growth below average in March

The Chicago Fed National Activity Index (CFNAI) edged down to –0.44 in March from –0.38 in February. Three of the four broad categories of indicators that make up the index decreased from February, and all four categories made nonpositive contributions to the index in March.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, decreased to –0.18 in March from –0.11 in February. March’s CFNAI-MA3 suggests that growth in national economic activity was somewhat below its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was below the historical trend in March (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Earlier: Philly Fed Manufacturing Survey showed Slight Contraction in April

by Calculated Risk on 4/21/2016 11:05:00 AM

Earlier from the Philly Fed: April 2016 Manufacturing Business Outlook Survey

Firms responding to the Manufacturing Business Outlook Survey reported no improvement in business conditions this month. The indicator for general activity, which rose sharply in March, fell to a slightly negative reading in April. Other broad indicators suggested a similar relapse in growth that was reported last month. The indicators for both employment and work hours also fell notably. Despite weakness in current conditions, the survey’s indicators of future activity showed continued improvement, suggesting that the fallback is considered temporary.This was below the consensus forecast of a reading of 9.0 for April.

...

The diffusion index for current activity decreased from 12.4 in March to -1.6 this month. The index had turned positive last month following six consecutive negative readings ...

The survey’s indicators of employment corroborate weakness in the other broad indicators this month. The employment index decreased 17 points and registered its fourth consecutive negative reading.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The yellow line is an average of the NY Fed (Empire State) and Philly Fed surveys through April. The ISM and total Fed surveys are through March.

The average of the Empire State and Philly Fed surveys remained positive in April (yellow). This suggests the ISM survey will probably be above 50 again this month.

Weekly Initial Unemployment Claims decrease to 247,000

by Calculated Risk on 4/21/2016 08:35:00 AM

The DOL reported:

In the week ending April 16, the advance figure for seasonally adjusted initial claims was 247,000, a decrease of 6,000 from the previous week's unrevised level of 253,000. This is the lowest level for initial claims since November 24, 1973 when it was 233,000. The 4-week moving average was 260,500, a decrease of 4,500 from the previous week's unrevised average of 265,000.The previous week was unrevised.

There were no special factors impacting this week's initial claims. This marks 59 consecutive weeks of initial claims below 300,000, the longest streak since 1973.

Note: The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 260,500.

This was well below the consensus forecast of 265,000. The low level of the 4-week average suggests few layoffs.

Wednesday, April 20, 2016

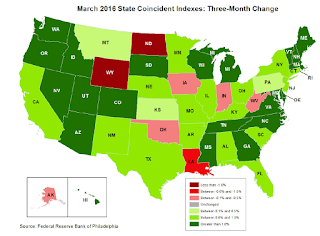

Philly Fed: State Coincident Indexes increased in 41 states in March

by Calculated Risk on 4/20/2016 06:15:00 PM

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 265 thousand initial claims, up from 253 thousand the previous week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for April. The consensus is for a reading of 9.0, down from 12.4.

• Also at 8:30 AM, Chicago Fed National Activity Index for March. This is a composite index of other data.

• At 9:00 AM, FHFA House Price Index for February 2016. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% month-to-month increase for this index.

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for March 2016. In the past month, the indexes increased in 41 states, decreased in seven, and remained stable in two, for a one-month diffusion index of 68. Over the past three months, the indexes increased in 42 states and decreased in eight, for a three-month diffusion index of 68.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In March, 42 states had increasing activity including minor increases.

Five states have seen declines over the last 6 months, in order they are North Dakota (worst), Wymong, Alaska, Louisiana and Oklahoma - mostly due to the decline in oil prices.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is mostly green now.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is mostly green now.Source: Philly Fed.

A Few Comments on March Existing Home Sales

by Calculated Risk on 4/20/2016 03:21:00 PM

Earlier: Existing Home Sales increased in March to 5.33 million SAAR

I'd consider any existing home sales rate in the 5 to 5.5 million range solid based on the normal historical turnover of the existing stock. I've seen reports calling the February sales rate "dismal" and the March sales rate "a strong rebound". Nah. This is just normal volatility. Sales in Q1 are up almost 6% from Q1 2015, and that is solid start to the year.

Going forward, there are some economic reasons for some softness in existing home sales in certain areas. Low inventory is probably holding down sales in many areas, and there will be weakness in some oil producing areas (see: Houston has a problem).

As always, it is important to remember that new home sales are more important for jobs and the economy than existing home sales. Since existing sales are existing stock, the only direct contribution to GDP is the broker's commission. There is usually some additional spending with an existing home purchase - new furniture, etc - but overall the economic impact is small compared to a new home sale.

Inventory is still key. I expected some increase in inventory last year, but that didn't happened. Inventory is still very low and falling year-over-year (down 1.5% year-over-year in March). More inventory would probably mean smaller price increases and slightly higher sales, and less inventory means lower sales and somewhat larger price increases.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA in March (red column) were the highest for March since 2007 (NSA).

Note that January and February are usually the slowest months of the year and March is the beginning of the "selling season". This is a solid start to the year.

AIA: "Architecture Billings Index Ends the First Quarter on an Upswing"

by Calculated Risk on 4/20/2016 12:31:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index Ends the First Quarter on an Upswing

he Architecture Billings Index reflects consecutive months of increasing demand for design activity at architecture firms. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the March ABI score was 51.9, up from the mark of 50.3 in the previous month. This score reflects an increase in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 58.1, down from a reading of 59.5 the previous month.

“The first quarter was somewhat disappointing in terms of the growth of design activity, but fortunately expanded a bit entering the traditionally busy spring season. The Midwest is lagging behind the other regions, but otherwise business conditions are generally healthy across the country,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “As the institutional market has cooled somewhat after a surge in design activity a year ago, the multi-family sector is reaccelerating at a healthy pace.”

...

• Regional averages: South (52.4), Northeast (51.0), West (50.4), Midwest (49.8)

• Sector index breakdown: multi-family residential (55.7), commercial / industrial (51.8), mixed practice (50.0), institutional (48.0)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 51.9 in March, up from 50.3 in February. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

The multi-family residential market was negative for most of 2015 - suggesting a slowdown or less growth for apartments - but has turned around and been positive for the last six months - so there might be another pickup in multi-family starts.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 8 of the last 12 months, suggesting a further increase in CRE investment in 2016.