by Calculated Risk on 4/18/2016 08:06:00 PM

Monday, April 18, 2016

Tuesday: Housing Starts

Tuesday:

• At 8:30 AM, Housing Starts for March. Total housing starts decreased to 1.178 million (SAAR) in February. Single family starts increased to 822 thousand SAAR in February. The consensus for 1.167 million, down from the February rate.

From Matthew Graham at Mortgage News Daily: Mortgage Rates Hold Steady Despite Market Volatility

Most lenders have been quoting top tier conventional 30yr fixed rates of either 3.5 or 3.625%, though there are a few laggards at 3.75% and even fewer standouts at 3.375%.

Lawler: Early Look at Existing Home Sales in March

by Calculated Risk on 4/18/2016 04:34:00 PM

From housing economist Tom Lawler: Early Look at Existing Home Sales in March

Based on publicly-available state and local realtor/MLS reports released through today, I project that US existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.27 million in March, up 3.7% from February’s preliminary pace (which should be revised up slightly), and up 0.4% from last March’s seasonally adjusted pace. Unadjusted sales should register a slightly higher YOY gain, as there was one more business day this March compared to last March.

Local realtor/MLS data suggest that the NAR’s estimate of the inventory of existing homes for sale at the end of March should be about 5.0% higher than February’s preliminary estimate, and down 1.8% from last February.

Finally, local/realtor/MLS data suggest that the NAR’s estimate of the median existing single-family home sales price in March should be up by about 4.7% from a year earlier.

CR Note: March existing home sales will be released on Wednesday, and the The consensus is for 5.27 million SAAR (the same as Lawler).

Ranking Economic Data

by Calculated Risk on 4/18/2016 02:11:00 PM

Here is an update to a list I posted several years ago with my ranking of economic data releases.

These lists are not exhaustive (I'm sure I left a few off), and the rankings are not static. As an example, a few years ago I ranked initial weekly unemployment claims as ‘B List’ data, but now that claims are close to normal levels, I've moved weekly claims down to the 'C List'. Currently I'm watching measures of household debt a little closer and I've moved up the NY Fed's quarterly "Household Debt and Credit Report" to the C-list.

Note: There has been some research by Wall Street analysts about how "surprises" for many of these indicators impact the stock market. In general the ranking is similar with the employment situation report being #1.

The NAR existing home sales report is difficult to rank. 'For sale' inventory is important - almost "B-List" - but the headline sales number is more "C-List".

For each indicator I've included a link to the source and a recent post with graphs (in parenthesis).

Some of the lower ranked data is useful as leading indicators. As an example, the Architecture Billings Index is a leading indicator for investment in commercial real estate. And the NMHC apartment survey leads changes in apartment rents and vacancy rates. Also some of the lower ranked data helps forecast some of the more important data.

A-List

• BLS: Employment Situation Report, (March Employment Report: 215,000 Jobs, 5.0% Unemployment Rate and Comments: Another Solid Employment Report)

• BEA: GDP Report (quarterly) (Q4 GDP Revised Up to 1.4% Annual Rate)

B-List

• Census: New Home Sales (New Home Sales increased to 512,000 Annual Rate in February)

• Census: Housing Starts (Housing Starts increased to 1.178 Million Annual Rate in February and Comments on February Housing Starts)

• ISM Manufacturing Index (ISM Manufacturing index increased to 51.8 in March)

• Census: Retail Sales (Retail Sales decreased 0.3% in March)

• BEA: Personal Income and Outlays (Personal Income increased 0.2% in February, Spending increased 0.1%)

• Fed: Industrial Production (Fed: Industrial Production decreased 0.6% in March)

• BLS: Core CPI (Key Measures Show Inflation close to 2% in March)

C-List

• NAR: Existing Home Sales (Existing Home Sales decreased in February to 5.08 million SAAR)

• DOL: Weekly Initial Unemployment Claims (Weekly Initial Unemployment Claims decrease to 253,000)

• Manufacturers: Light Vehicle Sales (U.S. Light Vehicle Sales decline to 16.45 million annual rate in March)

• Philly Fed: Philly Fed Index (Philly Fed Manufacturing Survey showed Expansion in March)

• NY Fed Empire State Manufacturing Index (NY Fed: April "General business conditions climbed nine points, highest in more than a year")

• Chicago ISM: Chicago PMI (Chicago PMI increases to 53.6)

• Census: Durable Goods

• ISM Non-Manufacturing Index (ISM Non-Manufacturing Index increased to 54.5% in March)

• House Prices: Case-Shiller and CoreLogic (Case-Shiller: National House Price Index increased 5.4% year-over-year in January and CoreLogic: House Prices up 6.8% Year-over-year in February)

• BLS: Job Openings and Labor Turnover Survey (BLS: Jobs Openings "little changed" in February)

• Census: Construction Spending (Construction Spending decreased 0.5% in February)

• Census: Trade Balance (Trade Deficit Increased in February to $47.1 Billion)

• MBA: Mortgage Delinquency Data (Quarterly) (MBA: Mortgage Delinquency and Foreclosure Rates Decrease in Q4)

• Black Knight: Mortgage Delinquency Data (Black Knight's First Look at February Mortgage Data: Delinquency rate lowest since April 2007)

• CoreLogic and Zillow: Negative Equity Report and Zillow (quarterly) (CoreLogic: "1 Million US Borrowers Regained Equity in 2015")

• AIA: Architecture Billings Index (AIA: "Modest Expansion for Architecture Billings Index")

• NY Fed: Household Debt and Credit Report (Quarterly) (NY Fed: Household Debt Increased "Modestly" in Q4 2015, Delinquency Rates Declined)

D-List

• Fed: Household Debt Service and Financial Obligations Ratios (Quarterly)

• Fed: Flow of Funds (Quarterly)

• Richmond Fed: Richmond Fed Manufacturing Index

• Kansas City Fed: Kansas City Fed Manufacturing Index

• Dallas Fed: Dallas Fed Manufacturing Index

• Reis: Office, Mall, Apartment Vacancy Rates (Quarterly)

• NMHC Apartment Survey (Quarterly)

• Univ. of Michigan Consumer Sentiment Index

• MBA: Mortgage Purchase Applications Index

• NAHB: Housing Market Index (

NAHB: Builder Confidence unchanged at 58 in April)

• Census: Housing Vacancy Survey (Quarterly)

• Fed: Senior Loan Officer Survey (Quarterly)

• ATA: Trucking

• NFIB: Small Business Survey

• STR: Hotel Occupancy

• NRA: Restaurant Performance Index

• Fed: Consumer Credit

• DOT: Vehicle Miles Driven

• LA and Long Beach Port Traffic

• BLS: Producer Price Index

• ADP Employment Report

• Conference Board Confidence Index

• NAR: Pending Home Sales

Sources (Government):

BEA: Bureau of Economic Analysis

BLS: Bureau of Labor Statistics

Census: Census Bureau

DOL: Dept of Labor

DOT: Dept. of Transportation

Fed: Federal Reserve

Sources (Industry):

AIA: American Institute of Architects

ISM: Institute for Supply Management

LPS: Black Knight

MBA: Mortgage Bankers Association

NAHB: National Association of Homebuilders

NAR: National Association of Realtors

NFIB: National Federation of Independent Business

NRA: National Restaurant Association

STR: Smith Travel Research

NAHB: Builder Confidence unchanged at 58 in April

by Calculated Risk on 4/18/2016 10:04:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 58 in April, unchanged from 58 in March. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Holds Firm in April

Builder confidence in the market for newly-built single-family homes remained unchanged in April at a level of 58 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI).

“Builder confidence has held firm at 58 for three consecutive months, showing that the single-family housing sector continues to recover at a slow but consistent pace,” said NAHB Chairman Ed Brady, a home builder and developer from Bloomington, Ill. “As we enter the spring home buying season, we should see the market move forward.”

“Builders remain cautiously optimistic about construction growth in 2016,” said NAHB Chief Economist Robert Dietz. “Solid job creation and low mortgage interest rates will sustain continued gains in the single-family housing market in the months ahead.”

...

The HMI components measuring sales expectations in the next six months rose one point to 62, and the index gauging buyer traffic also increased a single point to 44. Meanwhile, the component charting current sales conditions fell two points to 63.

Looking at the three-month moving averages for regional HMI scores, all four regions registered slight declines. The Northeast and West each fell two points to 44 and 67, respectively. Meanwhile, the Midwest and South each posted respective one-point losses to 57 and 58.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was below the consensus forecast of 59, but still a strong reading.

Sunday, April 17, 2016

Sunday Night Futures

by Calculated Risk on 4/17/2016 07:28:00 PM

For amusement, the Barron's cover this week says "Detroit is Back!" Hmmm ... the correct time to be looking for the bottom in auto sales was in 2009. It has been a nice ride.

Note: Some yellow journalism sites will trumpet the Barron's cover this week, but remember that they missed the bottom for auto sales in 2009. Someday I'll be bearish again (I was a Grizzly bear when I started this blog), but always bearish is mostly wrong!

From the WSJ: Oil Prices Fall After Producers Fail to Reach Deal at Doha

Oil prices opened sharply lower in early Asian trading hours on Monday after major oil producers ended their meeting in Doha, Qatar, over the weekend without reaching an agreement to cap production.Weekend:

...

U.S. crude plunged 6.7% at $37.70 a barrel and Brent was down 6.9% at $40.14 a barrel in early Asian trading.

• Schedule for Week of April 17, 2016

Monday:

• 10:00 AM, the April NAHB homebuilder survey. The consensus is for a reading of 59, up from 58 in March. Any number above 50 indicates that more builders view sales conditions as good than poor.

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 9 and DOW futures are down 75 (fair value).

Oil prices were down over the last week with WTI futures at $38.26 per barrel and Brent at $40.14 per barrel. A year ago, WTI was at $56, and Brent was at $61 - so prices are down about 33% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.12 per gallon (down about $0.30 per gallon from a year ago).

Hotels: Occupancy Rate Tracking close to Record Year

by Calculated Risk on 4/17/2016 10:38:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 9 April

The U.S. hotel industry recorded mostly positive results in the three key performance metrics during the week of 3-9 April 2016, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The occupancy rate should mostly move sideways for the next couple of months, and then increase further during the Summer travel period.

In year-over-year comparisons, the industry’s occupancy remained flat at 68.2%. Average daily rate for the week was up 3.9% to US$122.90, and revenue per available room increased 3.9% to US$83.83.

emphasis added

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.2015 was the best year on record for hotels.

So far 2016 is tracking close to 2015.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Saturday, April 16, 2016

Schedule for Week of April 17, 2016

by Calculated Risk on 4/16/2016 08:21:00 AM

The key economic reports this week are March housing starts on Tuesday, and March Existing Home Sales on Wednesday.

From manufacturing, the April Philly Fed manufacturing survey will be released this week.

10:00 AM: The April NAHB homebuilder survey. The consensus is for a reading of 59, up from 58 in March. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM: Housing Starts for March.

8:30 AM: Housing Starts for March. Total housing starts decreased to 1.178 million (SAAR) in February. Single family starts increased to 822 thousand SAAR in February.

The consensus for 1.167 million, down from the February rate.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for 5.27 million SAAR, up from 5.08 million in February.

10:00 AM: Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for 5.27 million SAAR, up from 5.08 million in February.During the day: The AIA's Architecture Billings Index for March (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 265 thousand initial claims, up from 253 thousand the previous week.

8:30 AM: the Philly Fed manufacturing survey for April. The consensus is for a reading of 9.0, down from 12.4.

8:30 AM ET: Chicago Fed National Activity Index for March. This is a composite index of other data.

9:00 AM: FHFA House Price Index for February 2016. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% month-to-month increase for this index.

No economic releases scheduled.

Friday, April 15, 2016

FNC: Residential Property Values increased 5.7% year-over-year in February

by Calculated Risk on 4/15/2016 03:21:00 PM

In addition to Case-Shiller, and CoreLogic, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their February 2016 index data. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values increased 0.1% from January to February (Composite 100 index, not seasonally adjusted).

The 10 city MSA increased 0.1% (NSA), the 20-MSA RPI increased 0.2%, and the 30-MSA RPI increased 0.2% in February. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

From FNC: FNC Index: February Home Prices Up 0.1%

The latest FNC Residential Price Index™ (RPI) indicated U.S. home prices moved slightly higher in February after dropping unexpectedly in January. Not adjusting for seasonality, February home prices were up 0.1%. On a yearover-year basis, prices continue to climb at a moderate pace, up 5.7% from a year ago.Notes: In addition to the composite indexes, FNC presents price indexes for 30 MSAs. FNC also provides seasonally adjusted data.

The index is still down 14.2% from the peak in 2006 (not inflation adjusted).

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change based on the FNC index (four composites) through February 2016. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

Most of the other indexes are also showing the year-over-year change in the mid single digit range.

Note: The February Case-Shiller index will be released on Tuesday, April 26th.

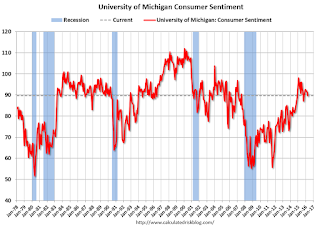

Earlier: Preliminary April Consumer Sentiment decreases to 89.7

by Calculated Risk on 4/15/2016 01:29:00 PM

The preliminary University of Michigan consumer sentiment index for April was at 89.7, down from 91.0 in March:

Consumer confidence continued its slow overall decline in early April, marking the fourth consecutive monthly decline. To be sure, the sizes of the recent losses have been quite small, with the Sentiment Index falling just 2.9 Index-points since December 2015, although it was down 6.2 Index-points from a year ago and 8.4 points below the peak in January 2015. None of these declines indicate an impending recession, although concerns have risen about the resilience of consumers in the months ahead. Consumers reported a slowdown in expected wage gains, weakening inflation-adjusted income expectations, and growing concerns that slowing economic growth would reduce the pace of job creation. These apprehensions should ease as the economy rebounds from its dismal start in the first quarter of 2016.This was below the consensus forecast of 91.8.

emphasis added

Click on graph for larger image.

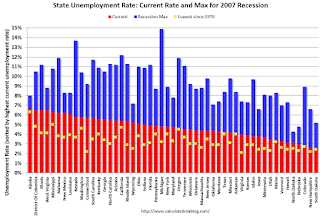

BLS: Unemployment Rate decreased in 21 States in March

by Calculated Risk on 4/15/2016 11:08:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were little changed in March. Twenty-one states had unemployment rate decreases from February, 15 states had increases, and 14 states and the District of Columbia had no change, the U.S. Bureau of Labor Statistics reported today.

...

South Dakota and New Hampshire had the lowest jobless rates in March, 2.5 percent and 2.6 percent, respectively, followed by Colorado, 2.9 percent. The rates in both Arkansas (4.0 percent) and Oregon (4.5 percent) set new series lows. (All region, division, and state series begin in 1976.) Alaska had the highest rate, 6.6 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement. The yellow squares are the lowest unemployment rate per state since 1976.

The states are ranked by the highest current unemployment rate. Alaska, at 6.6%, had the highest state unemployment rate.

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).Currently no state has an unemployment rate at or above 7% (light blue); Only seven states and D.C are at or above 6% (dark blue).