by Calculated Risk on 3/23/2016 06:58:00 PM

Wednesday, March 23, 2016

Thursday: Durable Goods, Unemployment Claims

Here is an interesting paper from Jordan Rappaport at the Kansas City Fed: The Limited Supply of Homes

Over the longer term, the supply of homes for purchase should considerably improve as baby boomers increasingly downsize from single-family to multifamily homes. But recent experience suggests that downsizing typically begins when people are in their late seventies, a milestone the leading edge of the baby boomers will not reach for another five years (Rappaport 2015). Until then, the supply of single-family homes for purchase is likely to remain tight, putting continuing upward pressure on home prices.Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 268 thousand initial claims, up from 265 thousand the previous week.

• Also at 8:30 AM, Durable Goods Orders for February from the Census Bureau. The consensus is for a 3.0% decrease in durable goods orders.

• At 11:00 AM, the Kansas City Fed Survey of Manufacturing Activity for March.

Comments on February New Home Sales

by Calculated Risk on 3/23/2016 03:20:00 PM

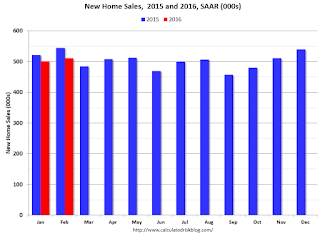

The new home sales report for February was slightly above expectations at 512,000 on a seasonally adjusted annual rate basis (SAAR), and combined sales for November, December and January were revised up.

Sales were down 6.1% year-over-year (YoY) compared to February 2015. However, we have to remember February 2015 was the strongest month of 2015 at 545,000 SAAR. Sales for all of 2015 were 501,000 (up 14.5% from 2014) - and since January and February were especially strong months last year, the YoY comparisons have been difficult so far.

Earlier: New Home Sales increased to 512,000 Annual Rate in February.

This graph shows new home sales for 2015 and 2016 by month (Seasonally Adjusted Annual Rate).

The comparisons for the first two months was difficult. I also expect lower growth this year overall.

Houston (and other oil producing areas) will have a problem this year. Inventory of existing homes is increasing quickly and prices will probably decline in those areas. And that means new home construction will slow in those areas too.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

AIA: "Modest Expansion for Architecture Billings Index"

by Calculated Risk on 3/23/2016 12:58:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Modest Expansion for Architecture Billings Index

The Architecture Billings Index saw a dip into negative terrain for the first time in five months in January, but inched back up in February with a small increase in demand for design services. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the February ABI score was 50.3, up slightly from the mark of 49.6 in the previous month. This score reflects a minor increase in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 59.5, up from a reading of 55.3 the previous month.

“March and April are traditionally the busiest months for architecture firms, so we should get a clearer reading of underlying momentum over the next couple of months,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “Hopefully the relatively mild weather conditions recently in most parts of the country will help design and construction activity move ahead at a somewhat faster pace.”

...

• Regional averages: South (51.1), West (49.9), Northeast (49.5), Midwest (49.3)

• Sector index breakdown: multi-family residential (53.0), commercial / industrial (52.3), institutional (48.1), mixed practice (47.7)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 50.3 in February, up from 49.6 in January. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

The multi-family residential market was negative for most of last year - suggesting a slowdown or less growth for apartments - but has been positive for the last five months.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 8 of the last 12 months, suggesting a further increase in CRE investment in 2016.

New Home Sales increased to 512,000 Annual Rate in February

by Calculated Risk on 3/23/2016 10:13:00 AM

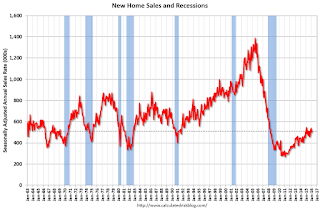

The Census Bureau reports New Home Sales in February were at a seasonally adjusted annual rate (SAAR) of 512 thousand.

The previous three months were revised up by a total of 12 thousand (SAAR).

"Sales of new single-family houses in February 2016 were at a seasonally adjusted annual rate of 512,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 2.0 percent above the revised January rate of 502,000, but is 6.1 percent below the February 2015 estimate of 545,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales since the bottom, new home sales are still fairly low historically.

The second graph shows New Home Months of Supply.

The months of supply was unchanged in February at 5.6 months.

The months of supply was unchanged in February at 5.6 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of February was 240,000. This represents a supply of 5.6 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

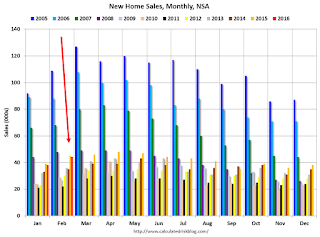

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In February 2016 (red column), 44 thousand new homes were sold (NSA). Last year 45 thousand homes were sold in February.

The all time high for February was 109 thousand in 2005, and the all time low for February was 22 thousand in 2011.

This was close to expectations of 512,000 sales SAAR in February, and prior months were revised up slightly - although sales were down year-over-year. Still a decent report. I'll have more later today.

MBA: Mortgage Applications Decreased in Latest Weekly Survey, Purchase Applications up 25% YoY

by Calculated Risk on 3/23/2016 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 18, 2016.

...

The Refinance Index decreased 5 percent from the previous week. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 1 percent compared with the previous week and was 25 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 3.93 percent from 3.94 percent, with points decreasing to 0.35 from 0.42 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity was higher in 2015 than in 2014, but it was still the third lowest year since 2000.

Refinance activity picked up earlier this year as rate declined.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 25% higher than a year ago.

Black Knight's First Look at February Mortgage Data: Delinquency rate lowest since April 2007

by Calculated Risk on 3/23/2016 12:01:00 AM

From Black Knight: Black Knight Financial Services’ First Look at February Mortgage Data: Delinquencies Fully Recover from January Spike, Hit Lowest Level Since April 2007

• Delinquency rate down 13 percent month-over-month; down nearly 16 percent year-over-yearAccording to Black Knight's First Look report for February, the percent of loans delinquent decreased 12.6% in February compared to January, and declined 15.9% year-over-year.

• Total non-current inventory falls below 3 million for the first time in over eight years

The percent of loans in the foreclosure process declined 0.6% in February and were down 24.6% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.45% in February, down from 5.09% in January. This is the lowest delinquency rate since April 2007.

The percent of loans in the foreclosure process declined slightly in February to 1.30%.

The number of delinquent properties, but not in foreclosure, is down 419,000 properties year-over-year, and the number of properties in the foreclosure process is down 211,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for February on April 4th.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Feb 2016 | Jan 2016 | Feb 2015 | Feb 2014 | |

| Delinquent | 4.45% | 5.09% | 5.30% | 5.94% |

| In Foreclosure | 1.30% | 1.30% | 1.72% | 2.30% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,252,000 | 2,575,000 | 2,671,000 | 2,994,000 |

| Number of properties in foreclosure pre-sale inventory: | 655,000 | 659,000 | 866,000 | 1,156,000 |

| Total Properties | 2,907,000 | 3,234,000 | 3,537,000 | 4,150,000 |

Tuesday, March 22, 2016

Wednesday: New Home Sales

by Calculated Risk on 3/22/2016 07:03:00 PM

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, New Home Sales for February from the Census Bureau. The consensus is for an increase in sales to 510 thousand Seasonally Adjusted Annual Rate (SAAR) in February from 494 thousand in January.

• During the day: The AIA's Architecture Billings Index for February (a leading indicator for commercial real estate).

Chemical Activity Barometer Expands in March

by Calculated Risk on 3/22/2016 01:49:00 PM

Here is an indicator that I'm following that appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Expands in March

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), expanded 0.1 percent in March following a revised 0.2 percent decline in February and 0.1 percent downward revision in January. All data is measured on a three-month moving average (3MMA). Accounting for adjustments, the CAB remains up 1.5 percent over this time last year, a marked deceleration of activity from one year ago when the barometer logged a 2.7 percent year-over-year gain from 2014.

...

Applying the CAB back to 1919, it has been shown to provide a lead of two to 14 months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

Currently CAB is up slightly year-over-year, and this suggests a slight increase in Industrial Production over the next year is possible.

Richmond Fed: Manufacturing Sector Activity Expanded in March

by Calculated Risk on 3/22/2016 10:06:00 AM

From the Richmond Fed: Manufacturing Sector Activity Expanded; New Orders and Shipments Increased

Fifth District manufacturing activity expanded in March, according to the most recent survey by the Federal Reserve Bank of Richmond. Shipments and the volume of new orders increased this month. Employment advanced at a slightly faster pace in March, while average wages grew moderately and the average workweek lengthened. Prices of raw materials and finished goods rose at a faster pace compared to last month.Based on the regional surveys released so far for March, it seems likely the ISM manufacturing index will suggest expansion in March after five months of contraction.

Overall, manufacturing activity increased markedly in March. The composite index for manufacturing climbed to a reading of 22, the highest since April 2010. The index for shipments added 38 points and the new orders index advanced 30 points, finishing at strong readings of 27 and 24, respectively. Manufacturing employment grew at a slightly faster pace this month; the employment indicator added two points to end at 11.

emphasis added

Lawler: “Shortfall” in Single-Family Production Almost All in Moderately Sized Homes

by Calculated Risk on 3/22/2016 08:11:00 AM

From housing economist Tom Lawler:

CR Update: Added Census Bureau discussion of square footage at bottom.

While single-family housing production has continued to recover, the overall level of production – in terms of units – has been well short of consensus forecasts from a few years ago. In looking at the production “shortfall,” the one thing that is striking is that production of moderately sized homes has barely recovered from the cyclical lows, while production of big homes (3000+ square feet) has been running at a higher pace that in all but one year of the 1990’s.

Before going into the distribution of single-family housing production by square feet of floor area, here is a chart of the median square feet of floor area by year for single-family housing completions from 1971 through 2015.

While Census has not yet released its annual report on the characteristics of new single-family home completions for 2015, both the median and the average square footage for completions were similar to 2014, and as such it’s probably not unreasonable to assume that the distribution of single-family completions by square feet of floor area was also similar.

And here are these estimates by averages for five-year periods, as well as for each of the last five years.

| Single-Family Housing Completions by Square Feet of Floor Area (000's, Average per Year) | ||||||

|---|---|---|---|---|---|---|

| <1600 | 1600-1999 | 2000-2399 | 2400-2999 | 3000+ | Total | |

| 1971-1975 | 602 | 129 | 195 | 74 | 37 | 1,038 |

| 1976-1980 | 573 | 236 | 209 | 107 | 59 | 1,184 |

| 1981-1985 | 462 | 183 | 107 | 90 | 53 | 894 |

| 1986-1990 | 411 | 233 | 169 | 141 | 109 | 1,064 |

| 1991-1995 | 314 | 231 | 177 | 157 | 134 | 1,013 |

| 1996-2000 | 321 | 265 | 215 | 194 | 188 | 1,183 |

| 2001-2005 | 315 | 298 | 258 | 262 | 294 | 1,427 |

| 2006-2010 | 189 | 185 | 162 | 173 | 232 | 941 |

| 2011 | 98 | 84 | 70 | 79 | 116 | 447 |

| 2012 | 93 | 89 | 80 | 93 | 128 | 483 |

| 2013 | 89 | 102 | 97 | 115 | 166 | 569 |

| 2014 | 90 | 104 | 102 | 131 | 193 | 620 |

| 2015 | 96 | 109 | 106 | 136 | 200 | 647 |

And here’s a comparison of single-family housing completions by square footage for the last two years compared to the average of the 1990’s.

| Single-Family Housing Completions by Square Feet of Floor Area (000's, Average per Year) | ||||||

|---|---|---|---|---|---|---|

| <1600 | 1600-1999 | 2000-2399 | 2400-2999 | 3000+ | Total | |

| 1990-1999 Average | 319 | 242 | 189 | 170 | 151 | 1,070 |

| 2014-2015 Average | 93 | 107 | 104 | 134 | 197 | 634 |

| % Change | -70.8% | -55.9% | -45.0% | -21.5% | 30.1% | -40.8% |

And here’s a fun stat.

Estimated Single-Family Homes Completed with Square Footage of 3,000 or More

1971-1995 (25 years): 1.962 million

2001-2008 (8 years): 2.399 million.

Update: From Census:

"For these statistics, floor area is defined as all completely finished floor space, including space in basements and attics with finished walls, floors, and ceilings. This does not include a garage, carport, porch, unfinished attic or utility room, or any unfinished area of the basement.

In concept, measurement is based on exterior dimensions. Measurements are taken to the outside of exterior walls for detached houses. Builders sometimes provide the gross square footage (based on exterior dimensions) of a detached structure. This footage usually does not contain unfinished space. However, in townhouses, the gross square footage often includes the whole lower level, even though that area might include a garage and unfinished rooms. For purposes of these statistics, where the floor area for a new house was reported based on interior dimensions, the figure is converted to exterior dimensions by multiplying by a standard conversion factor of 1.08. A standard conversion factor of 1.04 is used to convert figures to exterior dimensions where it was not known whether the reported area was based on exterior or interior dimensions."