by Calculated Risk on 3/10/2016 03:07:00 PM

Thursday, March 10, 2016

Hotel Occupancy in 2016: Tracking Just Behind 2015

Here is an update on hotel occupancy from HotelNewsNow.com: STR: US hotel results for week ending 5 March

he U.S. hotel industry reported mixed results in the three key performance metrics during the week of 28 February through 5 March 2016, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The occupancy rate should continue to increase into the Spring, and then increase further during the Summer travel period.

In year-over-year comparisons, the industry’s occupancy decreased 1.0% to 63.7%. Average daily rate for the week was up 3.3% to US$120.62, and revenue per available room increased 2.3% to US$76.89.

emphasis added

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.2015 was the best year on record for hotels.

So far 2016 is just behind 2015. Still a solid start to the year.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Fed's Flow of Funds: Household Net Worth increased in Q4

by Calculated Risk on 3/10/2016 12:38:00 PM

The Federal Reserve released the Q4 2015 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth increased in Q4 compared to Q3:

The net worth of households and nonprofits rose to $86.8 trillion during the fourth quarter of 2015. The value of directly and indirectly held corporate equities increased $758 billion and the value of real estate rose $458 billion.Household net worth was at $86.8 trillion in Q4 2015, up from $85.2 trillion in Q3.

The Fed estimated that the value of household real estate increased to $22.0 trillion in Q4 2015. The value of household real estate is still $0.5 trillion below the peak in early 2006 (not adjusted for inflation).

Click on graph for larger image.

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP. Household net worth, as a percent of GDP, is higher than the peak in 2006 (housing bubble), and above the stock bubble peak.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This ratio was increasing gradually since the mid-70s, and then we saw the stock market and housing bubbles.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q4 2015, household percent equity (of household real estate) was at 56.9% - up from Q3, and the highest since Q2 2006. This was because of an increase in house prices in Q4 (the Fed uses CoreLogic).

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 50+ million households with mortgages have far less than 56.7% equity - and several million still have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Mortgage debt increased by $22 billion in Q4.

Mortgage debt has declined by $1.27 trillion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

The value of real estate, as a percent of GDP, was up in Q4, and is somewhat above the average of the last 30 years (excluding bubble).

CoreLogic: "1 Million US Borrowers Regained Equity in 2015"

by Calculated Risk on 3/10/2016 09:58:00 AM

From CoreLogic: CoreLogic Reports 1 Million US Borrowers Regained Equity in 2015

CoreLogic ... today released a new analysis showing 1 million borrowers regained equity in 2015, bringing the total number of mortgaged residential properties with equity at the end of Q4 2015 to approximately 46.3 million, or 91.5 percent of all mortgaged properties. Nationwide, borrower equity increased year over year by $682 billion in Q4 2015. The CoreLogic analysis also indicates approximately 120,000 properties lost equity in the fourth quarter of 2015 compared to the third quarter of 2015.On states:

The total number of mortgaged residential properties with negative equity stood at 4.3 million, or 8.5 percent, in Q4 2015. This is an increase of 2.9 percent quarter over quarter from 4.2 million homes, or 8.3 percent, in Q3 2015 and a decrease of 19.1 percent year over year from 5.3 million homes, or 10.7 percent, compared with Q4 2014. ...

For the homes in negative equity status, the national aggregate value of negative equity was $311 billion at the end of Q4 2015, increasing approximately $5.5 billion, or 1.8 percent, from $305.5 billion in Q3 2015. On a year-over-year basis, the value of negative equity declined overall from $348 billion in Q4 2014, representing a decrease of 10.7 percent in 12 months.

...

“In Q4 of last year home equity increased by $680 billion or 11.5 percent, the 13th consecutive quarter of double digit growth," said Frank Nothaft, chief economist for CoreLogic. “The improvement in equity reflects positive home prices and continued deleveraging of mortgage balances by households.”

emphasis added

Nevada had the highest percentage of mortgaged residential properties in negative equity at 18.7 percent, followed by Florida (17.1 percent), Illinois (14.6 percent), Arizona (14 percent), and Rhode Island (13.5 percent). These top five states combined account for 30.8 percent of negative equity in the U.S., but only 16.5 percent of outstanding mortgages.Note: The share of negative equity is still very high in Nevada and Florida, but down from a year ago.

Click on graph for larger image.

Click on graph for larger image.This graph shows the distribution of home equity in Q4 2015 compared to Q3 2015. In Q4, approximately 3.0% of residential properties had 25% or more negative equity.

For reference, three years ago, in Q3 2012, 9.6% of residential properties had 25% or more negative equity.

Weekly Initial Unemployment Claims decrease to 259,000

by Calculated Risk on 3/10/2016 08:39:00 AM

The DOL reported:

In the week ending March 5, the advance figure for seasonally adjusted initial claims was 259,000, a decrease of 18,000 from the previous week's revised level. The previous week's level was revised down by 1,000 from 278,000 to 277,000. The 4-week moving average was 267,500, a decrease of 2,500 from the previous week's revised average. The previous week's average was revised down by 250 from 270,250 to 270,000.The previous week was revised down.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 267,500.

This was below the consensus forecast of 275,000. The low level of the 4-week average suggests few layoffs.

Wednesday, March 09, 2016

Thursday: Unemployment Claims, Quarterly Services, Flow of Funds

by Calculated Risk on 3/09/2016 07:27:00 PM

Brent oil prices closed above $40 today according to Bloomberg. WTI futures closed at $38.21.

From Reuters: U.S. crude hits three-month high on gasoline drawdown, OPEC speculation

Oil prices rose as much as 5 percent on Wednesday, with U.S. crude hitting three-month highs after a big gasoline inventory drawdown amid improving demand overshadowed growing record high crude stockpiles.Thursday:

Speculation that top producers might agree soon to an output freeze also supported crude oil.

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 275 thousand initial claims, down from 278 thousand the previous week.

• At 10:00 AM, the Q4 Quarterly Services Report from the Census Bureau.

• At 12:00 PM, Q4 Flow of Funds Accounts of the United States from the Federal Reserve.

• At 2:00 PM, The Monthly Treasury Budget Statement for February.

Update: Energy expenditures as a percentage of consumer spending

by Calculated Risk on 3/09/2016 04:11:00 PM

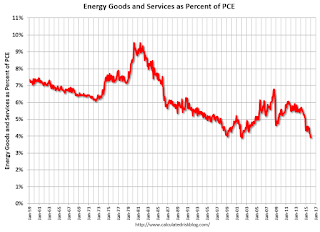

Here is a graph of expenditures on energy goods and services as a percent of total personal consumption expenditures through January 2016.

This is one of the measures that Professor Hamilton at Econbrowser looks at to evaluate any drag on GDP from energy prices.

Click on graph for larger image.

Data source: BEA Table 2.3.5U.

The huge spikes in energy prices during the oil crisis of 1973 and 1979 are obvious. As is the increase in energy prices during the 2001 through 2008 period.

In February 2016, WTI oil prices averaged close to $30 per barrel, down from $32 in January, so when PCE data for February is released on March 28th, we will probably see energy expenditures as a percent of PCE, were at all time lows. However, the new lows will not last long since oil prices have increased in March.

Update: Prime Working-Age Population Growing Again

by Calculated Risk on 3/09/2016 12:13:00 PM

An update: in 2014, I posted some demographic data for the U.S., see: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group, Decline in the Labor Force Participation Rate: Mostly Demographics and Long Term Trends, and The Future's so Bright ...

I pointed out that "even without the financial crisis we would have expected some slowdown in growth this decade (just based on demographics). The good news is that will change soon."

Changes in demographics are an important determinant of economic growth, and although most people focus on the aging of the "baby boomer" generation, the movement of younger cohorts into the prime working age is another key story. Here is a graph of the prime working age population (this is population, not the labor force) from 1948 through February 2016.

There was a huge surge in the prime working age population in the '70s, '80s and '90s - and the prime age population has been mostly flat recently (even declined a little).

The prime working age labor force grew even quicker than the population in the '70s and '80s due to the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s!

So when we compare economic growth to the '70s, '80, or 90's we have to remember this difference in demographics (the '60s saw solid economic growth as near-prime age groups increased sharply).

See: Demographics and GDP: 2% is the new 4%

The prime working age population peaked in 2007, and bottomed at the end of 2012. There are still fewer people in the 25 to 54 age group than in 2007.

The good news is the prime working age group has started to grow again, and is now growing at 0.5% per year - and this should boost economic activity. And it appears the prime working age group will exceed the previous peak later this year.

Demographics are now improving in the U.S.!

Update: U.S. Heavy Truck Sales

by Calculated Risk on 3/09/2016 10:01:00 AM

Update: The WSJ has an article last week: Truck Orders Plummeted 43% in February (ht Dividend Master). Maybe sales will decline in the coming months.

The following graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the February 2016 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the recession, falling to a low of 181 thousand in April 2009, on a seasonally adjusted annual rate basis (SAAR). Since then sales increased more than 2 1/2 times, and hit 491 thousand SAAR in November 2015.

Heavy truck sales declined in February to 440 thousand SAAR.

The level in November 2015 was the highest level since December 2006 (9 years ago). Sales have been above 400 thousand SAAR for 20 consecutive months, are now above the average (and median) of the last 20 years.

These are strong sales, especially considering the recent weakness in the oil sector.

Click on graph for larger image.

MBA: Mortgage Applications Increased in Latest Weekly Survey, Purchase Applications up 30% YoY

by Calculated Risk on 3/09/2016 07:00:00 AM

From the MBA: Purchase Apps Up, Refinance Apps Down in Latest MBA Weekly Survey

Mortgage applications increased 0.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 4, 2016.

...

The Refinance Index decreased 2 percent from the previous week. The seasonally adjusted Purchase Index increased 4 percent to the highest level since January 2016. The unadjusted Purchase Index increased 6 percent compared with the previous week and was 30 percent higher than the same week one year ago.

...

he average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 3.89 percent from 3.83 percent, with points decreasing to 0.38 from 0.39 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity was higher in 2015 than in 2014, but it was still the third lowest year since 2000.

Refinance activity has picked up recently as rates have declined.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 30% higher than a year ago.

Tuesday, March 08, 2016

Hilsenrath: Fed to "Keep Options Open for April or June"

by Calculated Risk on 3/08/2016 03:37:00 PM

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

It is pretty clear that there will not be a rate hike at the FOMC meeting next week, but the Fed will want to keep the April and June meetings in play.

From Jon Hilsenrath at the WSJ: Fed Likely to Stand Pat on Rates, Keep Options Open for April or June

Federal Reserve officials are likely to hold short-term interest rates steady at their policy meeting next week and leave open-ended when they’ll next raise rates given their uncertainties about markets and global growth.

For Fed Chairwoman Janet Yellen, that likely means crafting a message that gives the central bank flexibility to lift rates in April or June should the economy perform well in the weeks ahead, without committing to a move in case economic data disappoint or new market turmoil erupts.