by Calculated Risk on 10/28/2015 10:07:00 AM

Wednesday, October 28, 2015

Merrill on FOMC: Expect No "major changes in policy or language"

From Merrill Lynch:

The October FOMC meeting is unlikely to deliver any major changes in policy or language ... At this stage, we continue to see a relatively flat distribution for the timing of liftoff. December is our modal forecast for the first rate hike, but there is a significant chance that it could be later — depending on the upcoming data flow.

Markets are expecting a more dovish assessment of the outlook from the Fed, and the FOMC statement is likely to acknowledge that the recent US data have been more mixed since the September meeting. The FOMC may mark down their assessment of growth from moderate to modest, and may note that the pace of improvement in the labor market has slowed. They also may note the significant drag from inventory reduction and a widening trade deficit. However, watch for the possibility that the FOMC suggests that much of the current weakness should be short-lived — that would be a hawkish signal relative to market expectations for the first rate hike no earlier than March 2016.

...

The FOMC has tried to dissuade markets from expecting any explicit signals about upcoming policy changes, emphasizing data dependence. As such, we anticipate no meaningful changes to the policy guidance language. That should not be read as a sign the Fed will not hike in December; rather that they are keeping all options open. We still see a significant chance that the FOMC will hike this year ...

MBA: Mortgage Applications Decrease in Latest Weekly Survey, Purchase Applications up 23% YoY

by Calculated Risk on 10/28/2015 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 23, 2015. The previous week’s results included an adjustment for the Columbus Day holiday.

...

The Refinance Index decreased 4 percent from the previous week. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index increased 7 percent compared with the previous week and was 23 percent higher than the same week one year ago.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 3.98 percent from 3.95 percent, with points increasing to 0.44 from 0.43 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

Refinance activity remains low.

2014 was the lowest year for refinance activity since year 2000, and refinance activity will probably stay low for the rest of 2015.

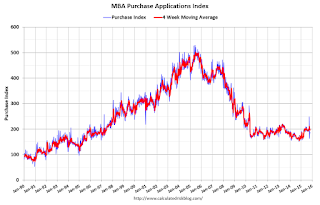

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 23% higher than a year ago.

Tuesday, October 27, 2015

Regional Fed Manufacturing Surveys Weak Again in October

by Calculated Risk on 10/27/2015 04:50:00 PM

Earlier from the Richmond Fed: Manufacturing Sector Activity Remained Soft; Volume of New Orders Leveled Off

Overall, manufacturing conditions remained soft in October. The composite index for manufacturing flattened to a reading of −1, following last month's reading of −5. Additionally, the index for new orders leveled off this month, gaining 12 points to end at 0. The index for shipments remained negative, losing one point to end at −4. Manufacturing employment continued to increase mildly this month. The indicator remained at a reading of 3 for a second month.This was the last of the regional Fed surveys for October. All of the regional surveys indicated contraction in October - although mostly slower than in September - and mostly due to weakness from oil and exports.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through October), and five Fed surveys are averaged (blue, through October) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through September (right axis).

It seems likely the ISM index will be weak again in October, and could possibly show contraction - a reading below 50. (although these regional surveys overemphasize oil producing areas). The early consensus is for an increase to 51.0 for the ISM index, from 50.2 in September.

Real Prices and Price-to-Rent Ratio in August

by Calculated Risk on 10/27/2015 01:22:00 PM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 4.7% year-over-year in August

The year-over-year increase in prices is mostly moving sideways now at between 4% and 5%.. In October 2013, the National index was up 10.9% year-over-year (YoY). In August 2015, the index was up 4.7% YoY.

Here is the YoY change since January 2014 for the National Index:

| Month | YoY Change |

|---|---|

| Jan-14 | 10.5% |

| Feb-14 | 10.1% |

| Mar-14 | 8.9% |

| Apr-14 | 7.9% |

| May-14 | 7.0% |

| Jun-14 | 6.3% |

| Jul-14 | 5.6% |

| Aug-14 | 5.1% |

| Sep-14 | 4.8% |

| Oct-14 | 4.6% |

| Nov-14 | 4.6% |

| Dec-14 | 4.5% |

| Jan-15 | 4.3% |

| Feb-15 | 4.2% |

| Mar-15 | 4.3% |

| Apr-15 | 4.3% |

| May-15 | 4.4% |

| Jun-15 | 4.5% |

| Jul-15 | 4.6% |

| Aug-15 | 4.7% |

Most of the slowdown on a YoY basis is now behind us. This slowdown in price increases this year was expected by several key analysts, and I think it is good news for housing and the economy.

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $276,000 today adjusted for inflation (38%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

It has been almost ten years since the bubble peak. In the Case-Shiller release this morning, the National Index was reported as being 6.7% below the bubble peak. However, in real terms, the National index is still about 20.6% below the bubble peak.

Nominal House Prices

The first graph shows the monthly Case-Shiller National Index SA, the monthly Case-Shiller Composite 20 SA, and the CoreLogic House Price Indexes (through August) in nominal terms as reported.

The first graph shows the monthly Case-Shiller National Index SA, the monthly Case-Shiller Composite 20 SA, and the CoreLogic House Price Indexes (through August) in nominal terms as reported.In nominal terms, the Case-Shiller National index (SA) is back to July 2005 levels, and the Case-Shiller Composite 20 Index (SA) is back to January 2005 levels, and the CoreLogic index (NSA) is back to July 2005.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to July 2003 levels, the Composite 20 index is back to April 2003, and the CoreLogic index back to January 2004.

In real terms, house prices are back to 2003 levels.

Note: CPI less Shelter is down 1.1% year-over-year, so this is pushing up real prices.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to May 2003 levels, the Composite 20 index is back to December 2002 levels, and the CoreLogic index is back to November 2003.

In real terms, and as a price-to-rent ratio, prices are back to 2003 levels - and the price-to-rent ratio maybe moving a little sideways now.

HVS: Q3 2015 Homeownership and Vacancy Rates

by Calculated Risk on 10/27/2015 11:00:00 AM

The Census Bureau released the Residential Vacancies and Homeownership report for Q3 2015.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate increased to 63.7% in Q3, from 63.4% in Q2.

I'd put more weight on the decennial Census numbers - and given changing demographics, the homeownership rate is probably close to a bottom.

This has been mostly moving sideways for the last 2+ years.

Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

I think the Reis quarterly survey (large apartment owners only in selected cities) is a much better measure of the rental vacancy rate, but this does suggest the rental vacancy rate might have bottomed.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey.

Case-Shiller: National House Price Index increased 4.7% year-over-year in August

by Calculated Risk on 10/27/2015 09:20:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for August ("August" is a 3 month average of June, July and August prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Widespread Gains in Home Prices for August According to the S&P/Case-Shiller Home Price Indices

The S&P/Case-Shiller U.S. National Home Price Index, covering all nine U.S. census divisions, recorded a slightly higher year-over-year gain with a 4.7% annual increase in August 2015 versus a 4.6% increase in July 2015. The 10-City Composite increased 4.7% in the year to August compared to 4.5% in the prior month. The 20-City Composite’s year-over-year gain was 5.1% versus 4.9% in the year to July.

...

Before seasonal adjustment, the National Index posted a gain of 0.3% month-over-month in August. The 10-City Composite and 20-City Composite both reported gains of 0.3% and 0.4% month-over-month respectively. After seasonal adjustment, the National Index posted a gain of 0.4%, while the 10-City and 20-City Composites both increased 0.1% month-over-month. Eighteen of 20 cities reported increases in August before seasonal adjustment; after seasonal adjustment, five were down, 11 were up, and four were unchanged.

...

“Home prices continue to climb at a 4% to 5% annual rate across the country,” says David M. Blitzer, Managing Director and Chairman of the Index Committee for S&P Dow Jones Indices.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 14.8% from the peak, and up 0.1% in August (SA).

The Composite 20 index is off 13.6% from the peak, and up 0.1% (SA) in August.

The National index is off 6.7% from the peak, and up 0.4% (SA) in August. The National index is up 26.1% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.7% compared to August 2014.

The Composite 20 SA is up 5.1% year-over-year..

The National index SA is up 4.7% year-over-year.

Prices increased (SA) in 13 of the 20 Case-Shiller cities in August seasonally adjusted. (Prices increased in 18 of the 20 cities NSA) Prices in Las Vegas are off 39.2% from the peak, and prices in Denver and Dallas are at new highs (SA).

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.As an example, at the peak, prices in Phoenix were 127% above the January 2000 level. Then prices in Phoenix fell slightly below the January 2000 level, and are now up 53% above January 2000 (53% nominal gain in almost 16 years).

These are nominal prices, and real prices (adjusted for inflation) are up about 40% since January 2000 - so the increase in Phoenix from January 2000 until now is about 12% above the change in overall prices due to inflation.

Two cities - Denver (up 68% since Jan 2000) and Dallas (up 51% since Jan 2000) - are above the bubble highs (a few other Case-Shiller Comp 20 city are close - Boston, Charlotte, San Francisco, Portland). Detroit prices are barely above the January 2000 level.

I'll have more on house prices later.

Monday, October 26, 2015

Tuesday: Case-Shiller House Prices, Durable Goods

by Calculated Risk on 10/26/2015 08:00:00 PM

From Nick Timiraos And Siobhan Hughes at the WSJ: White House and Boehner Close In on Budget Deal

The White House and Speaker John Boehner (R., Ohio) Monday were nearing a deal on a two-year budget plan that would also increase the federal debt limit, according to people familiar with the discussions.Tuesday:

...

A main object of the talks is to remove the risk that the government might default next month or face a partial government shutdown in December. A deal would suspend the debt limit into early 2017 and establish new spending levels through September 2017, according to people familiar with the discussions.

• At 8:30 AM ET, Durable Goods Orders for September from the Census Bureau. The consensus is for a 1.0% decrease in durable goods orders.

• At 9:00 AM, S&P/Case-Shiller House Price Index for August. Although this is the August report, it is really a 3 month average of June, July and August prices. The consensus is for a 5.1% year-over-year increase in the Comp 20 index for August. The Zillow forecast is for the National Index to increase 4.7% year-over-year in August.

• At 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for October.

• Also at 10:00 AM, the Q3 Housing Vacancies and Homeownership from the Census Bureau.

Vehicle Sales Forecast for October: Over 17 Million Annual Rate Again

by Calculated Risk on 10/26/2015 04:37:00 PM

The automakers will report October vehicle sales on Tuesday, November 3rd. Sales in September were at 18.1 million on a seasonally adjusted annual rate basis (SAAR), and it appears sales in October will be over 17 million SAAR again. Sales in September were boosted by the timing of Labor Day.

Note: There were 28 selling days in October, up from 27 in October 2014. Here are two forecasts:

From WardsAuto: Forecast: SAAR Expected to Remain Above 17 Million in October

WardsAuto forecast calls for October U.S. light-vehicle sales to reach a 17.5 million-unit seasonally adjusted annual rate, making it the sixth consecutive month above 17 million.From J.D. Power: October New-Vehicle Retail Sales Strongest in 15 years

The 17.5 million-unit SAAR would be higher than the 17.2 million recorded year-to-date through September and an 11-year peak for the month.

New-vehicle retail and total sales in October 2015 are expected to be the strongest for the month since 2001, according to a monthly sales forecast developed jointly by J.D. Power and LMC Automotive. ...Another solid month for auto sales, although I expect Volkswagen sales to be down year-over-year.

“September was a strong month—bolstered by the Labor Day weekend—so the expectation is that we would see some weakness is subsequent months, but that hasn’t been the case,” said John Humphrey, senior vice president of the global automotive practice at J.D. Power. “Through the first 18 days in October, retail sales are up 7 percent compared with the same period a year ago.” [17.4 million SAAR]

emphasis added

Comments on September New Home Sales

by Calculated Risk on 10/26/2015 01:18:00 PM

The new home sales report for September was well below expectations and sales for July and August were revised down. Sales were up only 2.0% year-over-year in September (SA). Overall this was a disappointing report.

Earlier: New Home Sales decreased to 468,000 Annual Rate in September.

Even though the September report was disappointing, sales are still up solidly year-to-date. The Census Bureau reported that new home sales this year, through September, were 392,000, not seasonally adjusted (NSA). That is up 17.6% from 333,000 sales during the same period of 2014 (NSA). That is a strong year-over-year gain for the first nine months of 2015!

In other words, no worries.

This graph shows new home sales for 2014 and 2015 by month (Seasonally Adjusted Annual Rate).

The year-over-year gain was weak in September, and I expect the year-over-year increases to be lower over the remaining months compared to earlier this year - but the overall year-over-year gain should be solid in 2015.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to move sideways (distressed sales will continue to decline and be partially offset by more conventional / equity sales). And I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales decreased to 468,000 Annual Rate in September

by Calculated Risk on 10/26/2015 10:14:00 AM

The Census Bureau reports New Home Sales in September were at a seasonally adjusted annual rate (SAAR) of 468 thousand.

The previous three months were revised down by a total of 39 thousand (SAAR).

"Sales of new single-family houses in September 2015 were at a seasonally adjusted annual rate of 468,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 11.5 percent below the revised August rate of 529,000, but is 2.0 percent above the September 2014 estimate of 459,000."

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales since the bottom, new home sales are still fairly low historically.

The second graph shows New Home Months of Supply.

The months of supply increased in September to 5.8 months.

The months of supply increased in September to 5.8 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of September was 225,000. This represents a supply of 5.8 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

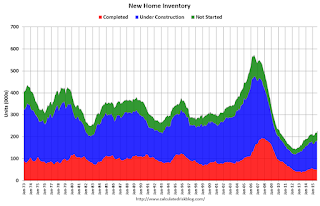

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In September 2015 (red column), 36 thousand new homes were sold (NSA). Last year 37 thousand homes were sold in September.

The all time high for August was 99 thousand in 2005, and the all time low for September was 24 thousand in 2011.

This was well below expectations of 549,000 sales SAAR in August, and prior months were revised down - a disappointing report. I'll have more later today.