by Calculated Risk on 9/28/2015 06:59:00 PM

Monday, September 28, 2015

Today in Fed Speak

Tuesday:

• At 9:00 AM ET, the S&P/Case-Shiller House Price Index for July. Although this is the July report, it is really a 3 month average of May, June and July prices. The consensus is for a 5.3% year-over-year increase in the Comp 20 index for July. The Zillow forecast is for the National Index to increase 4.6% year-over-year in July.

Today in Fed speak: This year, this year, and "middle of next year".

From NY Fed President William Dudley: Fed’s Dudley: Still Likely on Track for 2015 Rate Rise

“If the economy continues on the same trajectory it’s on…and everything else suggests that’s likely to continue…then there is a pretty strong case for lifting off” before 2015 ends, he said in a Wall Street Journal interview.From SF Fed President John Williams: The Economic Outlook: Live Long and Prosper

emphasis added

Looking forward, I expect that we’ll reach our maximum employment mandate in the near future and inflation will gradually move back to our 2 percent goal. In that context, it will make sense to gradually move away from the extraordinary stimulus that got us here. We already took a step in that direction when we ended QE3. And given the progress we’ve made and continue to make on our goals, I view the next appropriate step as gradually raising interest rates, most likely starting sometime later this year. Of course, that view is not immutable and will respond to economic developments over time.From Chicago Fed President Charles Evans: Thoughts on Leadership and Monetary Policy

Before raising rates, I would like to have more confidence than I do today that inflation is indeed beginning to head higher. Given the current low level of core inflation, some evidence of true upward momentum in actual inflation is critical to this assessment. I believe that it could well be the middle of next year before the headwinds from lower energy prices and the stronger dollar dissipate enough so that we begin to see some sustained upward movement in core inflation. After liftoff, I think it would be appropriate to raise the target interest rate very gradually. This would give us sufficient time to assess how the economy is adjusting to higher rates and the progress we are making toward our policy goals

ATA Trucking Index decreased 0.9% in August

by Calculated Risk on 9/28/2015 05:08:00 PM

From the ATA: ATA Truck Tonnage Index Fell 0.9% in August

AAmerican Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index declined 0.9% in August, following a revised increase of 3.1% during July. In August, the index equaled 134.2 (2000=100), down from 135.3 in July. The all-time high of 135.8 was reached in January 2015.

Compared with August 2014, the SA index increased 2.1%, which was below the 4% gain in July. Year-to-date through August, compared with the same period last year, tonnage was up 3.3%.

...

After such a robust July, it is not too surprising that tonnage took a breather in August,” said ATA Chief Economist Bob Costello. “The dip after a strong gain goes with the up and down pattern we’ve seen this year.”

Costello said a few factors hurt August’s reading, including soft housing starts and falling factory output.

“As I said last month, I remain concerned about the high level of inventories throughout the supply chain. This could have a negative impact on truck freight volumes over the next few months,” he said.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index is now up only 2.1% year-over-year.

Freddie Mac: Mortgage Serious Delinquency rate declined in August, Lowest since October 2008

by Calculated Risk on 9/28/2015 12:55:00 PM

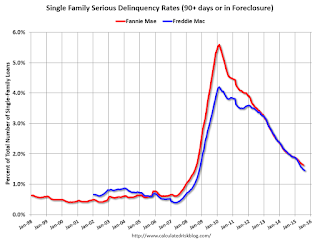

Freddie Mac reported that the Single-Family serious delinquency rate declined in August to 1.45%, down from 1.48% in July. Freddie's rate is down from 1.98% in August 2014, and the rate in August was the lowest level since October 2008.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Note: Fannie Mae will report their Single-Family Serious Delinquency rate for August later this week.

Although the rate is declining, the "normal" serious delinquency rate is under 1%.

The serious delinquency rate has fallen 0.53 percentage points over the last year, and at that rate of improvement, the serious delinquency rate will not be below 1% until the second half of 2016.

So even though delinquencies and distressed sales are declining, I expect an above normal level of Fannie and Freddie distressed sales through 2016 (mostly in judicial foreclosure states).

Dallas Fed: "Texas Manufacturing Activity Remains Steady" in September

by Calculated Risk on 9/28/2015 10:41:00 AM

From the Dallas Fed: Texas Manufacturing Activity Remains Steady

Texas factory activity was essentially flat in September, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, remained near zero (0.9), suggesting output held steady for a second month in a row after several months of declines.This was the last of the regional Fed surveys for September. All of the regional surveys indicated contraction in September, mostly due to weakness in oil producing areas.

...

Perceptions of broader business conditions remained weak in September. The general business activity index, which has been negative all year, rose 6 points to -9.5. The company outlook index plunged to -10.3 in August but recovered somewhat this month, climbing to -5.2.

Labor market indicators reflected employment declines and shorter workweeks. The September employment index posted a fifth consecutive negative reading, falling to -6.1.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through September), and five Fed surveys are averaged (blue, through September) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through August (right axis).

It seems likely the ISM index will be weak in September, and could possibly show contraction - a reading below 50. (although these regional surveys overemphasize oil producing areas). The consensus is for a decrease to 51.2 for the ISM index, from 51.6 in August.

NAR: Pending Home Sales Index decreased 1.4% in August, up 6% year-over-year

by Calculated Risk on 9/28/2015 10:02:00 AM

From the NAR: Pending Home Sales Retreat Again in August but Remain at Healthy Level

The Pending Home Sales Index, a forward–looking indicator based on contract signings, decreased 1.4 percent to 109.4 in August from 110.9 in July but is still 6.1 percent above August 2014 (103.1).This was below expectations of a 0.5% increase.

Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in September and October.

Personal Income increased 0.3% in August, Spending increased 0.4%

by Calculated Risk on 9/28/2015 08:42:00 AM

The BEA released the Personal Income and Outlays report for August:

Personal income increased $52.5 billion, or 0.3 percent ... according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $54.9 billion, or 0.4 percent.The following graph shows real Personal Consumption Expenditures (PCE) through August 2015 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.4 percent in August, compared with an increase of 0.3 percent in July. ... The price index for PCE increased 0.3 percent in May, compared with an increase of less than 0.1 percent in April. The PCE price index, excluding food and energy, increased 0.1 percent in May, the same increase as in April.

The August price index for PCE increased 0.3 percent from August a year ago. The August PCE price index, excluding food and energy, increased 1.3 percent from August a year ago.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was lower than expected. And the increase in PCE was above the 0.3% increase consensus. Including upward revisions, this was a strong report.

On inflation: The PCE price index increased 0.3 percent year-over-year due to the sharp decline in oil prices. The core PCE price index (excluding food and energy) increased 1.3 percent year-over-year in August.

Using the two-month method to estimate Q3 PCE growth, PCE was increasing at a 3.5% annual rate in Q3 2015 (using the mid-month method, PCE was increasing 3.3%). This suggests the estimates for Q3 GDP will be revised up.

Sunday, September 27, 2015

Monday: Personal Income and Outlays, Pending Home Sales

by Calculated Risk on 9/27/2015 07:52:00 PM

From the NY Times: John Boehner Says There Won’t Be a Government Shutdown

Speaker John A. Boehner said Sunday that he expects the House of Representatives to pass the Senate’s government funding measure with Democratic support this week, averting a shutdown that has looked increasingly less likely since he announced on Friday that he would resign.Who votes for these crazies? I hope Boehner is correct about no shutdown, but I'd like to see a backlash at the voting booth.

...

Mr. Boehner delivered a clear message to conservative colleagues credited with forcing his hand: Holding the government hostage to achieve untenable policy goals was reckless and harmful to the institution itself.

“We have got groups here in town, members of the House and Senate here in town, who whip people into a frenzy believing they can accomplish things that they know, they know are never going to happen,” Mr. Boehner said in a live interview broadcast on CBS’s “Face the Nation.”

The speaker described these conservative members of his party as “false prophets,” who promise policy victories they cannot deliver. “The Bible says, beware of false prophets,” he said. “And there are people out there spreading noise about how much can get done.”

Weekend:

• Schedule for Week of September 27, 2015

Monday:

• At 8:30 AM ET, Personal Income and Outlays for August. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 10:00 AM, Pending Home Sales Index for August. The consensus is for a 0.5% increase in the index.

• At 10:30 AM ET, Dallas Fed Manufacturing Survey for September.

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 12 and DOW futures are down 85 (fair value).

Oil prices were up slightly over the last week with WTI futures at $45.43 per barrel and Brent at $48.60 per barrel. A year ago, WTI was at $94, and Brent was at $95 - so prices are down about 50% year-over-year (It was a year ago that prices started falling sharply).

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.29 per gallon (down over $1.00 per gallon from a year ago).

A few comments on Possible Government Shutdown

by Calculated Risk on 9/27/2015 12:43:00 PM

There are two possible imminent government shutdowns by Congress. The first is related to a budget for the next fiscal year (starts October 1st) and the second is related to the so-called "debt ceiling" (really a question of paying the bills).

It is possible there will be a shutdown Wednesday evening due to disagreements on the budget. This will not have serious economic consequences, but it will have a negative impact on the economy, including (there would be much more) ...

• Shutdowns cost money (there are no savings; shutdowns are fiscally irresponsible).

• A number of services will be shutdown (as example, there will be a negative impact on mortgage applications and the National Parks will close).

• Several economic releases will be delayed. First up will be the September employment report scheduled for Friday. Depending on how long the shutdown lasts, other reports that could be delayed include CPI, housing starts, new home sales, trade deficit and much more.

A more serious issue will be if Congress doesn't agree to "pay the bills". The so-called "debt ceiling" will probably be reached in November, and failure to pay the bills would have serious economic consequences (that would start slow and build over time). It would be absolutely irresponsible to not pay the bills.

Hopefully there will be no shutdowns this year.

Saturday, September 26, 2015

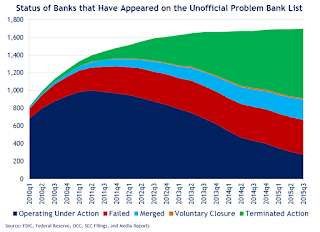

September 2015: Unofficial Problem Bank list declines to 276 Institutions, Q3 2015 Transition Matrix

by Calculated Risk on 9/26/2015 04:36:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for September 2015.

Changes and comments from surferdude808:

Update on the Unofficial Problem Bank List for September 2015. During the month, the list fell from 282 institutions to 276 after eight removals and two additions. Assets dropped by $683 million to an aggregate $82.0 billion. A year ago, the list held 432 institutions with assets of $136.8 billion.

Actions have been terminated against Virginia Community Bank, Louisa, VA ($215 million); US Metro Bank, Garden Grove, CA ($127 million); Freedom National Bank, Greenville, RI ($111 million); Amory Federal Savings and Loan Association, Amory, MS ($93 million Ticker: USMT); and Legacy Bank, Altoona, IA ($92 million).

Three banks found their way off the list by finding merger partners including Northwest Georgia Bank, Ringgold, GA ($286 million); The Patapsco Bank, Baltimore, MD ($219 million); and First Scottsdale Bank, National Association, Scottsdale, AZ ($96 million).

The additions this month were The National Capital Bank of Washington, Washington, DC ($420 million); and Anthem Bank & Trust, Plaquemine, LA ($136 million).

With it being the end of the third quarter, we bring an update on the transition matrix. Since the Unofficial Problem Bank List was first published on August 7, 2009 with 389 institutions, a total of 1,698 institutions have appeared on a weekly or monthly list at some point. There have been 1,422 institutions have come on and gone off the list. Departure methods include 785 action terminations, 393 failures, 230 mergers, and 14 voluntary liquidations. The third quarter of 2015 started with 309 institutions on the list, so the 25 action terminations during the quarter reduced the list by 8.1 percent. Of the 389 institutions on the first published list, 34 or 8.7 percent still remain six years later. The 393 failures are 23.1 percent of the 1,698 institutions that have appeared on the list. This failure rate is well above the 10-12 percent rate frequently cited in media reports on the failure rate of banks on the FDIC's official list.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 157 | (59,896,817) | |

| Unassisted Merger | 39 | (9,713,878) | |

| Voluntary Liquidation | 4 | (10,584,114) | |

| Failures | 155 | (184,358,339) | |

| Asset Change | (3,015,680) | ||

| Still on List at 9/30/2015 | 34 | 8,744,601 | |

| Additions after 8/7/2009 | 242 | 81,999,685 | |

| End (9/30/2015) | 376 | 87,456,390 | |

| Intraperiod Deletions1 | |||

| Action Terminated | 628 | 259,373,329 | |

| Unassisted Merger | 191 | 78,178,815 | |

| Voluntary Liquidation | 10 | 2,324,142 | |

| Failures | 238 | 119,574,853 | |

| Total | 1,067 | 459,451,139 | |

| 1Institution not on 8/7/2009 or 9/30/2015 list but appeared on a weekly list. | |||

Schedule for Week of September 27, 2015

by Calculated Risk on 9/26/2015 09:13:00 AM

Special Note: If Congress shuts down the government on Wednesday, the employment report will not be released on Friday.

The key report this week is the September employment report on Friday.

Other key indicators include the September ISM manufacturing index and September vehicle sales, both on Thursday.

There are several Federal Reserve speakers this week.

8:30 AM ET: Personal Income and Outlays for August. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

10:00 AM: Pending Home Sales Index for August. The consensus is for a 0.5% increase in the index.

10:30 AM: Dallas Fed Manufacturing Survey for September.

9:00 AM: S&P/Case-Shiller House Price Index for July. Although this is the July report, it is really a 3 month average of May, June and July prices.

9:00 AM: S&P/Case-Shiller House Price Index for July. Although this is the July report, it is really a 3 month average of May, June and July prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the June 2015 report (the Composite 20 was started in January 2000).

The consensus is for a 5.3% year-over-year increase in the Comp 20 index for July. The Zillow forecast is for the National Index to increase 4.6% year-over-year in July.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for September. This report is for private payrolls only (no government). The consensus is for 190,000 payroll jobs added in September, the same as in August.

9:45 AM: Chicago Purchasing Managers Index for September. The consensus is for a reading of 53.6, down from 54.4 in August.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 272 thousand initial claims, up from 267 thousand the previous week.

10:00 AM: ISM Manufacturing Index for September. The consensus is for the ISM to be at 50.5, down from 51.1 in August.

10:00 AM: ISM Manufacturing Index for September. The consensus is for the ISM to be at 50.5, down from 51.1 in August.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 51.1% in August. The employment index was at 51.2%, and the new orders index was at 51.6%.

10:00 AM: Construction Spending for August. The consensus is for a 0.7% increase in construction spending.

All day: Light vehicle sales for September. The consensus is for light vehicle sales to decrease to 17.5 million SAAR in September from 17.7 million in August (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for September. The consensus is for light vehicle sales to decrease to 17.5 million SAAR in September from 17.7 million in August (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the August sales rate.

8:30 AM: Employment Report for September. The consensus is for an increase of 203,000 non-farm payroll jobs added in September, up from the 173,000 non-farm payroll jobs added in August.

The consensus is for the unemployment rate to be unchanged at 5.1%.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In August, the year-over-year change was over 2.9 million jobs.

As always, a key will be the change in real wages - and as the unemployment rate falls, wage growth should pickup.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for August. The consensus is a 1.3% decrease in orders.