by Calculated Risk on 8/29/2015 04:01:00 PM

Saturday, August 29, 2015

August 2015: Unofficial Problem Bank list declines to 282 Institutions

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for August 2015.

Changes and comments from surferdude808:

Update on the Unofficial Problem Bank List for August 2015. During the month, the list fell from 290 institutions to 282 after nine removals and one addition. Assets dropped by $1.2 billion to an aggregate $82.7 billion. The asset total was updated to reflect second quarter figures, which resulted in a small decline of $95 million. A year ago, the list held 439 institutions with assets of $139.97 billion. This week, we were anticipating for the FDIC to release second quarter industry results and an update on the Official Problem Bank List, but that will have to wait until next month's update.

Actions have been terminated against Bank of the Carolinas, Mocksville, NC ($363 million); Oxford Bank, Oxford, MI ($304 million Ticker: OXBC); Bank of the Rockies, National Association, White Sulphur Springs, MT ($131 million); Madison Bank, Richmond, KY ($123 million); and Bank of Monticello, Monticello, GA ($96 million).

Several banks merged to find their way off the problem bank list including First National Bank of Wauchula, Wauchula, FL ($76 million); Pineland State Bank, Metter, GA ($55 million); The Elkhart State Bank, Elkhart, TX ($43 million); and SouthBank, a Federal Savings Bank, Palm Beach Gardens, FL ($20 million).

Added this month was OSB Community Bank, Brooklyn, MI ($72 million). In addition, the Federal Reserve issued a Prompt Corrective Action order against Cecil Bank, Elkton, MD ($302 million).

Schedule for Week of August 30, 2015

by Calculated Risk on 8/29/2015 08:31:00 AM

The key report this week is the August employment report on Friday.

Other key indicators include the August ISM manufacturing index and August vehicle sales, both on Tuesday, and the July Trade Deficit on Thursday.

9:45 AM: Chicago Purchasing Managers Index for August. The consensus is for a reading of 54.9, up from 54.7 in July.

10:30 AM: Dallas Fed Manufacturing Survey for August.

10:00 AM: ISM Manufacturing Index for August. The consensus is for the ISM to be at 52.8, up from 52.7 in July.

10:00 AM: ISM Manufacturing Index for August. The consensus is for the ISM to be at 52.8, up from 52.7 in July.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 52.7% in July. The employment index was at 52.7%, and the new orders index was at 56.5%.

10:00 AM: Construction Spending for July. The consensus is for a 0.8% increase in construction spending.

All day: Light vehicle sales for August. The consensus is for light vehicle sales to decrease to 173 million SAAR in August from 17.5 million in July (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for August. The consensus is for light vehicle sales to decrease to 173 million SAAR in August from 17.5 million in July (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the July sales rate.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for August. This report is for private payrolls only (no government). The consensus is for 210,000 payroll jobs added in August, up from 185,000 in July.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for July. The consensus is a 0.9% increase in orders.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 273 thousand initial claims, up from 271 thousand the previous week.

8:30 AM: Trade Balance report for July from the Census Bureau.

8:30 AM: Trade Balance report for July from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through June. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $42.9 billion in July from $42.8 billion in June.

10:00 AM: the ISM non-Manufacturing Index for August. The consensus is for index to decrease to 58.5 from 60.3 in July.

8:30 AM: Employment Report for August. The consensus is for an increase of 223,000 non-farm payroll jobs added in August, up from the 215,000 non-farm payroll jobs added in July.

The consensus is for the unemployment rate to decrease to 5.2%.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In July, the year-over-year change was over 2.9 million jobs.

As always, a key will be the change in real wages - and as the unemployment rate falls, wage growth should pickup.

Friday, August 28, 2015

Fed's Vice Chair Fischer: “When the case is overwhelming, if you wait that long, then you’ve waited too long.”

by Calculated Risk on 8/28/2015 08:43:00 PM

Note: Tomorrow, Saturday, at 12:25 PM ET, Fed Vice Chairman Stanley Fischer will speak at the Jackson Hole Symposium on "U.S. Inflation Developments"

A couple of quotes from earlier today ...

From Binyamin Appelbaum at the NY Times: Fed Official Fischer Leaves Door Open for September Rate Increase

Mr. Fischer said the Fed was preparing to raise interest rates soon because of the “impressive” growth of the domestic economy. He suggested that the recent volatility of global financial markets could cause the Fed to hesitate, but only if it persisted.September is still possible, although many economists are now looking at December for the first rate hike.

“We haven’t made a decision yet, and I don’t think we should,” Mr. Fischer said in an interview with the cable network CNBC. “We’ve got time to wait and see,” because the Fed’s policy-making committee does not meet until Sept. 16 and 17.

...

Mr. Fischer also emphasized Friday that the Fed would not wait until all of its questions were answered. Some amount of uncertainty is inevitable. “When the case is overwhelming, if you wait that long,” he said, “then you’ve waited too long.”

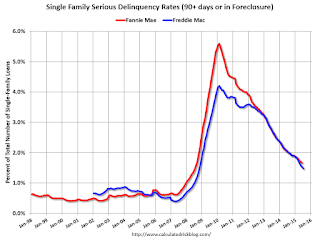

Freddie Mac: Mortgage Serious Delinquency rate declined in July, Lowest since October 2008

by Calculated Risk on 8/28/2015 03:04:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate declined in July to 1.48%, down from 1.53% in June. Freddie's rate is down from 2.02% in July 2014, and the rate in July was the lowest level since October 2008.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Note: Fannie Mae will report their Single-Family Serious Delinquency rate for July next week.

Although the rate is declining, the "normal" serious delinquency rate is under 1%.

The serious delinquency rate has fallen 0.54 percentage points over the last year, and at that rate of improvement, the serious delinquency rate will not be below 1% until mid-2016.

So even though delinquencies and distressed sales are declining, I expect an above normal level of Fannie and Freddie distressed sales through 2016 (mostly in judicial foreclosure states).

Vehicle Sales Forecasts for August: Over 17 Million Annual Rate Again

by Calculated Risk on 8/28/2015 11:49:00 AM

The automakers will report August vehicle sales on Tuesday, Sept 1. Sales in July were at 17.5 million on a seasonally adjusted annual rate basis (SAAR), and it appears sales in August will be over 17 million SAAR again.

Note: There were 26 selling days in August, down from 27 in August 2014 (Also note: Labor Day is not included in August this year). Here are two forecasts:

From J.D. Power: Industry Strength Continues in August, Full-Month Volume Impacted by Calendar

For the first time since 2012, new-vehicle sales over the Labor Day weekend will be tallied as part of September’s sales rather than counted in August’s number. Even when the Labor Day holiday falls in early September, its sales are often part of the August total, but not this year when the holiday lands on Sept. 7.From Kelley Blue Book: New-Car Sales To Drop 4 Percent In August 2015, According To Kelley Blue Book

...

New-vehicle retail sales are projected to hit 1.3 million units in August, a 1.2 percent decrease on a selling-day adjusted basis, compared with August 2014. ... [Total forecast 17.2 million SAAR]

“On a year-over-year basis, August sales are going to appear weak, when in fact it’s really a variance in the numbers created by the calendar,” said John Humphrey, senior vice president of the global automotive practice at J.D. Power.“There certainly is no cause for alarm. In fact, the daily selling rate month-to-date in August is trending 8 percent higher than the same period a year ago, although we do anticipate the absence of the holiday in August sales will diminish that rate by the end of the month.

“Our expectation is that with Labor Day falling in September, sales that would have occurred this month are being pushed into next month. If that happens, September will move sales back to the strong trend line we’ve been seeing throughout the year.”

emphasis added

New-vehicle sales are expected to decline 4 percent year-over-year to a total of 1.52 million units in August 2015, resulting in an estimated 17.2 million seasonally adjusted annual rate (SAAR), according to Kelley Blue BookAnother solid month for auto sales - although some reporting will ignore the calendar issues (Labor Day not included in August this year).

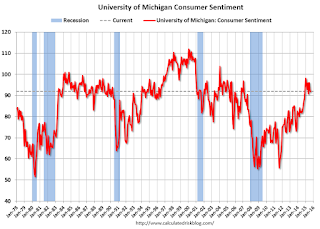

Final August Consumer Sentiment at 91.9

by Calculated Risk on 8/28/2015 10:03:00 AM

The final University of Michigan consumer sentiment index for August was at 91.9, down from the preliminary reading of 92.9, and down from 93.1 in July.

This was below the consensus forecast of 93.3.

Personal Income increased 0.4% in July, Spending increased 0.3%

by Calculated Risk on 8/28/2015 08:39:00 AM

The BEA released the Personal Income and Outlays report for July:

Personal income increased $67.1 billion, or 0.4 percent ... in July, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $37.4 billion, or 0.3 percent.The following graph shows real Personal Consumption Expenditures (PCE) through July 2015 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.2 percent in July, compared with an increase of less than 0.1 percent in June. ... The price index for PCE increased 0.3 percent in May, compared with an increase of less than 0.1 percent in April. The PCE price index, excluding food and energy, increased 0.1 percent in May, the same increase as in April.

The July price index for PCE increased 0.3 percent from July a year ago. The July PCE price index, excluding food and energy, increased 1.2 percent from July a year ago.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was at consensus expectations. And the increase in PCE was slightly below the consensus.

On inflation: The PCE price index increased 0.3 percent year-over-year due to the sharp decline in oil prices. The core PCE price index (excluding food and energy) increased 1.2 percent year-over-year in July.

Thursday, August 27, 2015

Friday: July Personal Income and Outlays, Consumer Sentiment

by Calculated Risk on 8/27/2015 09:01:00 PM

A couple of excerpts from a Merrill Lynch research note, first on the possibility of a September rate hike, and second their forecast for August NFP:

Markets are now pricing a fairly slim chance that the Fed will hike in September, taking to heart the remarks by New York Fed President Bill Dudley midweek that liftoff in September looks “less compelling.” We think a more careful reading of Dudley’s comments suggests that September has not been ruled out. Meanwhile, Vice Chair Stanley Fischer speaks at Jackson Hole this weekend. His comments on inflation and the markets will be most noteworthy, and we expect him to suggest that September remains viable provided the data continue to cooperate and market volatility fades.CR Note: a September rate hike is still on the table, and Fischer's talk on Saturday will be important.

Note: Saturday at 12:25 PM ET, Speech by Fed Vice Chairman Stanley Fischer, U.S. Inflation Developments, At the Federal Reserve Bank of Kansas City Economic Symposium, Jackson Hole, Wyoming

And from Merrill on August NFP:

Payrolls likely grew by a healthy 200,000 in August, not far from the 6-month moving average of 210,000. A pick-up in hiring in the household survey could also nudge the jobless rate down to 5.2% from 5.3% — a sign that labor market slack continues to diminish. Average hourly earnings should rise by a steady 0.2% mom, but softer base-year effects will take the yoy rate down a tenth of a percent to 2.0%.Friday:

• At 8:30 AM ET, Personal Income and Outlays for July. The consensus is for a 0.4% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 10:00 AM, University of Michigan's Consumer sentiment index (final for August). The consensus is for a reading of 93.3, up from the preliminary reading of 92.9.

MBA on Housing Demand from 2014 to 2024

by Calculated Risk on 8/27/2015 05:29:00 PM

The Mortgage Bankers Association released a new report this week: Demographics and the Numbers Behind the Coming Multi-Million increase in Households by Lynn Fisher and Jamie Woodwell.

The report has some great section titles such as "Demographics is Destiny" and "35 is the new 25". These are two topics I've written about extensively. See: Demographics and Behavior and Are Multi-Family Housing Starts near a peak?

The MBA estimates the number of households will increase by between 13.8 million and 15.8 million over the next decade. Add in some demolitions and some second home buying, and that would suggest housing starts of well over 1.5 million per year. Housing starts are running at about 1.1 million so far this year (1.2 million SAAR in July). This would suggest a further increase in starts.

The MBA presents two scenarios (both seem plausible although I haven't checked the numbers).

Under these conditions, the U.S. will see 15.9 million additional households — 12.7 million owner households (versus 10.3 million in scenario 1) and 3.1 million renter households (versus 5.6 million in scenario 1) — over the next ten years.Both scenarios suggest a shift to more owner built units (and more new home sales).

Note: For a current look at household formation, economist Jed Kolko wrote last week: Who Is Actually Forming New Households?

Early Look at 2016 Cost-Of-Living Adjustments and Maximum Contribution Base

by Calculated Risk on 8/27/2015 01:01:00 PM

The BLS reported this last week:

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) decreased 0.3 percent over the last 12 months to an index level of 233.806 (1982-84=100). For the month, the index was essentially unchanged prior to seasonal adjustment.CPI-W is the index that is used to calculate Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and is not seasonally adjusted (NSA).

Since the highest Q3 average was last year (Q3 2014), at 234.242, we only have to compare to last year.

Click on graph for larger image.

Click on graph for larger image.This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Note: The year labeled for the calculation, and the adjustment is effective for December of that year (received by beneficiaries in January of the following year).

By law, COLA can't be negative, so if the average for CPI-W is down year-over-year, COLA is set to zero (no adjustment).

CPI-W was down 0.3% year-over-year in July. This is early - we need the data for August and September - but if gasoline prices continue to decline, COLA could be zero this year.

Contribution and Benefit Base

The law prohibits an increase in the contribution and benefit base if COLA is not greater than zero. However if the there is even a small increase in COLA, the contribution base will be adjusted using the National Average Wage Index.

From Social Security: Method for determining the base

The formula for determining the OASDI contribution and benefit base is set by law. The formula is applicable only if a cost-of-living increase becomes effective for December of the year in which a determination of the base would ordinarily be made. ...This is based on a one year lag. The National Average Wage Index is not available for 2014 yet, but wages probably increased again in 2014. If wages increased the same as last year, then the contribution base next year will be increased to around $120,000 from the current $118,500. However, if COLA is zero, the contribution base will remain at $118,500.

Remember - this is an early look. What matters is average CPI-W for all three months in Q3 (July, August and September).