by Calculated Risk on 9/01/2015 12:25:00 PM

Tuesday, September 01, 2015

CoreLogic: House Prices up 6.9% Year-over-year in July

Notes: This CoreLogic House Price Index report is for July. The recent Case-Shiller index release was for June. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports Home Prices Rose by 6.9 Percent Year Over Year in July

Home prices, including distressed sales, increased 6.9 percent in July 2015 compared to July 2014. June marks the 41st consecutive month of year-over-year home price gains.

Excluding distressed sales, home prices increased by 6.7 percent year over year in July.

On a month-over-month basis, home prices increased by 1.7 percent in July compared to June data. Excluding distressed sales, home prices were up 1.5 percent month over month in July 2015.

Home prices nationwide remain 6.6 percent below their peak, which was set in April 2006.

emphasis added

Click on graph for larger image.

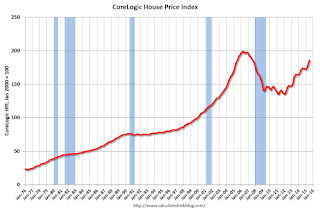

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 1.7% in July (NSA), and is up 6.9% over the last year.

This index is not seasonally adjusted, and this was a solid month-to-month increase.

The second graph is from CoreLogic. The year-over-year comparison has been positive for forty one consecutive months.

The second graph is from CoreLogic. The year-over-year comparison has been positive for forty one consecutive months.The YoY increase had been moving sideways over most of the last year, but has picked up recently.

Construction Spending increased 0.7% in July

by Calculated Risk on 9/01/2015 11:03:00 AM

The Census Bureau reported that overall construction spending increased in July:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during July 2015 was estimated at a seasonally adjusted annual rate of $1,083.4 billion, 0.7 percent above the revised June estimate of $1,075.9 billion. The July figure is 13.7 percent above the July 2014 estimate of $952.5 billionPrivate spending increased and public spending decreased:

Spending on private construction was at a seasonally adjusted annual rate of $787.8 billion, 1.3 percent above the revised June estimate of $777.4 billion. ...Note: Non-residential for offices and hotels is generally increasing, but spending for oil and gas has been declining. Early in the recovery, there was a surge in non-residential spending for oil and gas (because oil prices increased), but now, with falling prices, oil and gas is a drag on overall construction spending.

In July, the estimated seasonally adjusted annual rate of public construction spending was $295.6 billion, 1.0 percent below the revised June estimate of $298.5 billion.

emphasis added

As an example, construction spending for private lodging is up 41% year-over-year, whereas spending for power (includes oil and gas) construction peaked in mid-2014 and is down 13% year-over-year.

Click on graph for larger image.

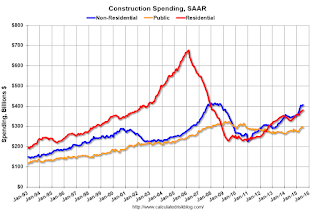

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has been increasing recently, and is 44% below the bubble peak.

Non-residential spending is only 2% below the peak in January 2008 (nominal dollars).

Public construction spending is now 9% below the peak in March 2009 and about 12% above the post-recession low.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 16%. Non-residential spending is up 18% year-over-year. Public spending is up 6% year-over-year.

Looking forward, all categories of construction spending should increase in 2015. Residential spending is still very low, non-residential is increasing (except oil and gas), and public spending has also increasing after several years of austerity.

This was close to the consensus forecast of a 0.8% increase, and spending for May and June was revised up. Overall, another solid construction report.

ISM Manufacturing index decreased to 51.1 in August

by Calculated Risk on 9/01/2015 10:03:00 AM

The ISM manufacturing index suggested expansion in August. The PMI was at 51.1% in August, down from 52.7% in July. The employment index was at 51.2%, down from 52.7% in July, and the new orders index was at 51.6%, down from 56.5%.

From the Institute for Supply Management: August 2015 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in August for the 32nd consecutive month, and the overall economy grew for the 75th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The August PMI® registered 51.1 percent, a decrease of 1.6 percentage points from the July reading of 52.7 percent. The New Orders Index registered 51.7 percent, a decrease of 4.8 percentage points from the reading of 56.5 percent in July. The Production Index registered 53.6 percent, 2.4 percentage points below the July reading of 56 percent. The Employment Index registered 51.2 percent, 1.5 percentage points below the July reading of 52.7 percent. Inventories of raw materials registered 48.5 percent, a decrease of 1 percentage point from the July reading of 49.5 percent. The Prices Index registered 39 percent, down 5 percentage points from the July reading of 44 percent, indicating lower raw materials prices for the 10th consecutive month. The New Export Orders Index registered 46.5 percent, down 1.5 percentage points from the July reading of 48 percent. Comments from the panel reflect a mix of modest to strong growth depending upon the specific industry, the positive impact of lower raw materials prices, but also a continuing concern over export growth."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 52.8%, and indicates slower manufacturing expansion in August.

Monday, August 31, 2015

Tuesday: ISM Mfg Index, Construction Spending, Auto Sales

by Calculated Risk on 8/31/2015 07:59:00 PM

From Tim Duy: Does 25bp Make A Difference?

Bottom Line: I am coming around to the belief that the timing of the first rate hike is more important than Fed officials would like us to believe. The lack of consensus regarding the timing of the first hike tells me that we don't fully understand the Fed's reaction function and, importantly, their confidence in their estimates of the natural rate of unemployment. The timing of the first hike will thus define that reaction function and thus send an important signal about the Fed's overall policy intentions.Tuesday:

• At 10:00 AM ET, the ISM Manufacturing Index for August. The consensus is for the ISM to be at 52.8. The ISM manufacturing index indicated expansion at 52.7% in July. The employment index was at 52.7%, and the new orders index was at 56.5%.

• Also t 10:00 AM, Construction Spending for July. The consensus is for a 0.8% increase in construction spending.

• All day, Light vehicle sales for August. The consensus is for light vehicle sales to decrease to 17.3 million SAAR in August from 17.5 million in July (Seasonally Adjusted Annual Rate).

Fannie Mae: Mortgage Serious Delinquency rate declined in July, Lowest since August 2008

by Calculated Risk on 8/31/2015 05:01:00 PM

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined in July to 1.63% from 1.66% in June. The serious delinquency rate is down from 2.00% in July 2014, and this is the lowest level since August 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate has only fallen 0.37 percentage points over the last year - the pace of improvement has slowed - and at that pace the serious delinquency rate will not be below 1% until 2017.

The "normal" serious delinquency rate is under 1%, so maybe Fannie Mae serious delinquencies will be close to normal some time in 2017. This elevated delinquency rate is mostly related to older loans - the lenders are still working through the backlog.

Restaurant Performance Index increased in July

by Calculated Risk on 8/31/2015 01:45:00 PM

Here is a minor indicator I follow from the National Restaurant Association: Stronger sales, traffic in July boost RPI

Driven by stronger same-store sales and customer traffic levels, the National Restaurant Association’s Restaurant Performance Index (RPI) posted a solid gain in July.

The RPI stood at 102.7 in July, up 0.7 percent from June and the first gain in three months. In addition, July represented the 29th consecutive month in which the RPI stood above 100, which signifies expansion in the index of key industry indicators.

“July’s RPI gain was fueled primarily by an improvement in the current situation indicators,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “Although a solid majority of operators reported higher same-store sales and customer traffic levels in July, their outlook for both sales growth and the economy is more cautious compared to recent months.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The index increased to 102.7 in July, up from 102.0 in June. (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month. Even with the decline in the index, this is a solid reading.

It appears restaurants are benefiting from lower gasoline prices.

Dallas Fed: "Texas Manufacturing Activity Holds Steady, but Outlooks Deteriorate"

by Calculated Risk on 8/31/2015 10:46:00 AM

From the Dallas Fed: Texas Manufacturing Activity Holds Steady, but Outlooks Deteriorate

Texas factory activity was essentially flat in August, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, climbed to near zero (-0.8), suggesting output held steady after five months of declines.This was the last of the regional Fed surveys for August. Three of the five surveys indicated contraction in August, mostly due to weakness in oil producing areas.

...

Perceptions of broader business deteriorated markedly in August. The general business activity index dropped 11 points from -4.6 to -15.8, and the company outlook index also posted a double-digit decline, coming in at -10.3.

...

Labor market indicators reflected slight employment declines and stable workweek length. The August employment index was negative for a fourth month in a row but edged up to -1.4.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through August), and five Fed surveys are averaged (blue, through August) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through July (right axis).

It seems likely the ISM index will be weak in August, and will possibly decrease from the July level (although these regional surveys overemphasize oil producing areas). The consensus is for an increase to 52.8 for the ISM index, from 52.7 in July.

Chicago PMI decreases slightly in August

by Calculated Risk on 8/31/2015 09:57:00 AM

Chicago PMI: August Chicago Business Barometer Down 0.3 Point to 54.4

The Chicago Business Barometer held on to most of July’s gain, falling just a fraction to 54.4 in August from 54.7 in July. While below the highs seen towards the end of last year, it’s still consistent with a bounceback in activity in the third quarter following recent weaker growth.This was below the consensus forecast of 54.7.

...

Chief Economist of MNI Indicators Philip Uglow said, “It was pretty much steady as she goes in August with orders and output just about holding on to July‘s gains. While the slowdown earlier in the year looks temporary, we‘re still some way below the strong growth rates seen towards the end of 2014“

emphasis added

Sunday, August 30, 2015

Sunday Night Futures

by Calculated Risk on 8/30/2015 08:27:00 PM

A September rate hike is still on the table, from Jon Hilsenrath and Ben Leubsdorf at the WSJ: Fed Appears to Hold Line on Rate Plan

Federal Reserve officials emerged from a week of head-spinning financial turbulence largely sticking to their plan to raise U.S. interest rates before the end of the year.Weekend:

During the Federal Reserve Bank of Kansas City’s annual economic symposium here, many policy makers signaled that stock-market volatility and China’s woes haven’t seriously dented their view that the U.S. job market is improving, and that domestic economic output is expanding at a steady, modest pace.

...

“There is good reason to believe that inflation will move higher as the forces holding inflation down—oil prices and import prices, particularly—dissipate further,” said Fed Vice Chairman Stanley Fischer in comments delivered to the conference, which ended Saturday.

• Schedule for Week of August 30, 2015

Monday:

• At 9:45 AM ET, the Chicago Purchasing Managers Index for August. The consensus is for a reading of 54.9, up from 54.7 in July.

• At 10:30 AM, the Dallas Fed Manufacturing Survey for August.

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 18 and DOW futures are down 140 (fair value).

Oil prices were up over the last week with WTI futures at $44.85 per barrel and Brent at $49.41 per barrel. A year ago, WTI was at $98, and Brent was at $101 - so prices are down over 50% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.47 per gallon (down almost $1.00 per gallon from a year ago). Gasoline prices will probably continue to decline over the next month or more (follow oil prices down).

Vehicle Sales Forecast for August: Over 17 Million Annual Rate Again

by Calculated Risk on 8/30/2015 12:30:00 PM

The automakers will report August vehicle sales on Tuesday, Sept 1. Sales in July were at 17.5 million on a seasonally adjusted annual rate basis (SAAR), and it appears sales in August will be over 17 million SAAR again.

Note: There were 26 selling days in August, down from 27 in August 2014 (Also note: Labor Day is not included in August this year). Here is another forecast:

From WardsAuto: Forecast: LV SAAR Should Hold Steady in August

A new WardsAuto forecast calls for strong U.S. light-vehicle sales in August, extending a streak of light-vehicle SAARs that round to at least 17 million units.

The report calls for automakers to sell 1.53 million LVs in the U.S. this month, for a daily sales rate of 58,866 units (over 26 days), a 0.7% improvement over same-month year-ago (27 days). The modest increase actually represents a more meaningful year-over-year gain since last August’s official sales reports included Labor Day weekend sales, which lifted the daily sales rate for the entire month. This year, the heavily-incentivized holiday-weekend sales will fall entirely in September.

The forecasted seasonally adjusted rate of 17.3 million-units would make August the fourth consecutive month with an LV SAAR of at least 17 million and mark the longest such streak since a 12-month run ending in June 2002.