by Calculated Risk on 5/19/2015 04:15:00 PM

Tuesday, May 19, 2015

Quarterly Housing Starts by Intent

In addition to housing starts for April, the Census Bureau also released the Q1 "Started and Completed by Purpose of Construction" report today.

It is important to remember that we can't directly compare single family housing starts to new home sales. For starts of single family structures, the Census Bureau includes owner built units and units built for rent that are not included in the new home sales report. For an explanation, see from the Census Bureau: Comparing New Home Sales and New Residential Construction

We are often asked why the numbers of new single-family housing units started and completed each month are larger than the number of new homes sold. This is because all new single-family houses are measured as part of the New Residential Construction series (starts and completions), but only those that are built for sale are included in the New Residential Sales series.However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis.

The quarterly report released today showed there were 112,000 single family starts, built for sale, in Q1 2015, and that was below the 129,000 new homes sold for the same quarter, so inventory decreased in Q1 (Using Not Seasonally Adjusted data for both starts and sales).

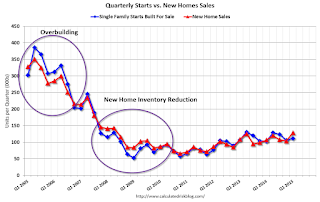

The first graph shows quarterly single family starts, built for sale and new home sales (NSA).

Click on graph for larger image.

Click on graph for larger image.In 2005, and most of 2006, starts were higher than sales, and inventories of new homes increased. The difference on this graph is pretty small, but the builders were starting about 30,000 more homes per quarter than they were selling (speculative building), and the inventory of new homes soared to record levels. Inventory of under construction and completed new home sales peaked at 477,000 in Q3 2006.

In 2008 and 2009, the home builders started far fewer homes than they sold as they worked off the excess inventory that they had built up in 2005 and 2006.

Now it looks like builders are generally starting about the same number of homes that they are selling, and the inventory of under construction and completed new home sales is still very low.

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions). This is not perfect because of the handling of cancellations, but it does suggest the builders are keeping inventories under control.

The second graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Single family starts built for sale were up about 9% compared to Q1 2014.

Single family starts built for sale were up about 9% compared to Q1 2014. Owner built starts were down 4% year-over-year. And condos built for sale are just above the record low.

The 'units built for rent' has increased significantly over the last few years, but was only 1% compared to Q1 2014.

Sacramento Housing in April: Total Sales up 9% Year-over-year

by Calculated Risk on 5/19/2015 01:27:00 PM

During the recession, I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For some time, not much changed. But over the last 2+ years we've seen some significant changes with a dramatic shift from foreclosures (REO: lender Real Estate Owned) to short sales, and the percentage of total distressed sales declining sharply.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In April, 11.9% of all resales were distressed sales. This was down from 12.4% last month, and down from 16.3% in April 2014. Since distressed sales happen year round, but conventional sales decline in December and January, the percent of distressed sales bumps up in the winter (seasonal).

The percentage of REOs was at 6.5%, and the percentage of short sales was 5.5%.

Here are the statistics.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional (equity) sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes increased 26.0% year-over-year (YoY) in April. In general the YoY increases have been trending down after peaking at close to 100%, however the YoY increase was slightly larger in April than in March.

Cash buyers accounted for 16.4% of all sales (frequently investors).

Total sales were up 8.9% from April 2014, and conventional equity sales were up 14.6% compared to the same month last year.

Summary: This data suggests a healing market with fewer distressed sales, more equity sales, and less investor buying.

Comments on April Housing Starts

by Calculated Risk on 5/19/2015 11:15:00 AM

So much for the doom and gloom of February and March.

Total housing starts in April were solid and well above expectations - and at the highest level since 2007.

Single family starts were at the highest level since January 2008.

This first graph shows the month to month comparison between 2014 (blue) and 2015 (red).

Even with weak housing starts in February and March, total starts are still running 5.5% ahead of 2014 through April.

Single family starts are running 7.6% ahead of 2014 through April.

Starts for 5+ units are only up 1% for the first four months compared to last year.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years, and completions (red line) have lagged behind - but completions have been catching up (more deliveries), and will continue to follow starts up (completions lag starts by about 12 months).

Note that the blue line (multi-family starts) might be starting to move more sideways.

I think most of the growth in multi-family starts is probably behind us - although I expect solid multi-family starts for a few more years (based on demographics).

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

A solid report.

Housing Starts increased to 1.135 Million Annual Rate in April, Highest since 2007

by Calculated Risk on 5/19/2015 08:43:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in April were at a seasonally adjusted annual rate of 1,135,000. This is 20.2 percent above the revised March estimate of 944,000 and is 9.2 percent above the April 2014 rate of 1,039,000.

Single-family housing starts in April were at a rate of 733,000; this is 16.7 percent above the revised March figure of 628,000. The April rate for units in buildings with five units or more was 389,000.

emphasis added

Building Permits:

Privately-owned housing units authorized by building permits in April were at a seasonally adjusted annual rate of 1,143,000. This is 10.1 percent above the revised March rate of 1,038,000 and is 6.4 percent above the April 2014 estimate ...

Single-family authorizations in April were at a rate of 666,000; this is 3.7 percent above the revised March figure of 642,000. Authorizations of units in buildings with five units or more were at a rate of 444,000 in April.

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased in April. Multi-family starts are up 9.2% year-over-year.

Single-family starts (blue) increased in April and are up about 14.7% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),

The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),This was well above expectations of 1.029 million starts in April. Overall this was a solid report with upward revisions to prior months. I'll have more later ...

Monday, May 18, 2015

Tuesday: Housing Starts

by Calculated Risk on 5/18/2015 07:06:00 PM

From the SF Fed: The Puzzle of Weak First-Quarter GDP Growth

In late April, the Bureau of Economic Analysis (BEA) released its initial estimate of U.S. economic growth for the first three months of 2015. The report was very disappointing, as inflation-adjusted, or real, gross domestic product (GDP) edged up a mere 0.2% at an annual rate in the first quarter. This estimate was far weaker than many economists had forecast, and it raised concerns that the underlying economic recovery may have stalled. Such anemic growth is of particular concern to Federal Reserve policymakers considering when to begin normalizing monetary policy.Q1 will probably be revised down to a negative reading, but ... no worries!

However, a number of analysts have suggested that the reported weakness in first-quarter growth may have been exaggerated by a statistical anomaly (see, for example, Liesman 2015 and Wolfers 2015). Indeed, an unusual pattern has prevailed for some time in which first-quarter real GDP growth is generally lower than growth later in the year. This regular, calendar-based statistical pattern is a puzzle because the BEA seasonally adjusts the GDP data to remove such fluctuations. First-quarter seasonally adjusted real GDP growth should not be consistently higher or lower than growth in any other quarter. Accordingly, the anomalous pattern of generally weak first-quarter growth suggests that the BEA’s estimate of GDP growth for the first three months of 2015 may understate the true strength of the economy.

...

The application of second-round seasonal adjustment increases real GDP growth in the first quarter of 2015 from its initial published value of 0.2% to 1.8%. Taking this correction at face value, real GDP growth in the first quarter was stronger and much closer to the economy’s sustainable rate of trend growth.

...

The very weak initial estimate of first-quarter real GDP growth this year surprised many forecasters, in part because it was at odds with other fairly positive data, including solid employment gains over the past six months. We show that, although the BEA adjusts for seasonal movements at a disaggregated level, the published real GDP data still exhibit calendar-based fluctuations—that is, residual seasonality. After we apply a second round of seasonal adjustment directly to the published aggregate data, we estimate much faster real GDP growth in the first quarter of this year. We conclude that there is a good chance that underlying economic growth so far this year was substantially stronger than reported.

Tuesday:

• At 8:30 AM ET, Housing Starts for April. Total housing starts increased to 926 thousand (SAAR) in March. Single family starts increased to 618 thousand SAAR in March. The consensus is for total housing starts to increase to 1.029 million (SAAR) in April.

LA area Port Traffic Decreased in April

by Calculated Risk on 5/18/2015 02:42:00 PM

Note: LA area ports were impacted by labor negotiations that were settled on February 21st. Port traffic surged in March as the waiting ships were unloaded (the trade deficit increased in March too), and port traffic declined in April.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was down 0.2% compared to the rolling 12 months ending in March. Outbound traffic was down 1.1% compared to 12 months ending in March.

Inbound traffic had been increasing, and outbound traffic had been moving down recently. The recent downturn in exports might be due to the strong dollar and weakness in China.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Imports were down 2% year-over-year in April; exports were down 11% year-over-year.

The labor issues are now resolved - the ships have disappeared from the outer harbor - and the distortions from the labor issues are behind us. This data suggests a smaller trade deficit in April.

Apartments: Supply and Demand

by Calculated Risk on 5/18/2015 12:50:00 PM

Time flies! It was five years ago that we started discussing the turnaround for apartments. Then, in January 2011, I attended the NMHC Apartment Strategies Conference in Palm Springs, and the atmosphere was very positive. (Note: This is an update to a post I wrote a year ago).

The drivers were 1) very low new supply, and 2) strong demand (favorable demographics, and people moving from owning to renting).

Demographics are still favorable, but my sense is the move "from owning to renting" has slowed. And more supply has been coming online.

On demographics, a large cohort has been moving into the 20 to 34 year old age group (a key age group for renters). Also, in 2015, based on Census Bureau projections, the two largest 5 year cohorts are 20 to 24 years old, and 25 to 29 years old (the largest cohorts are no longer be the "boomers"). Note: Household formation would be a better measure than population, but reliable data for households is released with a long lag.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the population in the 20 to 34 year age group has been increasing. This is actual data from the Census Bureau for 1985 through 2010, and current projections from the Census Bureau from 2015 through 2035.

The circled area shows the recent and projected increase for this group.

From 2020 to 2030, the population for this key rental age group is expected to remain mostly unchanged.

This favorable demographic is a key reason I've been positive on the apartment sector for the last five years - and I expect new apartment construction to stay strong for a few more years.

And on supply, the table below shows the number of 5+ units started and completed per year since 1990 (Completions matter for supply). New supply will probably increase by 250,000 to 260,000 units this year - and increase further in 2015 since it can take over a year from start to completion for large complexes. Note: This doesn't include houses converted to rentals - and that is a substantial number in recent years.

This suggests new supply will probably balance demand soon, and that means vacancy rates have likely bottomed.

| 5+ Units, Starts and Completions (000s)1 | ||

|---|---|---|

| Year | Completions | Starts |

| 1990 | 297.3 | 260.4 |

| 1991 | 216.6 | 137.9 |

| 1992 | 158.0 | 139.0 |

| 1993 | 127.1 | 132.6 |

| 1994 | 154.9 | 223.5 |

| 1995 | 212.4 | 244.1 |

| 1996 | 251.3 | 270.8 |

| 1997 | 247.1 | 295.8 |

| 1998 | 273.9 | 302.9 |

| 1999 | 299.3 | 306.6 |

| 2000 | 304.7 | 299.1 |

| 2001 | 281.0 | 292.8 |

| 2002 | 288.2 | 307.9 |

| 2003 | 260.8 | 315.2 |

| 2004 | 286.9 | 303.0 |

| 2005 | 258.0 | 311.4 |

| 2006 | 284.2 | 292.8 |

| 2007 | 253.0 | 277.3 |

| 2008 | 277.2 | 266.0 |

| 2009 | 259.8 | 97.3 |

| 2010 | 146.5 | 104.3 |

| 2011 | 129.9 | 167.3 |

| 2012 | 157.6 | 233.9 |

| 2013 | 186.2 | 293.7 |

| 2014 | 255.6 | 341.7 |

| 20152 | 265.0 | 350.0 |

| 1 5+ units is close to the number of units built for rent each year. | ||

| 2 Pace through March 2015, completions will probably be above 270,000 for 2015 | ||

NAHB: Builder Confidence decreased to 54 in May

by Calculated Risk on 5/18/2015 10:04:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 54 in May, down from 56 in April. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Falls Two Points in May

Builder confidence in the market for newly built, single-family homes in May dropped two points to a level of 54 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) released today. It is a nine-point increase from the May 2014 reading of 45.

...

“Consumers are exhibiting caution, and want to be on more stable financial footing before purchasing a home,” said NAHB Chief Economist David Crowe. “On the bright side, the HMI component measuring future sales expectations has been tracking upward all year, mortgage rates remain low, and house prices are affordable. These factors should spur the release of pent-up demand moving forward.”

...

The index’s components were mixed in May. The component charting sales expectations in the next six months rose one point to 64, the index measuring buyer traffic dropped a single point to 39, and the component gauging current sales conditions decreased two points to 59.

Looking at the three-month moving averages for regional HMI scores, the South and Midwest each rose one point to 57 and 55, respectively. The Northeast fell by one point to 41 and the West dropped three points to 55.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was below the consensus forecast of 57.

Sunday, May 17, 2015

Sunday Night Futures

by Calculated Risk on 5/17/2015 08:58:00 PM

Monday:

• At 10:00 AM ET, the May NAHB homebuilder survey. The consensus is for a reading of 57, up from 56 last month. Any number above 50 indicates that more builders view sales conditions as good than poor.

Weekend:

• Schedule for Week of May 17, 2015

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures and DOW futures are mostly unchanged (fair value).

Oil prices were up over the last week with WTI futures at $59.79 per barrel and Brent at $66.90 per barrel. A year ago, WTI was at $100, and Brent was at $108 - so, even with the recent increases, prices are down 40%+ year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are up to $2.70 per gallon (down less than $1.00 per gallon from a year ago).

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Goldman's Hatzius: "The Employment Gap Is Much Bigger than the FOMC's Current Estimate"

by Calculated Risk on 5/17/2015 11:42:00 AM

Some excerpts from a research piece by Goldman Sachs chief economist Jan Hatzius: The Employment Gap Is Much Bigger than the FOMC's Current Estimate of the Unemployment Gap

The Fed's most "official" view of excess labor market slack is the gap between the unemployment rate (currently 5.4%) and the midpoint of the FOMC's central tendency range for the "longer-term" rate (currently 5.1%), which is usually taken to be an estimate of the structural unemployment rate. Taken at face value, this implies that the US economy can only create an additional 500,000 jobs before the labor market starts to overheat. ... If this is the right perspective, it would be entirely sensible, and perhaps urgent, to start normalizing monetary policy soon.CR Note: Here is the Chicago Fed Research Hatzius references: Changing labor force composition and the natural rate of unemployment. It is difficult to estimate the amount of slack in the labor market. However, because the risks are not symmetrical (normalizing monetary policy too soon is more risky than normalizing too late), this is an argument for waiting until there are signs of a pickup in wages and inflation. However, as Yellen recently noted: "we need to keep in mind the well-established fact that the full effects of monetary policy are felt only after long lags. This means that policymakers cannot wait until they have achieved their objectives to begin adjusting policy."

But we think it is a misleading perspective, for two reasons. First, the FOMC's current estimate of the structural unemployment rate is likely to continue falling ... This would not only be in keeping with the trend over the past two years, but also with a new study by the Chicago Fed which argues that population aging is likely to push structural unemployment significantly lower over time. ... If the Chicago Fed estimates are correct, the economy would be able to create about 800,000 jobs before the labor market starts to overheat in the short term, and as many as 1.4 million jobs in the longer term. This would already imply significantly less urgency to start normalizing monetary policy than the 500,000 jobs gap implied by the current FOMC estimate of the structural unemployment rate.

Second, there is probably significant labor market slack outside the unemployment gap because there is an important cyclical element in the decline of the labor force participation rate since 2007. This is consistent with Federal Reserve Research. For example, we can use updated estimates of the "demographically adjusted" employment/population ratio by Samuel Kapon and Joseph Tracy at the New York Fed to calculate another, broader version of the current jobs gap. Under the assumption that the labor market was at full employment in the third quarter of 2005--in line with the CBO estimate used in the Chicago Fed estimate above--the Kapon-Tracy numbers imply that the employment/population ratio is currently 1.2 percentage points below its equilibrium level. Multiplying this number by the over-16 population of about 250 million, the implied jobs gap is as large as 3 million. This implies much less urgency to start normalizing monetary policy than the unemployment-based numbers discussed above, and it is an important reason why we think it would be better for the FOMC to wait until 2016 before starting the normalization process.