by Calculated Risk on 3/25/2015 03:28:00 PM

Wednesday, March 25, 2015

Vehicle Sales Forecasts: Best March since 2005

The automakers will report March vehicle sales on Wednesday, April 1st. Sales in February were at 16.2 million on a seasonally adjusted annual rate basis (SAAR), and it appears sales rebounded in March to close to 17.0 million SAAR. March sales (SA) will probably be the best since 2005.

Note: There were 25 selling days in March, one less than last year. Here are a couple of forecasts:

From WardsAuto: Forecast: March Sales Spring Forward

A WardsAuto forecast calls for U.S. automakers to deliver 1.52 million light vehicles this month. The forecasted daily sales rate (DSR) of 60,935 over 25 days represents a 3.5% improvement from like-2014 (26 days). ... The report puts the seasonally adjusted annual rate of sales for the month at 16.9 million units, compared with year-ago’s 16.4 million and February’s 16.2 million mark.From J.D. Power: J.D. Power and LMC Automotive Report: New-Vehicle Sales Rebound in March to Highest Levels for the Month since 2005

U.S. total new-vehicle sales in March 2015 are bouncing back from last month and are expected to reach their highest levels for the month in a decade, according to a monthly sales forecast from J.D. Power and LMC Automotive.Looks like a strong month for auto sales.

After winter storms stymied sales in February, total new light-vehicle sales in March 2015 are expected to reach 1,539,600 units, a 4 percent increase on a selling-day adjusted basis compared with March 2014 and their highest levels for the month since March 2005 when 1,572,909 new vehicles were sold. [17.0 million SAAR[

New Home Prices: More homes priced in the $200K to $300K range

by Calculated Risk on 3/25/2015 12:31:00 PM

Here are two graphs I haven't posted for some time ...

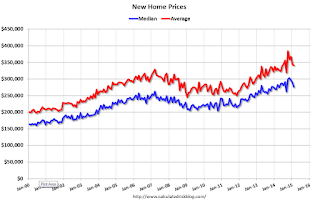

As part of the new home sales report, the Census Bureau reported the number of homes sold by price and the average and median prices.

From the Census Bureau: "The median sales price of new houses sold in February 2015 was $275,500; the average sales price was $341,000."

The following graph shows the median and average new home prices.

During the housing bust, the builders had to build smaller and less expensive homes to compete with all the distressed sales. When housing started to recovery - with limited finished lots in recovering areas - builders moved to higher price points to maximize profits.

Recently some builders have announced new homes at lower price points.

The average price in February 2015 was $341,000 and the median price was $275,500. Both are above the bubble high (this is due to both a change in mix and rising prices), but are below the recent peak.

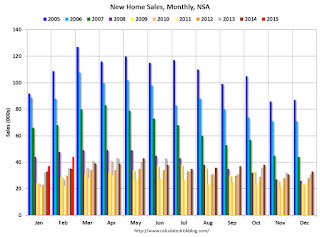

The second graph shows the percent of new homes sold by price.

However there has been a pickup in homes sold in the $200K to $300K range (Up to 37.8% of homes in February 2015).

Yesterday on New Home Sales:

• New Home Sales at 539,000 Annual Rate in February

• Comments on New Home Sales

Freddie Mac: Mortgage Serious Delinquency rate declined in February

by Calculated Risk on 3/25/2015 09:33:00 AM

Freddie Mac reported that the Single-Family serious delinquency rate declined in February to 1.81%, down from 1.86% in January. Freddie's rate is down from 2.29% in February 2014, and the rate in February was the lowest level since December 2008. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Note: Fannie Mae will report their Single-Family Serious Delinquency rate for February next week.

Although the rate is declining, the "normal" serious delinquency rate is under 1%.

The serious delinquency rate has fallen 0.48 percentage points over the last year - and the rate of improvement has slowed recently - but at that rate of improvement, the serious delinquency rate will not be below 1% until late 2016.

Note: Very few seriously delinquent loans cure with the owner making up back payments - most of the reduction in the serious delinquency rate is from foreclosures, short sales, and modifications.

So even though distressed sales are declining, I expect an above normal level of Fannie and Freddie distressed sales for 2 more years (mostly in judicial foreclosure states).

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 3/25/2015 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 9.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 20, 2015. ...

The Refinance Index increased 12 percent from the previous week. The seasonally adjusted Purchase Index increased 5 percent from one week earlier to its highest level since January 2015.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 3.90 percent, its lowest level since February 2015, from 3.99 percent, with points decreasing to 0.37 from 0.40 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

2014 was the lowest year for refinance activity since year 2000.

2015 will probably see a little more refinance activity than in 2014, but not a large refinance boom.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 3% higher than a year ago.

Tuesday, March 24, 2015

DOT: Vehicle Miles Driven increased 4.9% year-over-year in January, Rolling 12 Months at All Time High

by Calculated Risk on 3/24/2015 08:01:00 PM

Wednesday:

• 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Durable Goods Orders for February from the Census Bureau. The consensus is for a 0.5% increase in durable goods orders.

With lower gasoline prices, vehicle miles driven have reached a new high on a rolling 12 month basis.

The Department of Transportation (DOT) reported:

◦Travel on all roads and streets changed by 4.9% (11.1 billion vehicle miles) for January 2015 as compared with January 2014.The following graph shows the rolling 12 month total vehicle miles driven to remove the seasonal factors.

◦Travel for the month is estimated to be 237.4 billion vehicle miles.

◦The seasonally adjusted vehicle miles traveled for January 2015 is 257.9 billion miles, a 5.1% (12.5 billion vehicle miles) increase over January 2014. It also represents a -0.2% change (-0.5 billion vehicle miles) compared with December 2014.

The rolling 12 month total is moving up, after moving sideways for several years.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Miles driven had been below the previous peak for 85 months - an all time record.

The second graph shows the year-over-year change from the same month in the previous year.

In January 2015, gasoline averaged of $2.21 per gallon according to the EIA. That was down significantly from January 2014 when prices averaged $3.39 per gallon.

In January 2015, gasoline averaged of $2.21 per gallon according to the EIA. That was down significantly from January 2014 when prices averaged $3.39 per gallon. However gasoline prices are just part of the story. The lack of growth in miles driven over the last 7 years was probably also due to the lingering effects of the great recession (lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

Now, miles driven - on a rolling 12 month basis - is at a new high.

ATA Trucking Index declined in February

by Calculated Risk on 3/24/2015 05:50:00 PM

Here is an indicator that I follow on trucking, from the ATA: ATA Truck Tonnage Index Fell 3.1% in February

American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index decreased 3.1% in February, following a revised gain of 1.3% during the previous month. In February, the index equaled 131.6 (2000=100), the lowest level since September 2014.

Compared with February 2014, the SA index increased 3%, although this was the smallest year-over-year gain since June of last year and below the 2014 annual increase of 3.7%. ...

“The February drop in truck tonnage was not a surprise,” said ATA Chief Economist Bob Costello. “Retail sales, manufacturing output and housing starts were all off during the month, so the tonnage decline fits with those indicators. The surprise would have been had tonnage increased with all of those sectors falling.”

Costello added that the winter weather that impacted a large portion of the country during February had a negative impact on truck tonnage as well as industries that drive tonnage, like retail, manufacturing and housing starts.

Trucking serves as a barometer of the U.S. economy, representing 69.1% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9.7 billion tons of freight in 2013. Motor carriers collected $681.7 billion, or 81.2% of total revenue earned by all transport modes.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index is now up 3.0% year-over-year.

Lawler: Updated Table of Distressed Sales and Cash buyers for Selected Cities in February

by Calculated Risk on 3/24/2015 02:57:00 PM

Economist Tom Lawler sent me the updated table below of short sales, foreclosures and cash buyers for several selected cities and areas in February.

On distressed: Total "distressed" share is down in most of these markets mostly due to a decline in short sales (Mid-Atlantic is up year-over-year because of an increase foreclosure as lenders work through the backlog).

Short sales are down in these areas.

Foreclosures are up in several areas, especially in Florida.

The All Cash Share (last two columns) is declining year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Feb-15 | Feb-14 | Feb-15 | Feb-14 | Feb-15 | Feb-14 | Feb-15 | Feb-14 | |

| Las Vegas | 9.3% | 14.0% | 9.7% | 12.0% | 19.0% | 26.0% | 37.4% | 46.8% |

| Reno** | 7.0% | 13.0% | 7.0% | 7.0% | 14.0% | 20.0% | ||

| Phoenix | 4.4% | 5.3% | 5.8% | 8.3% | 10.1% | 13.7% | 29.9% | 35.4% |

| Sacramento | 6.3% | 12.4% | 8.6% | 7.0% | 14.9% | 19.4% | 19.8% | 26.5% |

| Minneapolis | 2.7% | 5.0% | 15.3% | 25.3% | 18.1% | 30.3% | ||

| Mid-Atlantic | 5.3% | 7.7% | 15.1% | 10.9% | 20.4% | 18.6% | 21.2% | 21.4% |

| Orlando | 5.3% | 9.4% | 27.0% | 23.8% | 32.3% | 33.2% | 42.2% | 48.2% |

| California * | 6.2% | 9.0% | 6.8% | 8.0% | 13.0% | 17.0% | ||

| Bay Area CA* | 4.8% | 6.3% | 4.5% | 5.0% | 9.3% | 11.3% | 26.7% | 28.4% |

| So. California* | 6.1% | 9.0% | 6.1% | 6.7% | 12.2% | 15.7% | 28.0% | 31.0% |

| Florida SF | 4.9% | 8.4% | 24.0% | 23.6% | 28.9% | 32.0% | 42.4% | 47.9% |

| Florida C/TH | 2.9% | 6.0% | 18.8% | 17.8% | 21.7% | 23.8% | 69.4% | 73.2% |

| Tampa MSA SF | 5.2% | 9.9% | 26.6% | 24.9% | 31.8% | 34.8% | 43.2% | 46.4% |

| Tampa MSA C/TH | 2.4% | 5.3% | 19.0% | 19.2% | 21.5% | 24.6% | 65.4% | 71.2% |

| Miami MSA SF | 7.7% | 13.8% | 22.5% | 16.4% | 30.1% | 30.1% | 42.2% | 48.7% |

| Miami MSA C/TH | 3.6% | 7.5% | 23.5% | 18.3% | 27.1% | 25.8% | 71.9% | 75.2% |

| Northeast Florida | 37.6% | 44.5% | ||||||

| Chicago (city) | 29.9% | 40.0% | ||||||

| Hampton Roads | 22.6% | 30.7% | ||||||

| Des Moines | 21.3% | 23.3% | ||||||

| Georgia*** | 27.1% | 35.3% | ||||||

| Omaha | 19.6% | 25.6% | ||||||

| Pensacola | 36.7% | 41.8% | ||||||

| Knoxville | 23.9% | 27.4% | ||||||

| Richmond VA | 13.9% | 22.2% | 21.5% | 22.2% | ||||

| Springfield IL** | 15.3% | 18.3% | 21.4% | N/A | ||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

Key Measures Show Low Inflation in February

by Calculated Risk on 3/24/2015 12:01:00 PM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (3.0% annualized rate) in February. The 16% trimmed-mean Consumer Price Index rose 0.2% (2.0% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for February here. Motor fuel added to inflation in February following several months of steep declines. However oil and gasoline prices declined again in March, and will pull down inflation again.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.2% (2.6% annualized rate) in February. The CPI less food and energy rose 0.2% (1.9% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.8%, and the CPI less food and energy rose 1.7%. Core PCE is for January and increased 1.3% year-over-year.

On a monthly basis, median CPI was at 3.0% annualized, trimmed-mean CPI was at 2.0% annualized, and core CPI was at 1.9% annualized.

On a year-over-year basis these measures suggest inflation remains below the Fed's target of 2% (median CPI is slightly above 2%).

The key question for the Fed is if these key measures will move back towards 2%.

Comments on New Home Sales

by Calculated Risk on 3/24/2015 11:03:00 AM

The new home sales report for February was above expectations at 539 thousand on a seasonally adjusted annual rate basis (SAAR).

Also, sales for January were revised up (sales for November and December was revised slightly).

Sales in 2015 are off to a solid start, although this is just two months of data.

Earlier: New Home Sales at 539,000 Annual Rate in February

The Census Bureau reported that new home sales this year, through February, were 81,000, Not seasonally adjusted (NSA). That is up 19% from 68,000 during the same period of 2014 (NSA). This is very early - and the next six months are usually the strongest of the year NSA - but this is a solid start.

Sales were up 24.8% year-over-year in February.

This graph shows new home sales for 2014 and 2015 by month (Seasonally Adjusted Annual Rate).

The year-over-year gain will be strong in Q1 (the first half was especially weak in 2014), and I expect the year-over-year increases to slow later this year.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to move sideways (distressed sales will continue to decline and be partially offset by more conventional / equity sales). And I expect this gap to slowly close, mostly from an increase in new home sales.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down, and this ratio will probably continue to trend down over the next several years.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales at 539,000 Annual Rate in February

by Calculated Risk on 3/24/2015 10:05:00 AM

The Census Bureau reports New Home Sales in February were at a seasonally adjusted annual rate (SAAR) of 539 thousand.

January sales were revised up from 481 thousand to 500 thousand, and December sales were revised down slightly from 482 thousand to 479 thousand.

"Sales of new single-family houses in February 2015 were at a seasonally adjusted annual rate of 539,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 7.8 percent above the revised January rate of 500,000 and is 24.8 percent above the February 2014 estimate of 432,000."

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the previous two years, new home sales are still close to the bottoms for previous recessions.

The second graph shows New Home Months of Supply.

The months of supply was declined in February at 4.7 months.

The months of supply was declined in February at 4.7 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of February was 210,000. This represents a supply of 4.7 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In February 2015 (red column), 44 thousand new homes were sold (NSA). Last year 35 thousand homes were sold in February. This is the highest for February since 2008.

The high for February was 109 thousand in 2005, and the low for February was 22 thousand in 2011.

This was way above expectations of 475,000 sales in February, and is a strong start to 2015. I'll have more later today.