by Calculated Risk on 3/27/2015 03:45:00 PM

Friday, March 27, 2015

Yellen: Normalizing Monetary Policy: Prospects and Perspectives

From Fed Chair Janet Yellen: Normalizing Monetary Policy: Prospects and Perspectives. Excerpts:

Why Might an Increase in the Federal Funds Rate Be Warranted Later This Year?

The Committee's decision about when to begin reducing accommodation will depend importantly on how economic conditions actually evolve over time. Like most of my FOMC colleagues, I believe that the appropriate time has not yet arrived, but I expect that conditions may warrant an increase in the federal funds rate target sometime this year. So let me spell out the reasoning that underpins this view.

I would first note that the current stance of monetary policy is clearly providing considerable economic stimulus. The near-zero setting for the federal funds rate has facilitated a sizable reduction in labor market slack over the past two years and appears to be consistent with further substantial gains. A modest increase in the federal funds rate would be highly unlikely to halt this progress, although such an increase might slow its pace somewhat.

Second, we need to keep in mind the well-established fact that the full effects of monetary policy are felt only after long lags. This means that policymakers cannot wait until they have achieved their objectives to begin adjusting policy. I would not consider it prudent to postpone the onset of normalization until we have reached, or are on the verge of reaching, our inflation objective. Doing so would create too great a risk of significantly overshooting both our objectives of maximum sustainable employment and 2 percent inflation, potentially undermining economic growth and employment if the FOMC is subsequently forced to tighten policy markedly or abruptly. In addition, holding rates too low for too long could encourage inappropriate risk-taking by investors, potentially undermining the stability of financial markets. That said, we must be reasonably confident at the time of the first rate increase that inflation will move up over time to our 2 percent objective, and that such an action will not impede continued solid growth in employment and output.

An important factor working to increase my confidence in the inflation outlook will be continued improvement in the labor market. A substantial body of theory, informed by considerable historical evidence, suggests that inflation will eventually begin to rise as resource utilization continues to tighten.2 It is largely for this reason that a significant pickup in incoming readings on core inflation will not be a precondition for me to judge that an initial increase in the federal funds rate would be warranted. With respect to wages, I anticipate that real wage gains for American workers are likely to pick up to a rate more in line with trend labor productivity growth as employment settles in at its maximum sustainable level. We could see nominal wage growth eventually running notably higher than the current roughly 2 percent pace. But the outlook for wages is highly uncertain even if price inflation does move back to 2 percent and labor market conditions continue to improve as projected. For example, we cannot be sure about the future pace of productivity growth; nor can we be sure about other factors, such as global competition, the nature of technological change, and trends in unionization, that may also influence the pace of real wage growth over time. These factors, which are outside of the Federal Reserve's control, likely explain why real wages have failed to keep pace with productivity growth for at least the past 15 years. For such reasons, we can never be sure what growth rate of nominal wages is consistent with stable consumer price inflation, and this uncertainty limits the usefulness of wage trends as an indicator of the Fed's progress in achieving its inflation objective.

I have argued that a pickup in neither wage nor price inflation is indispensable for me to achieve reasonable confidence that inflation will move back to 2 percent over time. That said, I would be uncomfortable raising the federal funds rate if readings on wage growth, core consumer prices, and other indicators of underlying inflation pressures were to weaken, if market-based measures of inflation compensation were to fall appreciably further, or if survey-based measures were to begin to decline noticeably.

Under normal circumstances, simple monetary policy rules, such as the one proposed by John Taylor, could help us decide when to raise the federal funds rate. Even with core inflation running below the Committee's 2 percent objective, Taylor's rule now calls for the federal funds rate to be well above zero if the unemployment rate is currently judged to be close to its normal longer-run level and the "normal" level of the real federal funds rate is currently close to its historical average. But the prescription offered by the Taylor rule changes significantly if one instead assumes, as I do, that appreciable slack still remains in the labor market, and that the economy's equilibrium real federal funds rate--that is, the real rate consistent with the economy achieving maximum employment and price stability over the medium term--is currently quite low by historical standards.Under assumptions that I consider more realistic under present circumstances, the same rules call for the federal funds rate to be close to zero. Moreover, I would assert that simple rules are, well, too simple, and ignore important complexities of the current situation, about which I will have more to say shortly.

The FOMC will, of course, carefully deliberate about when to begin the process of removing policy accommodation. But the significance of this decision should not be overemphasized, because what matters for financial conditions and the broader economy is the entire expected path of short-term interest rates and not the precise timing of the first rate increase. The spending and investment decisions the FOMC seeks to influence depend primarily on expectations of policy well into the future, as embedded in longer-term interest rates and other asset prices. More important than the timing of the Committee's initial policy move will be the strategy the Committee deploys in adjusting the federal funds rate over time, in response to economic developments, to achieve its dual mandate. Market participants' perceptions of that reaction function and the implications for the likely longer-run trajectory of short-term interest rates will influence the borrowing costs faced by households and businesses, including the rates on corporate bonds, auto loans, and home mortgages.

BLS: Twenty-Six States had Unemployment Rate Decreases in February

by Calculated Risk on 3/27/2015 11:33:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were little changed in February. Twenty-six states had unemployment rate decreases from January, 6 states and the District of Columbia had increases, and 18 states had no change, the U.S. Bureau of Labor Statistics reported today.

...

Nebraska had the lowest jobless rate in February, 2.7 percent, followed by North Dakota, 2.9 percent. Nevada had the highest rate among the states, 7.1 percent. The District of Columbia had a rate of 7.8 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement. The yellow squares are the lowest unemployment rate per state since 1976.

The states are ranked by the highest current unemployment rate. Nevada, at 7.1%, had the highest state unemployment rate although D.C was higher. North Dakota had had the lowest unemployment rate for 75 consecutive months, however Nebraska was the lowest in February.

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).Currently no state has an unemployment rate at or above 8% (light blue); Two states and D.C. are still at or above 7% (dark blue).

Final March Consumer Sentiment at 93.0

by Calculated Risk on 3/27/2015 10:00:00 AM

Click on graph for larger image.

The final University of Michigan consumer sentiment index for March was at 93.0, up from the preliminary estimate of 91.2, and down from 95.4 in February.

This was above the consensus forecast of 91.8. Gasoline prices have probably been the key factor for the recent changes in sentiment.

Q4 GDP unrevised at 2.2% Annual Rate

by Calculated Risk on 3/27/2015 08:31:00 AM

From the BEA: Gross Domestic Product: Fourth Quarter 2014 (Third Estimate)

Real gross domestic product -- the value of the production of goods and services in the United States, adjusted for price changes -- increased at an annual rate of 2.2 percent in the fourth quarter of 2014, according to the "third" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 5.0 percent.Here is a Comparison of Third and Secord Estimates. PCE was revised up from 4.2% to 4.4% - solid. Private investment was revised down from 5.1% to 3.7%. This was below expectations of a revision to 2.4%.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was also 2.2 percent. While increases in exports and in personal consumption expenditures (PCE) were larger than previously estimated and the change in private inventories was smaller, GDP growth is unrevised, and the general picture of the economy for the fourth quarter remains the same

Thursday, March 26, 2015

Friday: Yellen, GDP, Consumer Sentiment

by Calculated Risk on 3/26/2015 08:44:00 PM

From Merrill Lynch on the March employment report:

The recent employment reports have been exceptionally strong with job growth averaging 293,000 a month for the past six months. Although we expect a slight moderation in March with job growth of 270,000, this would still be a healthy number. ...Friday:

Despite strong job growth, we think the unemployment rate will tick up to 5.6%. ... The risk is that the labor force participation rate increases, reversing the decline in February. As always, the focus will be on wages. We look for a 0.2% gain, an improvement from the 0.12% increase in February. This would leave the yoy rate at 2.0%. We think the risk, however, is that average hourly earnings surprises on the upside relative to our forecast.

• 8:30 AM ET, Gross Domestic Product, 4th quarter 2014 (third estimate). The consensus is that real GDP increased 2.4% annualized in Q4, up from the second estimate of 2.2%.

• At 10:00 AM, the University of Michigan's Consumer sentiment index (final for March). The consensus is for a reading of 91.8, up from the preliminary reading of 91.2, but down from the February reading of 95.4.

• Also at 10:00 AM, Regional and State Employment and Unemployment (Monthly), February 2015

• At 3:45 PM, Speech, Fed Chair Janet Yellen, Monetary Policy, At the Federal Reserve Bank of San Francisco Conference: The New Normal for Monetary Policy, San Francisco, Calif

Mortgage News Daily: Mortgage Rates increased Today

by Calculated Risk on 3/26/2015 05:24:00 PM

Earlier I posted the results of the weekly Freddie Mac survey that showed rates declined recently. However mortgage rates increased today.

From Matthew Graham at Mortgage News Daily: Mortgage Rates Increase Rapidly

Mortgage rates rose rapidly today, almost completely erasing the improvement following last week's Fed Announcement. This is especially ironic considering most major media outlets are running Freddie Mac's weekly mortgage rate survey headline. Because that survey receives most of its responses on Monday and Tuesday, it fully benefited from the stronger levels earlier in the week after having totally missed out on last Wednesday and Thursday's big move lower. As such, the headlines suggest that rates are significantly lower this week. That was certainly true on Tuesday afternoon, but rates have risen roughly an eighth of a point since then. That's a big move considering we've gone entire months without moving more than an eighth.Here is a table from Mortgage News Daily:

Specifically, what had been 3.625 to 3.75% is now 3.75 to 3.875% in terms of the most prevalently-quoted conventional 30yr fixed rates for top tier scenarios. The upfront costs associated with moving down to 3.75 from 3.875% are still quite low.

Freddie Mac: 30 Year Mortgage Rates decrease to 3.69% in Latest Weekly Survey

by Calculated Risk on 3/26/2015 02:01:00 PM

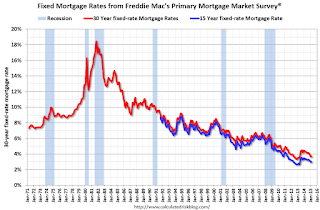

From Freddie Mac today: Mortgage Rates Move Down Again

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates moving down again across the board. Average fixed rates that continue to run below four percent will help keep affordability high for those in the market to buy a home as we head into the spring homebuying season. ...

30-year fixed-rate mortgage (FRM) averaged 3.69 percent with an average 0.6 point for the week ending March 26, 2015, down from last week when it averaged 3.78 percent. A year ago at this time, the 30-year FRM averaged 4.40 percent.

15-year FRM this week averaged 2.97 percent with an average 0.6 point, down from last week when it averaged 3.06 percent. A year ago at this time, the 15-year FRM averaged 3.42 percent

Click on graph for larger image.

Click on graph for larger image.This graph shows the 30 year and 15 year fixed rate mortgage interest rates from the Freddie Mac Primary Mortgage Market Survey®.

30 year mortgage rates are up a little (34 bps) from the all time low of 3.35% in late 2012, but down from 4.40% a year ago.

The Freddie Mac survey started in 1971. Mortgage rates were below 5% back in the 1950s.

Kansas City Fed: Regional Manufacturing Activity Declined in March

by Calculated Risk on 3/26/2015 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Declined

The Federal Reserve Bank of Kansas City released the March Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity declined in March, and producers’ expectations moderated somewhat but remained slightly positive.Some of this decline was due to lower oil prices (Oklahoma was especially weak), however overall, lower oil prices will a positive for the economy. Also some of this decline was related to the West Coast port labor issues that are now resolved.

“We saw our first monthly decline in regional factory activity in over a year," said Wilkerson. “Some firms blamed the West Coast port disruptions, while producers of oil and gas-related equipment blamed low oil prices.”

Tenth District manufacturing activity declined in March, and producers’ expectations moderated somewhat but remained slightly positive. Most price indexes continued to decrease, with several reaching their lowest level since 2009. In a special question about the West Coast port disruptions, 32 percent of firms said it had affected them negatively.

The month-over-month composite index was -4 in March, down from 1 in February and 3 in January. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. The overall slower growth was mostly attributable to declines in plastics, food, and chemical production and continued weakness in metals and machinery. Looking across District states, the largest decline was in Oklahoma, with moderate slowdowns in Kansas and Nebraska. ... the employment and new orders for exports indexes inched higher but remained negative.

emphasis added

This was another weak regional manufacturing report (the Richmond Fed survey released earlier this week also showed contraction in March). The Dallas Fed survey for March will be released this coming Monday and will probably show contraction too.

Weekly Initial Unemployment Claims decreased to 282,000

by Calculated Risk on 3/26/2015 08:34:00 AM

The DOL reported:

In the week ending March 21, the advance figure for seasonally adjusted initial claims was 282,000, a decrease of 9,000 from the previous week's unrevised level of 291,000. The 4-week moving average was 297,000, a decrease of 7,750 from the previous week's unrevised average of 304,750.The previous week was unrevised.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 297,000.

This was below the consensus forecast of 293,000, and the low level of the 4-week average suggests few layoffs.

Wednesday, March 25, 2015

Thursday: Unemployment Claims, Kansas City Mfg Survey

by Calculated Risk on 3/25/2015 07:05:00 PM

Some excerpts from a research piece by Goldman Sachs economist Kris Dawsey: Core Inflation Still Has Room to Fall

... With the PPI and CPI reports already in hand for the month, we think that the core PCE price index—the Fed’s preferred inflation measure—will post an above-trend 0.20% increase in February. ... In light of the latest news, one might be tempted to wonder whether we have seen the bottom on core inflation, which could help the Fed to be "reasonably confident" that inflation will be moving back to its target over the medium term—a precondition for the first rate hike.Thursday:

We ... find that in the near term downward pressure on core inflation from the effects of the stronger dollar and energy price pass-through are likely to overwhelm upward pressure from diminished slack in the economy. ... Recent firmness in shelter inflation—which appears insensitive to dollar and oil effects—is likely to persist, but we think that core goods inflation will probably move down further. Our bottom-up analysis suggests that headline and core consumer prices will probably bottom around the middle of the year ...

• 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 293 thousand from 291 thousand.

• At 11:00 AM, the Kansas City Fed manufacturing survey for March.