by Calculated Risk on 1/31/2015 01:11:00 PM

Saturday, January 31, 2015

Schedule for Week of February 1, 2015

The key report this week is the January employment report on Friday.

Other key reports include the January ISM manufacturing index on Monday, January vehicle sales on Tuesday, the ISM non-manufacturing index on Wednesday, and the December Trade Deficit on Thursday.

8:30 AM ET: Personal Income and Outlays for December. The consensus is for a 0.2% increase in personal income, and for a 0.2% decrease in personal spending. And for the Core PCE price index to be unchanged.

10:00 AM: ISM Manufacturing Index for January. The consensus is for a decrease to 54.5 from 55.5 in December.

10:00 AM: ISM Manufacturing Index for January. The consensus is for a decrease to 54.5 from 55.5 in December.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion in December at 55.5%. The employment index was at 56.8%, and the new orders index was at 57.3%

10:00 AM: Construction Spending for December. The consensus is for a 0.6% increase in construction spending.

All day: Light vehicle sales for January. The consensus is for light vehicle sales to decrease to 16.6 million SAAR in January from 16.8 million in December (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for January. The consensus is for light vehicle sales to decrease to 16.6 million SAAR in January from 16.8 million in December (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the December sales rate.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for December. The consensus is for a 2.0 decrease in December orders.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for January. This report is for private payrolls only (no government). The consensus is for 220,000 payroll jobs added in January, down from 241,000 in December.

10:00 AM: ISM non-Manufacturing Index for January. The consensus is for a reading of 56.5, up from 56.2 in December. Note: Above 50 indicates expansion.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 290 thousand from 265 thousand.

8:30 AM: Trade Balance report for December from the Census Bureau.

8:30 AM: Trade Balance report for December from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through November. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $38.0 billion in December from $39.0 billion in November.

8:30 AM: Employment Report for January. The consensus is for an increase of 230,000 non-farm payroll jobs added in January, down from the 252,000 non-farm payroll jobs added in December.

The consensus is for the unemployment rate to be unchanged at 5.6% in January from 5.6% the previous month.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In December, the year-over-year change was 2.95 million jobs, and that should increase further in January.

As always, a key will be the change in real wages - and as the unemployment rate falls, wage growth should eventually start to pickup.

Notes: The annual benchmark revision will be released with the January report. The preliminary estimate was an additional 7,000 jobs as of March 2014.

Also, the new population controls will be used in the Current Population Survey (CPS) estimation process. It is important to note that "household survey data for January 2015 will not be directly comparable with data for December 2014 or earlier periods". Someone better alert Rick Santelli at CNBC!

3:00 PM: Consumer Credit for December from the Federal Reserve. The consensus is for credit to increase $15.0 billion.

Unofficial Problem Bank list declines to 388 Institutions

by Calculated Risk on 1/31/2015 08:05:00 AM

UPDATE: The Federal Reserve announced the termination of the enforcement action for Pacific Mercantile Bancorp, Costa Mesa, California; Pacific Mercantile Bank, Costa Mesa, California on Nov 20, 2014. The bank has been removed from the "unofficial list".

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Jan 30, 2015.

Changes and comments from surferdude808:

As expected, the FDIC released an update on its enforcement action activities through December 2014 that contributed to all of the changes to the Unofficial Problem Bank List this week. In all, there were five removals and three additions that leave the list at 388 institutions with assets of $122.5 billion. A year ago, the list held 590 institutions with assets of $195.4 billion. When the weekly was list was first published back on August 7, 2009 it had 389 institutions, so this is the first time a subsequent list held fewer institutions than its inception. There are still 53 institutions from the original list that still remain on it.CR Note: As Surfer Dude noted, the list has come full circle (back to number when we started)!

FDIC terminated actions against Signature Bank of Arkansas, Fayetteville, AR ($492 million); Village Bank, Saint Francis, MN ($176 million); Golden Eagle Community Bank, Woodstock, IL ($136 million); The Wilmington Savings Bank, Wilmington, OH ($127 million); and VistaBank, Aiken, SC ($107 million).

FDIC issued new actions against Seaway Bank and Trust Company, Chicago, IL ($522 million); International Bank, Raton, NM ($292 million); and Sage Bank, Lowell, MA ($208 million).

Next week will likely see fewer changes to the list.

Friday, January 30, 2015

Restaurant Performance Index shows Expansion in December

by Calculated Risk on 1/30/2015 05:47:00 PM

I think restaurants are happy with lower gasoline prices (except, I hear, McDonald's) ...

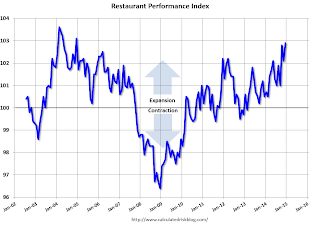

Here is a minor indicator I follow from the National Restaurant Association: Restaurant Performance Index Finished the Year on a Positive Note

Driven by positive sales and traffic and an uptick in capital expenditures, the National Restaurant Association’s Restaurant Performance Index (RPI) finished 2014 with a solid gain. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 102.9 in December, up 0.8 percent from its November level of 102.1. In addition, December marked the 22nd consecutive month in which the RPI stood above 100, which signifies expansion in the index of key industry indicators.

“Growth in the RPI was driven by the current situation indicators in December, with a solid majority of restaurant operators reporting higher same-store sales and customer traffic levels,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “In addition, six in 10 operators reported making a capital expenditure during the fourth quarter, with a similar proportion planning for capital spending in the first half of 2015.”

“Overall, the RPI posted three consecutive months above 102 for the first time since the first quarter of 2006, which puts the industry on a positive track heading into 2015,” Riehle added.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The index increased to 102.9 in December, down from 102.1 in November. (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month. This is a very solid reading - and it is likely restaurants are benefiting from lower gasoline prices.

Freddie Mac: Mortgage Serious Delinquency rate declined in December

by Calculated Risk on 1/30/2015 02:31:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate declined in December to 1.88%, down from 1.91% in November. Freddie's rate is down from 2.39% in December 2013, and the rate in December was the lowest level since December 2008. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Note: Fannie Mae will report their Single-Family Serious Delinquency rate for December next week.

Although the rate is generally declining, the "normal" serious delinquency rate is under 1%.

The serious delinquency rate has fallen 0.51 percentage points over the last year - and the rate of improvement has slowed recently - but at that rate of improvement, the serious delinquency rate will not be below 1% until late 2016.

Note: Very few seriously delinquent loans cure with the owner making up back payments - most of the reduction in the serious delinquency rate is from foreclosures, short sales, and modifications.

So even though distressed sales are declining, I expect an above normal level of Fannie and Freddie distressed sales for 2+ more years (mostly in judicial foreclosure states).

Comment on Q4 GDP and Investment: R-E-L-A-X

by Calculated Risk on 1/30/2015 12:08:00 PM

There are legitimate concerns about a strong dollar, and weak economic activity overseas, impacting U.S. exports and GDP growth. However, overall, the Q4 GDP report was solid.

The key numbers are: 1) PCE increased at a 4.3% annual rate in Q4 (the two month method nails it again), and 2) private fixed investment increased at a 2.3% rate. The negatives were trade (subtracted 1.02 percentage point) and Federal government spending (subtracted 0.54 percentage points).

As usual, I like to focus on private fixed investment because that is the key to the business cycle.

The first graph shows the Year-over-year (YoY) change in real GDP, real PCE, and real fixed private investment.

Click on graph for larger image.

It appears the pace of growth for real GDP and PCE has been picking up a little. Real GDP was up 2.5% Q1 over Q1, and real PCE was up 2.8%. Both will show stronger growth next quarter (since Q1 2014 was so weak).

The dashed black line is the year-over-year change in private fixed investment. This slowed a little in Q4, but has been increasing solidly.

The graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Note: This can't be used blindly. Residential investment is so low as a percent of the economy that the small decline early last year was not a concern.

Residential investment (RI) increased at a 4.1% annual rate in Q4. Equipment investment decreased at a 1.9% annual rate, and investment in non-residential structures increased at a 2.6% annual rate. On a 3 quarter trailing average basis, RI is moving up (red), equipment is moving sideways (green), and nonresidential structures dipped a little (blue).

Note: Nonresidential investment in structures typically lags the recovery, however investment in energy and power provided a boost early in this recovery.

I expect investment to be solid going forward (except for energy and power), and for the economy to grow at a solid pace in 2015.

Final January Consumer Sentiment at 98.1

by Calculated Risk on 1/30/2015 10:00:00 AM

Click on graph for larger image.

The final University of Michigan consumer sentiment index for January was at 98.1, down slightly from the preliminary estimate of 98.2, and up from 93.6 in December.

This was close to the consensus forecast of 98.2. Lower gasoline prices and a better labor market are probably the reasons for the recent increase.

BEA: Real GDP increased at 2.6% Annualized Rate in Q4

by Calculated Risk on 1/30/2015 08:30:00 AM

From the BEA: Gross Domestic Product: Fourth Quarter and Annual 2014 (Advance Estimate)

Real gross domestic product -- the value of the production of goods and services in the United States, adjusted for price changes -- increased at an annual rate of 2.6 percent in the fourth quarter of 2014, according to the "advance" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 5.0 percent.The advance Q4 GDP report, with 2.6% annualized growth, was below expectations of a 3.2% increase.

...

The increase in real GDP in the fourth quarter reflected positive contributions from personal consumption expenditures (PCE), private inventory investment, exports, nonresidential fixed investment, state and local government spending, and residential fixed investment that were partly offset by a negative contribution from federal government spending. Imports, which are a subtraction in the calculation of GDP, increased.

The deceleration in real GDP growth in the fourth quarter primarily reflected an upturn in imports, a downturn in federal government spending, and decelerations in nonresidential fixed investment and in exports that were partly offset by an upturn in private inventory investment and an acceleration in PCE.

The price index for gross domestic purchases, which measures prices paid by U.S. residents, decreased 0.3 percent in the fourth quarter, in contrast to an increase of 1.4 percent in the third. Excluding food and energy prices, the price index for gross domestic purchases increased 0.7 percent, compared with an increase of 1.6 percent.

Personal consumption expenditures (PCE) increased at a 4.3% annualized rate - a strong pace!

The key negatives were trade (subtracted 1.02 percentage point) and Federal government spending (subtracted 0.54 percentage points).

Click on graph for larger image.

Click on graph for larger image.The first graph shows residential investment as a percent of GDP.

Residential Investment as a percent of GDP has been increasing, but it still below the levels of previous recessions - and I expect RI to continue to increase for the next few years.

I'll break down Residential Investment into components after the GDP details are released this coming week. Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

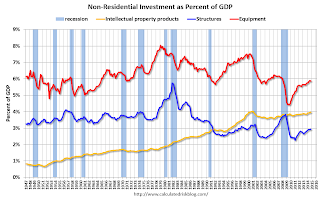

The second graph shows non-residential investment in structures, equipment and "intellectual property products". Investment is trending up as a percent of GDP..

The second graph shows non-residential investment in structures, equipment and "intellectual property products". Investment is trending up as a percent of GDP..I'll add details for investment in offices, malls and hotels next week.

Overall this was a solid report with strong PCE and private domestic investment.

Thursday, January 29, 2015

Friday: GDP, Chicago PMI, Consumer Sentiment

by Calculated Risk on 1/29/2015 07:31:00 PM

From the Atlanta Fed:

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2014 was 3.5 percent on January 27, unchanged from January 21.From Nomura:

Incoming data suggest that the economy grew at a slower pace in Q4 than the strong 5.0% growth in Q3. As such, we forecast that GDP increased at a still robust annualized rate of 3.4% in Q4. In particular, we expect final sales to grow by 3.4%, exceeding 3% for the fifth time in six quarters. Personal spending should make a significant positive contribution to growth in Q4. We expect inventory investment to make a negligible negative contribution.The two month method for forecasting PCE (using October and November), suggests real PCE growth of 4.3% in Q4 (of course December could be disappointing). That would be the best quarter for real PCE growth since 2006.

Friday:

• At 8:30 AM ET, Gross Domestic Product, 4th quarter 2014 (advance estimate). The consensus is that real GDP increased 3.2% annualized in Q4.

• At 9:45 AM, Chicago Purchasing Managers Index for January. The consensus is for a reading of 57.7, down from 58.8 in December.

• At 10:00 AM, the University of Michigan's Consumer sentiment index (final for January). The consensus is for a reading of 98.2, unchanged from the preliminary reading of 98.2, and up from the December reading of 93.6.

Zillow: Case-Shiller House Price Index year-over-year change expected to slow further in December

by Calculated Risk on 1/29/2015 03:15:00 PM

The Case-Shiller house price indexes for November were released Tuesday. Zillow has started forecasting Case-Shiller a month early - now including the National Index - and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: Expect Recent Trend of Sub-5% Annual Growth in Case-Shiller to Continue into 2015

The November S&P/Case-Shiller (SPCS) data released [Tuesday] showed a slight uptick in the pace of national home value appreciation in the housing market, with annual growth in the U.S. National Index rising to 4.7 percent, from 4.6 percent in October.So the year-over-year change in the Case-Shiller index will probably slow in December.

Despite the modestly faster pace of growth, annual appreciation in home values as measured by SPCS has been less than 5 percent for the past three months. We anticipate this trend to continue as annual growth in home prices slows to more normal levels between 3 percent and 5 percent. Zillow predicts the U.S. National Index to rise 4.5 percent on an annual basis in December.

The 10- and 20-City Indices saw annual growth rates decline in November; the 10-City index rose 4.2 percent and the 20-City Index rose 4.4 percent – down from rates of 4.4 percent and 4.5 percent, respectively, in October.

The non-seasonally adjusted (NSA) 20-City index fell 0.2 percent from October to November, and we expect it to decrease 0.4 percent in December from November. We expect the same monthly decline in the 10-City Composite Index next month, falling 0.4 percent from November to December (NSA).

All forecasts are shown in the table below. These forecasts are based on the November SPCS data release and the December 2014 Zillow Home Value Index (ZHVI), released Jan. 22. Officially, the SPCS Composite Home Price Indices for December will not be released until Tuesday, Feb. 24.

| Zillow Case-Shiller Forecast | ||||||

|---|---|---|---|---|---|---|

| Case-Shiller Composite 10 | Case-Shiller Composite 20 | Case-Shiller National | ||||

| NSA | SA | NSA | SA | NSA | SA | |

| November Actual YoY | 4.2% | 4.2% | 4.3% | 4.3% | 4.7% | 4.7% |

| December Forecast YoY | 3.8% | 3.8% | 4.0% | 4.0% | 4.5% | 4.5% |

| December Forecast MoM | -0.4% | 0.2% | -0.4% | 0.3% | 0.0% | 0.5% |

Philly Fed: State Coincident Indexes increased in 46 states in December

by Calculated Risk on 1/29/2015 11:58:00 AM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for December 2014. In the past month, the indexes increased in 46 states and remained stable in four, for a one-month diffusion index of 94. Over the past three months, the indexes increased in 50 states, for a three-month diffusion index of 100.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In December, 49 states had increasing activity (including minor increases). This measure has been moving up and down, and is in the normal range for a recovery.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is all green again.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is all green again. It seems likely that several oil producing states will turn red sometime in 2015 - possibly Texas, North Dakota, Alaska or Oklahoma.