by Calculated Risk on 1/30/2015 08:30:00 AM

Friday, January 30, 2015

BEA: Real GDP increased at 2.6% Annualized Rate in Q4

From the BEA: Gross Domestic Product: Fourth Quarter and Annual 2014 (Advance Estimate)

Real gross domestic product -- the value of the production of goods and services in the United States, adjusted for price changes -- increased at an annual rate of 2.6 percent in the fourth quarter of 2014, according to the "advance" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 5.0 percent.The advance Q4 GDP report, with 2.6% annualized growth, was below expectations of a 3.2% increase.

...

The increase in real GDP in the fourth quarter reflected positive contributions from personal consumption expenditures (PCE), private inventory investment, exports, nonresidential fixed investment, state and local government spending, and residential fixed investment that were partly offset by a negative contribution from federal government spending. Imports, which are a subtraction in the calculation of GDP, increased.

The deceleration in real GDP growth in the fourth quarter primarily reflected an upturn in imports, a downturn in federal government spending, and decelerations in nonresidential fixed investment and in exports that were partly offset by an upturn in private inventory investment and an acceleration in PCE.

The price index for gross domestic purchases, which measures prices paid by U.S. residents, decreased 0.3 percent in the fourth quarter, in contrast to an increase of 1.4 percent in the third. Excluding food and energy prices, the price index for gross domestic purchases increased 0.7 percent, compared with an increase of 1.6 percent.

Personal consumption expenditures (PCE) increased at a 4.3% annualized rate - a strong pace!

The key negatives were trade (subtracted 1.02 percentage point) and Federal government spending (subtracted 0.54 percentage points).

Click on graph for larger image.

Click on graph for larger image.The first graph shows residential investment as a percent of GDP.

Residential Investment as a percent of GDP has been increasing, but it still below the levels of previous recessions - and I expect RI to continue to increase for the next few years.

I'll break down Residential Investment into components after the GDP details are released this coming week. Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

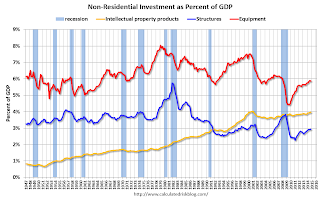

The second graph shows non-residential investment in structures, equipment and "intellectual property products". Investment is trending up as a percent of GDP..

The second graph shows non-residential investment in structures, equipment and "intellectual property products". Investment is trending up as a percent of GDP..I'll add details for investment in offices, malls and hotels next week.

Overall this was a solid report with strong PCE and private domestic investment.