by Calculated Risk on 1/27/2015 09:05:00 AM

Tuesday, January 27, 2015

Case-Shiller: National House Price Index increased 4.7% year-over-year in November

S&P/Case-Shiller released the monthly Home Price Indices for November ("November" is a 3 month average of September, October and November prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Price Gains Continue to Slow According to the S&P/Case-Shiller Home Price Indices

Data released today for November 2014 shows a continued slowdown in home prices nationwide, but with price increases in nine cities. ... Both the 10-City and 20-City Composites saw year-over-year growth rates decline in November compared to October. The 10-City Composite gained 4.2% year-over-year, down from 4.4% in October. The 20-City Composite gained 4.3% year-over-year, compared to 4.5% in October. The S&P/Case-Shiller U.S. National Home Price Index, which covers all nine U.S. census divisions, recorded a 4.7% annual gain in November 2014 versus 4.6% in October 2014.

...

The National and Composite Indices were both marginally negative in November. The 10 and 20-City Composites reported declines of -0.3% and -0.2%, while the National Index posted a decline of -0.1% for the month. Tampa led all cities in November with an increase of 0.8%. Chicago and Detroit offset those gains by reporting decreases of -1.1% and -0.9% respectively.

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 17.4% from the peak, and up 0.7% in November (SA).

The Composite 20 index is off 16.4% from the peak, and up 0.7% (SA) in November.

The National index is off 9.1% from the peak, and up 0.8% (SA) in November. The National index is up 22.8% from the post-bubble low set in Dec 2011 (SA).

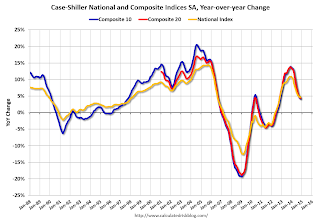

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.2% compared to November 2013.

The Composite 20 SA is up 4.3% year-over-year..

The National index SA is up 4.7% year-over-year.

Prices increased (SA) in all 20 of the 20 Case-Shiller cities in November seasonally adjusted. (Prices increased in 11 of the 20 cities NSA) Prices in Las Vegas are off 41.7% from the peak, and prices in Denver and Dallas are at new highs (SA).

This was close to the consensus forecast for a 4.6% YoY increase for the National index, and suggests a slight further slowdown in price increases. I'll have more on house prices later.

Monday, January 26, 2015

Tuesday: New Home Sales, Case-Shiller House Prices, Durable Goods and More

by Calculated Risk on 1/26/2015 08:11:00 PM

I was looking at the outer Los Angeles and Long Beach harbor today, and I realized I've never seen so many loaded freighters queued up to unload at the port. The West Coast port slowdown is getting serious.

The Long Beach Press Telegram had an editorial today: Enough is enough on West Coast port labor dispute

West Coast dockworkers and their employers need to stop holding the economy hostage and sign a labor contract. ...Hopefully this will get resolved soon.

Meantime, both sides are blaming the other for slowdowns at the port.

But the real issues, the ones that are being discussed at the table, need to be resolved. Earlier this month, both sides agreed to bring in a federal mediator to do just that.

It’s unclear what’s going on beyond closed doors, but it has become apparent that both parties are going to have to work harder to get this contract signed.

Tuesday:

• At 8:30 AM ET, Durable Goods Orders for December from the Census Bureau. The consensus is for a 0.7% increase in durable goods orders.

• At 9:00 AM, S&P/Case-Shiller House Price Index for November. Although this is the November report, it is really a 3 month average of September, October and November prices. The consensus is for a 4.6% year-over-year increase in the National Index for November, down from 4.7% in October.

• At 10:00 AM, New Home Sales for December from the Census Bureau. The consensus is for an increase in sales to 450 thousand Seasonally Adjusted Annual Rate (SAAR) in December from 438 thousand in November.

• Also at 10:00 AM, Conference Board's consumer confidence index for January. The consensus is for the index to increase to 95.0 from 92.6.

• Also at 10:00 AM, Regional and State Employment and Unemployment (Monthly) for December 2014

• Also at 10:00 AM, Richmond Fed Survey of Manufacturing Activity for January.

Lawler: Updated Table of Distressed Sales and Cash buyers for Selected Cities in December

by Calculated Risk on 1/26/2015 05:05:00 PM

Economist Tom Lawler sent me the updated table below of short sales, foreclosures and cash buyers for a few selected cities in December.

On distressed: Total "distressed" share is down in almost all of these markets, mostly due to a decline in short sales.

Short sales are down in these areas (except Sacramento).

Foreclosures are up in a few areas (working through the logjam, mostly in judicial states - especially in Florida).

The All Cash Share (last two columns) is mostly declining year-over-year.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Dec-14 | Dec-13 | Dec-14 | Dec-13 | Dec-14 | Dec-13 | Dec-14 | Dec-13 | |

| Las Vegas | 10.0% | 20.7% | 8.0% | 8.5% | 18.0% | 29.2% | 34.1% | 44.4% |

| Reno** | 8.0% | 24.0% | 5.0% | 4.0% | 13.0% | 28.0% | ||

| Phoenix | 4.6% | 9.5% | 5.2% | 7.5% | 9.8% | 17.1% | 29.2% | 34.6% |

| Sacramento | 6.2% | 6.1% | 7.1% | 5.4% | 13.3% | 11.5% | 15.4%** | 19.5%** |

| Minneapolis | 3.7% | 5.5% | 12.6% | 17.1% | 16.3% | 22.7% | ||

| Mid-Atlantic | 4.9% | 8.0% | 11.2% | 9.3% | 16.1% | 17.3% | 20.3% | 19.3% |

| Orlando | 4.8% | 13.5% | 26.7% | 19.1% | 31.5% | 32.7% | 40.0% | 45.0% |

| California * | 6.3% | 10.3% | 5.7% | 6.9% | 12.0% | 17.2% | ||

| Bay Area CA* | 4.0% | 7.9% | 3.7% | 4.6% | 7.7% | 12.5% | 19.0% | 23.5% |

| So. California* | 6.2% | 10.2% | 5.0% | 5.8% | 11.2% | 16.0% | 23.8% | 28.8% |

| Tampa MSA SF | 6.2% | 11.9% | 23.4% | 18.2% | 29.6% | 30.1% | 36.9% | 42.0% |

| Tampa MSA C/TH | 3.3% | 8.4% | 18.4% | 15.8% | 21.7% | 24.2% | 60.3% | 62.8% |

| Tampa MSA C/TH | 3.3% | 8.4% | 18.4% | 15.8% | 21.7% | 24.2% | 60.3% | 62.8% |

| Florida SF | 5.3% | 11.0% | 21.8% | 19.5% | 27.1% | 30.5% | 38.4% | 42.5% |

| Florida C/TH | 3.3% | 9.0% | 17.6% | 16.0% | 20.9% | 25.1% | 65.3% | 68.4% |

| Northeast Florida | 30.6% | 37.9% | ||||||

| Hampton Roads | 21.5% | 29.1% | ||||||

| Tucson | 28.7% | 32.3% | ||||||

| Toledo | 37.9% | 36.5% | ||||||

| Wichita | 26.8% | 30.2% | ||||||

| Des Moines | 20.3% | 23.1% | ||||||

| Peoria | 23.6% | 23.0% | ||||||

| Georgia*** | 25.5% | N/A | ||||||

| Omaha | 20.5% | 23.9% | ||||||

| Pensacola | 33.1% | 35.5% | ||||||

| Knoxville | 25.0% | 25.0% | ||||||

| Memphis* | 15.0% | 21.0% | ||||||

| Rhode Island | 14.7% | 19.1% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

Lawler: D.R. Horton reports Home Sales Soared Last Quarter

by Calculated Risk on 1/26/2015 02:24:00 PM

From housing economist Tom Lawler:

D.R. Horton, the nation’s largest home builder, reported that net home orders in the quarter ended December 31, 2014 totaled 7,370, up 35.1% from the comparable quarter of 2013. Net orders per active community were up about 27% YOY. Horton’s average net order price last quarter was $286,000, up 3.8% from a year earlier. Home deliveries last quarter totaled 7,973, up 28.8% from the comparable quarter of 2013, at an average sales price of $281,000, up 6.6% from a year earlier. A company official said that the YOY increase in its average sales price reflected a 4% increase in the average size of a home closed and a “small” increase in the average price per square foot. Company officials said that they expect the company’s average sales price in 2015 to be “flat” relative to 2014. The company’s order backlog at the end of December was 9,285, up 20.8% from last December, at an average order price of $293,600, up 6.8% from a year ago.

“Express” Homes, Horton’s “lower priced/fewer amenities” brand targeted at “entry-level” buyers, accounted for about 13% of last quarter’s net home orders (in units), up from 7% in the previous quarter and 3% in the comparable quarter of 2013, and about 10% of home deliveries, up from 5% in the previous quarter and 4% a year ago.

The company’s gross margin last quarter was down both from the previous quarter and a year ago, but was in line with guidance given by officials in the previous two quarters.

Horton “surprised” many analysts and competitors last spring by saying that it had increased its sales incentives from “unusually” low to “more normal” levels in order to drive its unit sales pace. As a result, Horton’s market share increased significantly since last spring. More recently a number of other builders have “warned” that they have had to increase incentives.

Vehicle Sales Forecasts: "Best January in 8 Years"

by Calculated Risk on 1/26/2015 12:57:00 PM

The automakers will report January vehicle sales on February 3rd. Sales in December were at 16.8 million on a seasonally adjusted annual rate basis (SAAR), and it appears sales in January will be lower - but will probably be the best January in eight years.

Note: There were 26 selling days in January this year compared to 25 last year.

Here are two forecasts:

From WardsAuto: Forecast: U.S. Automakers to Record Best January in Eight Years

A WardsAuto forecast calls for U.S. automakers to deliver 1.13 million light vehicles in January, marking the industry’s best kickoff since January 2006. ... the report puts the seasonally adjusted annual rate of sales for the month at 16.4 million units, compared with a year-ago SAAR of 15.2 million and December’s 16.8 million mark.And from TrueCar: TrueCar forecasts strong start for 2015 auto sales with 13.2% volume gain and 16.6 Million SAAR in January

TrueCar, Inc. ... forecasts the pace of auto sales in January expanded to a seasonally adjusted annualized rate (SAAR) of 16.6 million new units on continued consumer demand.Another strong month for auto sales.

New light vehicle sales, including fleet, should reach 1,446,600 units for the month, up 13.2 percent over a year ago. On a daily selling rate (DSR) basis, adjusting for one additional selling day this January versus a year ago, deliveries will likely rise 8.9 percent.

Dallas Fed: Texas Manufacturing Activity Stalls and Outlook Worsens

by Calculated Risk on 1/26/2015 10:37:00 AM

From the Dallas Fed: Texas Manufacturing Activity Stalls and Outlook Worsens

Texas factory activity was flat in January, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, came in at 0.7, indicating output was essentially unchanged from December.With lower oil prices, a slowdown in Texas should be expected.

Other survey measures also reflected sluggish activity during the month. The capacity utilization index fell to 5.1, its lowest reading in five months. The shipments index plunged from 20.8 to 6, due to a much higher share of respondents noting a decline in shipments in January than in December. The new orders index moved down from 2.7 to -7.7, registering its first negative reading since April 2013.

Perceptions of broader business conditions worsened this month, with both the general business activity index and the company outlook index dropping below zero for the first time in 20 months. The general business activity index dropped to -4.4, and the company outlook index fell 13 points, coming in at -3.8.

Labor market indicators reflected unchanged workweeks but continued employment increases. The employment index was 9.0 in January, slightly below last month’s level but close to its average reading over the past two years.

emphasis added

Black Knight: House Price Index up slightly in November, Up 4.5% year-over-year

by Calculated Risk on 1/26/2015 08:37:00 AM

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA, FNC and more). Note: Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight: U.S. Home Prices Up 0.1 Percent for the Month; Up 4.5 Percent Year-Over-Year

Today, the Data and Analytics division of Black Knight Financial Services released its latest Home Price Index (HPI) report, based on November 2014 residential real estate transactions. The Black Knight HPI combines the company’s extensive property and loan-level databases to produce a repeat sales analysis of home prices as of their transaction dates every month for each of more than 18,500 U.S. ZIP codes. The Black Knight HPI represents the price of non-distressed sales by taking into account price discounts for REO and short sales.The Black Knight HPI increased 0.1% percent in November, and is off 10.1% from the peak in June 2006 (not adjusted for inflation).

The year-over-year increases had been getting steadily smaller since peaking in 2013 - as shown in the table below - but the YoY increase has been about the same for the last three months:

| Month | YoY House Price Increase |

|---|---|

| Jan-13 | 6.7% |

| Feb-13 | 7.3% |

| Mar-13 | 7.6% |

| Apr-13 | 8.1% |

| May-13 | 7.9% |

| Jun-13 | 8.4% |

| Jul-13 | 8.7% |

| Aug-13 | 9.0% |

| Sep-13 | 9.0% |

| Oct-13 | 8.8% |

| Nov-13 | 8.5% |

| Dec-13 | 8.4% |

| Jan-14 | 8.0% |

| Feb-14 | 7.6% |

| Mar-14 | 7.0% |

| Apr-14 | 6.4% |

| May-14 | 5.9% |

| June-14 | 5.5% |

| July-14 | 5.1% |

| Aug-14 | 4.9% |

| Sep-14 | 4.6% |

| Oct-14 | 4.5% |

| Nov-14 | 4.5% |

The press release has data for the 20 largest states, and 40 MSAs.

Black Knight shows prices off 40.9% from the peak in Las Vegas, off 34.1% in Orlando, and 31.6% off from the peak in Riverside-San Bernardino, CA (Inland Empire). Prices are at new highs in Colorado and Texas (Denver, Austin, Dallas, Houston and San Antonio metros). Prices are also at new highs in Honolulu, HI, Nashville, TN, and San Jose, CA.

Note: Case-Shiller for November will be released tomorrow.

Sunday, January 25, 2015

Sunday Night Futures: All Greek to me!

by Calculated Risk on 1/25/2015 09:09:00 PM

From the WSJ: Leftists Sweep to Power in Greece

Greek voters were set to hand power to a radical leftist party in national elections on Sunday, a popular rebellion against the bitter economic medicine Greece has swallowed for five years and a rebuke of the fellow European countries that prescribed it.We discussed this several years ago - in a democracy, austerity will eventually fail at the ballot box. The people will not tolerate 25% unemployment forever - with no hope in sight.

With nearly all votes counted, opposition party Syriza was on track to win about half the seats in Parliament. In the wee hours of the morning, it clinched a coalition deal with a small right-wing party also opposed to Europe’s economic policy to give the two a clear majority.

Monday:

• At 10:30 AM ET: the Dallas Fed Manufacturing Survey for January.

Weekend:

• Schedule for Week of January 25, 2015

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 12 and DOW futures are down 120 (fair value).

Oil prices were down over the last week with WTI futures at $44.99 per barrel and Brent at $48.45 per barrel. A year ago, WTI was at $96, and Brent was at $109 - so prices are down 54% and 56% year-over-year respectively.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $2.02 per gallon (down about $1.25 per gallon from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

GDP: Annual and Q4-over-Q4

by Calculated Risk on 1/25/2015 11:40:00 AM

The advance estimate for Q4 GDP will be released this week. The consensus forecast is that real GDP increased 3.2% annualized in Q4.

The FOMC GDP projections are for Q4-over-Q4. The most recent FOMC projection was for real GDP to increase 2.3% to 2.5% Q4 2014 over Q4 2013.

However many analysts forecast annual GDP, so here is a discussion of the difference between annual and Q4-over-Q4:

• The Bureau of Economic Analysis (BEA) reports real GDP growth on a seasonally adjusted annual rate (SAAR) basis. So this is adjusted for inflation (real), seasonally adjusted, and annualized. Other countries report GDP differently - as an example China reports GDP growth on a year-over-year basis, and the UK reports GDP growth for each quarter, but not annualized. A 3.2% annualized real growth rate in the US would be reported at 0.79% quarterly in the UK (not annualized).

Note: the easiest way to calculate the real change in GDP is to use the chained 2009 dollars series. Nominal GDP in 2014 was around $17.5 trillion.

• Calculating the Q4 GDP forecast: Using the consensus forecast of 3.2% real GDP growth in Q4, real GDP (2009 dollars) would be $16,333.7 billion (SAAR) in Q4. To calculate this, use Table 1.1.6. Real Gross Domestic Product, Chained Dollars at the BEA. The BEA reported Q3 GDP was $16,205.6 billion (SAAR). Multiply this by (1.032 ^ .25) to calculate Q4 real GDP (2009 dollars, SAAR).

• Calculating Q4-over-Q4 GDP growth: The BEA reported real GDP in Q4 2013 was $15,916.2 billion (SAAR, 2009 dollars). So the Q4-over-Q4 growth rate would be $16,333.7 (Q4 2014 forecast) divided by $15,916.2 (Q4 2013). That would be 2.6% (slightly above the December FOMC projections).

• Calculating 2014 GDP growth: To calculated GDP growth for 2013, first we calculate the annual real GDP for 2014 (this is an average of GDP for the four quarters). Using the forecast GDP for Q4, the 2014 annual GDP would be $16,095.4 billion. The annual real GDP (2009 dollars) for 2013 was $15,710.3 billion. So the 2014 annual growth rate would be $16,095.4 (four quarter average using Q4 forecast) divided by $15,710.3 (2013 real GDP). This would be 2.5%.

Not much difference between the annual rate and Q4-over-Q4, but it might be a little confusing when GDP is reported this week. Some articles might report the Q4-over-Q4 growth rate that the FOMC is looking at - other articles might report 2014 over 2013.

Of course most of the focus will be on the quarterly GDP rate (and also inflation).

Saturday, January 24, 2015

Schedule for Week of January 25, 2015

by Calculated Risk on 1/24/2015 01:04:00 PM

The key reports this week are the advance estimate of Q4 GDP, December New Home sales, and November Case-Shiller house prices.

For manufacturing, the January Dallas and Richmond Fed surveys will be released this week.

10:30 AM: Dallas Fed Manufacturing Survey for January.

8:30 AM: Durable Goods Orders for December from the Census Bureau. The consensus is for a 0.7% increase in durable goods orders.

9:00 AM: S&P/Case-Shiller House Price Index for November. Although this is the November report, it is really a 3 month average of September, October and November prices.

9:00 AM: S&P/Case-Shiller House Price Index for November. Although this is the November report, it is really a 3 month average of September, October and November prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the October 2014 report (the Composite 20 was started in January 2000).

The consensus is for a 4.6% year-over-year increase in the National Index for November, down from 4.7% in October. The Zillow forecast is for the National Index to increase 4.5% year-over-year in November, and for prices to increase 0.6% month-to-month seasonally adjusted.

10:00 AM: New Home Sales for December from the Census Bureau.

10:00 AM: New Home Sales for December from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the November sales rate.

The consensus is for an increase in sales to 450 thousand Seasonally Adjusted Annual Rate (SAAR) in December from 438 thousand in November.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for December 2014

10:00 AM: Richmond Fed Survey of Manufacturing Activity for January.

10:00 AM: Conference Board's consumer confidence index for January. The consensus is for the index to increase to 95.0 from 92.6.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

2:00 PM: FOMC Meeting Statement. The FOMC is expected to retain the word "patient" in the FOMC statement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 300 thousand from 307 thousand.

10:00 AM ET: Pending Home Sales Index for December. The consensus is for a 0.5% increase in the index.

10:00 AM: Q4 Housing Vacancies and Homeownership report from the Census Bureau. This report is frequently mentioned by analysts and the media to report on the homeownership rate, and the homeowner and rental vacancy rates. However, this report doesn't track with other measures (like the decennial Census and the ACS).

8:30 AM: Gross Domestic Product, 4th quarter 2014 (advance estimate). The consensus is that real GDP increased 3.2% annualized in Q4.

9:45 AM: Chicago Purchasing Managers Index for January. The consensus is for a reading of 57.7, down from 58.8 in December.

9:55 AM: University of Michigan's Consumer sentiment index (final for January). The consensus is for a reading of 98.2, unchanged from the preliminary reading of 98.2, and up from the December reading of 93.6.