by Calculated Risk on 1/21/2015 12:44:00 PM

Wednesday, January 21, 2015

Comments on December Housing Starts

Just over a year ago, in November 2013, housing starts were at a 1.091 million pace on a seasonally adjusted annual rate (SAAR) basis. (Since revised to 1.105 million).

That end of the year surge in 2013 led many analysts to push up their forecast for 2014 (see blue column for November 2013 in the first graph below).

It ends up not one month in 2014 was above November 2013 (as revised). This is a reminder not to be influenced too much by one month of data.

That brings us to this morning: the Census Bureau reported that single family starts were at 728 thousand in December, the highest level since early 2008. If single family starts just hold that level in 2015, annual single family starts would be up about 12% over 2014. With more growth, 20% would seem possible. However I think 20% is too optimistic (based on lots and pricing), and just like in 2013, we shouldn't let one month of data influence us too much.

This graph shows the month to month comparison between 2013 (blue) and 2014 (red).

There were 1.006 million total housing starts during 2014, up 8.7% from the 925 thousand in 2013. Single family starts were up 4.9%, and multifamily starts up 17.1%.

The following table shows the annual housing starts since 2005, and the percent change from the previous year. The housing recovery slowed in 2014, especially for single family starts. However I expect further growth in starts over the next several years.

| Housing Starts (000s) and Annual Change | ||||

|---|---|---|---|---|

| Total | Total % Change | Single | Single % Change | |

| 2005 | 2,068.3 | 5.8% | 1,715.8 | 6.5% |

| 2006 | 1,800.9 | -12.9% | 1,465.4 | -14.6% |

| 2007 | 1,355.0 | -24.8% | 1,046.0 | -28.6% |

| 2008 | 905.5 | -33.2% | 622.0 | -40.5% |

| 2009 | 554.0 | -38.8% | 445.1 | -28.4% |

| 2010 | 586.9 | 5.9% | 471.2 | 5.9% |

| 2011 | 608.8 | 3.7% | 430.6 | -8.6% |

| 2012 | 780.6 | 28.2% | 535.3 | 24.3% |

| 2013 | 924.9 | 18.5% | 617.6 | 15.4% |

| 2014 | 1,005.8 | 8.7% | 648.0 | 4.9% |

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The blue line is for multifamily starts and the red line is for multifamily completions.

The blue line is for multifamily starts and the red line is for multifamily completions. The rolling 12 month total for starts (blue line) increased steadily over the last few years, and completions (red line) have lagged behind - but completions have been catching up (more deliveries), and will continue to follow starts up (completions lag starts by about 12 months).

Note that the blue line (multi-family starts) might be starting to move more sideways.

I think most of the growth in multi-family starts is probably behind us - although I expect solid multi-family starts for a few more years (based on demographics).

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

AIA: Architecture Billings Index increased in December

by Calculated Risk on 1/21/2015 10:32:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From Reuters: U.S. architecture billings index rises in December

The index rose to 52.2 in December from 50.9 in November, making it ten months that the index had risen in 2014.

A reading above 50 indicates an increase in billings.

"Particularly encouraging is the continued solid upturn in design activity at institutional firms, since public sector facilities were the last nonresidential building project type to recover from the downturn," AIA Chief Economist Kermit Baker said.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 52.2 in December, up from 50.9 in November. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index has indicated expansion for eight consecutive months, and those positive readings suggest an increase in CRE investment in 2015.

Housing Starts increased to 1.089 Million Annual Rate in December

by Calculated Risk on 1/21/2015 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in December were at a seasonally adjusted annual rate of 1,089,000. This is 4.4 percent above the revised November estimate of 1,043,000 and is 5.3 percent above the December 2013 rate of 1,034,000.

Single-family housing starts in December were at a rate of 728,000; this is 7.2 percent above the revised November figure of 679,000. The December rate for units in buildings with five units or more was 339,000.

An estimated 1,005,800 housing units were started in 2014. This is 8.8 percent above the 2013 figure of 924,900.

emphasis added

Building Permits:

Privately-owned housing units authorized by building permits in December were at a seasonally adjusted annual rate of 1,032,000. This is 1.9 percent below the revised November rate of 1,052,000, but is 1.0 percent above the December 2013 estimate of [1,022,000].

Single-family authorizations in December were at a rate of 667,000; this is 4.5 percent above the revised November figure of 638,000. Authorizations of units in buildings with five units or more were at a rate of 338,000 in December.

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased slightly in December. Multi-family starts are up 5% year-over-year.

Single-family starts (blue) increased in December and are at the highest level since March 2008.

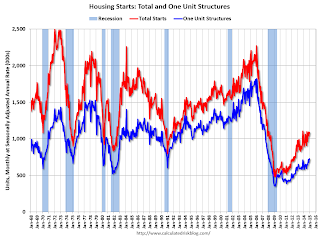

The second graph shows total and single unit starts since 1968.

The second graph shows the huge collapse following the housing bubble, and - after moving sideways for about two years and a half years - housing is now recovering (but still historically low),

The second graph shows the huge collapse following the housing bubble, and - after moving sideways for about two years and a half years - housing is now recovering (but still historically low),This was above expectations of 1.040 million starts in December, and starts in October and November were revised up, so this was a solid report. I'll have more later ...

MBA: "Mortgage Applications Increase in Latest MBA Weekly Survey"

by Calculated Risk on 1/21/2015 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 14.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 16, 2015. ...

The Refinance Index increased 22 percent from the previous week. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier.

...

“Mortgage application volume increased last week to its highest level since June 2013, led by a 22 percent increase in refinance application volume. This increase was largely due to mortgage rates dropping to their lowest level since May 2013. However, the recent reduction in FHA mortgage insurance premiums also played a role: FHA refinance applications increased 57 percent last week. Even with this increase, refinances made up only 48 percent of FHA volume, compared to 73 percent for VA, and 77 percent for conventional loans,” said Mike Fratantoni, MBA’s Chief Economist.

“Conventional purchase applications were down about 3 percent for the week on a seasonally adjusted basis, but up 5 percent relative to last year at this time. FHA purchase applications were down 1 percent for the week on a seasonally adjusted basis.”

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 3.80 percent, the lowest level since May 2013, from 3.89 percent, with points increasing to 0.29 from 0.23 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

2014 was the lowest year for refinance activity since year 2000.

It looks like 2015 will see more refinance activity than in 2014, especially from FHA loans!

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the purchase index is up 5% from a year ago.

Tuesday, January 20, 2015

Wednesday: Housing Starts

by Calculated Risk on 1/20/2015 07:38:00 PM

From Mortgage News Daily: Mortgage Rates Mixed to Begin Volatile Week

Mortgage rates were truly mixed today, with some lenders improving while others moved higher. More than a few were unchanged or close to it. All this despite the fact that broader interest rate benchmarks like 10yr US Treasuries were unequivocally in stronger territory.Wednesday:

...

The net effect of this mixed underperformance is that the most prevalent conforming, 30yr fixed rate quote remains 3.625%.

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Housing Starts for December. Total housing starts were at 1.028 million (SAAR) in November. Single family starts were at 677 thousand SAAR in November. The consensus is for total housing starts to increase to 1.040 million (SAAR) in December.

• During the day: The AIA's Architecture Billings Index for December (a leading indicator for commercial real estate).