by Calculated Risk on 11/23/2014 11:47:00 AM

Sunday, November 23, 2014

Update: Business Cycles and Markets

For fun ... recently we've seen another recession call for 2015, this time from the Jerome Levy Forecasting Center (following their an incorrect recession call in 2011). Over the last few years, there were several incorrect recession calls from ECRI and others. I disagreed with all of them, and I wrote I wasn't even on recession watch then, and I'm not on recession watch now!

But why do we care? Here is a repeat of a post I wrote in early 2011 (with updated tables and charts):

From 2011 [updates in brackets]: Here is something very different. This is NOT intended as investment advice.

Why is there so much focus on the business cycle? For companies, especially cyclical companies, the reason is obvious – it helps with planning, staffing and investment.

But why are investors so focused on the business cycle? Obviously earnings decline in a recession, and stock prices fall too. The following graph shows the year-over-year (YoY) change in the S&P 500 (using average monthly prices) since 1970. Notice that the market usually declines YoY in a recession.

Note: Because this is “year-over-year” there is a lag to the S&P 500 data. [Graph updated to November 2014]

So calling a recession isn’t just an academic exercise, there is some opportunity to preserve capital.

Not all downturns in the stock market are associated with recessions. As an example, the 1987 market crash was during an economic expansion. And the stock bubble collapse lasted from March 2000 through early 2003 – and the only official economic recession during that period was 7 months in 2001.

Although I don’t give investment advice, I think investors should measure their performance with some index. Warren Buffett likes to use the S&P 500 index, so I also used the S&P 500 for this exercise.

Imagine if we could call recessions in real time, and if we could predict recoveries in advance. The following table shows the performance of a buy-and-hold strategy (with dividend reinvestment), compared to a strategy of market timing based on 1) selling when a recession starts, and 2) buying 6 months before a recession ends.

For the buy and sell prices, I averaged the S&P 500 closing price for the entire month (no cherry picking price – just cherry picking the timing with 20/20 hindsight).

I assumed an investor started at four different times, in January of 1970, 1980, 1990, and 2000 [UPDATE: added 2010 start].

Note: Table columns for sensitivity corrected (ht YT)

| Return from Start Date | Recession Timing Sensitivity | |||||

|---|---|---|---|---|---|---|

| Start Investing | Buy and Hold | Recession Timing | Two Months Early | One Month Early | One Month Late | Two Months Late |

| Jan-70 | 9.3% | 12.7% | 11.8% | 12.4% | 12.6% | 12.1% |

| Jan-80 | 10.4% | 13.0% | 12.9% | 12.9% | 13.2% | 12.5% |

| Jan-90 | 8.6% | 11.8% | 11.5% | 11.7% | 11.7% | 11.2% |

| Jan-00 | 3.4% | 7.4% | 7.9% | 7.6% | 7.5% | 7.6% |

| Jan-10 | 14.4% | 14.4% | -- | -- | -- | -- |

The “recession timing” column gives the annualized return for each of the starting dates. Timing the recession correctly always outperforms buy-and-hold. The last four columns show the performance if the investor is two months early (both in and out), one month early, one month late, and two months late. The investor doesn’t have to be perfect!

Note: This includes dividends, but not taxes. Also I assumed no interest earned when the investor is out of the market (money in the mattress).

The second table provides the same information, but this time in dollars (assuming a $10,000 initial investment). Notice that someone could have bought the S&P 500 index in January 2000, and they’d be up about $150 [November 2014 Update: Up $16,410] now using buy-and-hold even though the market is still below the January 2000 average price of 1425 [Update: Now well above January 2000].

| Value based on Start Date | Recession Timing Sensitivity | |||||

|---|---|---|---|---|---|---|

| Start Investing | Buy and Hold | Recession Timing | Two Months Early | One Month Early | One Month Late | Two Months Late |

| Jan-70 | $532,650 | $2,113,480 | $1,497,100 | $1,905,810 | $2,053,620 | $1,678,730 |

| Jan-80 | $310,120 | $706,780 | $678,110 | $679,200 | $745,040 | $607,400 |

| Jan-90 | $77,950 | $159,530 | $148,160 | $156,400 | $157,430 | $140,910 |

| Jan-00 | $16,410 | $28,810 | $30,690 | $29,830 | $29,220 | $29,680 |

| Jan-10 | $19,150 | $19,150 | -- | -- | -- | -- |

Unfortunately forecasters have a terrible record of predicting downturns. The running joke is that forecasters have predicted 9 of the last 5 recessions! Although a forecaster doesn’t have to be perfect, they still have to be right. And that is very rare.

As economist Victor Zarnowitz said way back in 1960: “The record of predicting turning points — changes in the direction of economic activity — is on the whole poor." Forecasting hasn't improved much since then.

As an example, here are some comments from then Fed Chairman Alan Greenspan in 1990 (a recession began in July 1990):

“In the very near term there’s little evidence that I can see to suggest the economy is tilting over [into recession].”I'd say he missed that downturn. Of course Wall Street and Fed Chairmen are notoriously bad at calling downturns.

Chairman Greenspan, July 1990

“...those who argue that we are already in a recession I think are reasonably certain to be wrong.”

Greenspan, August 1990

“... the economy has not yet slipped into recession.”

Greenspan, October 1990

But the track record for calling recoveries isn’t much better. ... Calling recessions is a mug’s game, but I like to play. I was very lucky with the [2007] recession, but the key wasn’t calling the end in June 2009 (I thought it ended in July), but looking for the bottom in early 2009 (that is why I posted several times in early 2009 that I was looking for the sun).

This is NOT intended as investment advice. I am NOT an investment advisor. Just some (hopefully) fun musing ...

[Final Update: If investors sold when ECRI first made their recession call in Sept 2011, they would have a missed around a 75% increase in the market This shows why trying to add recession timing is difficult; investors have to be correct on the business cycle - and most forecasters and investors are wrong].

Saturday, November 22, 2014

Update: More 2015 Housing Forecasts

by Calculated Risk on 11/22/2014 06:05:00 PM

Update 11/26/2014 for Merrill Lynch (minor downward revisions) and Fannie Mae (no changes)

Update 11/24/2014: I've added Metrostudy's forecast.

Update: I've added the MBA and Goldman Sachs forecasts. Also Wells Fargo updated their forecast (slight changes).

Towards the end of each year I collect some housing forecasts for the following year, and it looks like most analysts are optimistic for 2015.

Here is a summary of forecasts for 2014. In 2014, new home sales will be around 440 thousand, and total housing starts will be close to 1 million. No one was close on New Home sales (all way too optimistic), and Michelle Meyer (Merrill Lynch) and Fannie Mae were the closest on housing starts (about 10% too high).

In 2014, many analysts underestimated the impact of higher mortgage rates and higher new home prices on new home sales and starts.

Note: Here is a summary of forecasts for 2013. In 2013, new home sales were 429 thousand, and total housing starts were 925 thousand. Barclays were the closest on New Home sales followed by David Crowe (NAHB). Fannie Mae and the NAHB were the closest on housing starts.

The table below shows several forecasts for 2015.

From Fannie Mae: Housing Forecast: November 2014

From NAHB: Single-Family Production Poised to Take Off in 2015

I don't have Moody's Analytics' forecast, but Mark Zandi, chief economist at Moody's Analytics said today "that single-family starts could be closing in on 1 million units by the end of 2015 and multifamily production could go as high as 500,000 units." That seems too high.

I haven't worked up a forecast yet for 2015.

| Housing Forecasts for 2015 | ||||

|---|---|---|---|---|

| New Home Sales (000s) | Single Family Starts (000s) | Total Starts (000s) | House Prices1 | |

| Fannie Mae | 523 | 783 | 1,170 | 4.9%2 |

| Goldman Sachs | 521 | 1,166 | 3.1% | |

| Merrill Lynch | 530 | 1,175 | 3.7% | |

| Metrostudy | 515 | 730 | 1,100 | 3.9%4 |

| MBA | 503 | 728 | 1,108 | 3.0%2 |

| NAHB | 547 | 802 | 1,158 | |

| NAR | 620 | 1,300 | 4%3 | |

| Wells Fargo | 530 | 770 | 1,160 | 3.3% |

| Zillow | 2.4%4 | |||

| 1Case-Shiller unless indicated otherwise 2FHFA Purchase-Only Index 3NAR Median Home price 4Zillow Home Value Index, Oct 2014 to Oct 2015 | ||||

Schedule for Week of November 23rd

by Calculated Risk on 11/22/2014 11:56:00 AM

This will be a short, but busy holiday week. The key reports this week are the second estimate of Q3 GDP, October New Home sales, October personal income and outlays, and September Case-Shiller house prices.

For manufacturing, the November Dallas and Richmond Fed surveys will be released this week.

Also, the NY Fed Q3 Report on Household Debt and Credit will be released on Tuesday.

8:30 AM ET: Chicago Fed National Activity Index for October. This is a composite index of other data.

10:30 AM: Dallas Fed Manufacturing Survey for November.

8:30 AM: Gross Domestic Product, 3rd quarter 2014 (second estimate); Corporate Profits, 3rd quarter 2014 (preliminary estimate). The consensus is that real GDP increased 3.3% annualized in Q3, revised down from the advance estimate of 3.5%..

9:00 AM: FHFA House Price Index for September 2013. This was original a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% increase.

9:00 AM: S&P/Case-Shiller House Price Index for September. Although this is the September report, it is really a 3 month average of July, August and September prices.

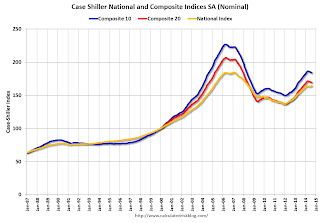

9:00 AM: S&P/Case-Shiller House Price Index for September. Although this is the September report, it is really a 3 month average of July, August and September prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the August 2014 report (the Composite 20 was started in January 2000).

The consensus is for a 4.5% year-over-year increase in the National Index for September, down from 5.1% in August (consensus 4.8% increase in Comp 20). The Zillow forecast is for the Composite 20 to increase 4.7% year-over-year in September, and for prices to increase 0.1% month-to-month seasonally adjusted.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for November.

10:00 AM: Conference Board's consumer confidence index for November. The consensus is for the index to increase to 95.7 from 94.5.

11:00 AM: NY Fed Q3 2014 Household Debt and Credit Report. The New York Fed will also release an accompanying blog, which will analyze household deleveraging.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 288 thousand from 291 thousand last week.

8:30 AM: Durable Goods Orders for October from the Census Bureau. The consensus is for a 0.5% decrease in durable goods orders.

8:30 AM: Personal Income and Outlays for October. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:45 AM: Chicago Purchasing Managers Index for November. The consensus is for a reading of 63.2, down from 66.2 in October.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for November). The consensus is for a reading of 90.0, up from the preliminary reading of 89.4, and up from the October reading of 86.9.

10:00 AM: New Home Sales for October from the Census Bureau.

10:00 AM: New Home Sales for October from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the September sales rate.

The consensus is for an increase in sales to 470 thousand Seasonally Adjusted Annual Rate (SAAR) in October from 467 thousand in September.

10:00 AM ET: Pending Home Sales Index for October. The consensus is for a 0.6% increase in the index.

All US markets will be closed in observance of the Thanksgiving Day Holiday.

The NYSE and the NASDAQ will close at 1:00 PM ET.

Unofficial Problem Bank list declines to 411 Institutions

by Calculated Risk on 11/22/2014 08:11:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Nov 21, 2014.

Changes and comments from surferdude808:

The OCC provided an update on its latest enforcement action activity that resulted in several removals from the Unofficial Problem Bank List. For the week, there were four removals that push the list count to 411 institutions with assets of $126.6 billion. A year ago, there were 654 institutions with assets of $222.8 billion.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now back down to 411.

The OCC terminated actions against Queensborough National Bank & Trust Company, Louisville, GA ($808 million); First Bank Richmond, National Association, Richmond, IN ($495 million); and First National Bank, Groesbeck, TX ($55 million). Texas Savings Bank, Snyder, TX ($74 million) found their way off the list by being acquired in an unassisted transaction.

Next week, we anticipate the FDIC will provide an update on its enforcement action activity, industry results for the third quarter, and updated aggregate figures for their official problem bank list.

Friday, November 21, 2014

Vehicle Sales Forecast: "Could Reach 17 Million" SAAR in November

by Calculated Risk on 11/21/2014 05:13:00 PM

The automakers will report November vehicle sales on Tuesday, December 2nd. Sales in October were at 16.35 million on a seasonally adjusted annual rate basis (SAAR), and it appears sales in November might be at or above 17 million SAAR.

Note: There were 25 selling days in November this year compared to 26 last year.

Here is an early forecast (I'll post more next week).

From WardsAuto: Forecast: SAAR Could Reach 17 Million for Second Time in Four Months

A WardsAuto forecast calls for U.S. light-vehicle sales to reach a 17 million-unit seasonally adjusted annual rate for just the second time since 2006, after crossing that threshold most recently in August, when deliveries equated to a 17.4 million SAAR. The WardsAuto report is calling for 1.29 million light vehicles to be delivered over 25 selling days. The resulting daily sales rate of 51,461 units represents an 8.1% improvement over same-month year-ago (over 26 days) and a 9.1% month-to-month gain on October (27 days), slightly ahead of an average 6% October-November gain over the past three years. The 17 million-unit SAAR would be significantly higher than the 16.3 million recorded year-to-date through October, and would help bring 2014 sales in line with WardsAuto’s full year forecast of 16.4 million units.It appears there will be a strong finish to 2014 for both auto sales and the economy!