by Calculated Risk on 10/29/2014 07:01:00 AM

Wednesday, October 29, 2014

MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 6.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 24, 2014. ...

The Refinance Index decreased 7 percent from the previous week. The seasonally adjusted Purchase Index decreased 5 percent from one week earlier. ... The seasonally adjusted purchase index and conventional purchase index were the lowest since February 2014, while the government purchase index was the lowest since August 2007.

...

“Borrowers with jumbo loans tend to be most sensitive to changes in rates, and that sensitivity has been clearly apparent in the past few weeks with double and even triple digit percentage changes in refinance application volume for jumbo loans,” said Mike Fratantoni, MBA’s Chief Economist. “The average loan size for refinance applications decreased to $263,600 in the most recent week from a survey high of $306,400 the previous week. The decrease was driven by a 41 percent drop in refinance applications for loans greater than $729,000, which had surged almost 130 percent the week before.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.13 percent from 4.10 percent, with points remaining unchanged at 0.21 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 68% from the levels in May 2013.

Even with the recent increase in activity - as people who purchased in the last year or so refinance - refinance activity is very low this year and 2014 will be the lowest since year 2000.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 15% from a year ago.

Tuesday, October 28, 2014

Wednesday: FOMC Statement

by Calculated Risk on 10/28/2014 07:15:00 PM

From Tim Duy: FOMC Meeting

Regarding the statement, here is what I anticipate:Wednesday:

1. The general description of the economy will remain essentially unchanged, expanding at a "moderate pace." ...

2. That said, they will mention they remain watchful of foreign growth.

3. They will acknowledge the further decline in unemployment rates yet retain the view that labor market indicators still suggest underutilization of resources. I would not be surprised by specific mention of low wage growth as evidence of underutilization.

4. I expect the Fed will acknowledge the decline in market-based measures of inflation expectations, but ultimately dismiss those measures for now in favor of stable of survey based measures. ...

5. I expect the risks to growth and employment will remain balanced, and the risk of persistently low inflation will continue to be "somewhat diminished."

6. They will announce the end of the asset purchase program, but emphasize continued reinvestment of principle and that the sizable asset holdings will continue to provide support for the recovery.

7. They will note that despite the end of asset purchases, such purchases remain in the monetary toolbox and could be revived if conditions warranted.

8. The "considerable time" language will remain. ...

9. I expect at least one dissent.

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 2:00 PM, the FOMC Meeting Statement. The FOMC is expected to announce the end of QE3 asset purchases at this meeting.

NMHC Survey: Apartment Market Conditions Slightly Tighter in Q3 2014

by Calculated Risk on 10/28/2014 02:16:00 PM

From the National Multi Housing Council (NMHC): Apartment Markets Expand Further in October NMHC Quarterly Survey

For the third quarter in a row, apartment markets expanded across all four areas of the National Multifamily Housing Council (NMHC) Quarterly Survey of Apartment Market Conditions. Market tightness (52), sales volume (58), equity financing (54) and debt financing (71) indexes all remained above 50 – indicating growth from the previous quarter.

“The apartment markets are still firing on all cylinders,” said Mark Obrinsky, NMHC’s SVP of Research and Chief Economist. “Demand for apartment residences is still strong enough to offset the gradually rising level of new apartment deliveries. Even with occupancy rates at high levels, markets got just a bit tighter in the last three months."

The survey also asked about apartment demand from demographics beyond the core mid-to-late twenties set. One in five (22 percent) reported a significant increase in the number of Baby Boomers among their residents. A similar share (21 percent) indicated a significant increase in “forty-somethings” in their properties. A smaller share of respondents reported increases among single parents (13 percent) and married couples with children (4 percent).

“Young people still make up a disproportionate share of apartment renters. But now we’re starting to see growing segment of baby boomers attracted to apartment living,” said Obrinsky.

...

The Market Tightness Index fell from 68 to 52. Slightly more than half (52 percent) of respondents reported unchanged conditions. Approximately one-quarter (26 percent) saw conditions as tighter than three months ago, a decrease from July’s survey, where half saw conditions as tighter than three months ago. Looser conditions were reported by 22 percent of respondents, a slight uptick from July’s 15 percent.

emphasis added

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tighter conditions from the previous quarter. This indicates slightly tighter market conditions in Q3.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010. The apartment market is still solid.

House Prices: Real Prices and Price-to-Rent Ratio in August

by Calculated Risk on 10/28/2014 11:59:00 AM

I started 2014 expecting a slowdown in year-over-year (YoY) house prices as "For Sale" inventory increases - and the price slowdown is very clear. The Case-Shiller Composite 20 index was up 5.6% YoY in August; the smallest YoY increase since October 2012 (the National index was up 5.1%, also the slowest YoY increase since October 2012.

This slowdown was expected by several key analysts, and I think it is good news. As Zillow chief economist Stan Humphries said today:

“After several months in a row of slowing home value growth, it’s fair to say now the market has officially turned a corner and entered a new phase of the recovery. We’re transitioning away from a period of hot and bothered market activity, characterized by low inventory and rapid price growth, onto a more slow and steady trajectory, which is great news. In housing, boring is better."Boring - in the housing market - would be good!

emphasis added

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $280,000 today adjusted for inflation (40%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

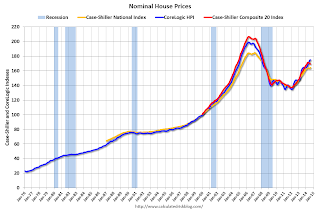

Nominal House Prices

The first graph shows the monthly Case-Shiller National Index SA, the monthly Case-Shiller Composite 20 SA, and the CoreLogic House Price Indexes (through July) in nominal terms as reported.

The first graph shows the monthly Case-Shiller National Index SA, the monthly Case-Shiller Composite 20 SA, and the CoreLogic House Price Indexes (through July) in nominal terms as reported.In nominal terms, the Case-Shiller National index (SA) is back to February 2005 levels, and the Case-Shiller Composite 20 Index (SA) is back to September 2004 levels, and the CoreLogic index (NSA) is back to February 2005.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to September 2002 levels, the Composite 20 index is back to June 2002, and the CoreLogic index back to March 2003.

In real terms, house prices are back to early '00s levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to February 2003 levels, the Composite 20 index is back to September 2002 levels, and the CoreLogic index is back to July 2003.

In real terms, and as a price-to-rent ratio, prices are mostly back to early 2000 levels - and maybe moving a little sideways now.

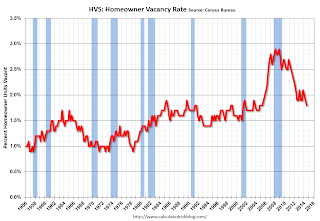

HVS: Q3 2014 Homeownership and Vacancy Rates

by Calculated Risk on 10/28/2014 10:00:00 AM

The Census Bureau released the Housing Vacancies and Homeownership report for Q3 2014.

This report is frequently mentioned by analysts and the media to track the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate decreased to 64.4% in Q3, from 64.7% in Q2.

I'd put more weight on the decennial Census numbers - and given changing demographics, the homeownership rate is probably close to a bottom.

It isn't really clear what this means. Are these homes becoming rentals?

Once again - this probably shows that the general trend is down, but I wouldn't rely on the absolute numbers.

I think the Reis quarterly survey (large apartment owners only in selected cities) is a much better measure of the rental vacancy rate - and Reis reported that the rental vacancy rate increased slightly in Q3 - and might have bottomed.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey. Unfortunately many analysts still use this survey to estimate the excess vacant supply.