by Calculated Risk on 10/28/2014 09:00:00 AM

Tuesday, October 28, 2014

Case-Shiller: National House Price Index increased 5.1% year-over-year in August

S&P/Case-Shiller released the monthly Home Price Indices for August ("August" is a 3 month average of June, July and August prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the new monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Price Gains Fade Further According to the S&P/Case-Shiller Home Price Indices

Data through August 2014, released today by S&P Dow Jones Indices for its S&P/Case-Shiller Home Price Indices ... continue to show a deceleration in home price gains. The 10-City Composite gained 5.5% year-over-year and the 20-City 5.6%, both down from the 6.7% reported for July. The National Index gained 5.1% annually in August compared to 5.6% in July.

On a monthly basis, the National Index and Composite Indices showed a slight increase of 0.2% for the month of August. Detroit led the cities with the gain of 0.8%, followed by Dallas, Denver and Las Vegas at 0.5%. Gains in those cities were offset by a decline of 0.4% in San Francisco followed by declines of 0.1% in Charlotte and San Diego. ...

“The deceleration in home prices continues,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “The Sun Belt region reported its worst annual returns since 2012, led by weakness in all three California cities -- Los Angeles, San Francisco and San Diego. Despite the weaker year-over-year numbers, home prices are still showing an overall increase, as the National Index increased for its eighth consecutive month."

Click on graph for larger image.

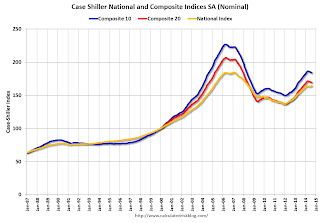

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 18.8% from the peak, and down 0.2% in August (SA). The Composite 10 is up 22.8% from the post bubble low set in Jan 2012 (SA).

The Composite 20 index is off 17.9% from the peak, and down 0.2% (SA) in August. The Composite 20 is up 23.8% from the post-bubble low set in Jan 2012 (SA).

The National index is off 11.3% from the peak, and up 0.4% (SA) in August. The National index is up 19.7% from the post-bubble low set in Dec 2012 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 5.5% compared to August 2013.

The Composite 20 SA is up 5.6% compared to August 2013.

The National index SA is up 5.1% compared to August 2013.

Prices increased (SA) in 8 of the 20 Case-Shiller cities in August seasonally adjusted. (Prices increased in 14 of the 20 cities NSA) Prices in Las Vegas are off 42.6% from the peak, and prices in Denver and Dallas are at new highs (SA).

This was slightly above than the consensus forecast for a 4.9% YoY increase for the National index, and suggests a further slowdown in price increases. I'll have more on house prices later.

Monday, October 27, 2014

Tuesday: Case-Shiller House Prices, Durable Goods, and much more

by Calculated Risk on 10/27/2014 07:46:00 PM

From Nick Timiraos at the WSJ: Gas at $3 Carries Rewards—and Risks

Gasoline prices have dropped below $3 a gallon at most U.S. gas stations, delivering a welcome lift to American consumers and retailers heading into the holidays. But the related oil-price drop has a thorny underside: It is threatening to slow the nation’s energy boom and hit the broader economy.I'll take the rewards! Besides $80 per barrel isn't cheap. In January 2001, oil was under $30 per barrel (about $40 adjusted for inflation), and then increased more than four-fold to $134 per barrel in 2008 - before crashing during the financial crisis.

Tuesday:

• At 8:30 AM ET, Durable Goods Orders for September from the Census Bureau. The consensus is for a 0.9% increase in durable goods orders.

• At 9:00 AM, the S&P/Case-Shiller House Price Index for August. Although this is the August report, it is really a 3 month average of June, July and August prices. The consensus is for a 4.9% year-over-year increase in the National Index for August , down from 5.7% in July (consensus 5.8% increase in Comp 20). The Zillow forecast is for the Composite 20 to increase 5.7% year-over-year in August, and for prices to increase 0.1% month-to-month seasonally adjusted.

• At 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for October.

• Also at 10:00 AM, the Conference Board's consumer confidence index for October. The consensus is for the index to increase to 87.2 from 86.0.

• Also at 10:00 AM, the Q3 Housing Vacancies and Homeownership report from the Census Bureau. This report is frequently mentioned by analysts and the media to report on the homeownership rate, and the homeowner and rental vacancy rates. However, this report doesn't track with other measures (like the decennial Census and the ACS).

• During the day, the Q3 NMHC Apartment Tightness Index.

Vehicle Sales Forecasts: Over 16 Million SAAR again in October

by Calculated Risk on 10/27/2014 03:35:00 PM

The automakers will report October vehicle sales on Monday, Nov 3rd. Sales in September were at 16.34 million on a seasonally adjusted annual rate basis (SAAR), and it appears sales in October will be solidly above 16 million SAAR again.

Note: There were the 27 selling days in October this year compared to 27 (same) last year.

Here are a few forecasts:

From WardsAuto: Forecast: October Sales Steady Before End-of-Year Spike

A WardsAuto forecast calls for U.S. automakers to maintain solid year-over year gains in October, delivering 1.28 million light vehicles over 27 selling days. The resulting daily sales rate of 47,356 units represents a 6.5% improvement over same-month year-ago (also 27 days) and an 8.2% month-to-month drop from September (24 days), in line with seasonal expectations. The forecast equates to a 16.4 million-unit SAAR, a tick above the 16.3 million year-to-date SAAR through September.From J.D. Power: New-Vehicle Retail Sales On Pace for 1.1 Million, the Strongest October since 2004; Record-Breaking Consumer Spending for the Month

New-vehicle retail sales in October 2014 are projected to come in at 1.1 million units, a 6 percent increase, compared with October 2013. The retail seasonally adjusted annualized rate (SAAR) in October is expected to be 13.6 million units, 0.7 million units stronger than October 2013.From Kelley Blue Book: New-Vehicle Sales To Jump 5.4 Percent In October, According To Kelley Blue Book

...

“The industry continues to demonstrate strong sales growth and robust transaction prices, resulting in another record-breaking month for industry consumer spending,” said John Humphrey, senior vice president of the global automotive practice at J.D. Power. [Total forecast 16.3 million SAAR]

New-vehicle sales are expected to increase 5.4 percent year-over-year to a total of 1.27 million units ... The seasonally adjusted annual rate (SAAR) for October 2014 is estimated to be 16.3 million, up from 15.3 million in October 2013 and even with 16.3 million in September 2014.From TrueCar: TrueCar Forecasts Strong Sales in October; Up 5.9% Compared to Last Year

Seasonally Adjusted Annualized Rate ("SAAR") for October of 16.3 million new vehicle sales.Another solid month for auto sales, and this should be the best year since 2006.

"Industry-wide, we're looking at the strongest October since 2004, with incentive spending at healthy levels, and on-track to finish the year at 16.4 million units." [said John Krafcik, president of TrueCar].

ATA Trucking Index Unchanged in September

by Calculated Risk on 10/27/2014 12:31:00 PM

Here is a minor indicator that I follow, from ATA: ATA Truck Tonnage Index Unchanged in September

American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index was unchanged in September, following a gain of 1.6% the previous month. In September the index equaled 132.6 (2000=100), the same as in August and a record high.

Compared with September 2013, the SA index increased 3.7%, down from August’s 4.5% year-over-year gain. Year-to-date, compared with the same period last year, tonnage is up 3.2%. ...

“September data was a mixed bag, with retail sales falling while factory output increased nicely,” said ATA Chief Economist Bob Costello. “As a result, I’m not too surprised that truck tonnage split both of those readings and remained unchanged.”

“During the third quarter, truck tonnage jumped 2.4% from the second quarter and surged 4% from the same period last year,” Costello said. He also noted that the third quarter average was the highest on record.

...

Trucking serves as a barometer of the U.S. economy, representing 69.1% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9.7 billion tons of freight in 2013. Motor carriers collected $681.7 billion, or 81.2% of total revenue earned by all transport modes.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index is now up 3.7% year-over-year.

NAR: Pending Home Sales Index increased 0.3% in September, up 1.0% year-over-year

by Calculated Risk on 10/27/2014 10:00:00 AM

From the NAR: Pending Home Sales Hold Steady in September

The Pending Home Sales Index, a forward-looking indicator based on contract signings, inched 0.3 percent to 105.0 in September from 104.7 in August, and is now 1.0 percent higher than September 2013 (104.0). The index is above 100 for the fifth consecutive month and is at the second-highest level since last September.Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in October and November.

...

The PHSI in the Northeast increased 1.2 percent to 87.5 in September, and is now 2.9 percent above a year ago. In the Midwest the index decreased 1.2 percent to 101.2 in September, and is now 4.0 percent below September 2013.

Pending home sales in the South increased 1.4 percent to an index of 118.5 in September, and is 1.7 percent above last September. The index in the West inched back 0.8 percent in September to 101.3, but is still 3.6 percent above a year ago.