by Calculated Risk on 7/21/2014 08:39:00 AM

Monday, July 21, 2014

Chicago Fed: "Index shows economic growth decelerated slightly in June"

The Chicago Fed released the national activity index (a composite index of other indicators): Index shows economic growth decelerated slightly in June

Led by slower growth in production-related indicators, the Chicago Fed National Activity Index (CFNAI) edged down to +0.12 in June from +0.16 in May. Two of the four broad categories of indicators that make up the index made nonpositive contributions to the index in June, but two of the four categories increased from May.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, decreased to +0.13 in June from +0.28 in May, marking its fourth consecutive reading above zero. June’s CFNAI-MA3 suggests that growth in national economic activity was somewhat above its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests limited inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was somewhat above the historical trend in June (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, July 20, 2014

Sunday Night Futures

by Calculated Risk on 7/20/2014 09:39:00 PM

Monday:

• At 8:30 AM ET, the Chicago Fed National Activity Index for June. This is a composite index of other data.

Weekend:

• Schedule for Week of July 20th

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down slightly and DOW futures are down 7 (fair value).

Oil prices moved up over the last week with WTI futures at $102.93 per barrel and Brent at $107.16 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.57 per gallon (down about a dime from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

CoStar: Commercial Real Estate prices increased more than 11% year-over-year in May

by Calculated Risk on 7/20/2014 11:49:00 AM

Here is a price index for commercial real estate that I follow.

From CoStar: Value-Weighted U.S. Composite Price Index Approaches Prerecession Peak Levels

COMMERCIAL REAL ESTATE PRICES POST DOUBLE-DIGIT ANNUAL GAINS IN MAY: The two broadest measures of aggregate pricing for commercial properties within the CCRSI—the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index—increased by 0.9% and 1.2%, respectively, in the month of May 2014, and 11.4% and 11.7% respectively, year over year, reflecting a broad improvement in market fundamentals seen across all property types. The value-weighted U.S. Composite Index, which is heavily influenced by core property transactions, has now risen within 1% of its prerecession peak level reached in 2007, while its equal-weighted counterpart, which is more influenced by smaller non-core property sales, has recovered to within 20% of its 2007 high water mark.

...

DISTRESS LEVELS CONTINUE TO DISSIPATE: The percentage of commercial transactions involving distressed assets has declined to 10.5% in May 2014 from over 17% one year earlier. In the multifamily and industrial sectors, the distress share of total sales fell into the single digits, while it remains comparatively high at 11% in the retail sector and 17% in the office sector, suggesting there is more room for pricing appreciation. The share of distress trades in late-recovery markets such as Chicago, Atlanta, and Detroit remain near 20%, while in the early-recovery, coastal markets of Los Angeles, San Francisco and San Jose, distress levels are nearly non-existent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index indexes.

The value weighted index is almost back to the pre-recession peak, however the equal weighted index is about 20% below the pre-recession peak.

The second graph shows the percent of distressed "pairs".

The second graph shows the percent of distressed "pairs".The distressed share is down from over 30% at the peak, to 10.5% in May.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

Saturday, July 19, 2014

Schedule for Week of July 20th

by Calculated Risk on 7/19/2014 01:11:00 PM

The key reports this week are New and Existing home sales for June.

For manufacturing, the July Richmond and Kansas City Fed surveys will be released.

For prices, CPI will be released on Tuesday.

8:30 AM ET: Chicago Fed National Activity Index for June. This is a composite index of other data.

8:30 AM: Consumer Price Index for June. The consensus is for a 0.3% increase in CPI in June and for core CPI to increase 0.2%.

9:00 AM: FHFA House Price Index for May. This was original a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.3% increase.

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for sales of 4.99 million on seasonally adjusted annual rate (SAAR) basis. Sales in May were at a 4.89 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 4.96 million SAAR.

A key will be the reported year-over-year increase in inventory of homes for sale.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for July. The consensus is for a reading of 5.5, up from 3 in June.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for June (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 310 thousand from 302 thousand.

10:00 AM: New Home Sales for June from the Census Bureau.

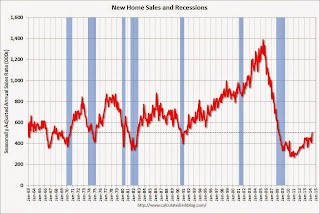

10:00 AM: New Home Sales for June from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the May sales rate.

The consensus is for a decrease in sales to 475 thousand Seasonally Adjusted Annual Rate (SAAR) in June from 504 thousand in May.

11:00 AM: the Kansas City Fed manufacturing survey for July.

8:30 AM: Durable Goods Orders for June from the Census Bureau. The consensus is for a 0.2% increase in durable goods orders.

Unofficial Problem Bank list declines to 463 Institutions

by Calculated Risk on 7/19/2014 08:11:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for July 18, 2014.

Changes and comments from surferdude808:

Surprisingly there were few changes to the Unofficial Problem Bank List this week given that the OCC released an update of its enforcement action activity this Friday. There were two removals this week that push the list count down to 463 institutions with assets of $147.4 billion. A year ago, the list held 734 institutions with assets of $267.2 billion.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 463.

Removals this week include the OCC terminating an action against Commerce National Bank & Trust, Winter Park, FL ($77 billion). The other removal was the failed Eastside Commercial Bank, Conyers, GA ($169 million), which was the 13th failure this year. This is the first failure in Georgia since Sunrise Bank failed more than a year ago on May 10, 2013. Still, there have now been an astonishing 88 failures of Georgia-based institutions with aggregate assets of $33.4 billion since the on-set of the Great Recession. So 17.5 percent of the 503 institutions that have failed in this crisis were headquartered in Georgia.

Next week we anticipate the FDIC will provide an update on its enforcement action activity.

Friday, July 18, 2014

Bank Failure #13 in 2014: Eastside Commercial Bank, Conyers, Georgia

by Calculated Risk on 7/18/2014 05:17:00 PM

From the FDIC: Community & Southern Bank, Atlanta, Georgia, Assumes All of the Deposits of Eastside Commercial Bank, Conyers, Georgia

As of March 31, 2014, Eastside Commercial Bank had approximately $169.0 million in total assets and $161.6 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $33.9 million. ... Eastside Commercial Bank is the 13th FDIC-insured institution to fail in the nation this year, and the first in Georgia.There hasn't been a failure in Georgia since May 2013, but this is the 88th failure in Georgia since the crisis started - the most of any state.

The Recovery for U.S. Heavy Truck Sales

by Calculated Risk on 7/18/2014 01:52:00 PM

Just a quick graph ... heavy truck sales really collapsed during the recession, falling to a low of 181 thousand in April 2009 on a seasonally adjusted annual rate (SAAR) from a peak of 555 thousand in February 2006.

Sales were above 382 thousand (SAAR) in June (after increasing to over 400 thousand SAAR in April for the first time since 2007).

Click on graph for larger image.

This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is current estimated sales rate.

The recovery for heavy truck has slowed, but as construction for both residential and commercial picks up, heavy truck sales will probably increase further.

BLS: No State with Unemployment Rate at or above 8% in June, First Time since mid-2008

by Calculated Risk on 7/18/2014 10:45:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally little changed in June. Twenty-two states and the District of Columbia had unemployment rate decreases from May, 14 states had increases, and 14 states had no change, the U.S. Bureau of Labor Statistics reported today. Forty-nine states and the District of Columbia had unemployment rate decreases from a year earlier and one state had an increase.

...

Mississippi and Rhode Island had the highest unemployment rates among the states in June, 7.9 percent each. North Dakota again had the lowest jobless rate, 2.7 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement.

The states are ranked by the highest current unemployment rate. Rhode Island and Mississippi had the highest unemployment rates in June at 7.9%.

The second graph shows the number of states with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).For the first time since mid-2008, no state has an unemployment rate at or above 8% (light blue), although 9 states are still at or above 7% (dark blue).

Preliminary July Consumer Sentiment decreases to 81.3

by Calculated Risk on 7/18/2014 09:55:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for July was at 81.3, down from 82.5 in June.

This was below the consensus forecast of 83.0. Sentiment has generally been improving following the recession - with plenty of ups and downs - and a big spike down when Congress threatened to "not pay the bills" in 2011.

Thursday, July 17, 2014

DataQuick: "California Foreclosure Starts Lowest Since 2005"

by Calculated Risk on 7/17/2014 08:12:00 PM

From DataQuick: California Foreclosure Starts Lowest Since 2005

A total of 17,524 Notices of Default (NoDs) were recorded at county recorders offices during the April-through-June period. That was down 8.8 percent from 19,215 in the prior quarter, and down 31.9 percent from 25,747 in second-quarter 2013, according to DataQuick, which is owned by Irvine-based CoreLogic, a leading global property information, analytics and data-enabled services provider.

Last quarter's NoD tally was the lowest since fourth-quarter 2005, when 15,337 NoDs were recorded. NoD filings peaked in first-quarter 2009 at 135,431. DataQuick's NoD statistics go back to 1992.

"It looks like the mortgage servicers doing the foreclosure paperwork are systematically working through a backlog. While their pile is getting smaller, they're working at a steady pace. With one exception, the number of NoDs we've seen filed each quarter over the last year-and-a-half hasn't changed much, and probably just reflects staffing and workload logistics," said John Karevoll, DataQuick analyst.

In first quarter 2013 California saw 18,568 NoDs filed. In last year's second quarter the number was 25,747. In third quarter 2013 it was 20,314. Fourth quarter was 18,120. In first quarter 2014 the tally was 19,215, and last quarter it was 17,524.

"The relatively high NoD tally in second quarter last year reflected a one-time bump because of deferred activity and policy change. Otherwise the quarterly flow of NoDs since early last year has been remarkably flat, and probably doesn't reflect any meaningful changes in trends. The overall trend is that homeowner distress continues to decline because of a stronger economy and rising home prices," Karevoll said.

Most of the loans going into default are still from the 2005-2007 period.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of Notices of Default (NoD) filed in California each year. 2014 is in red (Q1 plus Q2 times 2).

Last year was the lowest year for foreclosure starts since 2005, and 2013 was also below the levels in 1997 through 2000 when prices were rising following the much smaller late '80s housing bubble / early '90s bust in California.

Overall foreclosure starts are close to a normal level in California (foreclosure starts were over 50,000 in 2004 and 2005 when prices were rising quickly).

Note: Foreclosures are still higher than normal in states with a judicial foreclosure process.