by Calculated Risk on 7/17/2014 06:06:00 PM

Thursday, July 17, 2014

LA area Port Traffic: Imports increasing

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for June since LA area ports handle about 40% of the nation's container port traffic. Note: This is for the month before the recent trucker strike.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic was up 1.0% compared to the rolling 12 months ending in May. Outbound traffic was up 0.5% compared to 12 months ending in May.

Inbound traffic has been increasing, and outbound traffic has been moving up a little recently after moving sideways.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Imports were up 13% year-over-year in June, exports were up 7% year-over-year.

Imports were 4% below the all time high for June (set in June 2007), and it is possible that imports will be at a record high later this year.

A few comments on June Housing Starts

by Calculated Risk on 7/17/2014 01:32:00 PM

This was a weak report for housing starts in June.

There were 479 thousand total housing starts during the first half of 2014 (not seasonally adjusted, NSA), up 6.0% from the 452 thousand during the same period of 2013. Single family starts are up 1%, and multi-family starts up 18%. The key weakness is in single family starts.

The weak growth so far in 2014 is due to several factors: severe weather early in the year, higher mortgage rates (although rates are now down year-over-year), higher prices and probably supply constraints in some areas. And some judicial foreclosure states are still working through a backlog of distressed homes that depress new construction.

Starts were up 7.5% year-over-year in June, but the year-over-year comparison for housing starts is easier now than in Q1 (see first graph). There was a huge surge in housing starts early in 2013, and then a lull - and finally more starts at the end of the year.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the month to month comparison between 2013 (blue) and 2014 (red).

Starts in Q1 averaged 925 thousand SAAR, and starts in Q2 averaged 980 thousand SAAR (up 6% from Q1).

This year, I expect starts to increase (Q1 will probably be the weakest quarter, and Q2 the second weakest).

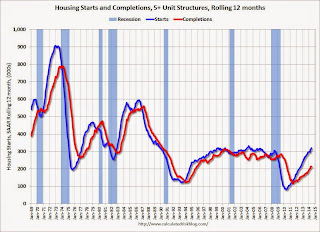

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The blue line is for multifamily starts and the red line is for multifamily completions.

The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) are lagging behind - but completions will continue to follow starts up (completions lag starts by about 12 months).

This means there will be an increase in multi-family completions in 2014 and 2015. Multi-family starts will probably move more sideways soon.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

Single family starts had been moving up, but recently starts have been moving sideways on a rolling 12 months basis.

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

Philly Fed Manufacturing Survey highest since March 2011

by Calculated Risk on 7/17/2014 10:11:00 AM

From the Philly Fed: July Manufacturing Survey

The diffusion index of current general activity increased from a reading of 17.8 in June to 23.9 this month. The index has remained positive for five consecutive months and is at its highest reading since March 2011. The current new orders [at 34.2] and shipments indexes increased notably this month, increasing 17 points and 19 points, respectively.This was above the consensus forecast of a reading of 15.5 for July.

...

The current indicators for labor market conditions also suggest improved conditions this month. The employment index remained positive, and, although it increased less than 1 point [to 12.2], it has improved for four consecutive months.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through July. The ISM and total Fed surveys are through June.

The average of the Empire State and Philly Fed surveys is at the highest level since 2004, and this suggests stronger expansion in the ISM report for July.

Weekly Initial Unemployment Claims decrease to 302,000, 4-Week Average Lowest since June 2007

by Calculated Risk on 7/17/2014 09:31:00 AM

The DOL reports:

In the week ending July 12, the advance figure for seasonally adjusted initial claims was 302,000, a decrease of 3,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 304,000 to 305,000. The 4-week moving average was 309,000, a decrease of 3,000 from the previous week's revised average. This is the lowest level for this average since June 2, 2007 when it was 307,500. The previous week's average was revised up by 500 from 311,500 to 312,000.The previous week was revised up to 305,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 309,000.

This was lower than the consensus forecast of 310,000. The 4-week average is now at normal levels for an expansion.

Housing Starts decline to 893 thousand Annual Rate in June

by Calculated Risk on 7/17/2014 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in June were at a seasonally adjusted annual rate of 893,000. This is 9.3 percent below the revised May estimate of 985,000, but is 7.5 percent above the June 2013 rate of 831,000.

Single-family housing starts in June were at a rate of 575,000; this is 9.0 percent below the revised May figure of 632,000. The June rate for units in buildings with five units or more was 305,000.

emphasis added

Building Permits:

Privately-owned housing units authorized by building permits in June were at a seasonally adjusted annual rate of 963,000. This is 4.2 percent below the revised May rate of 1,005,000, but is 2.7 percent above the June 2013 estimate of 938,000.

Single-family authorizations in June were at a rate of 631,000; this is 2.6 percent above the revised May figure of 615,000. Authorizations of units in buildings with five units or more were at a rate of 301,000 in June.

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in June (Multi-family is volatile month-to-month).

Single-family starts (blue) also decreased in June.

The second graph shows total and single unit starts since 1968.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years. This was well below expectations of 1.020 million starts in June. Note: Starts for April and May were revised slightly lower. I'll have more later.

Wednesday, July 16, 2014

Thursday: Housing Starts, Unemployment Claims, Philly Fed Mfg Survey

by Calculated Risk on 7/16/2014 08:59:00 PM

A reminder of a friendly bet I made with NDD on housing starts in 2014 (I've already "won", and NDD made a donation to the Tanta Memorial Fund - but he could still win too):

If starts or sales are up at least 20% YoY in any month in 2014, [NDD] will make a $100 donation to the charity of Bill's choice, which he has designated as the Memorial Fund in honor of his late co-blogger, Tanta. If housing permits or starts are down 100,000 YoY at least once in 2014, he make a $100 donation to the charity of my choice, which is the Alzheimer's Association.In June 2013, starts were at a 831 thousand seasonally adjusted annual rate (SAAR). For me to win again (only one win counts), starts would have to be up 20% or at 997.2 thousand SAAR in June (very possible). For NDD to win, starts would have to fall to 731 thousand SAAR (not likely). NDD could also "win" if permits fall to 838 thousand SAAR from 938 thousand SAAR in June 2013.

Thursday:

• At 8:30 AM ET, Housing Starts for June. Total housing starts were at 1.001 million (SAAR) in May. Single family starts were at 625 thousand SAAR in May. The consensus is for total housing starts to increase to 1.020 million (SAAR) in June.

• Also at 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 310 thousand from 304 thousand.

• At 10:00 AM, the Philly Fed manufacturing survey for July. The consensus is for a reading of 15.5, down from 17.8 last month (above zero indicates expansion).

DataQuick on California Bay Area: June Home Sales up 0.2% Year-over-year

by Calculated Risk on 7/16/2014 05:56:00 PM

From DataQuick: Bay Area Home Sales Up Slightly; Price Increases Slow

A total of 7,915 new and resale houses and condos sold in the nine-county Bay Area last month. That was up 0.2 percent from 7,898 in May and up 0.2 percent from 7,897 in June last year, according to DataQuick ....A few key year-over-year trends: 1) declining distressed sales, 2) generally declining investor buying, 3) flat or declining total sales, but 4) some increase in non-distressed sales. Though total sales were up 0.2% year-over-year, the percent of non-distressed sales was up about 9%. There were 7,915 total sales this year in June, and only 7.5% were distressed. In June 2013, there were 7,897 total sales, and 15.2% were distressed.

June’s year-over-year increase in sales was the Bay Area’s first since last September, when sales rose 3.6 percent from a year earlier. Since 1988, when DataQuick’s statistics begin, June sales have ranged from a low of 7,118 in 1993 to a high of 15,735 in 2004. Last month’s sales were 20.2 percent below the June average of 9,916 sales since 1988. Bay Area sales haven’t been above average for any particular month in more than eight years.

...

Last month foreclosure resales – homes that had been foreclosed on in the prior 12 months – accounted for 3.1 percent of all resales. That was unchanged from the month before, and down from 5.7 percent a year earlier. Foreclosure resales in the Bay Area peaked at 52.0 percent in February 2009, while the monthly average over the past 17 years is 9.8 percent.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 4.4 percent of Bay Area resales last month. That was down from an estimated 4.6 percent in May and down from 9.5 percent a year earlier.

Last month absentee buyers – mostly investors – purchased 20.8 percent of all Bay Area homes. That was up slightly from May’s revised 19.3 percent and down from 21.8 percent in June last year.

emphasis added

Fed's Beige Book: Residential construction activity "generally increased"

by Calculated Risk on 7/16/2014 02:07:00 PM

Fed's Beige Book "Prepared at the Federal Reserve Bank of Kansas City and based on information collected before July 7, 2014. "

All twelve Federal Reserve Districts indicated that economic activity continued to expand since the previous report. The pace of economic growth was characterized as moderate in New York, Chicago, Minneapolis, Dallas, and San Francisco, while the remaining Districts reported modest expansion. Compared to the previous reporting period, Boston and Richmond noted a slightly slower pace of growth. Most Districts were optimistic about the outlook for growth.And on real estate:

Residential real estate activity continued to vary by Federal Reserve District, reflecting generally low inventories and mixed levels of demand. ...Somewhat positive comments on both residential and non-residential real estate.

Residential construction activity generally increased across the Districts, with only St. Louis and Minneapolis reporting a decline in overall activity. ...

Commercial construction activity strengthened across most Districts. Cleveland and Atlanta reported increased commercial construction activity compared to a year ago, and Philadelphia, Chicago, St. Louis, Minneapolis, Kansas City, Dallas, and San Francisco noted gains since the previous survey period. Boston and Richmond saw mixed commercial construction activity across their Districts since the previous report. Dallas indicated strong overall commercial real estate construction activity, and commercial real estate construction increased in the Minneapolis District compared with the previous report. Boston, New York, Richmond, Chicago, Kansas City, and Dallas reported tight commercial vacancy rates. Industrial real estate construction and leasing activity was strong in the Philadelphia and Chicago Districts.

emphasis added

DataQuick on SoCal: June Home Sales down 4% Year-over-year, Non-Distressed sales up Year-over-year

by Calculated Risk on 7/16/2014 12:22:00 PM

From DataQuick: Southland Home Sales Down from Last Year Again; Price Gains Throttle Back

Southern California homes sold at the slowest pace for a June in three years as investor purchases fell again and other would-be buyers continued to struggle with inventory and affordability constraints. ...Both distressed sales and investor buying is declining - and this has been dragging down overall sales. Even though total sales are still down year-over-year, the percent of non-distressed sales is up slightly year-over-year. There were 20,654 total sales this year in June, and 11.3% were distressed. In June 2013, there were 21,608 total sales, and 23.5% were distressed.

A total of 20,654 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was up 5.6 percent from 19,556 sales in May, and down 4.4 percent from 21,608 sales in June last year, according to DataQuick ...

On average, sales have increased 6.4 percent between May and June since 1988, when DataQuick’s statistics begin. Sales have fallen on a year-over-year basis for nine consecutive months. Sales during the month of June have ranged from a low of 18,032 in June 2008 to a high of 40,156 in June 2005. Last month was 23.7 percent below the June average of 27,069 sales. Sales haven’t been above the long-term average for more than eight years.

...

“Many of the market indicators we track continue to ease toward normalcy ... For example, the use of larger, so-called jumbo loans is up significantly this year, as is the use of adjustable-rate mortgages. Distressed property sales are way down and, related to that, investor and cash purchases are trending lower, toward more normal levels.” [said Andrew LePage, a DataQuick analyst].

Foreclosure resales – homes foreclosed on in the prior 12 months – accounted for 5.3 percent of the Southland resale market last month. That was up slightly from a revised 5.0 percent the prior month and down from 9.0 percent a year earlier. In recent months the foreclosure resale rate has been the lowest since early 2007. In the current cycle, foreclosure resales hit a high of 56.7 percent in February 2009.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 6.0 percent of Southland resales last month. That was down from a revised 6.4 percent the prior month and down from 14.5 percent a year earlier.

Absentee buyers – mostly investors and some second-home purchasers – bought 23.6 percent of the Southland homes sold last month. That was the lowest share since December 2010 ...

emphasis added

NAHB: Builder Confidence increased to 53 in July, Highest in Six Months

by Calculated Risk on 7/16/2014 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 53 in July, up from 49 in June. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Surpasses Key Benchmark in July

Builder confidence in the market for newly-built single-family homes reached an important milestone in July, rising four points to a reading of 53 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) released today. Any reading over 50 indicates that more builders view sales conditions as good than poor.

...

“An improving job market goes hand-in-hand with a rise in builder confidence,” said NAHB Chief Economist David Crowe. “As employment increases and those with jobs feel more secure about their own economic situation, they are more likely to feel comfortable about buying a home.”

Derived from a monthly survey that NAHB has been conducting for 30 years, the NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

All three HMI components posted gains in July. The index gauging current sales conditions increased four points to 57, while the index measuring expectations for future sales rose six points to 64 and the index gauging traffic of prospective buyers increased three points to 39.

The HMI three-month moving average was up in all four regions, with the Northeast and Midwest posting a one-point and two-point gain to 35 and 48, respectively. The West registered a five-point gain to 52 while the South rose two points to 51.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was the first reading above 50 since January.