by Calculated Risk on 6/26/2014 08:34:00 AM

Thursday, June 26, 2014

Weekly Initial Unemployment Claims decrease to 312,000

The DOL reports:

In the week ending June 21, the advance figure for seasonally adjusted initial claims was 312,000, a decrease of 2,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 312,000 to 314,000. The 4-week moving average was 314,250, an increase of 2,000 from the previous week's revised average. The previous week's average was revised up by 500 from 311,750 to 312,250.The previous week was revised up from 312,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 314,250.

This was close to the consensus forecast of 313,000. The 4-week average is now at normal levels for an expansion.

Wednesday, June 25, 2014

Thursday: May Personal Income and Outlays, Weekly Unemployment Claims

by Calculated Risk on 6/25/2014 08:23:00 PM

First, according to Mortgage News Daily, 30 year mortgage rates have fallen to 4.13% today, down from 4.18% yesterday, and down from 4.59% a year ago.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 313 thousand from 312 thousand last week.

• Also at 8:30 AM, Personal Income and Outlays for May. The consensus is for a 0.4% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 11:00 AM, the Kansas City Fed manufacturing survey for May.

Merrill Lynch on Q1 GDP Revision

by Calculated Risk on 6/25/2014 02:09:00 PM

From Merrill Lynch:

In the final release of 1Q GDP, growth was revised down significantly to -2.9% qoq saar from -1.0% previously. This was a big disappointment ...

The downward revision owed to two primary factors: weaker consumer spending on healthcare and a wider trade deficit. Updated data on healthcare spending contributed to a 1.2pp downward revision to GDP growth ... The large change to healthcare spending was due to the BEA significantly overestimating the impact of the Affordable Care Act (ACA).

The other major moving part was in net exports, largely due to a wider services trade deficit. ... This equates to an additional 0.6pp drag on GDP growth.

...

We caution against reading too much into the weakness, as it is clear that special factors during the quarter distorted growth. The severe winter weather weighed heavily on consumption, fixed investment and trade. Furthermore, there was a notable inventory drawdown that amounted to a 1.7pp drag on growth, following two strong quarters of inventory build in 3Q and 4Q of 2013. Despite the deeper contraction in this final release, we are not revising 2Q GDP growth. We continue to expect a 4.0% rebound in the second quarter, and the recent data suggest that we are headed in that direction. However, uncertainty around this number remains elevated: there could continue to be special factors at play stemming from the weakness in 1Q. Moreover, benchmark GDP revisions, released with the first estimate of 2Q GDP in July, could alter the trajectory.

Assuming 4.0% growth in 2Q and solid 3.0% growth in 2H, growth will still only average 1.7% this year. It certainly was not the start of the year we were hoping for.

emphasis added

DOT: Vehicle Miles Driven increased 1.8% year-over-year in April

by Calculated Risk on 6/25/2014 11:17:00 AM

The Department of Transportation (DOT) reported:

Travel on all roads and streets changed by 1.8% (4.6 billion vehicle miles) for April 2014 as compared with April 2013.The following graph shows the rolling 12 month total vehicle miles driven.

Travel for the month is estimated to be 254.9 billion vehicle miles.

Cumulative Travel for 2014 changed by 0.0% (0.3 billion vehicle miles).

The rolling 12 month total is still mostly moving sideways ...

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 77 months - 6+ years - and still counting. Currently miles driven (rolling 12 months) are about 2.3% below the previous peak.

The second graph shows the year-over-year change from the same month in the previous year.

In April 2014, gasoline averaged of $3.74 per gallon according to the EIA. That was up from April 2013 when prices averaged $3.64 per gallon.

In April 2014, gasoline averaged of $3.74 per gallon according to the EIA. That was up from April 2013 when prices averaged $3.64 per gallon. Of course gasoline prices are just part of the story. The lack of growth in miles driven over the last 6+ years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

With all these factors, it might take a few more years before we see a new peak in miles driven.

Q1 GDP Revised Down to -2.9% Annual Rate

by Calculated Risk on 6/25/2014 08:35:00 AM

From the BEA: Gross Domestic Product: First Quarter 2014 (Third Estimate)

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- decreased at an annual rate of 2.9 percent in the first quarter of 2014 according to the "third" estimate released by the Bureau of Economic Analysis. In the fourth quarter of 2013, real GDP increased 2.6 percent....Here is a Comparison of Third and Second Estimates. PCE growth was revised down from 3.1% to 1.0%. Ouch!

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, real GDP was estimated to have decreased 1.0 percent. With the third estimate for the first quarter, the increase in personal consumption expenditures (PCE) was smaller than previously estimated, and the decline in exports was larger than previously estimated ...

The decrease in real GDP in the first quarter primarily reflected negative contributions from private inventory investment, exports, state and local government spending, nonresidential fixed investment, and residential fixed investment that were partly offset by a positive contribution from PCE. Imports, which are a subtraction in the calculation of GDP, increased.

MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

by Calculated Risk on 6/25/2014 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 20, 2014. ...

The Refinance Index decreased 1 percent from the previous week to the lowest level since May 2014. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier to the lowest level since May 2014. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.33 percent from 4.36 percent, with points decreasing to 0.18 from 0.24 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 75% from the levels in May 2013.

As expected, refinance activity is very low this year.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 18% from a year ago.

Tuesday, June 24, 2014

Wednesday: Ugly 3rd Estimate of Q1 GDP, Durable Goods

by Calculated Risk on 6/24/2014 08:33:00 PM

From Neil Irwin at The Upshot (NY Times): Rise in Home Prices Is Slowing, and That’s a Good Thing

Home price numbers tend to move in more steady, gradual waves than other economic data. They also come out with long delays; the April Case-Shiller numbers are actually based on transactions that closed from February through April — and those home sales generally went under contract a month or two before they closed.Wednesday:

So the latest home price readings are very much a look in the rearview mirror, and it’s a look that suggests a deceleration is underway. ... The healthiest thing for the housing market would be home price rises that thread the needle: high enough that homeowners are building equity and homebuilders have incentive to start new construction, but low enough that they don’t significantly outpace wage growth and result in unaffordable housing and a painful correction. The April home price numbers suggest we may be heading there.

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Q1 GDP (third estimate). This is the third estimate of Q1 GDP from the BEA. The consensus is that real GDP decreased 1.8% annualized in Q1, revised down from the second estimate of a 1.0% decrease.

• Also at 8:30 AM, Durable Goods Orders for May from the Census Bureau. The consensus is for a 0.4% increase in durable goods orders.

House Prices: Real Prices and Price-to-Rent Ratio decline slightly in April

by Calculated Risk on 6/24/2014 04:20:00 PM

I've been expecting a slowdown in year-over-year prices as "For Sale" inventory increases, and it appears the slowdown has started. The Case-Shiller Composite 20 index was up 10.8% year-over-year in April; the smallest year-over-year increase since early 2013. Still, this is a very strong year-over-year change.

On a seasonally adjusted monthly basis, the Case-Shiller Composite 20 index was up 0.2% in April - and the Composite 10 was close to unchanged - the smallest monthly increase since prices bottomed in early 2012.

On a real basis (inflation adjusted), prices actually declined slightly for the first time since 2012. The price-rent ratio also declined slightly in April for the Case-Shiller Composite 20 index.

It is important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $278,000 today adjusted for inflation (39%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

The first graph shows the quarterly Case-Shiller National Index SA (through Q1 2014), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through April) in nominal terms as reported.

The first graph shows the quarterly Case-Shiller National Index SA (through Q1 2014), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through April) in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) is back to mid-2004 levels (and also back up to Q2 2008), and the Case-Shiller Composite 20 Index (SA) is back to November 2004 levels, and the CoreLogic index (NSA) is back to December 2004.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q4 2001 levels, the Composite 20 index is back to August 2002, and the CoreLogic index back to December 2002.

In real terms, house prices are back to early '00s levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q1 2002 levels, the Composite 20 index is back to December 2002 levels, and the CoreLogic index is back to April 2003.

In real terms, and as a price-to-rent ratio, prices are mostly back to early 2000 levels.

Comments on Housing and the New Home Sales report

by Calculated Risk on 6/24/2014 01:39:00 PM

In early May I wrote: What's Right with Housing? I concluded with "Housing is a slow moving market - and the recovery will not be smooth or fast with all the residual problems. But overall housing is clearly improving and the outlook remains positive for the next few years."

Here are a few positive updates:

1) Existing home sales were down 5.0% year-over-year in May. This is good news because the decline is due to fewer foreclosures and short sales.

2) Mortgage delinquencies are down sharply. See: Black Knight: Mortgage Loans in Foreclosure Process Lowest since July 2008 and Fannie Mae and Freddie Mac: Mortgage Serious Delinquency rate declined in April

3) The impact from rising mortgage rates is mostly behind us. In fact, mortgage rates are now down year-over-year. On June 23, 2013, 30 year mortgage rates were at 4.49%. On June 23, 2014, 30 year fixed rates were at 4.18%.

4) Existing home inventory is increasing, and house price increases are slowing. Sometimes rising inventory is a sign of trouble (I was pointing to this in 2005), but now inventory is so low that it is a positive that inventory is increasing. This will also slow house price increases (I think that will be a positive for housing too - a more normal market).

Overall the housing recovery is ongoing and should continue.

Also this morning the Census Bureau reported that new home sales were at a seasonally adjusted annual rate (SAAR) of 504 thousand in May. That is the highest level since May 2008. As usual, I don't read too much into any one report. In fact, through May this year, sales were 196,000, Not seasonally adjusted (NSA) - only up 2% compared to the same period in 2013 - not much of an increase.

This was a disappointing start to the year, probably mostly due to higher mortgage rates and higher prices. Also there were probably supply constraints in some areas and credit remains difficult for many potential borrowers.

Also early 2013 was a difficult comparison period. Annual sales in 2013 were up 16.3% from 2012, but sales in the first five months of 2013 were up 23% from the same period in 2012!

Click on graph for larger image.

Click on graph for larger image.

This graph shows new home sales for 2013 and 2014 by month (Seasonally Adjusted Annual Rate).

The comparisons to last year will be a little easier starting in July, and I still expect to see solid year-over-year growth later this year.

And here is another update to the "distressing gap" graph that I first started posting several years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through May 2014. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through May 2014. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to mostly move sideways (distressed sales will slowly decline and be offset by more conventional / equity sales). And I expect this gap to slowly close, mostly from an increase in new home sales.

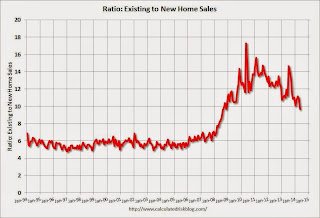

Another way to look at this is a ratio of existing to new home sales.

Another way to look at this is a ratio of existing to new home sales.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down - and is currently at the lowest level since November 2008. I expect this ratio to continue to trend down over the next several years as the number of distressed sales declines and new home sales increase.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales increase sharply to 504,000 Annual Rate in May

by Calculated Risk on 6/24/2014 10:00:00 AM

The Census Bureau reports New Home Sales in May were at a seasonally adjusted annual rate (SAAR) of 504 thousand.

April sales were revised down from 433 thousand to 425 thousand, and March sales were revised up from 407 thousand to 410 thousand.

Sales of new single-family houses in May 2014 were at a seasonally adjusted annual rate of 504,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 18.6 percent above the revised April rate of 425,000 and is 16.9 percent above the May 2013 estimate of 431,000.

Click on graph for larger image.

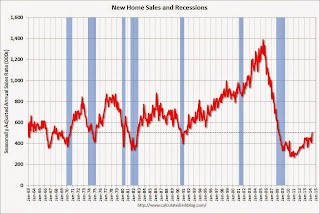

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

This is the highest sales rate since May 2008. Even with the increase in sales over the previous two years, new home sales are still just above the bottom for previous recessions.

The second graph shows New Home Months of Supply.

The months of supply decreased in May to 4.5 months from 5.3 months in April.

The months of supply decreased in May to 4.5 months from 5.3 months in April. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of May was 189,000. This represents a supply of 4.5 months at the current sales rate."

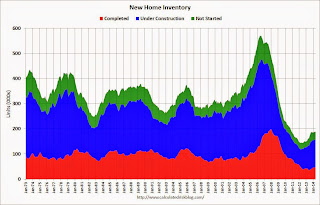

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In May 2014 (red column), 49 thousand new homes were sold (NSA). Last year 40 thousand homes were also sold in May. The high for May was 120 thousand in 2005, and the low for May was 26 thousand in 2010.

This was well above expectations of 441,000 sales in May, and sales were up 16.9% year-over-year.

I'll have more later today .