by Calculated Risk on 3/31/2014 09:16:00 PM

Monday, March 31, 2014

Tuesday: Auto Sales, ISM Mfg Index, Construction Spending, Q1 Office Vacancy Survey

Oh no, not April 1st! From the NY Times: Beware the April Fools’ Jokes Coming From Madison Avenue

In the last three or four years, the ranks of pranksters seem to have grown, partly because of the ability of social media to rapidly communicate and amplify messages. For instance, a trick pulled off for April Fools’ Day last year by FreshDirect — the introduction of a blueberry and banana hybrid called a “bluenana” — was “a hit with our customers, garnering lots of buzz across social media,” said Jodi Kahn, chief consumer officer at FreshDirect.Tuesday:

...

Time will tell whether any of the jokes for 2014 will rank among the funniest — and most successful in fooling consumers — of previous April Fools’ Days. Among those was a “left-handed” Whopper from Burger King in 1998 and an announcement in 1996 that Taco Bell had bought the Liberty Bell and renamed it the Taco Liberty Bell.

• Early: Reis Q1 2014 Office Survey of rents and vacancy rates.

• All day: Light vehicle sales for March. The consensus is for light vehicle sales to increase to 15.8 million SAAR in March (Seasonally Adjusted Annual Rate) from 15.3 million SAAR in February.

• At 9:00 AM ET, the Markit US PMI Manufacturing Index for March.

• At 10:00 AM, the ISM Manufacturing Index for March. The consensus is for an increase to 54.0 from 53.2 in February.

• Also at 10:00 AM, Construction Spending for February. The consensus is for a 0.1% increase in construction spending.

Fannie Mae: Mortgage Serious Delinquency rate declined in February, Lowest since November 2008

by Calculated Risk on 3/31/2014 05:40:00 PM

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined in February to 2.27% from 2.33% in January. The serious delinquency rate is down from 3.13% in February 2013, and this is the lowest level since November 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Last week, Freddie Mac reported that the Single-Family serious delinquency rate declined in February to 2.29% from 2.34% in January. Freddie's rate is down from 3.15% in February 2013, and is at the lowest level since February 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

The Fannie Mae serious delinquency rate has fallen 0.86 percentage points over the last year, and at that pace the serious delinquency rate will be under 1% in late 2015.

Note: The "normal" serious delinquency rate is under 1%.

Maybe serious delinquencies will be back to normal in late 2015 or 2016.

Weekly Update: Housing Tracker Existing Home Inventory up 6.7% year-over-year on March 31st

by Calculated Risk on 3/31/2014 03:51:00 PM

Here is another weekly update on housing inventory ...

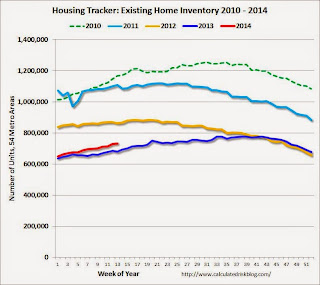

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for February). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

In 2013 (Blue), inventory increased for most of the year, and finished up about 2.7% YoY.

Inventory in 2014 (Red) is now 6.7% above the same week in 2013.

Inventory is still very low, but this increase in inventory should slow house price increases.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess is inventory will be up 10% to 15% year-over-year by the end of 2014 (inventory would still be below normal).

Restaurant Performance Index indicates expansion in February

by Calculated Risk on 3/31/2014 01:51:00 PM

From the National Restaurant Association: Restaurant Performance Index Remained Above 100 in February Despite Continued Dampened Customer Traffic Levels

Although challenging weather conditions in many parts of the country continued to impact customer traffic in February, the National Restaurant Association’s Restaurant Performance Index (RPI) remained above 100 for the 12th consecutive month. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 100.5 in February, down 0.2 percent from January’s level of 100.7. Despite the modest decline, the fact that the overall RPI remains above 100 continues to signify expansion in the index of key industry indicators.

“Restaurant operators continued to report net positive same-store sales results in February, despite customer traffic levels that were challenged by the weather,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “Looking forward, operators are generally optimistic about sales gains in the months ahead, although they aren’t as bullish about the overall economy.””

...

Although results were mixed in February, restaurant operators reported net positive same-store sales for the 12th consecutive month. ... In contrast, restaurant operators reported a net decline in customer traffic for the third consecutive month.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The index decreased to 100.5 in February, down from 100.7 in January. (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month - and this is fairly positive considering the terrible weather in February.

Dallas Fed: Texas Manufacturing Strengthens Further

by Calculated Risk on 3/31/2014 10:30:00 AM

From the Dallas Fed: Texas Manufacturing Strengthens Further

Texas factory activity increased for the eleventh month in a row in March, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose from 10.8 to 17.1, indicating output grew at a stronger pace than in February.A solid report.

Other measures of current manufacturing activity also reflected more robust growth. The new orders index rose to a nine-month high of 14.7 ... Labor market indicators reflected stronger employment growth and longer workweeks. The March employment index rose markedly to a 21-month high of 15.

...

The general business activity index moved up to a six-month high of 4.9 after slipping to zero last month.

Expectations regarding future business conditions remained optimistic in March. The index of future general business activity edged up to 17.6, and the index of future company outlook rose 7 points to 27.4.

This is the last of the regional surveys. Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through March), and five Fed surveys are averaged (blue, through March) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through February (right axis).

This suggests some increase in the March ISM survey to be released tomorrow, Tuesday, April 1st.

Chicago PMI declines to 55.9

by Calculated Risk on 3/31/2014 09:45:00 AM

From the Chicago ISM:

March 2014:

The Chicago Business Barometer decreased 3.9 points in March to 55.9, the lowest level since August, led by a decline in New Orders and a sharp fall in Employment. ...This was below the consensus estimate of 58.5.

Although New Orders remained firm above the 50 breakeven level, they eased for the second consecutive month pointing to a slight softening in demand. Like the Barometer, New Orders posted the lowest reading since August. Order Backlogs also decreased, to their lowest level since September.

Employment, the second biggest contributor to the Barometer’s decline, decreased sharply in March, erasing nearly all of February’s double digit rise.

Commenting on the MNI Chicago Report, Philip Uglow, Chief Economist of MNI Indicators said, “March saw a significant weakening in activity following a five month spell of firm growth. It’s too early to tell, though, if this is the start of a sustained slowdown or just a blip.”

“Panellists, though, were optimistic about the future. Asked about the outlook for demand over the next three months, the majority of businesses said they expected tosee a pick-up.” he added.

emphasis added

Sunday, March 30, 2014

Monday: Chicago PMI, Dallas Fed Mfg Survey, Yellen

by Calculated Risk on 3/30/2014 09:05:00 PM

Monday:

• At 9:45 AM ET, Chicago Purchasing Managers Index for March. The consensus is for a decrease to 58.5, down from 59.8 in February.

• At 9:55 AM, Speech, Fed Chair Janet Yellen, Strengthening Communities, At the 2014 National Interagency Community Reinvestment Conference, Chicago, Ill.

• At 10:30 AM, Dallas Fed Manufacturing Survey for March. This is the last of the regional Fed manufacturing surveys for March.

Weekend:

• Schedule for Week of March 30th

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 8 and DOW futures are up 65 (fair value).

Oil prices are up with WTI futures at $101.46 per barrel and Brent at $107.95 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.53 per gallon (up over the last two months, but still down from the same week a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Merrill and Nomura on March Employment Report

by Calculated Risk on 3/30/2014 11:28:00 AM

Here are some excepts from two research reports ... first, from Ethan Harris at Merrill Lynch:

We expect a solid jobs report in March with payroll growth of 230,000, reflecting a weather-induced snapback. We saw a modest recovery in job growth in February, with acceleration to 175,000 from 129,000 in January and 84,000 in December. The gain in February occurred despite still-harsh winter weather, implying pent-up activity. The survey week in February had poor conditions with snowstorms across the East coast. In contrast, the survey week in March was notably warmer, allowing for greater economic activity, particularly construction and manufacturing. ... Given the noise in the data, we advise smoothing through the recent swings and focus on a six month moving average, which is trending between 180-190K, revealing decent job growth. As the economy builds momentum, as we expect, we should see this trend move above 200K.And from Nomura:

We look for the unemployment rate to hold steady at 6.7%. The household survey has been quite strong, with job growth averaging 445,000 over the prior four months. The series is typically mean-reverting, suggesting there is a risk of weakening in March. We also think the labor force participation rate will inch higher as confidence about labor market prospects continues to improve, assuggested by the conference board survey (the labor differential in March weakened slightly, but has been on an upward trend).

Also of interest will be average hourly earnings and the work week. Average hourly earnings surged 0.4% mom to bring the yoy rate up to 2.2%. We do not expect such strong gains to continue and look for a slowdown to 0.2% mom which still translates to a 2.3% yoy increase. The risk, however, is to the upside. We think the workweek will rebound to 34.3 after falling to 34.2 in February, which we believe was largely due to weather conditions given the spike in the percent of workers who said they couldn’t report to work due to harsh weather.

[W]e are forecasting a 190k increase in private payrolls with a 5k increase in government jobs, implying that total nonfarm payrolls will gain 195k. Furthermore, given the weaker labor market indicators within regional manufacturing surveys, we expect manufacturing employment to remain unchanged in March. Lastly, we expect the household survey to show that the unemployment rate fell 0.1pp to 6.6% in March.The consensus is for an increase of 206,000 non-farm payroll jobs in March, up from the 175,000 non-farm payroll jobs added in February.

Average weekly hours worked for private industries fell below trend in the past three months, most likely a result of the inclement weather which likely shortened the workweek at some businesses. However, given that the weather was better in March, we expect average weekly hours to rebound to 34.4 from 34.2 in February.

The consensus is for the unemployment rate to decline to 6.6% in March.

I'll write an employment report preview later this week after more data for March is released.

Saturday, March 29, 2014

Unofficial Problem Bank list declines to 538 Institutions, Q1 2014 Transition Matrix

by Calculated Risk on 3/29/2014 04:03:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for March 28, 2014.

Changes and comments from surferdude808:

The FDIC released its enforcement action activity through February 2014 today as anticipated. In that month, the FDIC was very busy terminating enforcement actions. For the week, there were 14 removals that leave the list at 538 institutions with assets of $174.3 billion. A year ago, the list held 791 institutions with assets of $290.0 billion. During March 2014, the list declined by 28 institutions and $8.0 billion in assets after 23 action terminations, four mergers, and one voluntary liquidation.

Removals included 12 action terminations against the following: Florida Bank, Tampa, FL ($536 million); Foundation Bank, Bellevue, WA ($364 million); First Bank of Dalton, Dalton, GA ($188 million); Proficio Bank, Cottonwood Heights, UT ($169 million); Regal Bank & Trust, Owings Mills, MD ($143 million); Bank of George, Las Vegas, NV ($112 million); RiverBank, Spokane, WA ($103 million); Security State Bank, Iron River, WI ($81 million); Bank of Bozeman, Bozeman, MT ($59 million); OmniBank, Bay Springs, MS ($47 million); Key Community Bank, Inver Grove Heights, MN ($42 million); and Cowboy State Bank, Ranchester, WY ($41 million). Hartford Savings Bank, Hartford, WI ($175 million) exited through a voluntary liquidation and Great Northern Bank, Saint Michael, MN ($71 million) through an unassisted merger.

We have updated the Unofficial Problem Bank List transition matrix through the first quarter of 2014. Full details are available in the accompanying table and a visual of the trends may be found in accompanying chart. Since the Unofficial Problem Bank List appeared in August 2009, 1,665 institutions have graced the list with only 32.3% or 538 remaining on the list. Removals total 1,127 with 555 coming through action termination. Another 375 have failed, 183 found a merger partner, and 14 exited through a voluntary liquidation. In the first quarter of 2014, action terminations accelerated to their fastest pace as 9.7 percent or 60 of the 595 institutions at the start of the quarter had their action terminated.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 129 | (43,313,416) | |

| Unassisted Merger | 31 | (6,663,407) | |

| Voluntary Liquidation | 4 | (10,584,114) | |

| Failures | 153 | (184,209,338) | |

| Asset Change | (11,291,149) | ||

| Still on List at 3/31/2014 | 72 | 20,252,005 | |

| Additions after 8/7/2009 | 466 | 154,056,606 | |

| End (3/31/2014) | 538 | 174,308,611 | |

| Intraperiod Deletions1 | |||

| Action Terminated | 426 | 187,850,337 | |

| Unassisted Merger | 152 | 70,216,490 | |

| Voluntary Liquidation | 10 | 2,324,142 | |

| Failures | 222 | 110,834,945 | |

| Total | 810 | 371,225,914 | |

| 1Institution not on 8/7/2009 or 3/31/2014 list but appeared on a weekly list. | |||

Schedule for Week of March 30th

by Calculated Risk on 3/29/2014 08:52:00 AM

This will be a busy week for economic data with several key reports including the March employment report on Friday.

Other key reports include the ISM manufacturing index on Tuesday, February vehicle sales on Tuesday, the ISM service index on Thursday, and the February trade deficit report on Thursday.

Also, Reis is scheduled to release their Q1 surveys of rents and vacancy rates for apartments, offices and malls.

9:45 AM: Chicago Purchasing Managers Index for March. The consensus is for a decrease to 58.5, down from 59.8 in February.

9:55 AM: Speech, Fed Chair Janet Yellen, Strengthening Communities, At the 2014 National Interagency Community Reinvestment Conference, Chicago, Ill.

10:30 AM: Dallas Fed Manufacturing Survey for March. This is the last of the regional Fed manufacturing surveys for March.

Early: Reis Q1 2014 Office Survey of rents and vacancy rates.

All day: Light vehicle sales for March. The consensus is for light vehicle sales to increase to 15.8 million SAAR in March (Seasonally Adjusted Annual Rate) from 15.3 million SAAR in February.

All day: Light vehicle sales for March. The consensus is for light vehicle sales to increase to 15.8 million SAAR in March (Seasonally Adjusted Annual Rate) from 15.3 million SAAR in February.This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the February sales rate.

9:00 AM ET: The Markit US PMI Manufacturing Index for March.

10:00 AM ET: ISM Manufacturing Index for March. The consensus is for an increase to 54.0 from 53.2 in February.

10:00 AM ET: ISM Manufacturing Index for March. The consensus is for an increase to 54.0 from 53.2 in February.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion in February at 53.2%. The employment index was at 52.3%, and the new orders index was at 54.5%.

10:00 AM: Construction Spending for February. The consensus is for a 0.1% increase in construction spending.

Early: Reis Q1 2014 Apartment Survey of rents and vacancy rates.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for March. This report is for private payrolls only (no government). The consensus is for 190,000 payroll jobs added in March, up from 139,000 in February.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for February. The consensus is for a 0.8% increase in February orders.

Early: Reis Q1 2014 Mall Survey of rents and vacancy rates.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 320 thousand from 311 thousand.

8:30 AM: Trade Balance report for February from the Census Bureau.

8:30 AM: Trade Balance report for February from the Census Bureau. Imports and exports increased in January.

The consensus is for the U.S. trade deficit to decrease to $38.5 billion in February from $39.1 billion in January.

10:00 AM: ISM non-Manufacturing Index for March. The consensus is for a reading of 53.5, up from 51.6 in February. Note: Above 50 indicates expansion, below 50 contraction.

8:30 AM: Employment Report for March. The consensus is for an increase of 206,000 non-farm payroll jobs in March, up from the 175,000 non-farm payroll jobs added in February.

The consensus is for the unemployment rate to decline to 6.6% in March.

This graph shows the percentage of payroll jobs lost during post WWII recessions through February.

This graph shows the percentage of payroll jobs lost during post WWII recessions through February.The economy has added 8.7 million private sector jobs since employment bottomed in February 2010 (8.0 million total jobs added including all the public sector layoffs).

There are still almost 129 thousand fewer private sector jobs now than when the recession started in 2007. Private sector employment at a new high will probably be a headline for the March report.