by Calculated Risk on 3/27/2014 08:30:00 AM

Thursday, March 27, 2014

Q4 GDP Revised up to 2.6%, Weekly Initial Unemployment Claims decline to 311,000

From the BEA: Gross Domestic Product, 4th quarter and annual 2013 (third estimate); Corporate Profits, 4th quarter and annual 2013

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 2.6 percent in the fourth quarter of 2013 (that is, from the third quarter to the fourth quarter), according to the "third" estimate released by the Bureau of Economic Analysis. ...Here is a Comparison of Third and Second Estimates. PCE growth was revised up from 2.6% to 3.3%. Private investment was revised down.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 2.4 percent. With this third estimate for the fourth quarter, the general picture of economic growth remains largely the same; personal consumption expenditures (PCE) was larger than previously estimated, while private investment in inventories and in intellectual property products were smaller than previously estimated ...

The DOL reports:

In the week ending March 22, the advance figure for seasonally adjusted initial claims was 311,000, a decrease of 10,000 from the previous week's revised figure of 321,000. The 4-week moving average was 317,750, a decrease of 9,500 from the previous week's revised average of 327,250.The previous week was revised up from 320,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 317,750.

This was below the consensus forecast of 325,000. The 4-week average is moving down and is close to normal levels during an expansion.

Wednesday, March 26, 2014

Thursday: Q4 GDP (3rd Estimate), Unemployment Claims, Pending Home Sales

by Calculated Risk on 3/26/2014 06:55:00 PM

From the Federal Reserve: Comprehensive Capital Analysis and Review

The Federal Reserve on Wednesday announced it has approved the capital plans of 25 bank holding companies participating in the Comprehensive Capital Analysis and Review (CCAR). The Federal Reserve objected to the plans of the other five participating firms--four based on qualitative concerns and one because it did not meet a minimum post-stress capital requirement.Thursday:

...

When considering an institution's capital plan, the Federal Reserve considers both qualitative and quantitative factors. These include a firm's capital ratios under severe economic and financial market stress and the strength of the firm's capital planning process. After the Federal Reserve objects to a capital plan, the institution may only make capital distributions with prior written approval from the Federal Reserve.

...

Based on qualitative concerns, the Federal Reserve objected to the capital plans of Citigroup Inc.; HSBC North America Holdings Inc.; RBS Citizens Financial Group, Inc.; and Santander Holdings USA, Inc. The Federal Reserve objected to the capital plan of Zions Bancorporation because the firm did not meet the minimum, post-stress tier-1 common ratio of 5 percent.

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 325 thousand from 320 thousand.

• Also at 8:30 AM, The third estimate of Q4 GDP from the BEA. The consensus is that real GDP increased 2.7% annualized in Q4, revised up from the second estimate of 2.4%.

• At 10:00 AM, Pending Home Sales Index for February. The consensus is for a 0.8% decrease in the index.

• At 11:00 AM, the Kansas City Fed manufacturing survey for March.

Vehicle Sales Forecasts: March Rebound

by Calculated Risk on 3/26/2014 03:30:00 PM

Auto sales were clearly impacted by the harsh winter weather in January and February. For an excellent article on weather and auto sales, see Weakening Economy or Just Bad Winter? by Atif Mian and Amir Sufi. Now we will see if sales rebound ...

Note: The automakers will report March vehicle sales on Tuesday, April 1st. Sales in February were at a 15.3 million seasonally adjusted annual rate (SAAR), and it appears there will be a solid increase in March.

Here are a couple of forecasts:

From Kelley Blue Book: New-Car Sales Expected To Rise 2 Percent In March, Fall 0.3 Percent In First Quarter 2014

New-vehicle sales are expected to rise 2 percent year-over-year to a total of 1.48 million units, and an estimated 15.7 million seasonally adjusted annual rate (SAAR), according to Kelley Blue Book ... A 15.7 million SAAR would mark the seventeenth consecutive month above 15 million and the greatest March since 2007.Note: In March 2014, there was one less selling day than in March 2013 (26 days vs. 27 last year).

"Following two months of weaker-than-expected sales, the industry should start to bounce back in March," said Alec Gutierrez, senior analyst for Kelley Blue Book. "Although we aren't expected to hit 16 million SAAR, indications show that consumers are returning to showrooms in spring. The momentum built in March should set the market up for a big month in April.

From J.D. Power: Auto Sales Recovering After Slow Start to 2014

Cold and snowy weather may have depressed new-vehicle sales in January and February of 2014, but customers are returning to dealership showrooms in March, according to a new sales forecast jointly issued by J.D. Power and LMC Automotive. According to the latest forecast, retail sales are expected to demonstrate a 7% increase over March 2013, with 1,148,338 new cars, trucks, SUVs, and minivans rolling into American driveways.J.D. Power didn't provide a fleet forecast or SAAR forecast, but this suggests a significant increase over the February rate.

Additionally, the average transaction price for those new vehicles remains above $29,300, the highest ever for the month of March and $700 higher than in March 2013, reflecting continued economic strength and improved consumer confidence.

"The severe weather had an impact on retail sales in January and February, but as the weather has improved, so have sales," said John Humphrey, senior vice president of the global automotive practice at J.D. Power. "Additionally, stronger pricing coupled with lower reliance on fleet continues to bode well for the overall health of the sector."

At the start of March 2014, automakers had stockpiled an 80-day supply of new vehicles, while a 60-day supply is considered ideal. LMC Automotive isn't concerned, though, and expects a faster selling rate to reduce inventories to normal levels.

Chemical Activity Barometer for March Suggests "continued modest growth"

by Calculated Risk on 3/26/2014 12:37:00 PM

Here is a new indicator that I'm following that appears to be a leading indicator for industrial production.

From the American Chemistry Council: Equity Prices Drive Chemical Activity Barometer Growth Despite Continued Adverse Weather

While winter weather extremes continue to impact economic reporting, strengthening chemical equity prices drove solid gains in the American Chemistry Council’s (ACC) monthly Chemical Activity Barometer (CAB), released today. March’s reading featured a gain of 0.3% over February on a three-month moving average basis (3MMA), rebounding past the average 0.2% gain in late 2013, and pointing to modest but continued growth in the U.S. economy through the fourth quarter of 2014. Strengthening chemical equity prices in February and March are a positive signal and a major factor in this month’s CAB reading. The economic indicator, shown to lead U.S. business cycles by an average of eight months at cycle peaks, is up 2.5 percent over a year ago, at an improved year-earlier pace. The CAB reading for February was revised upwards slightly from earlier reports.

“Winter weather extremes have carried into March and continue to impact many of the economic readings, but all signs point to an expanding U.S. economy through 2014,” said Kevin Swift, chief economist at the American Chemistry Council. “Strengthening chemical equity prices, combined with the expansion of sales in intermediate goods, which constitute roughly 85% of overall chemical sales, are encouraging signs for the continued health of the U.S. economy.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

And this suggests that continued growth.

Freddie Mac: Mortgage Serious Delinquency rate declined in February, Lowest since February 2009

by Calculated Risk on 3/26/2014 10:27:00 AM

Freddie Mac reported that the Single-Family serious delinquency rate declined in February to 2.29% from 2.34% in January. Freddie's rate is down from 3.15% in February 2013, and this is the lowest level since February 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Note: Fannie Mae will report their Single-Family Serious Delinquency rate for February on Monday, March 31st.

Click on graph for larger image

Click on graph for larger image

Although this indicates progress, the "normal" serious delinquency rate is under 1%.

The serious delinquency rate has fallen 0.86 percentage points over the last year - and at that rate of improvement, the serious delinquency rate will not be below 1% until late 2015.

Note: Very few seriously delinquent loans cure with the owner making up back payments - most of the reduction in the serious delinquency rate is from foreclosures, short sales, and modifications.

So even though distressed sales are declining, I expect an above normal level of distressed sales for another 2 years (mostly in judicial foreclosure states).

MBA: Mortgage Purchase Applications Increase, Refinance Applications Decrease

by Calculated Risk on 3/26/2014 07:01:00 AM

From the MBA: Purchase Applications Increase in Latest MBA Weekly Survey

Mortgage applications decreased 3.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 21, 2014. ...

The Refinance Index decreased 8 percent from the previous week, including an 8.1 percent decline in conventional refinance applications and a 5.8 percent decline in government refinance applications; the government refinance index dropped to the lowest level since July 2011. In contrast, the seasonally adjusted Purchase Index increased 3 percent from one week earlier, driven mainly by a 4.0 percent increase in conventional purchase applications....

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.56 percent, the highest level since January 2014, from 4.50 percent, with points increasing to 0.29 from 0.26 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,000) increased to 4.45 percent from 4.39 percent, with points increasing to 0.27 from 0.19 (including the origination fee) for 80 percent LTV loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 72% from the levels in May 2013.

With the mortgage rate increases, refinance activity will be significantly lower in 2014 than in 2013.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index is now down about 19% from a year ago.

The purchase index is probably understating purchase activity because small lenders tend to focus on purchases, and those small lenders are underrepresented in the purchase index - but this is still very weak.

Tuesday, March 25, 2014

Zillow: Case-Shiller House Price Index expected to show 12.8% year-over-year increase in February

by Calculated Risk on 3/25/2014 07:12:00 PM

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, the Durable Goods Orders for February from the Census Bureau. The consensus is for a 1.0% increase in durable goods orders.

The Case-Shiller house price indexes for January were released today. Zillow has started forecasting Case-Shiller a month early - and I like to check the Zillow forecasts since they have been pretty close.

It looks like the year-over-year change for Case-Shiller will continue to slow. From Zillow: Case-Shiller Forecast Showing Moderate Slowdown in February

The Case-Shiller data for January 2014 came out this morning, and based on this information and the February 2014 Zillow Home Value Index (ZHVI, released March 19) we predict that next month’s Case-Shiller data (February 2014) will show that the non-seasonally adjusted (NSA) 20-City Composite Home Price Index and the NSA 10-City Composite Home Price Index increased 12.8 and 13.1 percent on a year-over-year basis, respectively. The seasonally adjusted (SA) month-over-month change from January to February will be 0.6 percent for both the 20-City Composite and the 10-City Composite Home Price Indices (SA). ... Officially, the Case-Shiller Composite Home Price Indices for February will not be released until Tuesday, April 29.The following table shows the Zillow forecast for the February Case-Shiller index.

| Zillow February Forecast for Case-Shiller Index | |||||

|---|---|---|---|---|---|

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | Feb 2013 | 159.09 | 162.52 | 146.51 | 149.81 |

| Case-Shiller (last month) | Jan 2013 | 180.08 | 182.6 | 165.50 | 168.03 |

| Zillow Forecast | YoY | 13.1% | 13.1% | 12.8% | 12.8% |

| MoM | --- | 0.6% | --- | 0.6% | |

| Zillow Forecasts1 | 179.9 | 183.7 | 165.3 | 169.0 | |

| Current Post Bubble Low | 146.45 | 149.69 | 134.07 | 136.92 | |

| Date of Post Bubble Low | Mar-12 | Jan-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 22.8% | 22.7% | 23.3% | 23.3% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

Comment on House Prices: Graphs, Real Prices, Price-to-Rent Ratio, Cities

by Calculated Risk on 3/25/2014 01:51:00 PM

S&P/Case-Shiller's website crashed this morning. For some reason people seem to care about house prices!

Here is the website and the monthly Home Price Indices for January ("January" is a 3 month average of November, December and January prices). This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

Here is the press release from S&P: Pace of Home Price Gains Slow According to the S&P/Case-Shiller Home Price Indices

Click on graph for larger image.

Click on graph for larger image.

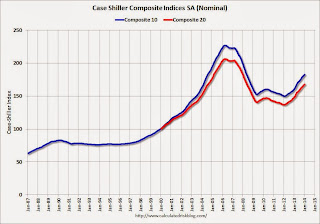

The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 19.5% from the peak, and up 0.8% in January (SA). The Composite 10 is up 21.9% from the post bubble low set in Jan 2012 (SA).

The Composite 20 index is off 18.7% from the peak, and up 0.8% (SA) in January. The Composite 20 is up 22.6% from the post-bubble low set in Jan 2012 (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 SA is up 13.5% compared to January 2013.

The Composite 20 SA is up 13.2% compared to January 2013.

Prices increased (SA) in 20 of the 20 Case-Shiller cities in January seasonally adjusted. (Prices increased in 7 of the 20 cities NSA) Prices in Las Vegas are off 44.8% from the peak, and prices in Dallas and Denver are at new highs (SA).

This was at the consensus forecast for a 13.3% YoY increase.

I've been hearing reports of a slowdown in house price increases (more than the usual seasonal slowdown), and perhaps this slowdown in price increases is finally showing up in the Case-Shiller index. This makes sense since inventory is starting to increase.

According to Trulia chief economist Jed Kolko, asking price increases have slowed down recently, and Kolko expects that price slowdown will "hit Feb sales prices and get reported in April index releases".

It might take a few months, but I also expect to see smaller year-over-year price increases going forward.

I also think it is important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $276,000 today adjusted for inflation (about 38%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

The first graph shows the quarterly Case-Shiller National Index SA (through Q4 2013), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through January) in nominal terms as reported.

The first graph shows the quarterly Case-Shiller National Index SA (through Q4 2013), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through January) in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) is back to Q1 2004 levels (and also back up to Q3 2008), and the Case-Shiller Composite 20 Index (SA) is back to Oct 2004 levels, and the CoreLogic index (NSA) is back to August 2004.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q2 2001 levels, the Composite 20 index is back to June 2002, and the CoreLogic index back to May 2002.

In real terms, house prices are back to early '00s levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q2 2001 levels, the Composite 20 index is back to Sept 2002 levels, and the CoreLogic index is back to Dec 2002.

In real terms - and as a price-to-rent ratio - prices are mostly back to early 2000 levels.

A comment on the New Home Sales report

by Calculated Risk on 3/25/2014 11:56:00 AM

Earlier: New Home Sales at 440,000 Annual Rate in February

The Census Bureau reported that new home sales in January and February combined were 68,000 not seasonally adjusted (NSA). This is the same as last year NSA - so there was no growth over the first two months of the year.

Weather probably played a small role in the lack of growth, but higher mortgage rates and higher prices probably were probably bigger factors.

Also this was a difficult comparison period. Sales in 2013 were up 16.8% from 2012, but sales in January and February 2013 were up over 28% from the same months of the previous year! The comparisons to last year will be easier in a few months - and I expect to see solid growth again this year.

On revisions: Although sales in January were revised down by 13 thousand, sales in November and December were revised up a combined 18 thousand - so overall revisions were positive.

Note: Based on estimates of household formation and demographics, I expect sales to increase to 750 to 800 thousand over the next several years - substantially higher than the 440 thousand sales rate in February. So I expect the housing recovery to continue.

And here is another update to the "distressing gap" graph that I first started posting over four years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

Click on graph for larger image.

Click on graph for larger image.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through February 2014. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales kept existing home sales elevated, and depressed new home sales since builders weren't able to compete with the low prices of all the foreclosed properties.

I expect existing home sales to decline some more or move sideways (distressed sales will slowly decline and be partially offset by more conventional / equity sales). And I expect this gap to close, mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales at 440,000 Annual Rate in February

by Calculated Risk on 3/25/2014 10:00:00 AM

The Census Bureau reports New Home Sales in February were at a seasonally adjusted annual rate (SAAR) of 440 thousand.

January sales were revised down from 468 thousand to 455 thousand, and December sales were revised up from 427 thousand to 441 thousand (November was revised up slightly too).

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Sales of new single-family houses in February 2014 were at a seasonally adjusted annual rate of 440,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 3.3 percent below the revised January rate of 455,000 and is 1.1 percent below the February 2013 estimate of 445,000.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Even with the increase in sales over the last two years, new home sales are still near the bottom for previous recessions.

The second graph shows New Home Months of Supply.

The months of supply increased in February to 5.2 months from 5.0 months in January.

The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

This is now in the normal range (less than 6 months supply is normal)."The seasonally adjusted estimate of new houses for sale at the end of February was 189,000. This represents a supply of 5.2 months at the current sales rate."On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale is still low, but moving up. The combined total of completed and under construction is also very low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In February 2014 (red column), 35 thousand new homes were sold (NSA). Last year 36 thousand homes were also sold in February. The high for February was 109 thousand in 2005, and the low for February was 22 thousand in 2011.

This was at expectations of 440,000 sales in February.

I'll have more later today .