by Calculated Risk on 2/26/2014 11:30:00 AM

Wednesday, February 26, 2014

FDIC: Earnings increased for insured institutions, Fewer Problem banks, Residential REO Declines in Q4

The FDIC released the Quarterly Banking Profile for Q4 today.

Commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) reported aggregate net income of $40.3 billion in the fourth quarter of 2013, a $5.8 billion (16.9 percent) increase from the $34.4 billion in earnings that the industry reported a year earlier. This is the 17th time in the last 18 quarters — since the third quarter of 2009 — that earnings have registered a year-over-year increase. The improvement in earnings was mainly attributable to an $8.1 billion decline in loan-loss provisions. Lower income stemming from reduced mortgage activity and a drop in trading revenue contributed to a year-over-year decline in net operating revenue (the sum of net interest income and total noninterest income). More than half of the 6,812 insured institutions reporting (53 percent) had year-over-year growth in quarterly earnings. The proportion of banks that were unprofitable fell to 12.2 percent, from 15 percent in the fourth quarter of 2012.The FDIC reported the number of problem banks declined:

emphasis added

The number of "problem banks" fell for the 11th consecutive quarter. The number of banks on the FDIC's "Problem List" declined from 515 to 467 during the quarter. The number of "problem" banks is down by almost half from the recent high of 888 at the end of the first quarter of 2011. Two FDIC-insured institutions failed in the fourth quarter of 2013, down from eight in the fourth quarter of 2012. For all of 2013, there were 24 failures, compared to 51 in 2012.

Click on graph for larger image.

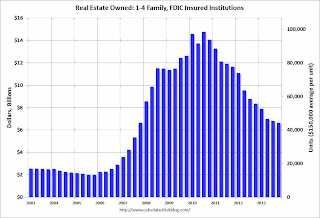

Click on graph for larger image.The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) declined from $6.79 billion in Q3 2013 to $6.64 billion in Q4. This is the lowest level of REOs since Q3 2007. Even in good times, the FDIC insured institutions have about $2.5 billion in residential REO.

This graph shows the dollar value of Residential REO for FDIC insured institutions. Note: The FDIC reports the dollar value and not the total number of REOs.

New Home Sales at 468,000 Annual Rate in January, Highest since 2008

by Calculated Risk on 2/26/2014 10:00:00 AM

The Census Bureau reports New Home Sales in January were at a seasonally adjusted annual rate (SAAR) of 468 thousand.

December sales were revised up from 414 thousand to 427 thousand, and November sales were revised down from 445 thousand to 444 thousand.

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Sales of new single-family houses in January 2014 were at a seasonally adjusted annual rate of 468,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 9.6 percent above the revised December rate of 427,000 and is 2.2 percent above the January 2013 estimate of 458,000.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This was the highest sales rate since 2008.

Even with the increase in sales over the last two years, new home sales are still near the bottom for previous recessions.

The second graph shows New Home Months of Supply.

The months of supply decreased in January to 4.7 months from 5.2 months in December.

The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

This is now in the normal range (less than 6 months supply is normal)."The seasonally adjusted estimate of new houses for sale at the end of January was 184,000. This represents a supply of 4.7 months at the current sales rate."On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale is near the record low. The combined total of completed and under construction is still very low.

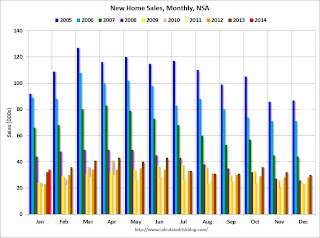

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In January 2014 (red column), 34 thousand new homes were sold (NSA). Last year 32 thousand homes were also sold in January. The high for January was 92 thousand in 2005, and the low for January was 213 thousand in 2011.

This was well above expectations of 405,000 sales in January.

I'll have more later today - but this was a decent start for 2014.

MBA: Mortgage Purchase Index lowest since 1995

by Calculated Risk on 2/26/2014 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 8.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 21, 2014. ...

The Refinance Index decreased 11 percent from the previous week. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier to the lowest level since 1995. ...

"Purchase applications were little changed on an unadjusted basis last week, but this is the time of a year we would expect a significant pickup in purchase activity, and we are not yet seeing it,” said Mike Fratantoni, MBA’s Chief Economist.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.53 percent, the highest rate since week ending January 17, 2014, from 4.50 percent, with points increasing to 0.31 from 0.26 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,000) increased to 4.47 percent, the highest rate since week ending January 24, 2014, from 4.45 percent, with points increasing to 0.13 from 0.11 (including the origination fee) for 80 percent LTV loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 72% from the levels in May 2013.

With the mortgage rate increases, refinance activity will be significantly lower in 2014 than in 2013.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index is now down about 16% from a year ago - and the weekly purchase index is at the lowest level since 1995.

The purchase index is probably understating purchase activity because small lenders tend to focus on purchases, and those small lenders are underrepresented in the purchase index - but this is still very weak.

Note: Jumbo rates are still below conforming rates.

Tuesday, February 25, 2014

Wednesday: New Home Sales

by Calculated Risk on 2/25/2014 08:53:00 PM

An interesting article on land values from the WSJ: Land Investors Brace for Slowdown

A look at the sequential, quarter-to-quarter change in land prices underscores the cooling of the market. According to Zelman's monthly surveys of builders, brokers and developers in 55 major markets, prices of finished lots receded from their biggest recent gain—6.8% in the first quarter of 2013 from the previous quarter—to a more tepid 2.9% gain in last year's fourth quarter.Land prices fell sharply during the bust (land prices declined more than house prices), and prices increased quickly over the last couple of years. Now price appreciation is slowing.

Some economists and market observers now predict smaller price gains—and, in some cases, flat prices—for land in 2014. "We expect the pace of acceleration to ease," Zelman analyst Ryan McKeveny said.

Wednesday:

• At 7:00 AM ET, the The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, New Home Sales for January from the Census Bureau. The consensus is for a decrease in sales to 405 thousand Seasonally Adjusted Annual Rate (SAAR) in January from 414 thousand in December.

Zillow: Case-Shiller House Price Index expected to show 13.0% year-over-year increase in January

by Calculated Risk on 2/25/2014 06:45:00 PM

The Case-Shiller house price indexes for December were released today. Zillow has started forecasting Case-Shiller a month early - and I like to check the Zillow forecasts since they have been pretty close.

It looks like the year-over-year change for Case-Shiller is still strong, but slowing. In January 2013, the Composite 20 seasonally adjusted index was up 0.8% (a 10% annual rate), and is forecast to be up "only" 0.5% in January 2014 (a 6% annual rate).

From Zillow: Case-Shiller Indices Show Little Moderation

The Case-Shiller data for December 2013 came out this morning, and based on this information and the January 2014 Zillow Home Value Index (ZHVI, released February 19) we predict that next month’s Case-Shiller data (January 2014) will show that the non-seasonally adjusted (NSA) 20-City Composite Home Price Index and the NSA 10-City Composite Home Price Index increased 13.0 and 13.3 percent on a year-over-year basis, respectively. The seasonally adjusted (SA) month-over-month change from December to January will be 0.5 percent for both the 20-City Composite and the 10-City Composite Home Price Indices (SA). All forecasts are shown in the table below. Officially, the Case-Shiller Composite Home Price Indices for January will not be released until Tuesday, March 25.The following table shows the Zillow forecast for the December Case-Shiller index.

Case-Shiller indices have shown very little slowing in monthly appreciation, as they continue to show an inflated picture of home prices, especially when considering year-over-year growth. The Case-Shiller indices are biased toward the large, coastal metros currently seeing enormous home value gains, and they include foreclosure resales. The inclusion of foreclosure resales disproportionately boosts the index when these properties sell again for much higher prices — not just because of market improvements, but also because the sales are no longer distressed.

In contrast, the ZHVI does not include foreclosure resales and shows home values for January 2014 up 6.3 percent from year-ago levels. More on the differences between a repeat sales index, including the Case-Shiller indices, and an imputed hedonic index like the ZHVI can be found here. We expect home value appreciation to continue to moderate in 2014, rising 3.4 percent between January 2014 and January 2015 — a rate much more in line with historic appreciation rates. The main drivers of this moderation include rising mortgage rates and less investor participation – leading to decreased demand – and increasing for-sale inventory supply. Further details on our forecast of home values can be found here, and more on Zillow’s full January 2014 report can be found here.

| Zillow December Forecast for Case-Shiller Index | |||||

|---|---|---|---|---|---|

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | Jan 2013 | 158.61 | 160.50 | 146.15 | 148.05 |

| Case-Shiller (last month) | Dec 2013 | 180.13 | 180.17 | 165.69 | 166.70 |

| Zillow Forecast | YoY | 13.3% | 13.3% | 13.0% | 13.0% |

| MoM | -0.2% | 0.5% | -0.3% | 0.5% | |

| Zillow Forecasts1 | 179.7 | 182.0 | 165.2 | 167.4 | |

| Current Post Bubble Low | 146.45 | 149.69 | 134.07 | 136.92 | |

| Date of Post Bubble Low | Mar-12 | Jan-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 22.7% | 21.6% | 23.2% | 22.3% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

Lawler on Toll Brothers: Net Home Orders Down in Latest Quarter; Weather Only Partly to Blame

by Calculated Risk on 2/25/2014 05:55:00 PM

From housing economist Tom Lawler:

Toll Brothers, the self-proclaimed “nation’s leading builder of luxury homes,” reported that net home orders in the quarter ended January 31, 2014 totaled 916, down 5.9% from the comparable quarter of 2013. Net home orders for “traditional” homes (that is, excluding its “city-living” segment) totaled 865 last quarter, down 8.1% from a year earlier. The company’s sales cancellation rate, expressed as a % of gross orders, was 7.0% last quarter, up from 6.2% a year ago. Home deliveries last quarter totaled 928, up 24.4% from the comparable quarter of 2013, at an average sales price $694,000, up 22.0% from a year ago. The company’s order backlog at the end of January was 3,667, up 31.2% from last January, at an average order price of $733,000, up 10.2% from a year ago.

Here are a few excerpts from the conference call.

“The freezing, snowy weather of the past two months has impacted our business in the Northeast, Mid-Atlantic and Midwest markets, where about 50% of our selling communities are located. While it is still too early to draw conclusions about the Spring selling season, we remain optimistic based on solid affordability, attractive interest rates, growing pent-up demand and an industry still under-producing compared to both historical norms and current demographics.” “Encouragingly, our average price per home has risen dramatically, representing a combination of price increases and mix shift. Both components have helped boost our gross and operating margin.”For “traditional” homes, net orders last quarter were down YY in the “North,” up 0.4% in the “Mid-Atlantic” up 9.4% in the “South” (which includes Texas), and off 17.4% in the “West.” The decline in the West was not weather related, but rather reflected potential buyers’ response to Toll’s unusually aggressive price increases in the region, especially California. The average net order price in the West last quarter was $944,000, up 27.9% from a year earlier.

Based on results so far, Toll lowered slightly its wide “guidance” on expected home deliveries for its full fiscal year (ending October 31, 2014) to “between 5,100 and 5,850 homes” from “between 5,100 and 6,100 homes” given in its December 10, 2013 earnings press release. Toll delivered 4,184 homes in the fiscal year ended October 31, 2013.

Toll said that at the end of January it owned or controlled 51,235 lots, up 17.3% from last January and up 29.2% from the end of January 2012.

Update: Seasonal Pattern for House Prices

by Calculated Risk on 2/25/2014 03:55:00 PM

There has always been a clear seasonal pattern for house prices, but the seasonal differences have been more pronounced in recent years.

Even in normal times house prices tend to be stronger in the spring and early summer than in the fall and winter. Recently there has been a larger than normal seasonal pattern because conventional sales are following the normal pattern (more sales in the spring and summer), but distressed sales (foreclosures and short sales) happen all year. So distressed sales have had a larger negative impact on prices in the fall and winter.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the month-to-month change in the CoreLogic and NSA Case-Shiller Composite 20 index since 2001 (both through December). The seasonal pattern was smaller back in the early '00s, and increased since the bubble burst.

Case-Shiller NSA and CoreLogic both recently turned slightly negative month-to-month, but this is just seasonal.

The second graph shows the seasonal factors for the Case-Shiller composite 20 index. The factors started to change near the peak of the bubble, and really increased during the bust.

The second graph shows the seasonal factors for the Case-Shiller composite 20 index. The factors started to change near the peak of the bubble, and really increased during the bust.

Note: I was one of several people to question this change in the seasonal factor - and this led to S&P Case-Shiller reporting the NSA numbers.

It appears the seasonal factor has stopped increasing, and I expect that over the next several years - as the percent of distressed sales decline - the seasonal factors will slowly move back towards the previous levels.

Comment on House Prices: Real Prices, Price-to-Rent Ratio, Cities

by Calculated Risk on 2/25/2014 11:40:00 AM

I've been hearing reports of a slowdown in house price increases (more than the usual seasonal slowdown), and perhaps this slowdown in price increases is finally showing up in the Case-Shiller index. This makes sense since inventory is starting to increase.

According to Trulia chief economist Jed Kolko, asking price increases have slowed down recently, and Kolko expects that price slowdown will "hit Feb sales prices and get reported in April index releases".

It might take a few months, but I also expect to see smaller year-over-year price increases going forward.

Note: There was a small Not Seasonally Adjusted decline in December, but that decline was smaller than usual - and prices are still increasing fairly quickly on a seasonally adjusted basis.

I also think it is important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $276,000 today adjusted for inflation (about 38%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Earlier: Case-Shiller: Case-Shiller: Comp 20 House Prices increased 13.4% year-over-year in December

Nominal House Prices

The first graph shows the quarterly Case-Shiller National Index SA (through Q4 2013), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through December) in nominal terms as reported.

The first graph shows the quarterly Case-Shiller National Index SA (through Q4 2013), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through December) in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) is back to Q1 2004 levels (and also back up to Q3 2008), and the Case-Shiller Composite 20 Index (SA) is back to July 2004 levels, and the CoreLogic index (NSA) is back to September 2004.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q2 2001 levels, the Composite 20 index is back to May 2002, and the CoreLogic index back to May 2002.

In real terms, house prices are back to early '00s levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q2 2001 levels, the Composite 20 index is back to Sept 2002 levels, and the CoreLogic index is back to September 2002.

In real terms - and as a price-to-rent ratio - prices are mostly back to early 2000 levels.

Nominal Prices: Cities relative to Jan 2000

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

As an example, at the peak, prices in Phoenix were 127% above the January 2000 level. Then prices in Phoenix fell slightly below the January 2000 level, and are now up 44% above January 2000 (44% nominal gain in 14 years).

These are nominal prices, and as I noted above real prices (adjusted for inflation) are up about 38% since January 2000 - so the increase in Phoenix from January 2000 until now is just a little above the change in overall prices due to inflation.

Two cities - Denver (up 46% since Jan 2000) and Dallas (up 33% since Jan 2000) - are above the bubble highs (no other Case-Shiller Comp 20 city is very close). Denver is up slightly more than inflation over that period, and Dallas slightly less. Detroit prices are still below the January 2000 level.

Richmond Fed: "Manufacturing Sector Softened" in February

by Calculated Risk on 2/25/2014 10:04:00 AM

From the Richmond Fed: Manufacturing Sector Softened; Shipments and New Orders Declined

Manufacturing in the Fifth District slowed, according to the most recent survey by the Federal Reserve Bank of Richmond. Shipments and the volume of new orders declined. Hiring flattened, while the average workweek shortened and average wage growth rose. ...Another weak manufacturing survey for February.

The composite index of manufacturing dipped to a reading of −6 following last month's reading of 12. The index for shipments fell 20 points, ending at −6, and the index for new orders dropped 23 points, finishing at a reading of −9. The index for the number of employees shed six points, settling at 0. As a result of bad weather a few survey participants reported that manufacturing facilities experienced downtime in February, with some reductions in shipments.

Manufacturing employment eased off this month, settling at an index of 0 and the average workweek shortened. The index shed 13 points moving to a reading of −5. The index for average wages grew only slightly faster; that gauge edged up to 14 from the previous reading of 11.

Case-Shiller: Comp 20 House Prices increased 13.4% year-over-year in December

by Calculated Risk on 2/25/2014 09:15:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for December ("December" is a 3 month average of October, November and December prices).

This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities) and the quarterly national index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: ome Prices Lose Momentum According to the S&P/Case-Shiller Home Price Indices

Data through December 2013, released today by S&P Dow Jones Indices for its S&P/Case-Shiller Home Price Indices, the leading measure of U.S. home prices, showed that National home prices closed the year of 2013 up 11.3%. This represents a slight improvement over last quarter’s annual rate of 11.2%. In the fourth quarter of 2013, the National Index declined 0.3%.

In December, the 10-City Composite remained relatively unchanged while the 20-City Composite showed its second consecutive monthly decline of 0.1%. Year-over-year, the 10-City and 20-City Composites posted gains of 13.6% and 13.4%, approximately 30 basis points lower than their November rates. Chicago showed its highest year-over-year return since December 1988. Dallas set a new peak and posted its largest annual gain since its inception in 2000. Denver declined 0.1% and is now 0.7% below its all-time index level high set in September 2013.

“The S&P/Case-Shiller Home Price Index ended its best year since 2005,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “However, gains are slowing from month-to-month and the strongest part of the recovery in home values may be over. Year-over-year values for the two monthly Composites weakened and the quarterly National Index barely improved. The seasonally adjusted data also exhibit some softness and loss of momentum.

After 26 months of consecutive gains, Phoenix posted -0.3% for the month of December, its largest decline since March 2011. Phoenix once led the recovery from the bottom in 2012, but Las Vegas, Los Angeles and San Francisco were the top three performing cities of 2013 with gains of over 20%. The Sun Belt, with the exception of Dallas, Miami and Tampa, saw lower annual rates in December when compared to their November numbers. The six cities with the highest year-over-year figures saw their rates decline (Las Vegas, San Francisco, Los Angeles, Atlanta, San Diego and Detroit) and most cities ranked at the bottom improved (Denver, Washington and New York) – Charlotte and Cleveland were the two exceptions."

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 20.1% from the peak, and up 0.8% in December (SA). The Composite 10 is up 21.0% from the post bubble low set in Jan 2012 (SA).

The Composite 20 index is off 19.3% from the peak, and up 0.8% (SA) in December. The Composite 20 is up 21.7% from the post-bubble low set in Jan 2012 (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 13.6% compared to December 2012.

The Composite 20 SA is up 13.4% compared to December 2012.

Prices increased (SA) in 19 of the 20 Case-Shiller cities in December seasonally adjusted. (Prices increased in 6 of the 20 cities NSA) Prices in Las Vegas are off 45.5% from the peak, and prices in Dallas are at new highs (SA).

This was at the consensus forecast for a 13.3% YoY increase. I'll have more on prices later.