by Calculated Risk on 2/26/2014 11:30:00 AM

Wednesday, February 26, 2014

FDIC: Earnings increased for insured institutions, Fewer Problem banks, Residential REO Declines in Q4

The FDIC released the Quarterly Banking Profile for Q4 today.

Commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) reported aggregate net income of $40.3 billion in the fourth quarter of 2013, a $5.8 billion (16.9 percent) increase from the $34.4 billion in earnings that the industry reported a year earlier. This is the 17th time in the last 18 quarters — since the third quarter of 2009 — that earnings have registered a year-over-year increase. The improvement in earnings was mainly attributable to an $8.1 billion decline in loan-loss provisions. Lower income stemming from reduced mortgage activity and a drop in trading revenue contributed to a year-over-year decline in net operating revenue (the sum of net interest income and total noninterest income). More than half of the 6,812 insured institutions reporting (53 percent) had year-over-year growth in quarterly earnings. The proportion of banks that were unprofitable fell to 12.2 percent, from 15 percent in the fourth quarter of 2012.The FDIC reported the number of problem banks declined:

emphasis added

The number of "problem banks" fell for the 11th consecutive quarter. The number of banks on the FDIC's "Problem List" declined from 515 to 467 during the quarter. The number of "problem" banks is down by almost half from the recent high of 888 at the end of the first quarter of 2011. Two FDIC-insured institutions failed in the fourth quarter of 2013, down from eight in the fourth quarter of 2012. For all of 2013, there were 24 failures, compared to 51 in 2012.

Click on graph for larger image.

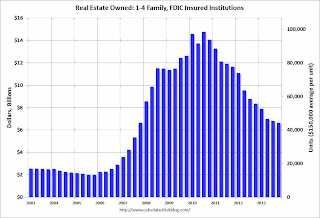

Click on graph for larger image.The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) declined from $6.79 billion in Q3 2013 to $6.64 billion in Q4. This is the lowest level of REOs since Q3 2007. Even in good times, the FDIC insured institutions have about $2.5 billion in residential REO.

This graph shows the dollar value of Residential REO for FDIC insured institutions. Note: The FDIC reports the dollar value and not the total number of REOs.