by Calculated Risk on 2/18/2014 08:45:00 AM

Tuesday, February 18, 2014

NY Fed: Empire State Manufacturing Survey indicates slower expansion in February

From the NY Fed: Empire State Manufacturing Survey

The February 2014 Empire State Manufacturing Survey indicates that business conditions improved marginally for New York manufacturers. The general business conditions index fell eight points, but remained positive at 4.5. The new orders index fell to about zero, indicating that orders were flat, and the shipments index declined thirteen points to 2.1. ...This is the first of the regional surveys for February. The general business conditions index was below the consensus forecast of a reading of 9.0, and indicates slower expansion in February. The internals were mixed, with new orders flat after hitting a two year high in January, and the employment index indicated modest improvement.

Employment indexes were little changed from last month and pointed to a modest improvement in labor market conditions. The number of employees index was 11.3, indicating a modest increase in employment levels, and the average workweek index inched up to 3.8, suggesting slightly longer workweeks.

...

Indexes for the six-month outlook continued to convey fairly strong optimism about future business conditions. The index for expected general business conditions rose to 39.0, and the index for future new orders climbed six points to 45.3, its highest level in two years.

emphasis added

Monday, February 17, 2014

Tuesday: NY Fed Mfg Survey, Homebuilder Survey, Q4 Household Debt and Credit

by Calculated Risk on 2/17/2014 09:08:00 PM

First, Don Lee of the LA Times interviewed San Francisco Fed President John Williams: Fed district chief expects central bank's stimulus cuts to continue

Would another jobs report next month like January's payroll growth of 113,000 be enough for you or the committee to put a hold on the so-called tapering of the Fed's bond-buying stimulus?The Fed may not be on a "preset course" to taper QE3, but it sounds like it would take a significant change in the data for the Fed to slow down. There is much more in the interview.

If there was another employment report similar to what we saw in January, I personally would not see that as being inconsistent with my view of the economic recovery. I wouldn't call for a change in tapering.

Tuesday:

• At 8:30 AM ET, the NY Fed Empire Manufacturing Survey for February. The consensus is for a reading of 9.8, down from 12.5 in January (above zero is expansion).

• At 10:00 AM, the February NAHB homebuilder survey. The consensus is for a reading of 56, unchanged from January. Any number above 50 indicates that more builders view sales conditions as good than poor.

• At 11:00 AM, the Q4 2013 Quarterly Report on Household Debt and Credit will be released by the Federal Reserve Bank of New York.

Weekly Update: Housing Tracker Existing Home Inventory up 6.6% year-over-year on Feb 17th

by Calculated Risk on 2/17/2014 06:44:00 PM

Here is another weekly update on housing inventory ...

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for December). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

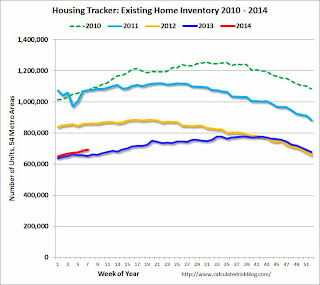

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

Inventory in 2014 is now 6.6% above the same week in 2013 (red is 2014, blue is 2013).

Inventory is still very low, but this increase in inventory should slow house price increases.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess is inventory will be up 10% to 15% year-over-year by the end of 2014 (inventory would still be below normal).

Las Vegas: Visitor Traffic declines slightly in 2013, Convention Attendance still 18% below Pre-Recession Peak

by Calculated Risk on 2/17/2014 05:44:00 PM

Just an update ... during the recession, I wrote about the troubles in Las Vegas and included a chart of visitor and convention attendance: Lost Vegas.

Since then Las Vegas visitor traffic recovered to a new record high in 2012. However visitor traffic was down slightly in 2013.

Convention attendance is still about 18% below the peak level in 2006. Here is the data from the Las Vegas Convention and Visitors Authority.

Click on graph for larger image.

Click on graph for larger image.

The blue bars are annual visitor traffic (left scale), and the red line is convention attendance (right scale).

There were 39,668,221 visitors to Las Vegas in 2013, just below the record 39,727,022 visitors in 2012. The pre-recession high was 39,196,761 in 2007.

Convention attendance was at 5,107,416 in 2013, still well below the record of 6,307,961 in 2006.

In general, the gamblers are back ... but the conventions are still lagging behind.

The Stimulus Success

by Calculated Risk on 2/17/2014 02:20:00 PM

It is important for the future to set aside ideology and recognize that the American Recovery and Reinvestment Act of 2009 helped the economy.

The stimulus could have been structured differently, for example, why have tax incentives for businesses to invest when their is already too much capacity? And research suggests the cash-for-clunkers program was not very helpful.

And more importantly - knowing that recoveries from financial crisis are slow - investment in infrastructure could have been larger and lasted longer (not just "shovel ready" programs).

It is the details that should be debated - understanding what worked and what didn't work would be useful during the next financial crisis (when the next generation of financial wizards think they've discovered how to turn lead into gold) - but overall the program was obviously helpful. Note: One of the reasons I was able to anticipate the bottom of the recession was that I correctly analyzed the impact of the stimulus.

It is sad today that extremist ideologues are arguing the stimulus failed. This is very dangerous for the future. As an example, look at these absurd comments via the WSJ:

"If you recall five years ago, the notion was that if the government spent all this money—that, by the way, was borrowed—that somehow the economy would begin to grow and create jobs," said Sen. Marco Rubio (R., Fla.), in a video message released Monday morning. ``Well, of course, it clearly failed."Obviously Rubio is clueless about the economy, but I think it is important to point that out. Debate the details, but the program clearly helped. From the White House:

The Recovery Act, by itself, saved or created about 6 million job-years, where a job-year is defined as one full-time job for one year. This translates to an average of 1.6 million jobs a year for four years through the end of 2012. This estimate is within the range of estimates provided by the Congressional Budget Office and other outside organizations.This impact is in line with analysis from the CBO and others. We should debate the actual impact of the stimulus. We should debate the effectiveness of each component of the stimulus. But we should also ridicule the ideologues ... Rubio's comments are not just wrong but dangerous (if enough people believe him).

Update: The Inland Empire Bust and Recovery

by Calculated Risk on 2/17/2014 10:31:00 AM

Way back in 2006 I disagreed with some analysts on the outlook for the Inland Empire in California. I wrote:

As the housing bubble unwinds, housing related employment will fall; and fall dramatically in areas like the Inland Empire. The more an area is dependent on housing, the larger the negative impact on the local economy will be.And sure enough, the economies of housing dependent areas like the Inland Empire were devastated during the housing bust. The good news is the Inland Empire is now recovering.

So I think some pundits have it backwards: Instead of a strong local economy keeping housing afloat, I think the bursting housing bubble will significantly impact housing dependent local economies.

Click on graph for larger image.

Click on graph for larger image.This graph shows the unemployment rate for the Inland Empire (using MSA: Riverside, San Bernardino, Ontario), and also the number of construction jobs as a percent of total employment.

The unemployment rate is falling, but still high at 8.9% (down from 15.0% in 2010). And construction employment is still near the lows.

Overall the outlook for the Inland Empire is much better today.

Sunday, February 16, 2014

Update: Household Debt Service Ratio at lowest level in 30+ years

by Calculated Risk on 2/16/2014 08:43:00 PM

Here is an update of the Fed's Household Debt Service ratio through Q3 2013 Household Debt Service and Financial Obligations Ratios. I used to track this quarterly back in 2005 and 2006 to point out that households were taking on excessive financial obligations.

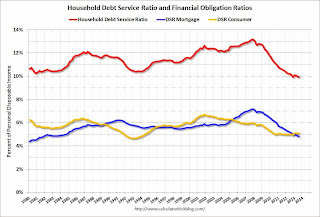

These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households. Note: The Fed changed the release in Q3.

The household Debt Service Ratio (DSR) is the ratio of total required household debt payments to total disposable income.This data has limited value in terms of absolute numbers, but is useful in looking at trends. Here is a discussion from the Fed:

The DSR is divided into two parts. The Mortgage DSR is total quarterly required mortgage payments divided by total quarterly disposable personal income. The Consumer DSR is total quarterly scheduled consumer debt payments divided by total quarterly disposable personal income. The Mortgage DSR and the Consumer DSR sum to the DSR.

The limitations of current sources of data make the calculation of the ratio especially difficult. The ideal data set for such a calculation would have the required payments on every loan held by every household in the United States. Such a data set is not available, and thus the calculated series is only an approximation of the debt service ratio faced by households. Nonetheless, this approximation is useful to the extent that, by using the same method and data series over time, it generates a time series that captures the important changes in the household debt service burden.

Click on graph for larger image.

Click on graph for larger image.The graph shows the Total Debt Service Ratio (DSR), and the DSR for mortgages (blue) and consumer debt (yellow).

The overall Debt Service Ratio decreased in Q3, and is at a record low. Note: The financial obligation ratio (FOR) is also near a record low (not shown)

Also the DSR for mortgages (blue) is near a new record low. This ratio increased rapidly during the housing bubble, and continued to increase until 2007. With falling interest rates, and less mortgage debt (mostly due to foreclosures), the mortgage ratio has declined significantly.

This data suggests household balance sheets are in much better shape than a few years ago.

Energy expenditures as a percentage of consumer spending

by Calculated Risk on 2/16/2014 11:19:00 AM

Just though I'd look at this ... below is a graph of expenditures on energy goods and services as a percent of total personal consumption expenditures.

This is one of the measures that Professor Hamilton at Econbrowser looks at to evaluate any drag on GDP from energy prices.

Click on graph for larger image.

Click on graph for larger image.

Data source: BEA Table 2.3.5U.

The huge spikes in energy prices during the oil crisis of 1973 and 1979 are obvious. As is the increase in energy prices during the 2001 through 2008 period.

Currently energy prices aren't much of a drag on the economy, and hopefully energy prices are resuming their down trend as a percent of PCE.

Saturday, February 15, 2014

By Request: Repeat U.S. Population by Age and Distribution, 1900 through 2060

by Calculated Risk on 2/15/2014 07:23:00 PM

Repeat: Here are animations of the U.S population by age and distribution, from 1900 through 2060. The population data and estimates are from the Census Bureau (actual through 2010 and projections through 2060).

Also - by request - I've slowed the animation down to 2 seconds per slide (and included a slower distribution animation below).

Note: For distribution, here are the same graphs using a slider (the user can look at individual slides).

There are many interesting points - the Depression baby bust, the baby boom, the 2nd smaller baby bust following the baby boom, the "echo" boom" and more. What jumps out at me are the improvements in health care. And also that the largest cohorts will all soon be under 40. Heck, in the last frame (2060), any remaining Boomers will be in those small (but growing) 95 to 99, and 100+ cohorts.

Animation updates every two seconds.

Notes: Population is in thousands (not labeled)! Prior to 1940, the oldest group in the Census data was "75+". From 1940 through 1985, the oldest group was "85+". Starting in 1990, the oldest group is 100+.

The second graph is by distribution (updates every 2 seconds).

Unofficial Problem Bank list declines to 586 Institutions

by Calculated Risk on 2/15/2014 01:11:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for February 14, 2014.

Changes and comments from surferdude808:

Some minor changes were made to the Unofficial Problem Bank List this week. Three removals and one addition leave the list at 586 institutions with assets of $194.9 billion. A year ago, the list held 812 institutions with assets of $303.0 billion.

Removed this week were Trans-Pacific National Bank, San Francisco, CA ($126 million); Conway Bank, National Association, Conway Springs, KS ($66 million); and First Security Bank of Malta, Malta, MT ($31 million). Conway Bank, N.A. had been under a formal action the longest of any banking as the OCC placed under a Formal Agreement in January 2005 that was subsequently replaced by a Consent Order in March 2011. There are five banks on the list that first became subject to a formal action in 2007.

The addition this week is Allied First Bank, SB, Oswego, IL ($121 million). Other changes to list were the termination of a Prompt Corrective Action order against Community Shores Bank, Muskegon, MI ($183 million).

Next Friday, the OCC should release its enforcement action activity through mid-January 2014. We may be able to update assets through year-end 2013. The FDIC will likely release industry results and update to the official list during the last full week of the month at the earliest.