by Calculated Risk on 12/26/2013 07:32:00 PM

Thursday, December 26, 2013

DOT: Vehicle Miles Driven increased 2.3% in October

The Department of Transportation (DOT) reported:

◦ Travel on all roads and streets changed by 2.3% (5.8 billion vehicle miles) for October 2013 as compared with October 2012.The following graph shows the rolling 12 month total vehicle miles driven.

◦ Travel for the month is estimated to be 258.7 billion vehicle miles.

◦ ◦Cumulative Travel for 2013 changed by 0.6% (15.6 billion vehicle miles).

The rolling 12 month total is still mostly moving sideways but has started to increase a little recently.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 71 months - almost 6 years - and still counting. Currently miles driven (rolling 12 months) are about 2.3% below the previous peak.

The second graph shows the year-over-year change from the same month in the previous year.

In October 2013, gasoline averaged of $3.42 per gallon according to the EIA. that was down sharply from 2012 when prices in October averaged $3.81 per gallon.

In October 2013, gasoline averaged of $3.42 per gallon according to the EIA. that was down sharply from 2012 when prices in October averaged $3.81 per gallon.Gasoline prices were down sharply year-over-year in November too, so I expect miles driven to be up in November too.

As we've discussed, gasoline prices are just part of the story. The lack of growth in miles driven over the last 6 years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

With all these factors, it might take a few more years before we see a new peak in miles driven - but it appears miles driven are increasing again.

Vehicle Sales Forecasts: Solid Sales Expected in December and in 2014

by Calculated Risk on 12/26/2013 02:14:00 PM

Note: The automakers will report December vehicle sales on January 3rd.

Here are two forecasts:

From Edmunds.com: Strong December Car Deals Give Car Shoppers More Reason to Celebrate this Holiday Season, Says Edmunds.com

Edmunds.com forecasts shoppers will snatch up 1,425,818 new cars and trucks in the U.S. in December for an estimated Seasonally Adjusted Annual Rate (SAAR) of 16.1 million. This will be ... about a five percent increase from December 2012. Edmunds projects that 2013 will see 15.66 million total new car sales, which would be a strong eight percent increase over 2012.From Kelley Blue Book: New-Car Sales To Improve Nearly 5 Percent From Last Year; Kelley Blue Book Projects 16.3 Million New Car Sales In 2014

New-vehicle sales are expected to improve 4.7 percent year-over-year in December to a total of 1.42 million units, and an estimated 16 million seasonally adjusted annual rate (SAAR), according to Kelley Blue Book ...It appears sales in December will be solid.

Looking forward to 2014, sales will continue to improve and Kelley Blue Book anticipates the industry to surpass 16 million SAAR for the first year since 2007. Growth will slow from recent years; however, the initial estimate from Kelley Blue Book for 2014 is 16.3 million units, up 4.3 percent from 2013.

Most forecasts were for auto sales growth to slow in 2013 to around 4% growth or 15.0 million units. However it now appears sales growth was closer to 8% - and expectations are for another 4% growth in 2014.

| Light Vehicle Sales | ||

|---|---|---|

| Sales (millions) | Annual Change | |

| 2000 | 17.4 | 2.7% |

| 2001 | 17.1 | -1.3% |

| 2002 | 16.8 | -1.8% |

| 2003 | 16.6 | -1.1% |

| 2004 | 16.9 | 1.4% |

| 2005 | 16.9 | 0.5% |

| 2006 | 16.5 | -2.6% |

| 2007 | 16.1 | -2.5% |

| 2008 | 13.2 | -18.0% |

| 2009 | 10.4 | -21.2% |

| 2010 | 11.6 | 11.1% |

| 2011 | 12.7 | 10.2% |

| 2012 | 14.4 | 13.4% |

| 20131 | 15.7 | 8.4% |

| 1Edmunds Forecast (based on actual through November) | ||

Question #9 for 2014: How much will housing inventory increase in 2014?

by Calculated Risk on 12/26/2013 11:38:00 AM

Earlier I posted some questions for next year: Ten Economic Questions for 2014. I'll try to add some thoughts, and maybe some predictions for each question.

Here is a review of the Ten Economic Questions for 2013.

9) Housing Inventory: It appears housing inventory bottomed in early 2013. Will inventory increase in 2014, and, if so, by how much?

Tracking housing inventory is very helpful. The plunge in inventory in 2011 helped me call the bottom for house prices in early 2012 (The Housing Bottom is Here). And the increase in inventory in late 2005 (see first graph below) helped me call the top for house prices in 2006.

Now an increase in inventory would probably mean smaller price increases in 2014.

This graph shows nationwide inventory for existing homes through November 2013.

Click on graph for larger image.

Click on graph for larger image.

According to the NAR, inventory declined to 2.09 million in November from 2.11 million in October. Inventory is up year-over-year from 1.99 million in November 2012.

Inventory is not seasonally adjusted, and usually inventory decreases from the seasonal high in mid-summer to the seasonal lows in December and January as sellers take their homes off the market for the holidays. Trulia chief economist Jed Kolko sent me the seasonally adjusted inventory and this shows that inventory bottomed in January, and is now up about 8.4% from the bottom on a seasonally adjusted basis.

The second graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

The second graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory increased 5.0% year-over-year in November from November 2012 (blue line).

Months of supply increased to 5.1 months in November, up from 4.9 months in October, and up from 4.8 months in November 2012. Even with the increase, the current supply is still very low.

Whenever I talk with real estate agents, I ask why they think inventory is so low. Last year, a common answer was that people didn't want to sell at the bottom. In a market with falling prices, sellers rush to list their homes, and inventory increases. But if sellers think prices have bottomed, then they believe they can be patient, and inventory declines.

Now - a more common reason for low inventory - is that potential sellers can't find homes to buy (because inventory is so low). In this case, a little more inventory will lead to more inventory.

Another reason for low inventory is that many homeowners are still "underwater" on their mortgage and can't sell. This is less of a problem now than a year ago.

With the recent price increases, some potential sellers will probably come off the fence, and more of these formerly underwater homeowners will be able to sell.

Right now my guess is active inventory will increase 10% to 15% in 2014 (inventory will decline seasonally in December and January, but I expect to see inventory up 10% to 15% year-over-year toward the end of 2014). This will put active inventory close to 6 months supply this summer. If correct, this will slow house price increases in 2014.

Here are the ten questions for 2014 and a few predictions:

• Question #1 for 2014: How much will the economy grow in 2014?

• Question #2 for 2014: How many payroll jobs will be added in 2014?

• Question #3 for 2014: What will the unemployment rate be in December 2014?

• Question #4 for 2014: Will too much inflation be a concern in 2014?

• Question #5 for 2014: Monetary Policy: Will the Fed end QE3 in 2014?

• Question #6 for 2014: How much will Residential Investment increase?

• Question #7 for 2014: What will happen with house prices in 2014?

• Question #8 for 2014: Housing Credit: Will we see easier mortgage lending in 2014?

• Question #9 for 2014: How much will housing inventory increase in 2014?

• Question #10 for 2014: Downside Risks

Weekly Initial Unemployment Claims decline to 338,000

by Calculated Risk on 12/26/2013 08:39:00 AM

The DOL reports:

In the week ending December 21, the advance figure for seasonally adjusted initial claims was 338,000, a decrease of 42,000 from the previous week's revised figure of 380,000. The 4-week moving average was 348,000, an increase of 4,250 from the previous week's revised average of 343,750.The previous week was revised up from 379,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 348,000.

Weekly claims are frequently volatile during the holidays because of the seasonal adjustment.

Wednesday, December 25, 2013

Question #10 for 2014: Downside Risks

by Calculated Risk on 12/25/2013 06:49:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2014. I'll try to add some thoughts, and maybe some predictions for each question (this one will be short).

For the last few years, "downside risks" were fairly high on my list of "questions" for the coming year. Europe has been an ongoing risk, and last year my top question was related to fiscal policy and the risks associated with the House of Representatives (with dumb policies like not cutting back on sequestration, and dumb stunts like shutting down the government).

Happily, looking forward, it seems the downside risks have diminished significantly. China remains a key risk with growth slowing and significant uncertainty around the large number of poor performing loans. That might be the #1 downside risk for 2014, although China remains opaque to outside observers - and the downside risks to the U.S. are probably small.

Europe appears to be growing again (although they haven't resolved the core issues with the Euro), and U.S. fiscal policy is settled with the recent budget agreement. Some politicians are making noises again about not paying the bills (aka the "debt ceiling"), but I'm confident they will fold their losing hand again. Since 2014 is an election year, I don't think Congress will do anything really stupid (like in 2011 and 2013).

There are always potential geopolitical risks (war with Iran, North Korea, or turmoil in some oil producing country). Right now those risks appear small, although it is always hard to tell. And there are always the risks of natural disasters (hurricanes, tsunamis, major meteor strikes, super volcanoes, etc). But those are low probability events and impossible to predict.

When I look around, I see few obvious downside risks for the U.S. economy in 2014. No need to borrow trouble - diminished downside risks are a reason for cheer.

Note: I'll discuss the possibility of inflation as a risk in question #4.

Here are the ten questions for 2014 and a few predictions:

• Question #1 for 2014: How much will the economy grow in 2014?

• Question #2 for 2014: How many payroll jobs will be added in 2014?

• Question #3 for 2014: What will the unemployment rate be in December 2014?

• Question #4 for 2014: Will too much inflation be a concern in 2014?

• Question #5 for 2014: Monetary Policy: Will the Fed end QE3 in 2014?

• Question #6 for 2014: How much will Residential Investment increase?

• Question #7 for 2014: What will happen with house prices in 2014?

• Question #8 for 2014: Housing Credit: Will we see easier mortgage lending in 2014?

• Question #9 for 2014: How much will housing inventory increase in 2014?

• Question #10 for 2014: Downside Risks

Q4 GDP: Here come the Upgrades

by Calculated Risk on 12/25/2013 10:53:00 AM

A little Christmas cheer ...

Via the WSJ:

Macroeconomic Advisers ... [raised] its estimate for fourth-quarter growth. It now forecasts gross domestic product to expand at an annualized rate of 2.6% in the final three months of the year, up three-tenths of a percentage point from an earlier estimate.And Goldman Sachs has increased their Q4 GDP tracking to 2.4% annualized growth.

And based on the November Personal Income and Outlays report:

Using the two-month method to estimate Q4 PCE growth (first two months of the quarter), PCE was increasing at a 4.1% annual rate in Q4 2013. This suggests solid PCE growth in Q4.Of course the contribution from private inventories will probably be negative in Q4, but final demand should be solid.

Happy Holidays and Merry Christmas to All!

Tuesday, December 24, 2013

Philly Fed: State Coincident Indexes increased in 46 states in November

by Calculated Risk on 12/24/2013 02:48:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for November 2013. In the past month, the indexes increased in 46 states, decreased in two states (Alaska and Ohio), and remained stable in two (New Hampshire and Washington), for a one-month diffusion index of 88. Over the past three months, the indexes increased in 46 states, decreased in three, and remained stable in one for a three-month diffusion index of 86.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In November, 48 states had increasing activity(including minor increases). This measure has been and up down over the last few years ...

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all green at times during the recovery.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all green at times during the recovery.There are a few states with three month declining activity, but most of the map is green - and I expect the map to be all green soon.

Comments on New Home Sales

by Calculated Risk on 12/24/2013 11:53:00 AM

Earlier: New Home Sales at 464,000 Annual Rate in November

Looking at the first eleven months of 2013, there has been a significant increase in new home sales this year. The Census Bureau reported that there were 401 new homes sold during the first eleven months of 2013, up 17.6% from the 341 thousand sold during the same period in 2012. That follows an annual increase of 20% in 2012.

This puts new home sales on pace for about 433 thousand in 2013. But even though there has been a large increase in the sales rate, sales are close to the lows for previous recessions. Right now it looks like 2013 will be the sixth worst year for new home sales since 1963.

The sales rate was only lower than 2013 in the worst housing bust years of 2009 through 2012, and the worst year of early '80s recession (1982).

| Worst Years for New Home Sales since 1963 | ||

|---|---|---|

| Rank | Year | New Home Sales (000s) |

| 1 | 2011 | 306 |

| 2 | 2010 | 323 |

| 3 | 2012 | 368 |

| 4 | 2009 | 375 |

| 5 | 1982 | 412 |

| 6 | 2013*** | 433 |

| 7 | 1981 | 436 |

| 8 | 1969 | 448 |

| 9 | 1966 | 461 |

| 10 | 1970 | 485 |

| 11 | 2008 | 485 |

| *** Estimate for 2013 | ||

This suggests significant upside over the next several years. Based on estimates of household formation and demographics, I expect sales to increase to 750 to 800 thousand over the next several years - substantially higher than the current 464 thousand sales rate. So I expect the recovery to continue.

And here is another update to the "distressing gap" graph that I first started posting over four years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

Click on graph for larger image.

Click on graph for larger image.The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through November 2013. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales kept existing home sales elevated, and depressed new home sales since builders weren't able to compete with the low prices of all the foreclosed properties.

I expect existing home sales to decline some (distressed sales will slowly decline and be partially offset by more conventional sales). And I expect this gap to continue to close - mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales at 464,000 Annual Rate in November

by Calculated Risk on 12/24/2013 10:00:00 AM

The Census Bureau reports New Home Sales in November were at a seasonally adjusted annual rate (SAAR) of 464 thousand.

October sales were revised up from 444 thousand to 474 thousand, and September sales were revised up from 354 thousand to 403 thousand. August sales were revised up from 379 thousand to 388 thousand.

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

"Sales of new single-family houses in November 2013 were at a seasonally adjusted annual rate of 464,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 2.1 percent below the revised October rate of 474,000, but is 16.6 percent above the November 2012 estimate of 398,000."

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This was reported as a decrease in the sales rate, but that was because sales in October were revised up. Sales in October and November were at the highest rate since 2008.

Even with this increase, new home sales are still near the bottom for previous recessions.

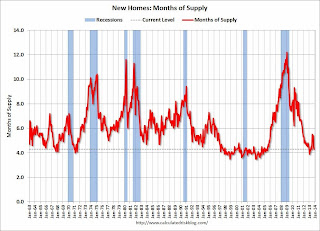

The second graph shows New Home Months of Supply.

The months of supply decreased in November to 4.3 months from 4.5 months in October.

The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

This is now in the normal range (less than 6 months supply is normal)."The seasonally adjusted estimate of new houses for sale at the end of November was 167,000. This represents a supply of 4.3 months at the current sales rate."On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale is near the record low. The combined total of completed and under construction is still very low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In November 2013 (red column), 33 thousand new homes were sold (NSA). Last year 29 thousand homes were sold in November. The high for November was 86 thousand in 2005, and the low for November was 20 thousand in 2010.

This was above expectations of 450,000 sales in November, and there were significant upward revisions to prior months.

I'll have more later today - but this was a solid report and the housing recovery will continue.

MBA: Mortgage Applications Decrease in Latest Weekly Survey, Refinance Activity Lowest since Nov 2008

by Calculated Risk on 12/24/2013 09:01:00 AM

From the MBA: Mortgage Applications Fall During Holiday-Shortened Week

Mortgage applications decreased 6.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 20, 2013. ...

The Refinance Index decreased 8 percent from the previous week. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier....

...

"Purchase volume was weak too, continuing to run more than ten percent below last year's pace." [said Mike Fratantoni, MBA’s Vice President of Research and Economics].

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.63 percent, the highest level since September 2013, from 4.61 percent, with points unchanged at 0.24 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down sharply - and down 72% from the levels in early May - and at the lowest level since November 2008

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index is now down about 11% from a year ago.