by Calculated Risk on 10/26/2013 03:30:00 PM

Saturday, October 26, 2013

Unofficial Problem Bank list declines to 670 Institutions

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for October 25, 2013.

Changes and comments from surferdude808:

The FDIC got back to issuing its enforcement action activity for the previous month on the last Friday of the current month. So we got their release today that led to several changes to the Unofficial Problem Bank List. For the week, there were eight removals and one addition that leave the list at 670 institutions with $234.0 billion of assets. A year ago, the list had 856 institutions with assets of $326.4 billion. For the month of October 2013, the list fell by 20 institutions after five additions and 25 removals, which were mostly action terminations. During the month, 24 actions were terminated, which is the second highest monthly count after 25 actions were terminated in April 2012.

Actions were terminated against Old Second National Bank, Aurora, IL ($1.9 billion Ticker: OSBC); Bank of Idaho, Idaho Falls, ID ($235 million); First Enterprise Bank, Oklahoma City, OK ($139 million); Foundations Bank, Pewaukee, WI ($118 million); Benchmark Bank, Gahanna, OH ($113 million); Meramec Valley Bank, Valley Park, MO ($97 million); State Bank of Georgia, Fayetteville, GA ($73 million); and Prairie Mountain Bank, Great Falls, MT ($71 million).

Added this week was The West Michigan Savings Bank, Bangor, MI ($39 million). In addition, the FDIC issued a Prompt Corrective Action order against First Community Bank of Crawford County, Van Buren, AR ($74 million), which has been operating under a Consent Order since July 2012.

The FDIC may be forced to finally issue a cross-guaranty claim against Capitol Bancorp, Ltd (Ticker: CBCRQ). Last week, we mentioned the deal struck to sell four units to Talmer Bancorp that is contigent upon the FDIC issuing cross-guaranty waivers. In a report from SNL Securities (Capitol Bancorp creditors balk at 'entirely inappropriate' FDIC concessions in 363 sale ), apparently the Creditor's Committee is balking at a proposed $4 million of sales proceeds being placed in escrow for the FDIC. The Committee believes this payment would be "extraordinary" as the FDIC has not filed a claim in the bankruptcy filing nor has it asserted a cross-guaranty liability on the part of Capitol Bancorp. Thus, for the sale to close, the FDIC may have to issue a cross-guaranty claim in order to receive any sales proceeds.

Schedule for Week of October 27th

by Calculated Risk on 10/26/2013 08:56:00 AM

This will be a very busy week for economic data. The key reports this week are September retail sales, September Industrial Production, August Case-Shiller house prices, October auto sales, and the ISM manufacturing index.

For prices, the September Producer Price and Consumer Price indexes will be released.

The ADP employment report will be released on Wednesday, however the BLS employment report for October has been delayed until the following week.

Also there will be an FOMC meeting on Tuesday and Wednesday, although no changes are expected.

9:15 AM ET: The Fed is scheduled to release Industrial Production and Capacity Utilization for September.

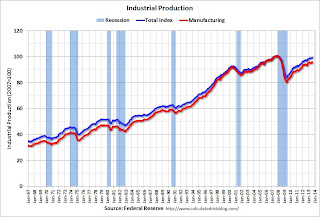

9:15 AM ET: The Fed is scheduled to release Industrial Production and Capacity Utilization for September.This graph shows industrial production since 1967.

The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 78.0%.

10:00 AM ET: Pending Home Sales Index for September. The consensus is for a no change in the index.

10:30 AM: Dallas Fed Manufacturing Survey for October. This is the last of the regional Fed surveys. The consensus is a reading of 9.0, up from 12.8 in September (above zero is expansion).

8:30 AM: Retail sales for September.

8:30 AM: Retail sales for September.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales are up 28.7% from the bottom, and now 12.8% above the pre-recession peak (not inflation adjusted)

The consensus is for retail sales to be unchanged in September, and to increase 0.4% ex-autos.

8:30 AM: Producer Price Index for September. The consensus is for a 0.2% increase in producer prices (0.1% increase in core).

9:00 AM: S&P/Case-Shiller House Price Index for August. Although this is the August report, it is really a 3 month average of June, July and August.

9:00 AM: S&P/Case-Shiller House Price Index for August. Although this is the August report, it is really a 3 month average of June, July and August. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through July 2012 (the Composite 20 was started in January 2000).

The consensus is for a 12.4% year-over-year increase in the Composite 20 index (NSA) for August. The Zillow forecast is for the Composite 20 to increase 12.4% year-over-year, and for prices to increase 0.6% month-to-month seasonally adjusted.

10:00 AM: Conference Board's consumer confidence index for October. The consensus is for the index to decrease to 75.0 from 79.7.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for August. The consensus is for a 0.3% increase in inventories.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for October. This report is for private payrolls only (no government). The consensus is for 138,000 payroll jobs added in October, down from 166,000 in September.

8:30 AM: Consumer Price Index for September. The consensus is for a 0.2% increase in CPI in September and for core CPI to increase 0.2%.

2:00 PM: FOMC Meeting Announcement. No change to interest rates or QE purchases is expected at this meeting.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 335 thousand from 350 thousand last week.

9:45 AM: Chicago Purchasing Managers Index for October. The consensus is for an increase to 55.0, up from 55.7 in September.

All day: Light vehicle sales for October. The consensus is for light vehicle sales to increase to 15.4 million SAAR in October (Seasonally Adjusted Annual Rate) from 15.2 million SAAR in September.

All day: Light vehicle sales for October. The consensus is for light vehicle sales to increase to 15.4 million SAAR in October (Seasonally Adjusted Annual Rate) from 15.2 million SAAR in September.This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the September sales rate.

9:00 AM: The Markit US PMI Manufacturing Index for October.

10:00 AM ET: ISM Manufacturing Index for October. The consensus is for a decrease to 55.0 from 56.2 in September.

10:00 AM ET: ISM Manufacturing Index for October. The consensus is for a decrease to 55.0 from 56.2 in September.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion in September at 56.2%. The employment index was at 55.4%, and the new orders index was at 60.5%.

Friday, October 25, 2013

Survey: "Small business owners appear poised to flip the switch to growth mode"

by Calculated Risk on 10/25/2013 08:27:00 PM

From the Press Enterprise (California's Inland Empire): ECONOMY: Small businesses feeling some love

Several business owners in Inland Southern California seem more upbeat, and American Express, which has done this survey twice annually since 2002, said the results indicate steady progress. ...This would be a welcome change! Happy Friday to all (it looks like another week with no banks closed by the FDIC).

"Small business owners appear poised to flip the switch to growth mode,” Susan Sobbott, president of American Express Open, said in a statement.

...

“I think we do see some optimism,” [Michael Vanderpool, president and COO of Security Bank of California, a Riverside-based small business lender] said. “Everyone wants it to be all over by tomorrow, but we know it won’t happen that way. It’s a slow slosh.”

DOT: Vehicle Miles Driven increased 1.3% in August

by Calculated Risk on 10/25/2013 04:06:00 PM

The Department of Transportation (DOT) reported:

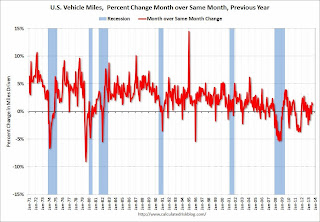

◦ Travel on all roads and streets changed by 1.3% (3.4 billion vehicle miles) for August 2013 as compared with August 2012.The following graph shows the rolling 12 month total vehicle miles driven.

◦ Travel for the month is estimated to be 267.0 billion vehicle miles.

◦ Cumulative Travel for 2013 changed by 0.3% (6.1 billion vehicle miles).

The rolling 12 month total is still mostly moving sideways.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 69 months - almost 6 years - and still counting.

The second graph shows the year-over-year change from the same month in the previous year.

Gasoline prices were down in August compared to August 2012. In August 2013, gasoline averaged of $3.65 per gallon according to the EIA. In 2012, prices in August averaged $3.78 per gallon.

Gasoline prices were down in August compared to August 2012. In August 2013, gasoline averaged of $3.65 per gallon according to the EIA. In 2012, prices in August averaged $3.78 per gallon.Gasoline prices were down year-over-year in September, so I expect miles driven to be up in September too.

As we've discussed, gasoline prices are just part of the story. The lack of growth in miles driven over the last 5+ years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

With all these factors, it might take several more years before we see a new peak in miles driven.

ATA Trucking Index Up Sharply in September, Up 8.4% Year-over-year

by Calculated Risk on 10/25/2013 12:45:00 PM

Here is a minor indicator that I follow, from ATA: ATA Truck Tonnage Index Jumped 1.4% in September

The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index increased 1.4% in September, which matched the August gain. (August’s increase was unchanged from what ATA reported on September 24, 2013.) In September, the SA index equaled 128.7 (2000=100) versus 126.9 in August. Compared with September 2012, the SA index surged 8.4%, which is the largest year-over-year gain since December 2011. Year-to-date, compared with the same period in 2012, the tonnage index is up 5.4%.

...

“I continue to be pleasantly surprised on the strength of truck tonnage,” ATA Chief Economist Bob Costello said. “I attribute a part of tonnage’s robustness to the sectors of the economy that are growing fastest, like housing construction, auto production, and energy output. These industries produce heavier than average freight, which leads to faster growth in tonnage versus a load or shipment measure.

“While tonnage is likely running ahead of overall economic growth, perhaps the economy is stronger than many believe. The index has now increased in four of the last five months and the year-over-year growth rate has accelerated. Plus, other measures of truck freight volumes, while increasing at a slower pace than tonnage, have also accelerated in recent months,” he said. “However, the government shutdown served as a headwind in the fourth quarter.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index is at a new high and up solidly year-over-year. This is another minor indicator that suggests the economy is picking up (however this was prior to the government shutdown).

Vehicle Sales Forecasts: Stronger Sales in October Despite Government Shutdown

by Calculated Risk on 10/25/2013 11:19:00 AM

Note: The automakers will report October vehicle sales Friday, Nov 1st. The consensus is for the sales rate to increase to a 15.5 million seasonally adjusted annual rate (SAAR) in October from 15.2 million in September.

Here are a few forecasts:

From Kelley Blue Book: October New-Car Sales Expected To Jump 12 Percent, According To Kelley Blue Book

In October, new light-vehicle sales, including fleet, are expected to hit 1,220,000 units, up 11.7 percent from October 2012 and up 7.4 percent from September 2013.From JD Power: Government Shutdown Curbs New-Vehicle Sales on East Coast

The seasonally adjusted annual rate (SAAR) for October 2013 is estimated to be 15.4 million, up from 14.3 million in October 2012 and up from 15.2 million in September 2013.

New car- and light-truck sales in the Atlantic Coastal region, which had the highest concentration of employees affected by the October 1-16 shutdown, declined the most among geographic regions analyzed, compared with the same period last year. However, demand for new vehicles bounced back when the shutdown ended, according to the J.D. Power update, which is based on new-vehicle sales transaction data collected during the first 17 selling days of the month.From Edmunds.com: October Auto Sales Keep Pace Despite Threat from Government Shutdown, Says Edmunds.com

October sales are projected to reach nearly 1.22 million units, up from 1.09 million unit sales in the same month of 2012. That's equal to a 15.4 million-unit seasonally adjusted annual selling rate, or SAAR, which is much stronger than last October's 14.2 million-unit pace. It's also slightly ahead of the selling pace in September 2013.

Edmunds.com ... forecasts that 1,229,860 new cars and trucks will be sold in the U.S. in October for an estimated Seasonally Adjusted Annual Rate (SAAR) of 15.5 million. The projected sales will be an 8.2 percent increase from September 2013, and a 12.7 percent increase from October 2012.It looks the government shutdown impacted sales early in the month - especially on the east coast - but sales recovered towards the end of the month.

"It looks like the government shutdown ended just in the nick of time," says Edmunds.com Senior Analyst Jessica Caldwell. "The week-by-week data suggests that consumers started to get jittery by the middle of the month. But with the government back to work, most lost sales should be made up in the latter half of the month, and the industry's momentum will continue the pace it enjoyed before the disruption in Washington."

Final October Consumer Sentiment declines to 73.2

by Calculated Risk on 10/25/2013 09:55:00 AM

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for October was at 73.2, down from the September reading of 77.5, and down from the preliminary October reading of 75.2.

This was below the consensus forecast of 74.8. Sentiment has generally been improving following the recession - with plenty of ups and downs - and one big spike down when Congress threatened to "not pay the bills" in 2011.

Unfortunately Congress shut down the government, and once again threatened to "not pay the bills", and this impacted sentiment (and possibly consumer spending) in October. The spike down wasn't as large this time, probably because many people realized the House was bluffing with a losing hand.

Thursday, October 24, 2013

Friday: Durable Goods, Consumer Sentiment

by Calculated Risk on 10/24/2013 09:21:00 PM

It is time to play "small ball"!

From the WSJ: Both Parties Seek Small Budget Deal

Republicans and Democrats will use budget talks that start next week to try to minimize or reorder broad spending cuts that began in March, with both sides Thursday playing down the possibility of a "grand bargain" that would address the nation's long-term fiscal problems.I think "small ball" is the correct approach at this time. Hopefully the "grand bargain" talk will subside - it is Not Gonna Happen during the next few months. Besides no one wants another shutdown since that was expensive and just plain dumb.

In de-emphasizing the likelihood of a larger deal, both parties appeared to be looking for limited areas of agreement in order to bypass the next round of the automatic spending cuts known as the sequester and buy time to deal with tax reform, entitlement cuts and other big-ticket items next year.

Friday:

• At 8:30 AM ET, the Durable Goods Orders for September from the Census Bureau. The consensus is for a 2.5% increase in durable goods orders.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (final for October). The consensus is for a reading of 74.8, down from the preliminary reading of 75.2, and down from the September reading of 77.5.

FHFA: No Change in Conforming Loan Limits for at least Six Months

by Calculated Risk on 10/24/2013 05:21:00 PM

From Nick Timiraos at the WSJ: DeMarco: No Mortgage Limit Declines Before Spring 2014 (ht Soylent Green is People)

Federal officials will delay any reduction in the maximum size of home-mortgage loans eligible for backing by Fannie Mae and Freddie Mac until next spring at the earliest amid heavy resistance from the real-estate industry and many lawmakers in Congress.It will be politically difficult to lower these limits, and the limits probably wouldn't be adjusted down very much. The conforming loan limit was $252,700 in 2000. Using the FHFA Purchase Only index, the national conforming loan limit might be lowered to $360,000 or so.

Currently, Fannie and Freddie can guarantee mortgages that have balances as high as $417,000 in most of the country and up to $625,500 in expensive housing markets, including parts of California and New York. Loans within the limits, called “conforming” loans ...

Potential loan-limit changes will be announced six months ahead of their implementation date, [DeMarco] said, and such changes wouldn’t be announced until November at the earliest. “Anything we do would have a long lead time and would be gradual and measured,” said Mr. DeMarco.

When the agency does move ahead with loan limit declines, the declines will apply to both the national limit and the high-cost limits, which were enacted on an emergency and temporary basis by Congress in 2008

Using the CoreLogic or Case-Shiller Comp 20 indexes, the conforming loan limit might be lowered to $380,000 to $395,000. Not a large downward adjustment for the national limit.

Lawler on Homebuilders: Rising mortgage rates, Higher home prices, Resulted in a material slowdown in net home orders last quarter

by Calculated Risk on 10/24/2013 01:59:00 PM

Some comments from housing economist Tom Lawler:

• PulteGroup, the nation’s second largest home builder, reported that net home orders in the quarter ended September 30, 2013 totaled 3,781, down 16.8% from the comparable quarter of 2012. The company’s community count at the end of last quarter was down 15% from a year ago. Home closings totaled 4,817 last quarter, up 9.0% from the comparable quarter of 2012, at an average sales price of $310,000, up 11.1% from a year ago. The company’s order backlog as of September 30, 2013 was 7,522, down 2.1% from last September.

In its press release, the company noted that “consumers have recently slowed home purchases due to higher home prices, a rapid rise in mortgage rates, and political and economic uncertainty,” though the company said it expects the slowdown will be “short lived.”

On the home price front, the company said that “(t)he higher average selling price realized in the quarter reflects price increases implemented by the Company and a continued shift in the mix of homes closed toward more move-up and active adult homes which typically carry higher selling prices.”

• M/I Homes, the nation’s 16th largest home builder, reported that net home orders in the quarter ended September 30, 2013 totaled 869, up 14.8% from the comparable quarter of 2012. The company’s average community county last quarter was up 14.3% from a year ago. Home deliveries totaled 937 last quarter, up 25.6% from the comparable quarter of 2012, at an average sales price of $284,000, up 6.8% from a year ago. The company’s order backlog as of September 30, 2013 was 1,607, up 36.3% from last September.

At the end of September the company owned or controlled 18,133 lots, up 61.9% from last September.

• NVR: Net Home Orders Fell Last Quarter; WAY Below “Consensus”. NVR, Inc, the nation’s fourth largest home builder, reported that net home orders in the quarter ended September 30, 2013 totaled 2,381, down 6.9% from the comparable quarter of 2012. The company’s sales cancellation rate, expressed as a % of gross orders, was 19%, up from 17% a year ago. Home settlements totaled 3,342 last quarter, up 25,8% from the comparable quarter of 2012, at an average sales price of $349,200, up 8.5% from a year ago. The company’s order backlog at the end of September was 5,656, up 14.3% from last September. The decline in net orders last quarter occurred despite a YOY increase in the company’s average community count of 10.0%. NVR is heavily concentrated in the Mid-Atlantic region, where net orders last quarter were down 9.7% from a year ago.

• Meritage Homes reported that net home orders in the quarter ended September 30, 2013 totaled 1,300, up 8.0% from the comparable quarter of 2012. The company’s sales cancellation rate, expressed as a % of gross orders, was 14% last quarter, up from 13% a year ago. Home deliveries last quarter totaled 1,418, up 18.5% from the comparable quarter of 2012, at an average sales price of $341,000, up 21.8% from a year ago. The company’s order backlog on September 30, 2013 was 2,190, up 35.4% from last September. The company noted that average orders per community were down 4% from a year ago. In its press release, a company official attributed last quarter’s slowdown in net home orders to the earlier jump in mortgage rates and to the company’s aggressive increase in home prices.

The company noted that net home orders in the “West Region” (Arizona, California, and Colorado) were down 16% YOY, and net orders per community were down 19%, in part reflecting the company’s aggressive hiking of home prices in the West.

The company’s revenues, gross margins, and overall income exceeded “consensus,” but net orders were well below consensus.

As with many other large builders, Meritage began to add aggressively to the number of lots it owns or controls over the last year, and as of the end of September it owned or controlled 25,046 lots, up about 41% from last September.

Here is a summary of selected results reported by publicly-traded builders for last quarter and compared to the same quarter of 2012.

| Net Orders | Settlements | Average Closing Price | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 9/30/13 | 9/30/12 | % Chg | 9/30/13 | 9/30/12 | % Chg | 9/30/13 | 9/30/12 | % Chg |

| Pulte Group | 3,781 | 4,544 | -16.8% | 4,817 | 4,418 | 9.0% | $310,000 | $279,000 | 11.1% |

| NVR | 2,381 | 2,558 | -6.9% | 3,342 | 2,656 | 25.8% | $349,200 | $321,700 | 8.5% |

| Meritage Homes | 1,300 | 1,204 | 8.0% | 1,418 | 1,197 | 18.5% | $341,000 | $280,000 | 21.8% |

| M/I Homes | 869 | 757 | 14.8% | 937 | 746 | 25.6% | $284,000 | $266,000 | 6.8% |

| Total | 8,331 | 9,063 | -8.1% | 10,514 | 9,017 | 16.6% | $324,324 | $290,635 | 11.6% |

There appears to be little doubt that rising mortgage rates, combined with higher home prices, resulted in a material slowdown in net home orders last quarter. Mortgage rates, of course, have fallen considerably since early September, though they remain well above levels since during the first five months of the year.